Stockholm congestion tax

Photo: Mikael Ullén

The Stockholm congestion tax or The Stockholm Trials (in Swedish: Trängselskatt i Stockholm or Stockholmsförsöket) is a traffic congestion and environmental tax that was imposed on most vehicles in Stockholm, Sweden during a trial period between January 3 2006 and July 31 2006. In the referendum in September 2006 the residents of Stockholm municipality voted yes and in 14 other municipalities voted no to implement it permanently. On October 1, 2006, the Swedish government declared it will implement the Stockholm congestion tax permanently; it will return in the first half of 2007. [1]

The primary purposes of the congestion tax is to reduce traffic congestion and improve the environmental situation in central Stockholm.

Affected area

The congestion tax area encompasses essentially the entire Stockholm City Centre, which includes for instance Södermalm, Norrmalm, Östermalm, Vasastaden, Kungsholmen, Stora Essingen, Lilla Essingen and Djurgården.

There are unmanned electronic payment stations at all entrances to this area. The congestion tax is applied on both entry and exit of the affected area.

Amount of tax to pay

The amount of tax that one has to pay depends on what time of the day one enters or exits the congestion tax area. The tax is not in effect on Saturdays, Sundays, public holidays or the day before public holidays, nor during nights (18:30 – 06:29). The maximum amount of tax per vehicle per day is 60 SEK (6.44 EUR, 8.23 USD).

| Time of day | Tax | In other currencies¹ |

|---|---|---|

| 06:30 – 06:59 | 10 SEK | 1.07 EUR, 1.37 USD |

| 07:00 – 07:29 | 15 SEK | 1.61 EUR, 2.06 USD |

| 07:30 – 08:29 | 20 SEK | 2.15 EUR, 2.74 USD |

| 08:30 – 08:59 | 15 SEK | |

| 09:00 – 15:29 | 10 SEK | |

| 15:30 – 15:59 | 15 SEK | |

| 16:00 – 17:29 | 20 SEK | |

| 17:30 – 17:59 | 15 SEK | |

| 18:00 – 18:29 | 10 SEK | |

| 18:30 – 06:29 | 0 SEK |

1/ Tax amount shown in a couple other currencies for comparative purposes. Currency rates as of May 25, 2006.

Method of payment

Payment of the tax is to be present on the Swedish Road Administration's account within five days of passage of a payment station. No bill is sent to the vehicle holder - one must keep track of this oneself. If one uses the transponder, one can choose to pay through autogiro, a service which allows the tax to be automatically deducted from one's bank account. Another alternative is to pay the tax on 7-Eleven and Pressbyrån convenience stores.

Failure to pay the tax within the allotted five days, has the result that a reminder bill will be sent with an added 70 SEK (7.50 EUR, 9.60 USD) fee. If one still hasn't paid the tax within four weeks, another additional fee of 500 SEK (54 EUR, 70 USD) will be added. In the end, cases of unpaid taxes will be forwarded to the Swedish Enforcement Administration. Taxes have a special procedure in Sweden regarding this. They must be paid within the assigned time even if the person owing them consider them wrong. The Dept Enforcement Administration will claim the money from e.g. the bank account without asking. This will immediately be noted in the public "bad payer" record. If the tax claim is later considered wrong the money will be paid back. For other types of depts the claim can be disputed in a court of law before the claim is enforced (on the condition you dispute them rather quickly).

Exemptions from the congestion tax

Some classes of vehicles are exempt from the congestion tax:

- Emergency services vehicles — while responding to an emergency

- Buses with a total weight of at least 14 tonnes

- Diplomatic corps registered vehicles

- Vehicles of the transportation service for the disabled with a total weight of under 14 tonnes

- Military vehicles

- Cars used by persons who have been granted a parking permit for disabled people.

- Environmental cars — cars that are driven entirely or partially with electricity, alcohol or other approved fuel

- Motorcycles and mopeds

- Foreign-registered vehicles

Also, due to the fact that Lidingö has its only access to the mainland through the congestion tax affected area, all traffic to and from Lidingö to and from the rest of the Stockholm County is exempt from the tax, provided that one passes the Ropsten payment station and some other payment station within 30 minutes of each other.

The Essingeleden motorway, part of European route E4, that goes through the congestion tax effected area is also exempt, due to it being the main road when travelling past central Stockholm, and no other viable alternatives are present in the vicinity. All exits and entrances of Essingeleden that are within the congestion tax area have payment stations placed at them.

Technology

This section needs expansion. You can help by adding to it. |

The vehicles passing the payment stations are photographed and their licence plates registered. An optional transponder can be used also to identify the vehicles, with which one can utilise an automated payment method. There are no payment booths at the payment stations, despite their name. The driver or owner has to pay later. Se the section Method of payment above. At a traditional toll booth, a substantial percentage of the toll goes to costs for the staff, which is avoided here.

History

This section needs expansion. You can help by adding to it. |

Fee or tax?

Initially this was planned as a congestion fee, not a tax. But the Swedish government ruled that this kind of endeavour was considered a tax and not a fee, and thus this was made a governmental tax, not a local tax, as municipalities in Sweden are not allowed to create new taxes.

Debate

The Stockholm Trials (Stockholmsförsöket) was before it's inception a highly debated proposition, especially in the peripheral parts of Stockholm county where residents who lived outside of the payment stations but worked in the city center argued that they should also have a say in whether or not the proposition was to be accepted. In the time since the payment stations were put in place however the debate has calmed down considerably as the system works smoothly and the actual cost of passing these stations is an acceptable one to most residents, as well as the fact that central Stockholm has been getting cleaner since the proposition went into action. The debate has instead in many instances shifted toward the political reasons behind the proposition, where some argue that the proposition is simply a way to punish the residents of Stockholm for the centralised Swedish political system, which reportedly many people in rural parts of Sweden feel favours Stockholm above other regions.

Future

The congestion tax trial period lasted from January 3 2006 to July 31 2006, after which the congestion taxes were lifted until a municipal referendum regarding this matter is held. The referendum will be held in the Stockholm municipality in September 2006, and it will determine whether the congestion taxes will be implemented permanently or not.

The municipalities surrounding Stockholm in Stockholm County, especially those which are part of the Stockholm urban area, have shown discontent with the fact that the people of those municipalities get no say whether the congestion taxes will be implemented permanently or not. A substantial number of the inhabitants of the nearby municipalities travel to and from work through the congestion tax area. Therefore several of these municipalities have decided also to have local referendums. A municipality is allowed to hold an advisory referendum at any time.

The result of the referendum in the Stockholm municipality was that 53% voted Yes, and 47% voted No. In most surrounding municipalities the results were clearly No.

The government is making the final formal decision, not any municipality, although it has promised to obey the Stockholm referendum. It is unclear what the significance of the other referendums is.

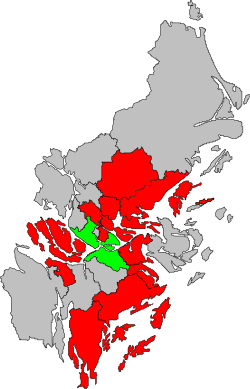

Referendum

These are the results from the referendums held in and around Stockholm:

The figures are calculated as "yes" and "no" votes as a percentage of all votes including blank and invalid votes. Therefore the sum of "yes" and "no" is not 100%.

| Municipality | Votes | ||

|---|---|---|---|

| # | Yes | No | |

| Danderyd | 16,962 | 32,5% | 67,5% |

| Ekerö | 13,528 | 39,9% | 60,1% |

| Haninge | 37,548 | 40,8% | 59,2% |

| Lidingö | 24,926 | 29,6% | 70,4% |

| Nacka | 44,785 | 42,9% | 57,1% |

| Nynäshamn | 12,588 | 41,2% | 58,8% |

| Salem | 7,563 | 39,6% | 60,4% |

| Sollentuna | 32,409 | 40,8% | 59,2% |

| Solna | 35,598 | 43,9% | 56,1% |

| Stockholm | 437,572 | 51,5% | 45,8% |

| Tyresö | 22,526 | 44,3% | 55,7% |

| Täby | 35,630 | 34,2% | 65,8% |

| Vallentuna | 14,884 | 42,5% | 57,5% |

| Vaxholm | 5,699 | 45,9% | 54,1% |

| Österåker | 20,140 | 40,9% | 59,1% |

| Total | 324,786 | 39,8% | 60,2% |

The question asked on the ballots were in Stockholm (translated): "Environmental fees/congestion tax means that fees will be charged in road traffic with the purpose to reduce queing and improve the environment. The incomes will be returned to the Stockholm region for investments in public transport and roads."

In the other municipalities the question on the ballots were: "Do you believe that congestion tax should be permanentely introduced in Stockholm ?"

The government has before the referendum day only supported the Stockholm referendum. The parties of the coming government has given support also to the other referendums, which makes the situation unclear until the government makes the final decision.

Sources:

See also

External links

- Stockholmsförsöket — official website, Swedish

- The Stockholm Trials — official website, English

- Trängselskatt / Vägverket — official page regarding the Stockholm congestion tax at the Swedish Road Authority