Productivity

Productivity is a measure of output from a production process, per unit of input. For example, labor productivity is typically measured as a ratio of output per labor-hour, an input. Productivity may be conceived of as a metric of the technical or engineering efficiency of production. As such, the emphasis is on quantitative metrics of input, and sometimes output. Productivity is distinct from metrics of allocative efficiency, which take into account both the monetary value (price) of what is produced and the cost of inputs used, and also distinct from metrics of profitability, which address the difference between the revenues obtained from output and the expense associated with consumption of inputs. (Courbois & Temple 1975, Gollop 1979, Kurosawa 1975, Pineda 1990, Saari 2006)

Economic growth and productivity

Production is a process of combining various material inputs (stuff) and immaterial inputs (plans, know-how) in order to make something for consumption (the output). The methods of combining the inputs of production in the process of making output are called technology. Technology can be depicted mathematically by the production function which describes the relation between input and output. The production function can be used as a measure of relative performance when comparing technologies.

The production function is a simple description of the mechanism of economic growth. Economic growth is defined as any production increase of a business or nation (whatever you are measuring). It is usually expressed as an annual growth percentage depicting growth of the company output (per entity) or the national product (per nation). Real economic growth (as opposed to inflation) consists of two components. These components are an increase in production input and an increase in productivity. (Genesca & Grifell 1992, Saari 2006)

The figure illustrates an economic growth process (exaggerated for clarity). The Value T2 (value at time 2) represents the growth in output from Value T1 (value at time 1). Each time of measurement has its own graph of the production function for that time (the straight lines). The output measured at time 2 is greater than the output measured at time one for both of the components of growth: an increase of inputs and an increase of productivity. The portion of growth caused by the increase in inputs is shown on line 1 and does not change the relation between inputs and outputs. The portion of growth caused by an increase in productivity is shown on line 2 with a steeper slope. So increased productivity represents greater output per unit of input.

Accordingly, an increase in productivity is characterised by a shift of the production function (steepening slope) and a consequent change to the output/input relation. The formula of total productivity is normally written as follows:

- Total productivity = Output quantity / Input quantity

According to this formula, changes in input and output have to be measured inclusive of both quantitative and qualitative changes. (Jorgenson and Griliches 1967). In practice, quantitative and qualitative changes take place when relative quantities and relative prices of different input and output factors alter. In order to accentuate qualitative changes in output and input, the formula of total productivity shall be written as follows:

- Total productivity = Output quality and quantity / Input quality and quantity

Main processes of a company

A company can be divided into sub-processes in different ways; yet, the following five are identified as main processes, each with a logic, objectives, theory and key figures of its own. It is important to examine each of them individually, yet, as a part of the whole, in order to be able to measure and understand them. The main processes of a company are as follows

- real process

- income distribution process

- production process

- monetary process

- market value process

Productivity is created in the real process, productivity gains are distributed in the income distribution process and these two processes constitute the production process. The production process and its sub-processes, the real process and income distribution process occur simultaneously, and only the production process is identifiable and measurable by the traditional accounting practices. The real process and income distribution process can be identified and measured by extra calculation, and this is why they need to be analysed separately in order to understand the logic of production performance.

Real process generates the production output from input, and it can be described by means of the production function. It refers to a series of events in production in which production inputs of different quality and quantity are combined into products of different quality and quantity. Products can be physical goods, immaterial services and most often combinations of both. The characteristics created into the product by the manufacturer imply surplus value to the consumer, and on the basis of the price this value is shared by the consumer and the producer in the marketplace. This is the mechanism through which surplus value originates to the consumer and the producer likewise. Surplus value to the producer is a result of the real process, and measured proportionally it means productivity.

Income distribution process of the production refers to a series of events in which the unit prices of constant-quality products and inputs alter causing a change in income distribution among those participating in the exchange. The magnitude of the change in income distribution is directly proportionate to the change in prices of the output and inputs and to their quantities. Productivity gains are distributed, for example, to customers as lower product sales prices or to staff as higher income pay. Davis has deliberated (Davis 1955) the phenomenon of productivity, measurement of productivity, distribution of productivity gains, and how to measure such gains. He refers to an article (1947, Journal of Accountancy, Feb. p. 94) suggesting that the measurement of productivity shall be developed so that it ”will indicate increases or decreases in the productivity of the company and also the distribution of the ’fruits of production’ among all parties at interest”. According to Davis, the price system is a mechanism through which productivity gains are distributed, and besides the business enterprise, receiving parties may consist of its customers, staff and the suppliers of production inputs. In this article, the concept of ”distribution of the fruits of production” by Davis is simply referred to as production income distribution or shorter still as distribution.

The production process consists of the real process and the income distribution process. A result and a criterion of success of the production process is profitability. The profitability of production is the share of the real process result the producer has been able to keep to himself in the income distribution process. Factors describing the production process are the components of profitability, i.e., returns and costs. They differ from the factors of the real process in that the components of profitability are given at nominal prices whereas in the real process the factors are at periodically fixed prices.

Monetary process refers to events related to financing the business. Market value process refers to a series of events in which investors determine the market value of the company in the investment markets.

Surplus value as a measure of production profitability

The scale of success run by a going concern is manifold, and there are no criteria that might be universally applicable to success. Nevertheless, there is one criterion by which we can generalise the rate of success in production. This criterion is the ability to produce surplus value. As a criterion of profitability, surplus value refers to the difference between returns and costs, taking into consideration the costs of equity in addition to the costs included in the profit and loss statement as usual. Surplus value indicates that the output has more value than the sacrifice made for it, in other words, the output value is higher than the value (production costs) of the used inputs. If the surplus value is positive, the owner’s profit expectation has been surpassed.

The table presents a surplus value calculation. This basic example is a simplified profitability calculation used for illustration and modelling. Even as reduced, it comprises all phenomena of a real measuring situation and most importantly the change in the output-input mix between two periods. Hence, the basic example works as an illustrative “scale model” of production without any features of a real measuring situation being lost. In practice, there may be hundreds of products and inputs but the logic of measuring does not differ from that presented in the basic example.

Both the absolute and relative surplus value have been calculated in the example. Absolute value is the difference of the output and input values and the relative value is their relation, respectively. The surplus value calculation in the example is at a nominal price, calculated at the market price of each period.

Productivity model

The next step is to describe a productivity model (Courbois & Temple 1975, Gollop 1979, Kurosawa 1975, Saari 1976, 2006) by help of which it is possible to calculate the results of the real process, income distribution process and production process. The starting point is a profitability calculation using surplus value as a criterion of profitability. The surplus value calculation is the only valid measure for understanding the connection between profitability and productivity or understanding the connection between real process and production process. A valid measurement of total productivity necessitates considering all production inputs, and the surplus value calculation is the only calculation to conform to the requirement.

The process of calculating is best understood by applying the clause of Ceteris paribus, i.e. "all other things being the same," stating that at a time only the impact of one changing factor be introduced to the phenomenon being examined. Therefore, the calculation can be presented as a process advancing step by step. First, the impacts of the income distribution process are calculated, and then, the impacts of the real process on the profitability of the production .

The first step of the calculation is to separate the impacts of the real process and the income distribution process, respectively, from the change in profitability (285.12 – 266.00 = 19.12). This takes place by simply creating one auxiliary column (4) in which a surplus value calculation is compiled using the quantities of Period 1 and the prices of Period 2. In the resulting profitability calculation, Columns 3 and 4 depict the impact of a change in income distribution process on the profitability and in Columns 4 and 7 the impact of a change in real process on the profitability.

Illustration of the real and income distribution processes

Measurement results can be illustrated by models and graphic presentations. The following figure illustrates the connections between the processes by means of indexes describing the change. A presentation by means of an index is illustrative because the magnitudes of the changes are commensurate. Figures are from the above calculation example of the production model. (Loggerenberg van et al. 1982. Saari 2006).

The nine most central key figures depicting changes in production performance can be presented as shown in Figure. Vertical lines depict the key figures of the real process, production process and income distribution process. Key figures in the production process are a result of the real process and the income distribution process. Horizontal lines show the changes in input and output processes and their impact on profitability. The logic behind the figure is simple. Squares in the corners refer to initial calculation data. Profitability figures are obtained by dividing the output figures by the input figures in each process. After this, the production process figures are obtained by multiplying the figures of the real and income distribution processes.

Depicting the development by time series

Development in the real process, income distribution process and production process can be illustrated by means of time series. (Kendrick 1984, Saari 2006) The principle of a time series is to describe, for example, the profitability of production annually by means of a relative surplus value and also to explain how profitability was produced as a consequence of productivity development and income distribution. A time series can be composed using the chain indexes as seen in the following.

Now the intention is to draw up the time series for the ten periods in order to express the annual profitability of production by help of productivity and income distribution development. With the time series it is possible to prove that productivity of the real process is the distributable result of production, and profitability is the share remaining in the company after income distribution between the company and interested parties participating in the exchange.

The graph shows how profitability depends on the development of productivity and income distribution. Productivity figures are fictional but in practice they are perfectly feasible indicating an annual growth of 1.5 per cent on average. Growth potentials in productivity vary greatly by industry, and as a whole, they are directly proportionate to the technical development in the branch. Fast-developing industries attain stronger growth in productivity. This is a traditional way of thinking. Today we understand that human and social capitals together with competition have a significant impact on productivity growth. In any case, productivity grows in small steps. By the accurate measurement of productivity, it is possible to appreciate these small changes and create an organisation culture where continuous improvement is a common value.

Measuring and interpreting partial productivity

Measurement of partial productivity refers to the measurement solutions which do not meet the requirements of total productivity measurement, yet, being practicable as indicators of total productivity. In practice, measurement in production means measures of partial productivity. In that case, the objects of measurement are components of total productivity, and interpreted correctly, these components are indicative of productivity development. The term of partial productivity illustrates well the fact that total productivity is only measured partially – or approximately. In a way, measurements are defective but, by understanding the logic of total productivity, it is possible to interpret correctly the results of partial productivity and to benefit from them in practical situations.

Typical solutions of partial productivity are:

- Single-factor productivity

- Value-added productivity

- Unit cost accounting

- Efficiency ratios

- Managerial control ratio system

Single-factor productivity refers to the measurement of productivity that is a ratio of output and one input factor. A most well-known measure of single-factor productivity is the measure of output per work input, describing work productivity. Sometimes it is practical to employ the value added as output. Productivity measured in this way is called Value-added productivity. Also, productivity can be examined in cost accounting using Unit costs. Then it is mostly a question of exploiting data from standard cost accounting for productivity measurements. Efficiency ratios, which tell something about the ratio between the value produced and the sacrifices made for it, are available in large numbers. Managerial control ratio systems are composed of single measures which are interpreted in parallel with other measures related to the subject. Ratios may be related to any success factor of the area of responsibility, such as profitability, quality, position on the market, etc. Ratios may be combined to form one whole using simple rules, hence, creating a key figure system.

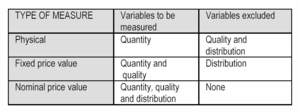

The measures of partial productivity are physical measures, nominal price value measures and fixed price value measures. These measures differ from one another by the variables they measure and by the variables excluded from measurements. By excluding variables from measurement makes it possible to better focus the measurement on a given variable, yet, this means a more narrow approach. The table below was compiled to compare the basic types of measurement. The first column presents the measure types, the second the variables being measured, and the third column gives the variables excluded from measurement.

National productivity

Productivity measures are often used to indicate the capacity of a nation to harness its human and physical resources to generate economic growth. Productivity measures are key indicators of economic performance and there is strong interest in comparing them internationally. The OECD publishes an annual Compendium of Productivity Indicators that includes both labour and multi-factor measures of productivity.

Labour productivity and multi-factor productivity

Labour productivity is the ratio of (the real value of) output to the input of labour. Where possible, hours worked, rather than the numbers of employees, is used as the measure of labour input. With an increase in part-time employment, hours worked provides the more accurate measure of labour input. Labour productivity should be interpreted very carefully if used as a measure of efficiency. In particular, it reflects more than just the efficiency or productivity of workers. Labour productivity is the ratio of output to labour input; and output is influenced by many factors that are outside of workers' influence, including the nature and amount of capital equipment that is available, the introduction of new technologies, and management practices.

Multifactor productivity is the ratio of the real value of output to the combined input of labour and capital. Sometimes this measure is referred to as total factor productivity. In principle, multifactor productivity is a better indicator of efficiency. It measures how efficiently and effectively the main factors of production - labour and capital - combine to generate output. However, in some circumstances, robust measures of capital input can be hard to find.

Labour productivity and multifactor productivity both increase over the long term. Usually, the growth in labour productivity exceeds the growth in multifactor productivity, reflecting the influence of relatively rapid growth of capital on labour productivity.

Importance of national productivity growth

Productivity growth is a crucial source of growth in living standards. Productivity growth means more value is added in production and this means more income is available to be distributed.

At a firm or industry level, the benefits of productivity growth can be distributed in a number of different ways:

- to the workforce through better wages and conditions;

- to shareholders and superannuation funds through increased profits and dividend distributions;

- to customers through lower prices;

- to the environment through more stringent environmental protection; and

- to governments through increases in tax payments (which can be used to fund social and environmental programs).

Productivity growth is important to the firm because it means that it can meet its (perhaps growing) obligations to workers, shareholders, and governments (taxes and regulation), and still remain competitive or even improve its competitiveness in the market place.

There are essentially two ways to promote growth in output:

- bring additional inputs into production; or

- increase productivity.

Adding more inputs will not increase the income earned per unit of input (unless there are increasing returns to scale). In fact, it is likely to mean lower average wages and lower rates of profit.

But, when there is productivity growth, even the existing commitment of resources generates more output and income. Income generated per unit of input increases. Additional resources are also attracted into production and can be profitably employed.

At the national level, productivity growth raises living standards because more real income improves people's ability to purchase goods and services (whether they are necessities or luxuries), enjoy leisure, improve housing and education and contribute to social and environmental programs.

‘Productivity isn't everything, but in the long run it is almost everything. A country's ability to improve its standard of living over time depends almost entirely on its ability to raise its output per worker. World War II veterans came home to an economy that doubled its productivity over the next 25 years; as a result, they found themselves achieving living standards their parents had never imagined. Vietnam veterans came home to an economy that raised its productivity less than 10 percent in 15 years; as a result, they found themselves living no better - and in many cases worse - than their parents’ (Krugman, 1992). Paul Krugman 1992, The Age of Diminished Expectations: US Economic Policy in the 1980s, MIT Press, Cambridge, p. 9.

‘Over long periods of time, small differences in rates of productivity growth compound, like interest in a bank account, and can make an enormous difference to a society's prosperity. Nothing contributes more to reduction of poverty, to increases in leisure, and to the country's ability to finance education, public health, environment and the arts’ (Blinder and Baumol, 1993). Alan Blinder and William Baumol 1993, Economics: Principles and Policy, Harcourt Brace Jovanovich, San Diego, p. 778.

Sources of productivity growth

In the most immediate sense, productivity is determined by:

- the available technology or know-how for converting resources into outputs desired in an economy; and

- the way in which resources are organised in firms and industries to produce goods and services.

Average productivity can improve as firms move toward the best available technology; plants and firms with poor productivity performance cease operation; and as new technologies become available. Firms can change organisational structures (eg core functions and supplier relationships), management systems and work arrangements to take the best advantage of new technologies and changing market opportunities. A nation's average productivity level can also be affected by the movement of resources from low-productivity to high-productivity industries and activities.

National productivity growth stems from a complex interaction of factors. As just outlined, some of the most important immediate factors include technological change, organisational change, industry restructuring and resource reallocation, as well as economies of scale and scope. Over time, other factors such as research and development and innovative effort, the development of human capital through education, and incentives from stronger competition promote the search for productivity improvements and the ability to achieve them. Ultimately, many policy, institutional and cultural factors determine a nation's success in improving productivity.

Aspects of productivity

Productivity studies

Productivity studies analyze technical processes and engineering relationships such as how much of an output can be produced in a specified period of time (see also Taylorism). It is related to the concept of efficiency. While productivity is the amount of output produced relative to the amount of resources (time and money) that go into the production, efficiency is the value of output relative to the cost of inputs used. Productivity improves when the quantity of output increases relative to the quantity of input. Efficiency improves, when the cost of inputs used is reduced relative the value of output. A change in the price of inputs might lead a firm to change the mix of inputs used, in order to reduce the cost of inputs used, and improve efficiency, without actually increasing the quantity of output relative the quantity of inputs. A change in technology, however, might allow a firm to increase output with a given quantity of inputs; such an increase in productivity would be more technically efficient, but might not reflect any change in allocative efficiency.

Increases in productivity

Companies can increase productivity in a variety of ways. The most obvious methods involve automation and computerization which minimize the tasks that must be performed by employees. Recently, less obvious techniques are being employed that involve ergonomic design and worker comfort. A comfortable employee, the theory maintains, can produce more than a counterpart who struggles through the day. In fact, some studies claim that measures such as raising workplace temperature can have a drastic effect on office productivity. Experiments done by the Japanese Shiseido corporation also suggested that productivity could be increased by means of perfuming or deodorising the air conditioning system of workplaces. Increases in productivity also can influence society more broadly, by improving living standards, and creating income. They are central to the process generating economic growth and capital accumulation. A new theory suggests that the increased contribution that productivity has on economic growth is largely due to the relatively high price of technology and its exportation via trade, as well as domestic use due to high demand, rather than attributing it to micro economic efficiency theories which tend to downsize economic growth and reduce labor productivity for the most part. Many economists see the economic expansion of the later 1990s in the United States as being allowed by the massive increase in worker productivity that occurred during that period. The growth in aggregate supply allowed increases in aggregate demand and decreases in unemployment at the same time that inflation remained stable. Others emphasize drastic changes in patterns of social behaviour resulting from new communication technologies and changed male-female relationships.

Labor productivity

Labour productivity is generally speaking held to be the same as the "average product of labor" (average output per worker or per worker-hour, an output which could be measured in physical terms or in price terms). It is not the same as the marginal product of labor, which refers to the increase in output that results from a corresponding increase in labor input. The qualitative aspects of labor productivity such as creativity, innovation, teamwork, improved quality of work and the effects on other areas in a company are more difficult to measure.

Marx on productivity

In Karl Marx's labor theory of value, the concept of capital productivity is rejected as an instance of reification, and replaced with the concepts of the organic composition of capital and the value product of labor. A sharp distinction is drawn by Marx for the productivity of labor in terms of physical outputs produced, and the value or price of those outputs. A small physical output might create a large value, while a large physical output might create only a small value - with obvious consequences for the way the labor producing it would be rewarded in the marketplace. Moreover if a large output value was created by people, this did not necessarily have anything to do with their physical productivity; it could be just due to the favorable valuation of that output when traded in markets. Therefore, merely focusing on an output value realised, to assess productivity, might lead to mistaken conclusions. In general, Marx rejected the possibility of a concept of productivity that would be completely neutral and unbiased by the interests or norms of different social classes. At best, one could say that objectively, some practices in a society were generally regarded as more or less productive, or as improving productivity - irrespective of whether this was really true. In other words, productivity was always interpreted from some definite point of view. Typically, Marx suggested in his critique of political economy, only the benefits of raising productivity were focused on, rather than the human (or environmental) costs involved. Thus, Marx could even find some sympathy for the Luddites, and he introduced the critical concept of the rate of exploitation of human labour power to balance the obvious economic progress resulting from an increase in the productive forces of labor.

Productivity paradox

Despite the proliferation of computers, there has not been any observable increases in productivity as a result.[1] One hypothesis to explain this is that computers are productive, yet their productive gains are realized only after a lag period, during which complementary capital investments must be developed to allow for the use of computers to their full potential. Another hypothesis states that computers are simply not very productivity enhancing because they require time, a scarce complementary human input. This theory holds that although computers perform a variety of tasks, these tasks are not done in any particularly new or efficient manner, but rather they are only done faster. It has also been argued that computer automation just facilitates ever more complex bureaucracies and regulation, and therefore produces a net reduction in real productivity.see Xiot-Ocio productivity[2] Another explanation is that knowledge work productivity and IT productivity are linked, and that without improving knowledge work productivity, IT productivity does not have a governing mechanism.[clarification needed]

See also

- Productivity model

- Production, costs, and pricing

- Production theory basics

- Production possibility frontier

- Production function

- Computer-aided manufacturing

- Productive and unproductive labour

- Productive forces

- Underinvestment employment relationship

- Division of labour

Footnotes

References

- Berglas, Anthony (2008), Why it is Important that Software Projects Fail, retrieved 2008-06-01

- Brayton, G.N. (1983). "Simplified Method of Measuring Productivity Identifies Opportunities for Increasing It". Industrial Engineering.

{{cite journal}}: Cite has empty unknown parameter:|coauthors=(help); Unknown parameter|month=ignored (help) - Courbois, R. (1975). La methode des ”Comptes de surplus” et ses applications macroeconomiques. 160 des Collect,INSEE,Serie C (35). p. 100.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - Craig, C. (1973). "Total Productivity Measurement at the Firm Level". Sloan Management Review (Spring 1973): 13–28.

{{cite journal}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - Davis, H.S. (1955). Productivity Accounting. University of Pennsylvania.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - Genesca, G.E. (1992). "Profits and Total Factor Productivity: A Comparative Analysis". Omega. The International Journal of Management Science. 20 (5/6): 553–568. doi:10.1016/0305-0483(92)90002-O.

{{cite journal}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - Gollop, F.M. (1979). "Accounting for Intermediate Input: The Link Between Sectoral and Aggregate Measures of Productivity Growth". Measurement and Interpretation of Productivity,. National Academy of Sciences.

{{cite journal}}: Cite has empty unknown parameter:|coauthors=(help)CS1 maint: extra punctuation (link) - Jorgenson, D.W. (1967). "The Explanation of Productivity Change". Review of Economic Studies. 34(99): 249–283.

{{cite journal}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - Kendrick, J. (1965). "Measuring Company Productivity: A handbook with Case Studies" (89). The National Industry Productivity Board.

{{cite journal}}: Cite journal requires|journal=(help); Unknown parameter|coauthors=ignored (|author=suggested) (help) - Kendrick, J.W. (1984). Improving Company Productivity. The Johns Hopkins University Press.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - Kurosawa (1975). "An aggregate index for the analysis of productivity". Omega. 3 (2): 157–168. doi:10.1016/0305-0483(75)90115-2.

{{cite journal}}: Cite has empty unknown parameters:|unused_data=,|authorlinkK.=, and|coauthors=(help) - Loggerenberg van, B. (1982). "Productivity Measurement and the Bottom Line". National Productivity Review. 1 (1): 87–99. doi:10.1002/npr.4040010111.

{{cite journal}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - Mundel, M.E. (1983). Improving Productivity and Effectiveness. Prentice-Hall, Inc.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - Pineda, A. (1990). A Multiple Case Study Research to Determine and respond to Management Information Need Using Total-Factor Productivity Measurement (TFPM). Virginia Polytechnic Institute and State University.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - Saari, S. (1976). A Proposal to Improve Planning (In Finnish). Pekema Oy.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - Saari, S. (2006). Productivity. Theory and Measurement in Business. Productivity Handbook (In Finnish). MIDO OY. p. 272.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - Saari, S. (2006). Productivity. Theory and Measurement in Business (PDF). Espoo, Finland: European Productivity Conference.

{{cite conference}}: Cite has empty unknown parameters:|booktitle=and|coauthors=(help) - Sumanth, D. (1979). Productivity Measurement and Evaluation Models for Manufacturing Companies. Illinois Institute of Technology. p. 291.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help)

External links

- Productivity and Costs – Bureau of Labor Statistics United States Department of Labor: contains international comparisons of productivity rates, historical and present

- Productivity Statistics - Organisation for Economic Co-operation and Development

- Greenspan Speech

- OECD estimates of labour productivity levels

- Productivity Science - source for personal and business productivity information