House price index

A House Price Index (HPI) measures the price changes of residential housing. Methodologies commonly used to calculate HPI are the hedonic regression (HR), simple moving average (SMA) and repeat-sales regression (RSR).

United States

FHFA/OFHEO

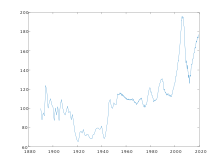

The US Federal Housing Finance Agency (formerly Office of Federal Housing Enterprise Oversight a.k.a. OFHEO) publishes the HPI inx, a quarterly broad measure of the movement of single-family house prices.

The HPI is a weighted, repeat-sales index, meaning that it measures average price changes in repeat sales or refinancings on the same properties in 363 metropolises. This information is obtained by reviewing repeat mortgage transactions on single-family properties whose mortgages have been purchased or securitized by Fannie Mae or Freddie Mac since January 1975.

Since the HPI index only includes houses with mortgages within the conforming amount limits, the index has a natural cap and does not account for jumbo mortgages.

The HPI was developed in conjunction with OFHEO's (now FHFA) responsibilities as a regulator of Fannie Mae and Freddie Mac. It is used to measure the adequacy of their capital against the value of their assets, which are primarily home mortgages.

On July 30, 2008 OFHEO became part of the new Federal Housing Finance Agency (FHFA). The index is now termed the FHFA HPI.

S&P/Case-Shiller Indices

The Case-Shiller index prices are measured monthly and tracks repeat sales of houses using a modified version of the weighted-repeat sales methodology proposed by Karl Case and Robert Shiller and Allan Weiss. This means that, to a large extent, it is able to adjust for the quality of the homes sold, unlike simple averages.

As a monthly tracking index, Case-Shiller Index has long lag time. Typically, it takes about 2 months for S&P to publish the results, as opposed to 1 month for most other monthly indices and indicators. Specific indexes are available for specific metropolitan areas, and composite indexes for the top 20 and top 10 metro areas, and nationwide.

FNC Residential Price Index

FNC Inc. publishes the Residential Price Index, which is based on data collected from public records blended with data from real-time appraisals of property and neighborhood attributes. The RPI is the mortgage industry's first hedonic price index for residential properties. The RPI is constructed to gauge price movement among non-distressed home sales, and excludes sales of foreclosed properties.[1]

As a monthly tracking index, the RPI has a lag time of about two months. Specific indices are available for specific metropolitan areas, and composite indices are available for the top 10, 20, 30, and 100[2] metro areas. The RPI is also available at the zip code level and can be constructed to track price trends for specific characteristics (e.g., ranch-style house, colonial-style house, etc.) since preferences can change over time.

United Kingdom

House Price Indices (HPIs) have been produced in the UK since around 1973, initially by mortgage-providers, and more recently by government bodies. More recently, they have come from property market websites. Currently, house prices are increasing strongly across most parts of the UK, with prices in London showing the highest growth. UK house prices increased by 10.5% in the year to May 2014, up from 9.9% in the year to April 2014.[3]

Governmental house price indices

- The Office for National Statistics produces a monthly House Price Index (HPI) release which publishes figures for average UK house prices. The index is calculated using mortgage financed transactions that are collected via the Regulated Mortgage Survey by the Council of Mortgage Lenders. These cover the majority of mortgage lenders in the UK. The HPI statistical bulletin[4] provides comprehensive information on the change in house prices on a monthly and annual basis. It also includes analysis by region, type of buyer and type of dwelling. To explain how the Office for National Statistics calculates HPI, they have produced a guidance document called Official House Price Statistics Explained[5] which details their methodology and explains the differences between the different sources of official house price statistics.

- The Land Registry House Price Index is calculated on behalf of HM Land Registry by Calnea Analytics. It uses the Land Registry’s own data, which consists of the transaction records of all residential property sales in England and Wales. It uses Repeat Sales Regression. The number of monthly transactions is approximately 100,000 per month. The index excludes sales from repossessions and auctions as these "do not represent full market price".[6]

- The DCLG House Price Index [1] for the Department of Communities and Local Government uses the mix-adjusted method, which is based on weighted averages. The data used in this HPI is mortgage completion data supplied by a few large lenders.

- A House Price Index used to be produced by the Department for the Environment.

Private sector house price indices

- The Nationwide House Price Index and Halifax House Price Index use Hedonic regression (also known as the characteristics based method) using their own datasets compiled from their mortgage lending. These indices have a longer time-series than the Governmental HPIs.

Current UK indices

| Index | Calculated by | Source data | Observations (approx) | Quality Adjustment Method | Local Indices | Frequency | Price Observations |

|---|---|---|---|---|---|---|---|

| HM Land Registry | Calnea Analytics | HM Land Registry | 100k | RSR | Yes | Monthly | Actual price paid |

| Knight Frank | Knight Frank | Knight Frank | 100k | RSR | Yes | Monthly | - |

| DCLG | DCLG | Lender data | 45k | SMA | Regional Only | Monthly | Mortgage completions |

| Halifax | Halifax | Loan approvals | 12k | HR | Regional Only | Monthly | Price agreed at time of loan approval |

| Nationwide | Nationwide | Loan approvals | 12k | HR | Regional Only | Monthly | Price agreed at time of loan approval |

| FindaProperty.com | Calnea Analytics | Rental prices | Undisclosed | HR | Regional Only | Monthly | Rental prices |

| Home.co.uk | Calnea Analytics | Asking prices online | 800k | SMA | Regional Only | Monthly | Asking price |

| Rightmove | Rightmove | Asking prices online | Undisclosed | SMA | Regional Only | Monthly | Asking price |

| Financial Times | Acadametrics | Land Registry | 100k | SMA | Yes | Monthly | Actual price paid |

Ireland

In the Republic of Ireland, Permanent TSB (a large mortgage lender) and the Economic and Social Research Institute (a think-tank) have published a monthly houseprice index since January 1996.

India

In India, National Housing Bank completely owned by Reserve Bank of India computes an index termed NHB RESIDEX. The index was formulated based on a pilot study covering 5 cities, Delhi, Mumbai, Kolkata, Bangalore and Bhopal representing the five regions of the country. Actual transactions prices are used to compute an Index reflecting the market trends. 2007 is taken as the base year for the study to be comparable with the WPI and CPI.[7] It now covers [8] Delhi with NCR, Bangalore, Mumbai, Kolkata, Bhopal, Hyderabad, Faridabad, Patna, Ahmedabad, Chennai, Jaipur, Lucknow, Pune, Surat, Kochi, Bhubaneshwar, Guwahati, Ludhiana, Vijayawada, Indore, Chandigarh, Coimbatore, Dehradun, Meerut, Nagpur and Raipur. The index shows that the prices have doubled in cities like Mumbai, Delhi and Bhopal, but have declined in Hyderabad and Kochi.

Canada

In Canada, the New Housing Price Index is calculated monthly by Statistics Canada. Additionally, a resale house price index is also maintained by the Canadian Real Estate Association, based on reported sale prices submitted by real estate agents, and averaged by region. In December 2008, the private National Bank and the information technology firm Teranet began a separate monthly house price index based on resale prices of individual single-family houses in selected metropolitan areas, using a methodology similar to the Case-Shiller index[9] and based on actual sale prices taken from government land registry databases. This allows Teranet and the National Bank to track prices without allowing periods of high sales in one city to push up the national average.[10] The National Bank also operates a forward market on Canadian housing prices.

See also

Resources

- Downie, M. L. & Robson G. (2007) Automated Valuation Models: an international perspective. Pp 11 Council of Mortgage Lenders, London, ISBN 1-905257-12-0.

- Lim, S. & Pavlou M. (2007) An improved national house price index using Land Registry data RICS research paper series: Volume 7 Number 11. Pp 10–14. London, ISBN 978-1-84219-347-1. Accessed 21 November 2007.

- How is the HPI calculated? (2014) Accessed 9 May 2014

References

- ^ http://msbusiness.com/blog/2013/11/19/fnc-strong-growth-home-prices-third-quarter/

- ^ http://blogs.wsj.com/developments/2011/12/23/introducing-the-home-price-scorecard/

- ^ http://www.ons.gov.uk/ons/dcp171778_370494.pdf

- ^ http://www.ons.gov.uk/ons/rel/hpi/house-price-index/index.html

- ^ http://www.ons.gov.uk/ons/rel/hpi/house-price-index/may-2014/index.html

- ^ Government House Price data 'flawed', The Guardian, 2008-11-30

- ^ About Residex NHB Residex

- ^ NHB Residex Base Year: 2007 = 100 Current values

- ^ "S&P Corelogic Case-Shiller Home Price Indices", "S&P Dow Jones Indices", 2016

- ^ The shocking truth about the value of your home, Maclean's, 2009-02-23