Passbook

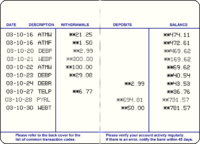

A passbook or bankbook is a paper book used to record bank transactions on a deposit account. Depending on the country or the financial institution, it can be of the dimensions of a chequebook or a passport.

Traditionally, a passbook is used for accounts with a low transaction volume, such as a savings account. Traditionally, a bank teller or postmaster would write, by hand, the date and amount of the transaction, the updated balance, and enter his or her initials. In the late 20th century, small dot matrix or inkjet printers were introduced capable of updating the passbook at the account holder's convenience, either at an automated teller machine or a passbook printer, either in a self-serve mode, by post, or in a branch.

Withdrawals normally required the account holder to visit the branch where the account was held, where a withdrawal slip would be prepared and signed. If the account holder was not known to the teller, the signature on the slip as well the authorities would be checked against the signature card at the branch, before money was paid out. In the 1960s, banks adopted the black light signature system for passbooks, which enabled withdrawals to be made from passbooks at a branch other than the one where an account was opened, unless prior arrangements were made to transfer the signature card to the other branch. Under this system, the passbook's owner would sign in the back of the passbook in an invisible ink and the signing authorities would also be noted. At the paying branch, the signature on the withdrawal slip would be checked against the signature in the book, which required a special ultraviolet reader to read.[1] Nowadays, customer verification is more likely to be by PIN.

For people who feel uneasy with telephone or online banking, this is an alternative to obtain, in real-time, the account activity without waiting for a bank statement. However, contrary to some bank statements, some passbooks offer fewer details, replacing easy-to-understand descriptions with short codes, also known as mnemonics.

References

See also

- Bank statement

- Deposit account

- Sberkassa, the bankbook heritage from the Soviet Union.