User:Melissam16/sandbox

A subsidy is a grant or other financial assistance given by one party for the support or development of another. [1] Subsidy has been used by economists with different meanings and connotations in different contexts. According to one OECD definition, “A subsidy is a measure that keeps prices for consumers below market levels, or keeps prices for producers above market levels or that reduces costs for both producers and consumers by giving direct or indirect support." [2] The most common definition of a subsidy refers to a payment made by the government to a producer. [3] Subsidies can be direct – cash grants, interest-free loans – or indirect – tax breaks, insurance, low-interest loans, depreciation write-offs, rent rebates. [4] This form of support can be legal, illegal, ethical or unethical. Subsidies are used for a variety of purposes, including employment, production and exports.

Subsidies are often regarded as a form of protectionism or trade barrier by making domestic goods and services artificially competitive against imports. Subsidies may distort markets, and can impose large economic costs.[3] Financial assistance in the form of a subsidy may come from one's government, but the term subsidy may also refer to assistance granted by others, such as individuals or non-governmental institutions.

Types of subsidies[edit]

Production Subsidy[edit]

A production subsidy encourages suppliers to increase the output of a particular product by partially offsetting the production costs or losses. [4] The objective of production subsidies may be to expand production of a particular product at a lower price. In such case, the government is also supporting the consumer. Other examples of production subsidies include the assistance in the creation of a new firm (Enterprise Investment Scheme), industry (Industrial Policy) and even the development of certain areas (Regional Policy).

Export Subsidy[edit]

An export subsidy is a support from the government for products that are exported, as a means of assisting the country’s balance of payments. [4]

Employment Subsidy[edit]

An employment subsidy serves as an incentive to businesses to provide more job opportunities to reduce the level of unemployment in the country (income subsidies) or to encourage research and development. [4] With an employment subsidy, the government provides assistance with wages. Another form of employment subsidy is the social security benefits. Employment subsidies allow a person receiving the benefit to enjoy some minimum standard of living.

Economic Effects[edit]

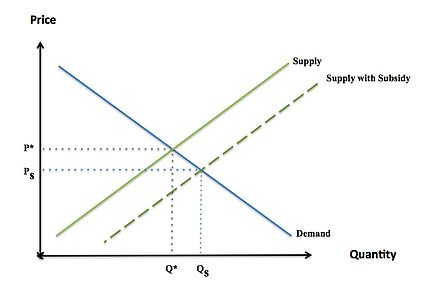

Competitive equilibrium is a state of balance between buyers and suppliers, in which the quantity demanded of a good is the quantity supplied at a specified price. When the quantity demanded exceeds the equilibrium quantity, price falls; conversely, a reduction in the supply of a good beyond equilibrium quantity implies an increase in the price.[5] The effect of a subsidy is to shift the supply or demand curve to the right (i.e. increases the supply or demand) by the amount of the subsidy. If a consumer is receiving the subsidy, a lower price of a good resulting from the marginal subsidy on consumption increases demand, shifting the demand curve to the right. If a supplier is receiving the subsidy, an increase in the price (revenue) resulting from the marginal subsidy on production results increases supply, shifting the supply curve to the right.

Assuming the market is in a perfectly competitive equilibrium, a subsidy increases the supply of the good beyond the equilibrium competitive quantity. The imbalance creates deadweight loss. Deadweight loss of from a subsidy is the amount by which the cost of the subsidy exceeds the gains of the subsidy. [6] The magnitude of the deadweight loss is dependent on the size of the subsidy. This is considered a market failure, or inefficiency.

Subsidies, by lowering the price of a good, make national goods more competitive against foreign goods, thereby reducing foreign competition. [1] As a result, many developing countries cannot engage in foreign trade and receive lower prices for their products in the global market. This is considered protectionism: a government policy to erect trade barriers in order to protect domestic industries. [7] The problem with protectionism arises when industries are selected for nationalistic reasons (Infant-Industry), rather than to gain a comparative advantage. The market distortion, and reduction in social welfare, is the logic behind the World Bank policy for the removal of subsidies in developing countries. [5]

Subsidies create spillover effects in other economic sectors and industries. A subsidized product sold in the world market lowers the price of the good in other countries. Since subsidies result in lower revenues for producers of foreign countries, they are a source of tension between the United States, Europe and poorer developing countries. [3] While subsidies may provide immediate benefits to an industry, in the long-run they pay prove to have unethical, negative effects. Subsidies are intended to support public interest, however, they can violate ethical or legal principles if they lead to higher consumer prices or discriminate against some producers to benefit others. [1] For example, domestic subsidies granted by individual states may be unconstitutional if they discriminate against out-of-state producers, violating the Privileges and Immunities Clause or the Dormant Commerce Clause of the United States Constitution. [1] Depending on their nature, subsidies are discouraged by international trade agreements such as the World Trade Organization (WTO).

Recent Controversies[edit]

The United States and the European Union, the two largest agricultural exporters, have long subsidized agricultural products. In 2005, U.S. farmers received $14 billion in agricultural subsidies and European Union farmers, $47 billion. [1] European dairy subsidies were such that each cow reportedly received the equivalent of $2.20 per day, an amount greater than the daily income of many people in developing countries. [1]

Cotton growers in the United States reportedly received half of their income from the U.S. government under the Farm Bill of 2002. The subsidy payments stimulated overproduction and resulted in a record cotton harvest in 2002, much of which was sold at very reduced prices in the global market. [1] For foreign producers, the depressed cotton price lowered their prices far below the break-even price. In fact, African farmers received 35 to 40 cents per pound for cotton, while U.S. cotton growers, backed by government agricultural payments, received 75 cents per pound. Developing countries and trade organizations argue that poorer countries should be able to export their principle commodities to survive, but protectionist laws and payments in the United States and Europe prevent the countries from engaging in international trade opportunities.

Non-governmental organizations like Oxfam describe farm subsidies as dumping millions of surplus commodities (like sugar) on world markets, destroying competition from farmers in undeveloped and poor countries, especially in Africa. For example, in the past EU spent €3.30 in subsidies to export sugar worth €1. [8] Another example of trade distorting subsidies is the Common Agricultural Policy of the European Union. It represents 48% of the entire EU's budget, €49.8 billion in 2006 (up from €48.5 billion in 2005).[6] These subsidies have remained in place even though many international accords have reduced other forms of subsidies or tariffs.[citation needed]

The Commitment to Development Index, published by the Center for Global Development, measures the effect that subsidies and trade barriers actually have on the undeveloped world. It uses trade along with six other components such as aid or investment to rank and evaluate developed countries on policies that affect the undeveloped world. It finds that the richest countries spend $106 billion per year subsidizing their own farmers - almost exactly as much as they spend on foreign aid.[9]

With the National Football League (NFL) profits topping records at $11 Billion, the highest of all sports, in stark contrast to the American economic late-2000s recession, attention is starting to look at the NFL's tax-exempt status [10] and all the Stadiums built through tax-free borrowing by the Cities, resulting in subsidies that come from the pockets of every American taxpayer.[11]

References[edit]

- ^ a b c d e f g Kolb, R. W. (Ed.). (2007). Subsidies . Encyclopedia of Business Ethics and Society.

- ^ Organization for Economic Co-Operation and Development. (2006). Subsidy Reform and Sustainable Development.

- ^ a b Parkin, M. (2005). Economics (Vol. 7). Prentice Hall.

- ^ a b c d Subsidy. (2006). Collins Dictionary of Economics .

- ^ a b Amegashie, J. A. (2006). The Economics of Subsidies. Crossroads , 6 (2), 7-15.

- ^ Watkins, T. (n.d.). The Impact of an Excise Tax or Subsidy on Price. Retrieved April 1, 2013, from San José State University Department of Economics: http://www.sjsu.edu/faculty/watkins/taximpact.htm

- ^ Protectionism. (2006). Collins Dictionary of Economics.

- ^ Oxfam International. Oxford, UK (2004). "A Sweeter Future? The potential for EU sugar reform to contribute to poverty reduction in southern Africa." Oxfam Briefing Paper No. 70. November 2004. pp. 39-40.

- ^ Roodman, David. "Production-weighted Estimates of Aggregate Protection in Rich Countries toward Developing Countries - Working Paper 66". Retrieved 15 April 2013.

- ^ Cohen, Rick. "NPQ Newswire: Fill out Your "March Madness" Brackets for a Charitable Windfall? Oxfam Report Ranks Companies on Corporate Social Responsibility Delaney Calls for Nonprofit Sector Unity in Face of Budget Cuts San Diego Coalition Aims to Stem Gang Violence Despite Police Cuts Lawsuit Alleges Financial Improprieties at Cy Twombly Foundation Vague Senate Budget Proposal Punts on Critical Charitable Giving Details And That Pink Smoke at the Vatican Means… Why Does NYU President Face "No Confidence" Vote? Why Nonprofits Should Care about "Paycheck Protection" Bills A Big No to "No Solicitation" in Colorado Springs Articles Playing by the NFL's Tax Exempt Rules". Retrieved 15 April 2013.

- ^ Kuriloff, Aaron and Darrell Preston. "In Stadium Building Spree, U.S. Taxpayers Lose $4 Billion". Retrieved 15 April 2013.