Letter of credit

A standard, commercial letter of credit (LC) is a document issued mostly by a financial institution, used primarily in trade finance, which usually provides an irrevocable payment undertaking.

The LC can also be the source of payment for a transaction, meaning that redeeming the letter of credit will pay an exporter. Letters of credit are used primarily in international trade transactions of significant value, for deals between a supplier in one country and a customer in another. They are also used in the land development process to ensure that approved public facilities (streets, sidewalks, stormwater ponds, etc.) will be built. The parties to a letter of credit are usually a beneficiary who is to receive the money, the issuing bank of whom the applicant is a client, and the advising bank of whom the beneficiary is a client. Almost all letters of credit are irrevocable, i.e., cannot be amended or canceled without prior agreement of the beneficiary, the issuing bank and the confirming bank, if any. In executing a transaction, letters of credit incorporate functions common to giros and Traveler's cheques. Typically, the documents a beneficiary has to present in order to receive payment include a commercial invoice, bill of lading, and documents proving the shipment was insured against loss or damage in transit. However, the list and form of documents is open to imagination and negotiation and might contain requirements to present documents issued by a neutral third party evidencing the quality of the goods shipped, or their place of origin.

Terminology

The English name “letter of credit” derives from the French word “accreditation”, a power to do something, which in turn is derivative of the Latin word “accreditivus”, meaning trust. S.‘The Application any defence relating to the underlying contract of sale. This is as long as the seller performs their duties to an extent that meets the requirements contained in the LC.

How it works

A business called the InCosmetika from time to time imports goods from a business called BLISS, which banks with the ABC Bank. InCosmetika holds an account at the Commonwealth Bank. InCosmetika wants to buy $500,000 worth of merchandise from BLISS, who agrees to sell the goods and give InCosmetika 60 days to pay for them, on the condition that they are provided with a 90-day letter of credit for the full amount. The steps to get the letter of credit would be as follows:

- InCosmetika goes to The Commonwealth Bank and requests a $500,000 letter of credit, with BLISS as the beneficiary.

- The Commonwealth Bank can issue an LC either on approval of a standard loan underwriting process or by InCosmetika funding it directly with a deposit of $500,000 plus fees which are typically between 1% and 8% of the face value of the LC.

- The Commonwealth Bank sends a copy of the LC to the ABC Bank, which notifies BLISS that payment is available and they can ship the merchandise InCosmetika has ordered with the full assurance of payment to them.

- On presentation of the stipulated documents in the letter of credit and compliance with the terms and conditions of the letter of credit, the Commonwealth Bank transfers the $500,000 to the ABC Bank, which then credits the account of BLISS for that amount.

- Note that banks deal only with documents required in the letter of credit and not the underlying transaction.

- Many exporters have mistakenly assumed that the payment is guaranteed after receiving the LC. The issuing bank is obligated to pay under the letter of credit only when the stipulated documents are presented and the terms and conditions of the letter of credit have been met.

Availability

, to the Beneficiary of the Credit provided, stipulated documents strictly complying with the provisions of the LC, UCP 600 and other international standard banking practices, are presented to the issuing bank , then :

- i.if the Credit provides for sight payment – by payment at sight against compliant presentation

- ii.if the Credit provides for deferred payment – by payment on the maturity date(s) determinable in accordance with the stipulations of the Credit; and of course undertaking to pay on due date and confirming maturity date at the time of compliant presentation

- iii.a.if the Credit provides for acceptance by the Issuing Bank – by acceptance of Draft(s) drawn by the Beneficiary on the Issuing Bank and payment at maturity of such tenor draft, or

- iii.b. if the Credit provides for acceptance by another drawee bank – by acceptance and payment at maturity Draft(s)drawn by the Beneficiary on the Issuing Bank in the event the drawee bank stipulated in the Credit does not accept Draft(s) drawn on it,

or by payment of Draft(s) accepted but not paid by such drawee bank at maturity;

- iv. if the Credit provides for negotiation by another bank – by payment without recourse to drawers and/or bona fide holders, Draft(s) drawn by the Beneficiary and/or document(s) presented under the Credit, (and so negotiated by the nominated bank )

- Negotiation means the giving of value for Draft(s) and/or document(s) by the bank authorized to negotiate, viz the nominated bank. Mere examination of the documents and forwarding the same to LC issuing bank for reimbursement, without giving of value / agreed to give, does not constitute a negotiation.

Some of the Documents Called for under a LC

- Financial Documents

- Bill of Exchange, Co-accepted Draft

- Commercial Documents

- Invoice, Packing list

- Shipping Documents

- Transport Document, Insurance Certificate, Commercial, Official or Legal Documents

- Official Documents

- License, Embassy legalization, Origin Certificate, Inspection Cert , Phyto-sanitary Certificate

- Transport Documents

- Bill of Lading (ocean or multi-modal or Charter party), Airway bill, Lorry/truck receipt, railway receipt, CMC Other than Mate Receipt, Forwarder Cargo Receipt, Deliver Challan...etc

- Insurance documents

- Insurance policy, or Certificate but not a cover note.

Legal principles governing documentary credits

One of the primary peculiarities of the documentary credit is that the payment obligation is abstract and independent from the underlying contract of sale or any other contract in the transaction. Thus the bank’s obligation is defined by the terms of the credit alone, and the sale contract is irrelevant. The defences of the buyer arising out of the sale contract do not concern the bank and in no way affect its liability.[1] Article 4(a) UCP states this principle clearly. Article 5 the UCP further states that banks deal with documents only, they are not concerned with the goods (facts). Accordingly, if the documents tendered by the beneficiary, or his or her agent, appear to be in order, then in general the bank is obliged to pay without further qualifications.

The policies behind adopting the abstraction principle are purely commercial and reflect a party’s expectations: firstly, if the responsibility for the validity of documents was thrown onto banks, they would be burdened with investigating the underlying facts of each transaction and would thus be less inclined to issue documentary credits as the transaction would involve great risk and inconvenience. Secondly, documents required under the credit could in certain circumstances be different from those required under the sale transaction; banks would then be placed in a dilemma in deciding which terms to follow if required to look behind the credit agreement. Thirdly, the fact that the basic function of the credit is to provide the seller with the certainty of receiving payment, as long as he performs his documentary duties, suggests that banks should honour their obligation notwithstanding allegations of misfeasance by the buyer. [2] Finally, courts have emphasised that buyers always have a remedy for an action upon the contract of sale, and that it would be a calamity for the business world if, for every breach of contract between the seller and buyer, a bank were required to investigate said breach.

The “principle of strict compliance” also aims to make the bank’s duty of effecting payment against documents easy, efficient and quick. Hence, if the documents tendered under the credit deviate from the language of the credit the bank is entitled to withhold payment even if the deviation is purely terminological.[3] The general legal maxim de minimis non curat lex has no place in the field of documentary credits.

The price of LCs

All the charges for issuance of Letter of Credit, negotiation of documents, reimbursements and other charges like courier are to the account of applicant or as per the terms and conditions of the Letter of credit. If the LC is silent on charges, then they are to the account of the Applicant. The description of charges and who would be bearing them would be indicated in the field 71B in the Letter of Credit.

Legal Basis for Letters of Credit

Although documentary credits are enforceable once communicated to the beneficiary, it is difficult to show any consideration given by the beneficiary to the banker prior to the tender of documents. In such transactions the undertaking by the beneficiary to deliver the goods to the applicant is not sufficient consideration for the bank’s promise because the contract of sale is made before the issuance of the credit, thus consideration in these circumstances is past. In addition, the performance of an existing duty under a contract cannot be a valid consideration for a new promise made by the bank: the delivery of the goods is consideration for enforcing the underlying contract of sale and cannot be used, as it were, a second time to establish the enforceability of the bank-beneficiary relation.

Legal writers have analyzed every possible theory from every legal angle and failed to satisfactorily reconcile the bank’s undertaking with any contractual analysis. The theories include: the implied promise, assignment theory, the novation theory, reliance theory, agency theories, estoppels and trust theories, anticipatory theory, and the guarantee theory. [4] Davis, Treitel, Goode, Finkelstein and Ellinger have all accepted the view that documentary credits should be analyzed outside the legal framework of contractual principles, which require the presence of consideration. Accordingly, whether the documentary credit is referred to as a promise, an undertaking, a chose in action, an engagement or a contract, it is acceptable in English jurisprudence to treat it as contractual in nature, despite the fact that it possesses distinctive features, which make it sui generis.

A few countries including the US (see Article 5 of the Uniform Commercial Code) have created statutes in relation to the operation of LCs. These statutes are designed to work with the rules of practice including the UCP and the ISP98. These rules are practice are incorporated into the LC transaction by agreement of the parties. The latest version of the UCP is the UCP600 effective July 1, 2007[5]. The previous revision was the UCP500 and became effective on 1 January 1994. Since the UCP are not laws, parties have to include them into their arrangements as normal contractual provisions.

International Trade Payment methods

- Advance payment (most secure for seller)

Where the buyer parts with money first and waits for the seller to forward the goods

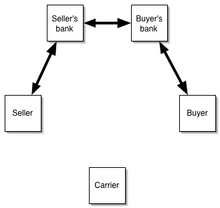

- Documentary Credit (more secure for seller as well as buyer)

subject to ICC's UCP 600, where the bank gives an undertaking (on behalf of buyer and at the request of applicant ) to pay the shipper ( beneficiary ) the value of the goods shipped if certain docs are submitted and if the stipulated terms and conditions are strictly complied.

Here the buyer can be confident that the goods he is expecting only will be received since it will be evidenced in the form of certain docs called for meeting the specified terms and conditions while the supplier can be confident that if he meets the stipulations his payment for the shipment is guaranteed by bank, who is independent of the parties to the contract.

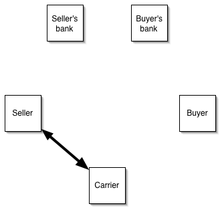

- Documentary collection (more secure for buyer and to a certain extent to seller)

subject to ICC's URC 525, sight and usance, for delivery of shipping documents against payment or acceptances of draft, where shipment happens first, then the title documents are sent to the [collecting bank] buyer's bank by seller's bank [remitting bank], for delivering documents against collection of payment/acceptance

- Direct payment (most secure for buyer)

Where the supplier ships the goods and waits for the buyer to remit the bill proceeds, on open account terms

Risk situations in LC transaction

General Risks

- If goods are being offered for sale at a price that is too good to be true, then it probably is too good to be true’

Fraud Risks

- The payment will be obtained for nonexistent or worthless merchandise against presentation by the Beneficiary of forged or falsified documents.

- Credit itself may be forged.

Sovereign and Regulatory Risks

- Performance of the Documentary Credit may be prevented by government action outside the control of the parties.

Legal Risks

- Possibility that performance of a Documentary Credit may be disturbed by legal action relating directly to the parties and their rights and obligations under the Documentary Credit

Force Majeure and Frustration of Contract

- Performance of a contract – including an obligation under a Documentary Credit relationship – is prevented by external factors such as natural disasters or armed conflicts

Risks to the Applicant

- Non-delivery of Goods

- Short Shipment

- Inferior Quality

- Early /Late Shipment

- Damaged in transit

- Foreign exchange

- Failure of Bank viz Issuing bank / Collecting Bank

Risks to the Issuing Bank

- Insolvency of the Applicant

- Fraud Risk, Sovereign and Regulatory Risk and Legal Risks

Risks to the Reimbursing Bank

- no obligation to reimburse the Claiming Bank unless it has issued a reimbursement undertaking.

Risks to the Beneficiary

- Failure to Comply with Credit Conditions

- Failure of, or Delays in Payment from, the Issuing Bank

- Credit Issued by Party other than Bank

Risks to the Advising Bank

- The Advising Bank’s only obligation – if it accepts the Issuing Bank’s instructions – is to check the apparent authenticity of the Credit and advising it to the Beneficiary

Risks to the Nominated Bank

- Nominated Bank has made a payment to the Beneficiary against documents that comply with the terms and conditions of the Credit and is unable to obtain reimbursement from the Issuing Bank

Risks to the Confirming Bank

- If Confirming Bank’s main risk is that, once having paid the Beneficiary, it may not be able to obtain reimbursement from the Issuing Bank because of insolvency of the Issuing Bank or refusal of the Issuing Bank to reimburse because of a dispute as to whether or not payment should have been made under the Credit

Risks in International Trade

- A Credit risk risk from change in the credit of an opposing business.

- An Exchange risk is a risk from a change in the foreign exchange rate.

- A Force majeure risk is 1. a risk in trade incapability caused by a change in a country's policy, and 2. a risk caused by a natural disaster.

- Other risks are mainly risks caused by a difference in law, language or culture. In these cases, the cargo might be found late because of a dispute in import and export dealings.

See also

References

- ^ See Ficom S.A. v. Sociedad Cadex [1980] 2 Lloyd’s Rep. 118.

- ^ United City Merchants (Investments) Ltd v Royal Bank of Canada (The American Accord) [1983] 1.A.C.168 at 183

- ^ J. H. Rayner & Co., Ltd., and the Oilseeds Trading Company, Ltd. v.Hambros Bank Limited [1942] 73 Ll. L. Rep. 32

- ^ For extensive analysis See Finkelstein, H. Legal Aspects of Commercial Letters of Credit, pp. 275-295

- ^ Dominique Doise,“The 2007 Revision of the Uniform Customs and Practice for Documentary Credits (UCP 600)”[1]