Diversification (finance)

Diversification in finance is a risk management technique, related to hedging, that mixes a wide variety of investments within a portfolio. It is the spreading out investments to reduce risks. [1]Because the fluctuations of a single security have less impact on a diverse portfolio, diversification minimizes the risk from any one investment.

A simple example of diversification is the following: On a particular island the entire economy consists of two companies: one that sells umbrellas and another that sells sunscreen. If a portfolio is completely invested in the company that sells umbrellas, it will have strong performance during the rainy season, but poor performance when the weather is sunny. The reverse occurs if the portfolio is only invested in the sunscreen company, the alternative investment: the portfolio will be high performance when the sun is out, but will tank when clouds roll in. To minimize the weather-dependent risk in the example portfolio, the investment should be split between the companies. With this diversified portfolio, returns are decent no matter the weather, rather than alternating between excellent and terrible.

There are three primary strategies used in improving diversification:

- Spread the portfolio among multiple investment vehicles, such as stocks, mutual funds, bonds, and cash.

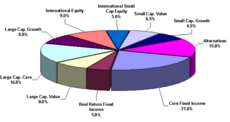

- Vary the risk in the securities. A portfolio can also be diversified into different mutual fund investment strategies, including growth funds, balanced funds, index funds, small cap, and large cap funds. When a portfolio includes investments with varied risk levels, large losses in one area are offset by other areas.

- Vary your securities by industry, or by geography. This will minimize the impact of industry- or location-specific risks. The example portfolio above was diversified by investing in both umbrellas and sunscreen. Another practical application of this kind of diversification is mixing investments between domestic and international funds. By choosing funds in many countries, events within any one country's economy have less effect on the overall portfolio.

Diversification reduces the risk of a portfolio, and consequently it can reduce the returns. However, since diversification reduces the risk of an entire portfolio being diminished by a single investment's loss, it is referred to as "the only free lunch in finance."[2] Statistical analysis shows that there may be some validity to this claim.[3]

Types of diversification

Horizontal diversification

Horizontal diversification is a when a portfolio is diversified between same-type investments. It can be a broad diversification (like investing in several NASDAQ companies) or more narrowed (investing in several stocks of the same branch or sector). In the example above, the move to invest in both umbrellas and sunscreen is an example of horizontal diversification. As usual, the broader the diversification the lower the risk from any one investment.

Vertical diversification

Vertical diversification is investment between different types of securities. Again, it can be a very broad diversification, like diversifying between bonds and stocks, or a more narrowed diversification, like diversifying between stocks of different branches. Continuing the example from the introduction, a vertical diversification would be taking some money from umbrella and sunscreen stock and investing it instead in bonds issued the government of the island.

While horizontal diversification lessens the risk of investing entirely in one security, vertical diversification goes beyond that and protects against market and/or economical changes.

Return expectations while diversifying

The average of all the returns in a diverse portfolio can never exceed that of the top-performing investment, and will almost always be lower than the highest return. This is unavoidable, and is the cost of the risk insurance that diversification provides. However, strategies exist that allow the portfolio's manager to maximize returns while still keeping risk as low as possible. Although detailed calculations are beyond the scope of this article, these strategies seek to maximize returns by giving different portfolio weights to investments based on their risk and return expectations.

Intra-portfolio correlation

| ||||||||||||

| The linear relationship between intra-portfolio correlation and diversifiable risk elimination. Intermediate values fall on the same line. |

Diversification can be quantified by the intra-portfolio correlation. This is a statistical measurement between negative one and positive one that measures the degree to which the various assets in a portfolio can be expected to perform in a similar fashion or not. A measure of -1 means that the assets within the portfolio perform perfectly oppositely: whenever one asset goes up, the other goes down. A measure of 0 means that the assets fluctuate independently, i.e. that the performance of one asset cannot be used to predict the performance of the others. A measure of 1, on the other hand, means that whenever one asset goes up, so do the others in the portfolio. To eliminate diversifiable risk completely, one needs an intra-portfolio correlation of -1.

The formula for calculating intra-portfolio correlation is

- ,

Where Q is the intra-portfolio correlation, is the fraction invested in asset i, is the fraction invested in asset j, is the correlation between assets i and j (another number between 1 and -1 that measures how similarly assets i and j perform compared to each other), and n is the number of different assets.

A chart comparing diversification to risk protection

| Number of Stocks in Portfolio | Average Standard Deviation of Annual Portfolio Returns | Ratio of Portfolio Standard Deviation to Standard Deviation of a Single Stock |

|---|---|---|

| 1 | 49.24% | 1.00 |

| 2 | 37.36 | 0.76 |

| 4 | 29.69 | 0.60 |

| 6 | 26.64 | 0.54 |

| 8 | 24.98 | 0.51 |

| 10 | 23.93 | 0.49 |

| 20 | 21.68 | 0.44 |

| 30 | 20.87 | 0.42 |

| 40 | 20.46 | 0.42 |

| 50 | 20.20 | 0.41 |

| 100 | 19.69 | 0.40 |

| 200 | 19.42 | 0.39 |

| 300 | 19.34 | 0.39 |

| 400 | 19.29 | 0.39 |

| 500 | 19.27 | 0.39 |

| 1000 | 19.21 | 0.39 |

History

Diversification is mentioned in the Talmud. The formula given there is to split one's assets into thirds: one third in business (buying and selling things), one third kept liquid (e.g. gold coins), and one third in land (real estate).

This is mentioned in Shakespeare[5] (Merchant of Venice):

- My ventures are not in one bottom trusted,

- Nor to one place; nor is my whole estate

- Upon the fortune of this present year:

- Therefore, my merchandise makes me not sad.

See also

References

- ^ Sullivan, arthur (2003). Economics: Principles in action. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. p. 273. ISBN 0-13-063085-3.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help)CS1 maint: location (link) - ^ See, for example, Cramer, J. "The Only Free Lunch On Wall Street"

- ^ Goetzmann, William N. An Introduction to Investment Theory. II. Portfolios of Assets. Retrieved on November 20, 2008.

- ^ These figures from Table 1 in M. Statman, "How Many Stocks Make a Diversified Portfolio?" Journal of Financial and Quantitative Analysis 22 (September 1987), pp. 353-64. They were derived from E. J. Elton and M. J. Gruber, "Risk Reduction and Portfolio Size: An Analytic Solution," Journal of Business 50 (October 1977), pp. 415-37. Taken from Ross, Westerfield, and Jordan, "Fundamentals of Corporate Finance" 7th Edition (2006-11-14), pp. 406.

- ^ The Only Guide to a Winning Investment Strategy You'll Ever Need

External links

- Macro-Investment Analysis, Prof. William F. Sharpe, Stanford University

- Yale Finance Lecture - Portfolio Diversification

- Asset Correlations, Dynamically-generated correlation matrices for the major asset classes

- An Introduction to Investment Theory, Prof. William N. Goetzmann, Yale School of Management