User:Remember/Helicopter drop

A helicopter drop is a term used to refer to a possible solution to a deflation where money is dropped out onto the public from a helicopter.

Background[edit]

In general, deflation, which is the increasing value of money, is seen as dangerous to an economy because it encourages consumers to save money rather to spend it. This in turn causes the overall economy to slow-down and can cause a recession or prolong a recession into a depression.

Under normal circumstances, a central bank can take action to stop deflation by injecting cash into the private banking system. This will encourage futher lending and help decrease the value of money which will stimulate economic growth. Nevertheless, in a certain situation, this may prove to be inadequate.

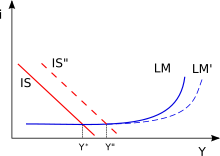

A liquidity trap is a situation described in Keynesian economics in which injections of cash into the private banking system by a central bank fail to lower interest rates and hence to stimulate economic growth. A liquidity trap is caused when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand, or war. Signature characteristics of a liquidity trap are short-term interest rates that are near zero and fluctuations in the monetary base that fail to translate into fluctuations in general price levels.

Origination[edit]

Friedman was the main proponent of the monetarist school of economics. He maintained that there is a close and stable association between price inflation and the money supply, mainly that price inflation should be regulated with monetary deflation and price deflation with monetary inflation. He famously quipped that price deflation can be fought by "dropping money out of a helicopter."[1]

Milton Friedman was the main proponent of the monetarist school of economics. He maintained that there is a close and stable association between price inflation and the money supply, mainly that price inflation should be regulated with monetary deflation and price deflation with monetary inflation. He famously quipped that price deflation can be fought by "dropping money out of a helicopter."[2]

In our hypothetical world in which paper money is the only medium of circulation, consider first a stationary situation in which the quantity of money has been constant for a long time, and so have other conditions. Individual members of the community are subject to enough uncertainty that they find cash balances useful to cope with unanticipated discrepancies between receipts and expenditures. ... Under those circumstances, it is clear that the price level is determined by how much money there is—how many pieces of paper of various denominations. If the quantity of money had settled at half the assumed level, every dollar price would be halved; at double the assumed level, every price would be doubled. ... Let us suppose, then, that one day a helicopter flies over our hypothetical long- stationary community and drops additional money from the sky equal to the amount already in circulation. ... The money will, of course, be hastily collected by members of the community. ... If everyone simply decided to hold on to the extra cash, nothing more would happen. ... But people do not behave in that way. ... It is easy to see what the final position will be. People‘s attempts to spend more than they receive will be frustrated, but in the process these attempts will bid up the nominal value of goods and services. The additional pieces of paper do not alter the basic conditions of the community. They make no additional productive capacity available. ... Hence, the final equilibrium will be a nominal income [that has doubled] ... with precisely the same flow of real goods and services as before.

Money mischief - [1]

See also[edit]

References[edit]

{{stub}}