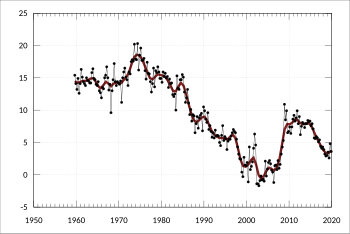

Average propensity to save

The average propensity to save (APS), also known as the savings ratio, is an economics term that refers to the proportion of income which is saved, usually expressed for household savings as a percentage of total household disposable income. The ratio differs considerably over time and between countries. The savings ratio can be affected by (for example): the proportion of older people, as they have less motivation and capability to save; the rate of inflation, as expectations of rising prices can encourage people to spend now rather than later (monetary base/mass depreciation).

The complement is the average propensity to consume (APC).

See also

- Marginal propensity to save

- Marginal propensity to consume

- Golden Rule savings rate

- Kinetic exchange models of markets