Pictet Group: Difference between revisions

updated with Basel ratio and agency rating |

added new logo |

||

| Line 2: | Line 2: | ||

{{Infobox bank |

{{Infobox bank |

||

|logo = |

|logo = Pictet_logo.jpg |

||

|industry = Private banking |

|industry = Private banking |

||

|founders = Jacob-Michel-François de Candolle and Jacques-Henry Mallet |

|founders = Jacob-Michel-François de Candolle and Jacques-Henry Mallet |

||

Revision as of 15:12, 9 July 2015

A major contributor to this article appears to have a close connection with its subject. (February 2015) |

| File:Pictet logo.jpg | |

| Industry | Private banking |

|---|---|

| Founded | 23 July 1805 |

| Founders | Jacob-Michel-François de Candolle and Jacques-Henry Mallet |

| Headquarters | |

Number of locations | 26 |

Area served | worldwide |

| 767,904,000 Swiss franc (2022) | |

| Total assets | |

Number of employees | 5,439 (2023) |

| Capital ratio | 21.3% |

| Rating | Moody's: Prime 1/Aa2[2]; Fitch: F1+/AA-[3] |

Pictet is a private bank and asset manager based in Geneva, Switzerland, since 1805. It belongs to the Henokiens, an association of family businesses and bicentenary companies. Pictet ranks among Switzerland’s leading private banks and is one of the premier independent asset managers in Europe.[4] It provides services in wealth management, asset management and asset servicing to private clients and institutions around the world.

Founded in Geneva in 1805, Pictet has operated as a partnership throughout its history. Over the past 210 years, there have been only 40 partners, each with an average tenure of more than 21 years. Today, it is organised as a corporate partnership of seven owner managers who are responsible for the entire business of the Group. Significant growth has been achieved since 1805 without making acquisitions or floating on a stock exchange.

The Pictet Group employs more than 3,800 people, including 900 investment managers.[1] It has a global network of 26 offices in financial services centres, including registered banks in Geneva, Luxemburg, Nassau, Hong Kong and Singapore.

According to the latest Group Annual Report, the Group had 435 CHF Bn of assets under management. And according to the Scorpio Partnership Global Private Benchmark 2014, it had, in that year, an increase of 12% on 2013.[5]

Pictet does not engage in investment banking, nor does it extend commercial loans. The Group’s capital significantly exceeds the already stringent levels demanded by Swiss regulation: its total capital ratio is 21.3%, all of which is core tier 1 capital.[1] Banque Pictet & Cie is rated Prime 1/Aa2 by Moody’s,[2] and F1+/AA- by Fitch.[3]

History

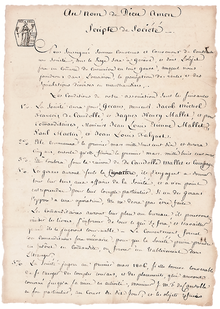

Pictet traces its origin to the foundation of Banque de Candolle Mallet & Cie in Geneva on 23 July 1805. On that day, Jacob-Michel-François de Candolle and Jacques-Henry Mallet signed, with three limited partners,[6] a Scripte de Société (memorandum of association) to form a partnership.[7] Like all Geneva banks at the time, it started out trading in goods, but soon abandoned trading to concentrate on assisting clients in their financial and commercial business and advising them on managing their wealth. By the 1830s, it held a broad range of securities on behalf of clients, to diversify their risks.

On the death of de Candolle in 1841, his wife’s nephew Edouard Pictet joined the partnership, and the name Pictet has remained with the bank ever since. Between 1890 and 1929, the Bank went through a period of substantial growth, the number of employees rising from 12 to more than 80 over 30 years.[8] Although the Pictet family had been intimately engaged with the bank since the mid 19th century, it was only in 1926 that the company changed its name to Pictet & Cie.

After a period of relative stagnation marked by the Great Depression of the 1930s and the Second World War, Pictet began to expand in the 1950s as the Western world entered a prolonged period of prosperity and economic growth. In the late 1960s, the Bank embarked on the new business of institutional asset management, which has since grown to account for around half its total assets under management.[9] In 1974, it opened an office in Montreal, the first of its current network of 26 offices around the world. Its workforce of 70 staff in 1950 rose to 300 by 1980.[10]

Pictet has focused on wealth management from the start and it continues to do so today, providing three main groups of services to individuals, families and institutions around the world: wealth management, asset management and asset services. It has now become Switzerland’s third largest asset manager, and also one of Europe’s largest bank in private hands[11]

In 2014, Pictet changed its legal structure from a simple partnership to become a corporate partnership (société en commandite par actions) which acts as a holding company for the Group’s activities around the world. This was designed to enable the Group to manage its businesses in an international environment,[12] and also allows the seven partners who are owner managers of the Group to preserve the rules of succession which have remained unchanged for more than 200 years.

Under those rules, ownership cannot be passed down to partners’ children: it is a temporary status which ends once a partner has retired. Partners hand over ownership of the Group in batches every five to ten years so that there are always partners from three generations connected to the family, to avoid problems that can arise with generational change.[11]

Pictet operates by assigning business activities and key functions like human resources, risk control and legal affairs to different partners. Small committees supervise the various corporate activities so that no single partner is solely responsible for an entire area. The Group’s Senior Partner, who is the eldest partner at the time of appointment, has no direct operational responsibilities but has oversight for all areas concerning auditing, risk and compliance.[11]

Structure

Wealth management

Pictet Wealth Management provides private banking expertise, wealth solutions for owners of larger fortunes and family office services for families of exceptional wealth. The services include dedicated asset management, advice on strategy and investment selection, execution in global markets, safeguarding client assets and continuous monitoring. For hedge funds, private equity and real estate investments, Pictet Alternative Advisors, an independent unit, selects third-party investment managers to construct alternative investment portfolios for investors.

Operating out of 19 Pictet offices worldwide, Pictet Wealth Management had CHF 166bn of assets under management at December 31, 2014 and employed 686 full-time equivalent employees, including 341 private bankers. Pictet Alternative Advisors has total alternative assets under management of CHF 16bn, including CHF 9.5bn in hedge funds, CHF6bn in private equity and CHF 800m in real estate.[1]

On November 26, 2012, it was reported that Pictet's wealth management unit was the target of a United States Department of Justice investigation.[13]

Asset management

Pictet Asset Management manages assets for institutional investors and investment funds, including large pension funds, sovereign wealth funds and financial institutions. It also manages assets for individual investors through an extensive range of mandates, products and services. It provides clients with active and quantitative support for managing equities, fixed income, multi-asset and alternative strategies.

Since 1997, the department has been developing Socially Responsible Investments (SRI). It now manages SRI core equity portfolios for all major markets. It has also taken a thematic approach, focusing on environmental themes or sectors such as clean energy and timber that are key to the concept of sustainability.[14]

Operating out of 17 Pictet offices worldwide, Pictet Asset Management had CHF 157bn of assets under management at December 31, 2014 and employed 740 full-time equivalent employees, including 320 investment professionals.[1]

Asset services

Pictet Asset Services provides a range of services for asset managers, pension funds and banks. These include: fund services for institutional or private investors and for independent asset managers; custody services in more than 80 countries; and round-the-clock trading across all significant asset classes by Pictet Global Markets. Fund services include setting up funds, administering them and fund governance. With nine booking centres accessing the single global platform, Pictet Asset Services had CHF 401bn of assets in custody at December 31, 2014 and employed 1,000 full-time equivalent employees.[1]

Corporate Social Responsibility

The Pictet Group's Charitable Foundation was created in 2009 to formalise the charitable and philanthropic work supported by Pictet’s partners. Its primary purpose is to help finance charitable organisations and public-interest projects in Switzerland and abroad. The Foundation lends its support to around 200 projects a year in the fields of health, social causes, arts and culture, and the environment.

In 2008, Pictet launched the Prix Pictet, the world's first photographic prize dedicated to sustainable development. Each year, nominated photographers are invited to submit a series of pictures on a chosen theme such as Consumption or Earth. The winner is selected by an independent jury.[15]

Since 2007, the Pictet Group has published an annual carbon footprint statement using a method that complies with ISO 14064-1, certified by the Swiss Association for Quality and Management Systems. The Group has a target of reducing carbon dioxide emissions by 40% per employee by 2020.[16]

References

- ^ a b c d e f "Annual report 2014" (PDF). www.pictet.com. The Pictet Group. 31 December 2014. Retrieved 30 June 2015.

- ^ a b "Moody's takes rating actions on Swiss banks". Moody’s Global Credit Research. 21 May 2015. Retrieved 1 July 2015.

- ^ a b "Fitch Affirms Banque Pictet at 'AA-'; Outlook Stable". Fith ratings. 17 December 2014. Retrieved 1 July 2015.

- ^ "FT Global Private Banking Awards". L’agefi. 1 November 2013.

- ^ Scorpio Partnership. "Global Private Banking Benchmark 2014 – Scorpio Report". Retrieved 1 July 2014.

- ^ Jean-Louis Mallet, brother of Jacques-Henry, Paul Martin and Jean-Louis Falquet

- ^ "Pictet & Cie", 1805-1955, Atar, Geneva, 1955.

- ^ Pictet Group Historical Archives, ref. AHP 1.1.7.1

- ^ "200 years of History : one bank and the men who built it", Atar, Geneva, 2005.

- ^ "Pictet & Cie, Genève : 1805-1980", Geneva, Atar, 1980.

- ^ a b c Städeli, Markus (27 November 2011). "Eckpunkte einer langen Firmengeschichte" [Turning points in a long corporate history]. NZZ (in German). Zurich. Retrieved 30 June 2015.

- ^ Sallier, Pierre-Alexandre (6 February 2013). "Schisme chez les banquiers privés" [Schism amongst private bankers]. Le Temps (in French). Geneva. Retrieved 30 June 2015.

- ^ Broom, Giles (26 November 2012). "Pictet Targeted in Widening U.S. Probe of Swiss Wealth Managers". Bloomberg.com. Retrieved 30 June 2015.

- ^ "Socially Responsible Investment (SRI)". www.pictet.com. Pictet. Retrieved 30 June 2015.

- ^ "Prix Pictet". The Financial Times. 3 July 2013. Retrieved 1 July 2015.

- ^ "Carbon footprint 2013" (PDF). www.pictet.com. Pictet. 5 November 2014. Retrieved 1 July 2015.