Break-even point

The break-even level or break-even point (BEP) represents the sales amount—in either unit or revenue terms—that is required to cover total costs (both fixed and variable). Total profit at the break-even point is zero. Break-even is only possible if a firm’s prices are higher than its variable costs per unit. If so, then each unit of the product sold will generate some “contribution” toward covering fixed costs.[1]

In economics and business, specifically cost accounting, the break-even point (BEP) is the point at which total cost and total revenue are equal: there is no net loss or gain, and one has "broken even." A profit or a loss has not been made, although opportunity costs have been "paid," and capital has received the risk-adjusted, expected return. In short, all costs that needs to be paid are paid by the firm but the profit is equal to 0. [2][3]

For example, if a business sells fewer than 200 tables each month, it will make a loss; if it sells more, it will make a profit. With this information, the business managers will then need to see if they expect to be able to make and sell 200 tables per month.

If they think they cannot sell that many, to ensure viability they could:

- Try to reduce the fixed costs (by renegotiating rent for example, or keeping better control of telephone bills or other costs)

- Try to reduce variable costs (the price it pays for the tables by finding a new supplier)

- Increase the selling price of their tables.

Any of these would reduce the break-even point. In other words, the business would not need to sell so many tables to make sure it could pay its fixed costs.

Purpose

The purpose of break-even analysis is to provide a rough indicator of the earnings impact of a marketing activity.[1]

The break-even point is one of the simplest yet least used analytical tools in management. It helps to provide a dynamic view of the relationships between sales, costs, and profits. For example, expressing break-even sales as a percentage of actual sales can give managers a chance to understand when to expect to break even (by linking the percent to when in the week/month this percent of sales might occur).

The break-even point is a special case of Target Income Sales, where Target Income is 0 (breaking even). This is very important for financial analysis.

Construction

In the linear Cost-Volume-Profit Analysis model (where marginal costs and marginal revenues are constant, among other assumptions), the break-even point (BEP) (in terms of Unit Sales (X)) can be directly computed in terms of Total Revenue (TR) and Total Costs (TC) as:

where:

- TFC is Total Fixed Costs,

- P is Unit Sale Price, and

- V is Unit Variable Cost.

The quantity, , is of interest in its own right, and is called the Unit Contribution Margin (C): it is the marginal profit per unit, or alternatively the portion of each sale that contributes to Fixed Costs. Thus the break-even point can be more simply computed as the point where Total Contribution = Total Fixed Cost:

To calculate the break-even point in terms of revenue (a.k.a. currency units, a.k.a. sales proceeds) instead of Unit Sales (X), the above calculation can be multiplied by Price, or, equivalently, the Contribution Margin Ratio (Unit Contribution Margin over Price) can be calculated:

R=C, Where R is revenue generated, C is cost incurred i.e. Fixed costs + Variable Costs or Q * P (Price per unit) = TFC + Q * VC (Price per unit), Q * P - Q * VC = TFC, Q * (P - VC) = TFC, or, Break Even Analysis Q = TFC/c/s ratio=Break Even

Margin of safety

Margin of safety represents the strength of the business. It enables a business to know what is the exact amount it has gained or lost and whether they are over or below the break-even point.[4]

- Margin of safety = (current output - breakeven output)

- Margin of safety% = (current output - breakeven output)/current output × 100

When dealing with budgets you would instead replace "Current output" with "Budgeted output." If P/V ratio is given then profit/PV ratio.

Break-even analysis

By inserting different prices into the formula, you will obtain a number of break-even points, one for each possible price charged. If the firm changes the selling price for its product, from $2 to $2.30, in the example above, then it would have to sell only 1000/(2.3 - 0.6)= 589 units to break even, rather than 715.

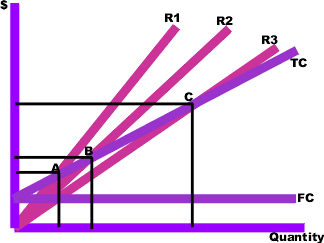

To make the results clearer, they can be graphed. To do this, you draw the total cost curve (TC in the diagram) which shows the total cost associated with each possible level of output, the fixed cost curve (FC) which shows the costs that do not vary with output level, and finally the various total revenue lines (R1, R2, and R3) which show the total amount of revenue received at each output level, given the price you will be charging.

The break-even points (A,B,C) are the points of intersection between the total cost curve (TC) and a total revenue curve (R1, R2, or R3). The break-even quantity at each selling price can be read off the horizontal axis and the break-even price at each selling price can be read off the vertical axis. The total cost, total revenue, and fixed cost curves can each be constructed with simple formula. For example, the total revenue curve is simply the product of selling price times quantity for each output quantity. The data used in these formula come either from accounting records or from various estimation techniques such as regression analysis.

Limitations

- Break-even analysis is only a supply-side (i.e., costs only) analysis, as it tells you nothing about what sales are actually likely to be for the product at these various prices.

- It assumes that fixed costs (FC) are constant. Although this is true in the short run, an increase in the scale of production is likely to cause fixed costs to rise.

- It assumes average variable costs are constant per unit of output, at least in the range of likely quantities of sales. (i.e., linearity).

- It assumes that the quantity of goods produced is equal to the quantity of goods sold (i.e., there is no change in the quantity of goods held in inventory at the beginning of the period and the quantity of goods held in inventory at the end of the period).

- In multi-product companies, it assumes that the relative proportions of each product sold and produced are constant (i.e., the sales mix is constant).

Notes

There is a myth that Black Friday is the annual break-even point in American retail sales, but in fact retailers generally break-even, and indeed profit, nearly every quarter.

See also

References

- ^ a b Farris, Paul W.; Neil T. Bendle; Phillip E. Pfeifer; David J. Reibstein (2010). Marketing Metrics: The Definitive Guide to Measuring Marketing Performance. Upper Saddle River, New Jersey: Pearson Education, Inc. ISBN 0-13-705829-2. The Marketing Accountability Standards Board (MASB) endorses the definitions, purposes, and constructs of classes of measures that appear in Marketing Metrics as part of its ongoing Common Language: Marketing Activities and Metrics Project.

- ^ Levine, David; Michele Boldrin (2008-09-07). Against Intellectual Monopoly. Cambridge University Press. p. 312. ISBN 978-0-521-87928-6.

- ^ Tapang, Bienvenido, and Lorelei Mendoza. Introductory Economics. University of the Philippines, Baguio.

- ^ The Margin of Safety in MAAW, Chapter 11.

External links

- Example of Break Even Point using Microsoft Excel

- Videos and Tutorials about Break Even Analysis

- Break Even, any profitability ratio search in what-if? model with MS Excel

- MASB Official Website

Further reading

- Dayananda, D.; Irons, R.; Harrison, S.; Herbohn, J.; and P. Rowland, 2002, Capital Budgeting: Financial Appraisal of Investment Projects. Cambridge University Press. pp. 150.