Modified gross national income: Difference between revisions

| Line 75: | Line 75: | ||

The CSO estimated that 2016 Irish GNI* (€190bn) is 30% below 2016 Irish GDP (€275bn) and Irish Debt/GNI* goes to 106% (Irish Debt/GDP was 73%).<ref name="gni1">{{cite web|url=https://www.irishtimes.com/business/economy/cso-paints-a-very-different-picture-of-irish-economy-with-new-measure-1.3155462|title=CSO paints a very different picture of Irish economy with new measure|publisher=Irish Times|date=15 July 2017}}</ref><ref name="gni2">{{cite web|url=https://www.independent.ie/business/irish/new-economic-leprechaun-on-loose-as-rate-of-growth-plunges-35932663.html|title=New economic Leprechaun on loose as rate of growth plunges|publisher=Irish Independent|date=15 July 2017}}</ref> |

The CSO estimated that 2016 Irish GNI* (€190bn) is 30% below 2016 Irish GDP (€275bn) and Irish Debt/GNI* goes to 106% (Irish Debt/GDP was 73%).<ref name="gni1">{{cite web|url=https://www.irishtimes.com/business/economy/cso-paints-a-very-different-picture-of-irish-economy-with-new-measure-1.3155462|title=CSO paints a very different picture of Irish economy with new measure|publisher=Irish Times|date=15 July 2017}}</ref><ref name="gni2">{{cite web|url=https://www.independent.ie/business/irish/new-economic-leprechaun-on-loose-as-rate-of-growth-plunges-35932663.html|title=New economic Leprechaun on loose as rate of growth plunges|publisher=Irish Independent|date=15 July 2017}}</ref> |

||

== |

==Debt metrics== |

||

A key driver of the creation of the "modified GNI" (or GNI*) was around providing global capital providers with appropriate Irish debt metrics. |

|||

The issues post "leprechaun economics" and "modified GNI", is captured on page 34 of the OECD 2018 Ireland survey:<ref name="oecd">{{cite web|url=http://www.finance.gov.ie/wp-content/uploads/2018/03/OECD-survey.pdf|title=OECD Ireland Survey 2018|publisher=OECD|date=March 2018}}</ref> |

|||

* On a Gross Public Debt-to-GDP basis, Ireland's 2015 figure at 78.8% is not of concern. |

|||

* On a Gross Public Debt-to-GNI* basis, Ireland's 2015 figure at 116.5% is more serious, but not alarming. |

|||

* On a Gross Public Debt Per Capita basis, Ireland's 2015 figure at over $62,686 per capita, exceeds every other OECD country, except Japan.<ref name="irip">{{cite web|url=https://www.independent.ie/irish-news/politics/national-debt-now-44000-per-head-35904197.html|title=National debt now €44000 per head|publisher=Irish Independent|date=7 July 2017}}</ref> |

|||

==See also== |

==See also== |

||

Revision as of 14:25, 7 April 2018

Modified GNI or also known as GNI* (or GNI star) was created by the Central Bank of Ireland in February 2017 as an improved way to measure the Irish economy due to the increasing distortions that Irish "multinational tax schemes" were having on Irish GNI, Irish GNP and Irish GDP. The situation reached a crisis in October 2016 when the Irish Central Statistics Office announced that 2015 Irish GDP rose 26.3% and 2015 Irish GNP rose 18.7% (subsequently proved to be due to Apple's 2015 restructuring of its Irish subsidiaries via a new "capital allowances for intangibles assets" scheme), which gained international notoriety as "leprechaun economics". The new Irish Modified GNI (or GNI*) is circa 30% below Irish GDP (based on 2016 data).

Background

Irish economic data and Irish GDP, in particular, has always been subject to caveats due to the tax planning activities of, mainly US, multinationals in Ireland. Tax planning "royalty schemes" like the famous "double Irish", create large flows that add to Irish GDP (especially), but do not incur material Irish taxes (if any).

From the mid-2000s, US multinationals in Ireland (i.e. Microsoft), materially increased their use of the Irish "double Irish" tax avoidance scheme (see table opposite for Apple's ASI subsidiary, who by 2014 was routing almost €35 billion in untaxed profits, equivalent to circa 20% of 2014 Irish GNI).[1]

Artificially inflated Irish GDP (above true growth rate), exaggerated the Irish "Celtic Tiger" period by further stimulating both Irish consumer optimism (who increased their borrowing) and global capital markets optimism about Ireland (who enabled Irish banks to borrow materially in excess of their deposit base).

This unwound in the economic crisis as global capital markets, who ignored Ireland's worsening private sector credit metrics (and OECD/IMF warnings) when Irish GDP was rising, took fright. Their withdrawal, from an over-borrowed Irish credit system, precipitated a more severe Irish property and economic collapse in 2010-2012.

The Irish economic collapse led to a material transfer of indebtedness from the Irish private sector balance sheet (who had become the most leveraged in the OECD), to the Irish public sector balance sheet (who was almost unleveraged pre-crisis) via Irish bank bailouts and public deficit spending.

Post the Irish economic collapse saw a material rise in US technology multinationals using the "double Irish" (Apple's ASI profits were circa 20% of 2014 Irish GNI), and a material rise in US corporate inversions of US pharmaceutical and medical device firms. By 2017, the top 20 Irish companies (by Irish turnover) were:

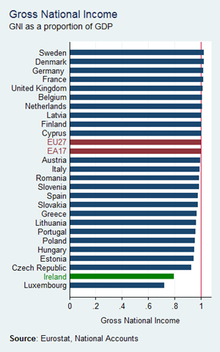

This rise further distorted Irish economic statistics. By 2011 Ireland's ratio of GNI to GDP, had fallen to 80% (only Luxembourg was lower at 73%). The EU27 average is closer to 100% (see GNI table).[2][3] An EU Commission report showed that from 2010 to 2015, almost a quarter of Ireland's GDP was represented by untaxed multinational net royalty payments.[4] This was raising conern in the EU-IMF over Ireland's true debt position.

Apple's restructure

The distortion of Irish GNI/GNP/GDP came to a climax when Apple restructured its controversial ASI subsidiary (which EU Commission had judged as receiving illegal Irish State Aid) in January 2015, and brought it "onshore" to Ireland via a new "capital allowances" scheme.[5]

Apple's restructuring led to 2015 Irish economic growth rates of 26.3% (GDP) and 18.7% (GNP) respectively.[6]

This led to widespread Irish and International riducle[7][8][9][10][11][12][13][14], and was labelled by Noble Prize economist Paul Krugman as "leprechaun economics".[15]

The situation was not helped by the fact that neither the CSO nor the Department of Finance, seemed to be able to accurately identify the source of such a large rise. The explanation provided changed over the course of the two weeks after it was announced (it wasn't until 2018 that Apple could be definitively proven as the source).

Markets saw Finance Minister Michael Noonan "pay" €380m in additional annual EU GDP levies[16][17] (he had made Apple's 2015 new Irish "capital allowance" scheme free of Irish taxes in the 2015 Budget by lifting the cap to 100%),[18] to generate "artificial" increases in the Irish GDP, GNP and GNI economic statistics.

His predessor, Finance Minister Paschal Donohoe immediately closed the 2015 Budget loophole to ensure that "capital allowances" schemes would at least pay effective Irish corporate tax rates of 2-3% (by reducing the cap on relief back to 80% from Noonan's 100% level). However, he only applied this to new schemes.[18]

While financial markets had always been wary of Irish economic data, Noonan's actions severally damaged their confidence.[19]

Introduction of GNI*

In response to these issues, and as a direct result of the "leprechaun economics" affair, the Governor of the Central Bank of Ireland, Philip R. Lane, convened a special economic steering group (Economic Statistics Review Group, or ESRG) in Septemner 2016, to recommend economic statistics that would better represent the true position of the Irish economy.[20]

The result was the creation of a new metric - "modified Gross National Income" (or GNI* for short). The difference between GNI* and GNI due to having to deal with two problems (a) The retained earnings of re-domiciled firms in Ireland (where the earnings ultimately accrue to foreign investors), and (b) depreciation on foreign-owned capital assets located in Ireland, such as intellectual property (which inflate the size of Irish GDP, but again the benefits accrue to foreign investors). Report Site of the ESRG.[21][22]

The CSO simplify the definition of Modified GNI (or GNI*) as:

GNI less the effects of the profits of re-domiciled companies and the depreciation of intellectual property products and aircraft leasing companies.[23]

The CSO will continue to calculate and release Irish GDP and Irish GNP to meet their EU and other International statistical reporting committments.

The CSO estimated that 2016 Irish GNI* (€190bn) is 30% below 2016 Irish GDP (€275bn) and Irish Debt/GNI* goes to 106% (Irish Debt/GDP was 73%).[24][25]

Debt metrics

A key driver of the creation of the "modified GNI" (or GNI*) was around providing global capital providers with appropriate Irish debt metrics.

The issues post "leprechaun economics" and "modified GNI", is captured on page 34 of the OECD 2018 Ireland survey:[26]

- On a Gross Public Debt-to-GDP basis, Ireland's 2015 figure at 78.8% is not of concern.

- On a Gross Public Debt-to-GNI* basis, Ireland's 2015 figure at 116.5% is more serious, but not alarming.

- On a Gross Public Debt Per Capita basis, Ireland's 2015 figure at over $62,686 per capita, exceeds every other OECD country, except Japan.[27]

See also

- Economy of Ireland

- Double Irish, Single Malt, Capital Allowances for Intangible Assets

- Irish Fiscal Advisory Council

- Revenue Commissioners

References

- ^ "After a Tax Crackdown, Apple Found a New Shelter for Its Profits". New York Times. 6 November 2017.

- ^ "International GNI to GDP Comparisons". Seamus Coffey, University College Cork. 29 April 2013.

- ^ "CRISIS RECOVERY IN A COUNTRY WITH A HIGH PRESENCE OF FOREIGN OWNED COMPANIES" (PDF). IMK Institute, Berlin. January 2017.

- ^ "Europe points finger at Ireland over tax avoidance". Irish Times. 7 March 2018.

- ^ "What Apple did next". Seamus Coffey, University College Cork. 24 January 2014.

- ^ "National Income and Expenditure Annual Results 2015". Central Statistics. 12 July 2016.

- ^ "'Leprechaun economics' - Ireland's 26pc growth spurt laughed off as 'farcical'". Irish Independent. 13 July 2016.

- ^ "Concern as Irish growth rate dubbed 'leprechaun economics'". Irish Times. 13 July 2016.

- ^ "Blog: The real story behind Ireland's 'Leprechaun' economics fiasco". RTE News. 25 July 2017.

- ^ "Irish tell a tale of 26.3% growth spurt". Financial Times. 12 July 2016.

- ^ ""Leprechaun economics" - experts aren't impressed with Ireland's GDP figures". thejournal.ie. 13 July 2016.

- ^ "Irish tell a tale of 26.3% growth spurt". Financial Times. 12 July 2016.

- ^ "'Leprechaun economics' leaves Irish growth story in limbo". Reuters News. 13 July 2016.

- ^ "'Leprechaun Economics' Earn Ireland Ridicule, $443 Million Bill". Bloomberg News. 13 July 2016.

- ^ "Leprechaun Economics". Paul Krugman (Twitter). 12 July 2016.

- ^ "Now 'Leprechaun Economics' puts Budget spending at risk". Irish Independent. 21 July 2016.

- ^ "Leprechaun economics pushes Ireland's EU bill up to €2bn". Irish Independent. 30 September 2017.

- ^ a b "Change in tax treatment of intellectual property and subsequent and reversal hard to fathom". Irish Times. 8 November 2017.

- ^ "Meaningless economic statistics will cause problems for stewardship of country". RTE News. 13 July 2016.

- ^ "REPORT OF THE ECONOMIC STATISTICS REVIEW GROUP" (PDF). Central Statistics Office. December 2016.

- ^ "ESRG Presentation and CSO Response" (PDF). Central Statistics Office. 4 February 2017.

- ^ "Leprechaun-proofing economic data". RTE News. 4 February 2017.

- ^ "CSO Data Editor's Note". Central Statistics Office. 14 July 2017.

- ^ "CSO paints a very different picture of Irish economy with new measure". Irish Times. 15 July 2017.

- ^ "New economic Leprechaun on loose as rate of growth plunges". Irish Independent. 15 July 2017.

- ^ "OECD Ireland Survey 2018" (PDF). OECD. March 2018.

- ^ "National debt now €44000 per head". Irish Independent. 7 July 2017.

]