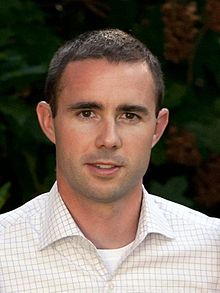

Devin Talbott

Devin Talbott | |

|---|---|

| |

| Born | Devin Talbott September 20, 1976 Washington D.C., U.S. |

| Alma mater | Georgetown University |

| Occupation | Private Investor |

| Parent(s) | Strobe Talbott Brooke Shearer |

Devin Talbott is an American entrepreneur and private investor.[1][2][3][4]

Talbott grew up in Washington D.C. and attended Amherst College, where he was a four-year varsity soccer player. He also earned JD and MBA degrees from Georgetown University.[5] Talbott began his investment banking career at Lazard and then worked for former Defense Secretary William Cohen's merchant bank. After that, Talbott became a vice president of investment firm D.E. Shaw before branching out to found Enlightenment Capital, an aerospace, defense & government focused private investment firm, in 2012.[6] Talbott also cofounded Generation Engage, a non-profit focused on engaging young voters in politics and civics.

Talbott was recognized in M&A Advisor’s ‘’40 Under 40,” as an emerging leader in the financing industry before the age of 40. [7]

Talbott served as a term member of the Council of Foreign Relations, a former advisory board member of the Aspen Security Forum, and currently sits on the board of the non-profit DC Scores, a non-profit that utilizes soccer, poetry, and service learning to support middle schoolers in at-risk neighborhoods.[8].[9]

References

- ^ Heath, Thomas. Capital Buzz: Enlightenment Capital has big-name backers “Washington Post”. December 14, 2014.

- ^ Conner, Jennifer.Big Beltway names, investment activity drive Enlightenment Capital forward “Biz Journals”. December 16, 2014.

- ^ Conner, Jennifer.[Enlightenment Capital closes debut fund on $80m Big Beltway names, investment activity drive Enlightenment Capital forward] “Biz Journals”. February 5, 2014.

- ^ Bach, James. Enlightenment Capital closes $147 million fund for aerospace and defense deals “Biz Journals” November 1st, 2016.

- ^ Beltran, Luisa. Enlightenment Capital Aims for $100M with First Fund “PE Hub”. November 27, 2012.

- ^ Bing, Chris. United's Coach Is Backing This Defense-Focused Investment Firm “Inside Defense”. March 15, 2016.

- ^ Winners

- ^ Membership Roster

- ^ Affiliates