Dynamic currency conversion

This article needs additional citations for verification. (June 2012) |

Dynamic Currency Conversion (DCC) or Cardholder Preferred Currency (CPC) is a financial service in which holders of credit cards have the cost of a transaction converted to their local currency when making a payment in a foreign currency. Currently this feature is only possible for Visa and MasterCard networks. American Express provides for multi currency transactions for ecommerce merchants. Dynamic currency conversion allows customers to see the exact amount their card will be charged, expressed in their own home currency, but the exchange rate is generally less favorable than that offered through their credit card company.

For example, the following is a typical DCC transaction at point of sale. A cardholder (say, from the United States) that is traveling in Europe presents a Visa/MasterCard for payment for a product/service priced in euros. The credit card details are captured on the point of sale device (POS), which identifies that the card is a USA issued card. The cashier asks the cardholder if he/she would like to pay in US dollars, and if so, the POS converts the euro amount into US dollars based on a set exchange rate. This exchange rate is selected by the merchant, but is usually less favorable to the cardholder than the rate offered by the card issuer.[1] The cardholder signs a receipt that shows the euro amount, rate of exchange and the US dollar amount. The service guarantees that this exact US dollar amount will be debited to the cardholder account, and the exact euro amount will be credited to the merchant’s account. However, the US bank that issued the card may impose an additional foreign transaction fee on the customer.

Prior to the card schemes (Visa and MasterCard) imposing rules relating to DCC, cardholder transactions were converted without the need to disclose that the transaction was converted into their home currency, in a process known as "back office DCC". Visa and MasterCard now prohibit this practice and require the customer's consent for DCC, although many travelers have reported that this is not universally followed.[2][3]

Even with Visa and MasterCard's rules, it can be argued that the customer is not given enough information to make a truly informed choice. However, for a non-DCC transaction the card schemes do not apply their exchange rates until the transaction is cleared, so the customer only becomes aware of the rate used when it appears on their account. While DCC transactions will generally have an poorer rate of exchange than the card scheme rates, the DCC rate used is displayed up-front to the cardholder before confirming the transaction.

DCC has proved popular with merchants.[citation needed] This is in part because merchants believe it will improve the customer experience and in part because it enables merchants to profit from the foreign exchange conversion that occurs during the payment process for a foreign denominated Visa or MasterCard.[citation needed] Anecdotal evidence suggests there are many customers who do not understand DCC and are not able to make an informed decision whether to elect to pay in the local currency or in their home currency.[citation needed]

Credit card acquirers and payment gateways will also take a profit on the foreign exchange conversion that occurs during the payment process for foreign denominated Visa and Mastercards when DCC is used. DCC revenue has been important for them because it offsets increasing international interchange fees.

Among the biggest advantages to customers according to proponents:

- the ability to view and therefore understand prices in foreign countries in their home currency

- the ability to enter expenses more easily (for business travellers)

- EU regulation 2560/2001 could make non-eurozone cash withdrawals within the European Economic Area cheaper for eurozone customers, because euro cash withdrawals are regulated. A Swedish law (SFS 2002:598) combined with the EU resolution does the same thing for Swedish cards if the transaction is in SEK or EUR. Generally, Eurozone banks charge a fixed fee for foreign cash withdrawals while domestic withdrawals are fee of charge. Because of the EU regulation, this makes EEA withdrawals in euros free of charge. For example, let's say that a eurozone card is used for a withdrawal in the UK. With DCC there are two options: processing the transaction in pounds (good exhange rate but a fixed cash withdrawal fee) or processing the transaction in euros (bad exchange rate but no fixed cash withdrawal fee). For small amounts, the latter option may turn out cheaper.

The major drawback of DCC for the customer is the unfavorable exchange rates being applied by the merchant, resulting in a higher charge on their credit card.

The size of the foreign exchange margin added using DCC varies depending on DCC provider, card acquirer or payment gateway and merchant. This margin is in addition to any charges levied by the customer's bank or credit card company for a foreign purchase. In most cases, customers are charged more using DCC than they would have been if they had simply paid in the foreign currency.[4][5][6]

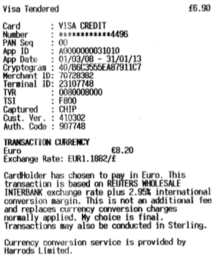

An example can be seen in the following image, where the same GBP purchase is made twice just after each other: one with DCC and one without DCC. In both cases, the original amount is GBP 6.90 and is paid with a Visa card denominated in EUR. When applying DCC (left part of the image), the amount becomes EUR 8.20. This will also be the amount on the credit card statement. Without DCC, the amount is GBP 6.90 and the resulting EUR charge can be found only at the credit card statement, and can vary with any fluctuations between the GBP and EUR currencies.

On the card statement, the difference in charges can be seen: the DCC transaction is correctly charged at EUR 8.20 while the non-DCC is charged at EUR 8.04 - a difference of almost 2%. While this may seem a small amount for the customer, it can mean a big income stream for acquirer and merchant.

DCC Third Party Providers

The primary providers of DCC are FEXCO Merchant Services [7], Fintrax Group, MONEX Financial Services [8] Planet Payment [9] and Global Blue [10]

Summary of DCC Pros and Cons

Pros:

- Amount on receipt, in home currency, will guarantee that amount on the credit card statement.

- No fumbling around with figuring out the local currency to home currency ratio.

- For businesses, time spent on reconciling credit card transactions may be quicker than converting the purchase from local currency to home currency.

- Merchants profit from DCC.

Cons:

- Rate is often poorer than the actual exchange rate; as merchant sets the rate in their favor.

- Customers are often provided "false" information by the vendor such as: "DCC bypasses foreign transaction fees (currency conversion fees)," which is not true as credit card companies state that all transactions are subject to foreign transaction fees regardless of whether it is made in local or home currency; per their credit card agreement.

- Customers may find DCC to be forced upon them, without a clear choice, as merchants "claim" their machines automatically convert purchases to home currency at the point of sale.

- Credit card disputes can be lengthy or impossible if a customer signs the receipt with / without a clear choice.

References

- ^ Keck, Gayle (31 July 2005). "Charge It . . . but Check the Math". Washington Post. Retrieved 31 December 2011.

- ^ Collinson, Patrick (12 July 2008). "Going to Spain? Just say no". The Guardian. London. Retrieved 1 May 2010.

- ^ "Dynamic currency exchange". FlyerTalk. Retrieved 31 December 2011.

- ^ Steele, Jason. "The Foreign Conversion Scam". Retrieved 31 December 2011.

- ^ Keck, Gayle (31 July 2005). "Charge It . . . but Check the Math". Washington Post. Retrieved 31 December 2011.

- ^ "Dynamic Currency Conversion: Still A Scam". 9 March 2008. courant.com. Retrieved 31 December 2011.

- ^ FEXCO Merchant Services

- ^ Monex Financial Services

- ^ Planet Payment

- ^ Global Blue