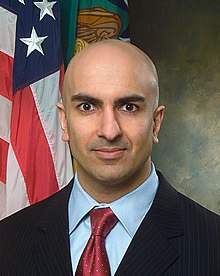

Neel Kashkari

Neel Kashkari | |

|---|---|

| |

| Born | July 30, 1973 |

| Education | Bachelor's degree, Engineering, University of Illinois at Urbana-Champaign Master's degrees, Engineering, University of Illinois at Urbana-Champaign MBA, Wharton School, University of Pennsylvania |

| Alma mater | University of Illinois, Urbana-Champaign |

| Known for | Serving as Interim U.S. Assistant Secretary of the Treasury for Financial Stability |

Neel Kashkari (born July 30, 1973) is the Interim Assistant Secretary of the Treasury for Financial Stability in the United States Department of the Treasury. In this role, he heads the Office of Financial Stability, the office set up to buy troubled troubled financial assets from U.S. financial firms under the $700 billion U.S. Government Troubled Assets Relief Program.

Kashkari joined the Treasury Department in July 2006 as Senior Advisor to U.S. Treasury Secretary Henry Paulson and was later appointed as the Assistant Secretary for International Economics and Development, a title he still holds, though his International Affairs responsibilities are delegated to Assistant Secretary for International Affairs Clay Lowery.[1][2][3]

Early life

Kashkari, an Indian-American,[4] was born on July 30, 1973 in Akron, Ohio and grew up in the Akron suburb of Stow, Ohio. He attended Stow–Munroe Falls schools before transferring to the Western Reserve Academy in Hudson, Ohio, from which he graduated in 1991. His parents, Chaman and Sheila Kashkari, are Hindus from Kashmir, India.[5]

Career

In July 2006, Kashkari was appointed as a special assistant to Treasury Secretary Henry Paulson. In the summer of 2008, he was appointed assistant secretary for international economics and was confirmed in that post by the U.S. Senate.[1] Paulson named Kashkari as the interim head of the new Office of Financial Stability. He is expected to oversee the United States government's $700 billion financial stabilization program.[6] This is an interim appointment; the permanent head of the Office of Financial Stability will require Senate confirmation, which is unlikely before the November elections.[4]

Prior to joining the Treasury Department, Mr. Kashkari was a Vice President at Goldman, Sachs & Co., where he headed Goldman's information technology security investment banking practice in San Francisco. Kashkari has a Bachelor's and Master's degree in engineering from the University of Illinois at Urbana-Champaign and an MBA in 2002 from the Wharton School at the University of Pennsylvania.[2][1] Before enrolling in Wharton's MBA program, Mr. Kashkari worked for the aerospace firm TRW, where, amongst other projects, he worked on the James Webb Space Telescope.[7]

Kashkari's work at TRW

Kashkari worked in the Mechanical Design Department at TRW (now Northrop Grumman Space Technology). He left after June 2000. His last technical assignment was to develop precision latching technology for the Space Interferometer Mission (SIM) and the Next Generation Space Telescope (now JWST). Kashkari designed the latches and test setup, integrated the laser distance measuring interferometers, and demonstrated that the latches could retain their precision to the nano-meter level with appropriate pre-load. This result is now being employed in the JWST wing latches, which must ensure that this contributor to primary mirror wavefront remain stable within a few nano-meters of its allocated error

Kashkari incompetent or just a straw man?

Kashkari is at this point only 6 years out of the university. This means that he lacks any competence or experience in handling a 700 billion bailout plan. However, according to democracy now, this makes complete sense. The White House is not interested in bailing out the people who are on bad loans but the banks only. None of this money will every reach the main street. Nothing will happen that slows down the economic crisis. The reasons are very clear: The banks will keep sitting on the 700 billion, since Americans can not afford any more loans anyway. Furthermore, the feds have already given out 800 billion to Wall Street in the last weeks, before the bailout was approved. Needless to say, Asians and European investors are pulling out all the money they can from America and this is why we have the slowdown. The solution: Have the banks write off their losses at their own expenses since they were the greedy party not the grieved party, give people reasonable loans and make them pay off their loans and pay cash after that. Kashkari appears just to be a straw man at this point and all and any of his actions need to be monitored, documented and he needs to be held accountable.

budget.[8]

See also

References

- ^ a b c "Bailout Role Elevates U.S. Official". The New York Times. October 9, 2008.

- ^ a b "Biography of Neel Kashkari". U.S. Treasury. October 6, 2008.

- ^ Rucker, Patrick (October 6, 2008). "Treasury names rescue program chief". Reuters.

- ^ a b "Paulson to name Kashkari to oversee bailout: WSJ". Press Trust of India. October 06, 2008.

{{cite news}}: Check date values in:|date=(help) - ^ McEwen, Colin (November 27, 2007). "Stow man nominated for U.S. Treasury position". Hudson Hub Times.

- ^ Agha, Miles (October 6, 2008). "Paulson to Tap Adviser to Run Rescue Program". New York: Wall Street Journal.

- ^ Henry Paulson names former Goldman Sachs banker Neel Kashkari to head Wall St. bailout Daily News

- ^ Breed, Allan G. (October 9, 2008). "Neel Kashkari: Space engineer to "bailout czar"". Associated Press.