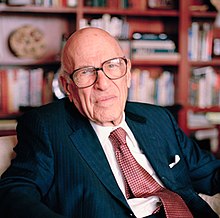

Walter Schloss

Walter J. Schloss | |

|---|---|

| |

| Born | August 28, 1916 New York City, U.S. |

| Died | February 19, 2012 (aged 95) New York City, U.S. |

| Nationality | United States |

| Education | No formal college education |

| Occupation | Investor |

| Employer | Graham-Newman Partnership |

| Known for | Manager of Walter & Edwin Schloss Associates |

Walter J. Schloss (August 28, 1916 – February 19, 2012) was an American investor. He was a well-regarded value investor, as well as a notable disciple of the Benjamin Graham school of investing. He died of leukemia at the age of 95.[1]

Biography

Schloss did not attend college. In 1934 at the age of 18, he started work as a runner on Wall Street. Schloss took investment courses taught by Graham at the New York Stock Exchange Institute. One of his classmates was Gus Levy, the future chairman of Goldman Sachs. He eventually went to work for Graham in the Graham-Newman Partnership.

In 1955, Schloss left Graham's company and started his own investment firm, eventually managing money for 92 investors. By maintaining a manageable asset size, Schloss averaged a 15.3% compound return over the course of four and a half decades, versus 10% for the S&P 500.[2] Between 1956 and 1984, the WJS Partnership's annual compounded rate was 21.3% (16.1% for the limited partners).[3]

Schloss closed out his fund in 2000 and stopped actively managing others' money in 2003.

He served four years in the U.S. Army during World War II.

Warren Buffett named him as one of The Superinvestors of Graham-and-Doddsville, who disproved the academic position that the market was efficient, and that beating the S&P 500 was "pure chance".[3]

Warren Buffett had this to say about Schloss:

He knows how to identify securities that sell at considerably less than their value to a private owner: And that's all he does... He owns many more stocks than I do and is far less interested in the underlying nature of the business; I don't seem to have very much influence on Walter. That is one of his strengths; no one has much influence on him.[3]

Philanthropy

Schloss was the Treasurer for Freedom House.[4] and was a patron of the Tenement Museum.[5]

His archive is held at Columbia University.[6]

See also

References

- ^ Arnold, Laurence (February 20, 2012). "Superinvestor Walter Schloss Dies at 95". Bloomberg. Retrieved February 20, 2012.

- ^ Investment Leadership: Building a Winning Culture for Long-Term Success. by James W. Ware, Beth Michaels, Dale Primer. Published by John Wiley and Sons, 2003. pg. 124. ISBN 0-471-45333-1.

- ^ a b c Buffett, Warren (2004). "The Superinvestors of Graham-and-Doddsville". Hermes: the Columbia Business School Magazine: 4–15.

- ^ Board of Trustees, Freedom House

- ^ Donors, Lower East Side Tenement Museum

- ^ Schloss Archives for Value Investing, The Heilbrunn Center for Graham & Dodd Investing at Columbia Business School