Kondratiev wave

| Cycle/wave name | Period (years) |

|---|---|

| Kitchin cycle (inventory, e.g. pork cycle) | 3–5 |

| Juglar cycle (fixed investment) | 7–11 |

| Kuznets swing (infrastructural investment) | 15–25 |

| Kondratiev wave (technological basis) | 45–60 |

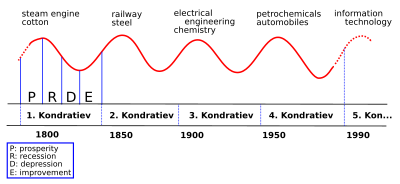

In economics, Kondratiev waves (also called supercycles, great surges, long waves, K-waves or the long economic cycle) are supposedly cycle-like phenomena in the modern capitalist world economy.[1] Averaging fifty and ranging from approximately forty to sixty years, the cycles consist of alternating periods between high sectoral growth and periods of relatively slow growth.[2] Unlike the short-term business cycle, the long wave of this theory is not accepted by current mainstream economics.

History of concept

The Soviet economist Nikolai Kondratiev (also written Kondratieff) was the first to bring these observations to international attention in his book The Major Economic Cycles (1925) alongside other works written in the same decade.[3][4] Two Dutch economists, Jacob van Gelderen and Samuel de Wolff, had previously argued for the existence of 50 to 60 year cycles in 1913. However, the work of de Wolff and van Gelderen has only recently been translated from Dutch to reach a wider audience.[citation needed]

Kondratiev's ideas were not supported by the Soviet government. Subsequently he was sent to the gulag and was executed in 1938.[3][4]

In 1939, Joseph Schumpeter suggested naming the cycles "Kondratieff waves" in his honor.

Since the inception of the theory, various studies have expanded the range of possible cycles, finding longer or shorter cycles in the data. The Marxist scholar Ernest Mandel revived interest in long wave theory with his 1964 essay predicting the end of the long boom after five years and in his Alfred Marshall lectures in 1979. However, in Mandel's theory, there are no long "cycles", only distinct epochs of faster and slower growth spanning 20–25 years.

The late-2000s financial crisis has increased an interest in the theories of long economical cycles as a potential explanation of its cause.[5]

The historian Eric Hobsbawm wrote of the theory: "That good predictions have proved possible on the basis of Kondratiev Long Waves—this is not very common in economics—has convinced many historians and even some economists that there is something in them, even if we don't know what." [6]

Characteristics of the cycle

Kondratiev identified three phases in the cycle: expansion, stagnation, recession. More common today is the division into four periods with a turning point (collapse) between the first and second phases. Writing in the 1920s, Kondratiev proposed to apply the theory to the 19th century:

- 1790–1849 with a turning point in 1815.

- 1850–1896 with a turning point in 1873.

- Kondratiev supposed that, in 1896, a new cycle had started.

The long cycle supposedly affects all sectors of an economy. Kondratiev focused on prices and interest rates, seeing the ascendant phase as characterized by an increase in prices and low interest rates, while the other phase consists of a decrease in prices and high interest rates. Subsequent analysis concentrated on output.

Explanations of the cycle

Technological innovation theory

According to the innovation theory, these waves arise from the bunching of basic innovations that launch technological revolutions that in turn create leading industrial or commercial sectors. Kondratiev's ideas were taken up by Joseph Schumpeter in the 1930s. The theory hypothesized the existence of very long-run macroeconomic and price cycles, originally estimated to last 50–54 years.

In recent decades there has been considerable progress in historical economics and the history of technology, and numerous investigations of the relationship between technological innovation and economic cycles. Some of the works involving long cycle research and technology include Mensch (1979), Tylecote (1991), The International Institute for Applied Systems Analysis (IIASA) (Marchetti, Ayres), Freeman and Louçã (2001) and Carlota Perez.

Perez (2002) places the phases on a logistic or S curve, with the following labels: beginning of a technological era as irruption, the ascent as frenzy, the rapid build out as synergy and the completion as maturity.[7]

Demographic theory

Because people have fairly typical spending patterns through their life cycle, such as schooling, marriage, first car purchase, first home purchase, upgrade home purchase, maximum earnings period, maximum retirement savings and retirement, demographic anomalies such as baby booms and busts exert a rather predictable influence on the economy over a long time period. Harry Dent has written extensively on demographics and economic cycles. Tylecote (1991) devoted a chapter to demographics and the long cycle. [8]

Modern modifications of Kondratiev theory

There are several modern timing versions of the cycle although most are based on either of two causes: one on technology and the other on the credit cycle.

Additionally, there are several versions of the technological cycles, and they are best interpreted using diffusion curves of leading industries. For example, railways only started in the 1830s, with steady growth for the next 45 years. It was after Bessemer steel was introduced that railroads had their highest growth rates; however, this period is usually labeled the "age of steel". Measured by value added, the leading industry in the U.S. from 1880 to 1920 was machinery, followed by iron and steel.[9]

The technological cycles can be labeled as follows:

- The Industrial Revolution—1771

- The Age of Steam and Railways—1829

- The Age of Steel and Heavy Engineering—1875

- The Age of Oil, Electricity, the Automobile and Mass Production—1908

- The Age of Information and Telecommunications—1971

Any influence of technology during the cycle that began in the Industrial Revolution pertains mainly to England. The U.S. was a commodity producer and was more influenced by agricultural commodity prices. There was a commodity price cycle based on increasing consumption causing tight supplies and rising prices. That allowed new land to the west to be purchased and after four or five years to be cleared and be in production, driving down prices and causing a depression, as in 1819 and 1839.[10] By the 1850s the U. S. was becoming industrialized.[11]

A typical, somewhat updated sequence of technological Kondratiev Waves in the U.S. and some other leading Western economies can be seen in the table below: [12]

| Period | Date (Prosperity to prosperity) | Innovation | Saturation point |

|---|---|---|---|

| First Industrial Revolution (Mechanical Age) | Circa 1787–1843 | Cotton-based technology: spinning weaving; atmospheric stationary steam engines replaced by high pressure engines, wrought iron, iron displaces wood in machinery,[13] canals, turnpikes.[14][15] Development of machine tools | Cotton textiles: British market saturated ca. 1800. By 1840, 71% of British cotton textiles were exported[7][16] |

| Railroad, Steam Engine and Steel Era | Circa 1842–1897 | Age of machinery, steam railways, steam powered factories and steam shipping. First inexpensive steel, telegraph, animal powered combine harvesters, etc. Final development of and diffusion of machine tools and interchangeable parts.[17] Emergence of petroleum and chemical industries and heavy industries after 1870.[15] Expansion of water and sewer systems. | Canals: Late 1840s[14][18]

1870: Steam exceeds water power and animal power.[19] 1890s: Railroads. Track mileage continued to grow but much is later abandoned.[18] |

| Age of mass production, electrification and internal combustion | 1897–1939 | Steel, electric motors, electrification of factories[20] and households, electric utilities, aluminum, chemicals and petrochemicals, internal combustion engine, automobiles, highway system, Fordist mass production, telephony, beginning of motorized agricultural mechanization, radio.[21] Electric street railways help create streetcar suburbs. Build out of urban and suburban public water supply and sewage systems.[22] | 1917: Railroads nationalized. Post World War I short depression. Railroads and electric street railways decline after 1920. Horses, mules and agricultural commodities: 1919. After 1923 industrial output rises as workforce slowly declines.[23] Depression of 1930s: Overcapacity in manufacturing, real estate. Work week reduced from 50 to 40 hours in mid-1930s. Total debt reaches 260% of GDP during early 1930s. |

| War and Post-war Boom: Suburbia | 1939–1982? | Oil displaces coal. Suburban growth and infrastructure. Greatest period of agricultural productivity growth 1940s-1970s.[24] Consumer goods, semiconductors, business computers, plastics, synthetic fibers, fertilizers, television and electronics, green revolution, military-industrial complex, diffusion of commercial aviation and air conditioning, beginning nuclear utilities.[21] | 1940s-50s: Diesel locomotives replace steam.[25]

1971: Peak U.S. oil production 1973: Peak steel consumption in U.S.[26] Pennsylvania steel cities and industrial midwest turn into "rust belt". 1973: Slow economic and productivity growth noted. 1980s: Highway system near saturation[27] |

| Post Industrial Era: Information Technology and care of elderly | 1982? – ?? | Fiber optics and Internet,[21] personal computers, wireless technology, on line commerce, biotechnology, Reagan's "Star Wars" military projects. Energy conservation. Beginning of industrial robots. In the U.S. health care becomes a major sector of the economy (16%) and financial sector increases to 7.5% of economy. | 1984: Peak U.S. employment in computer manufacturing.[28]

Long term decline in U.S. capacity utilization 1990s: Automobiles, land line telephones, chemicals, plastics, appliances, paper, other basic materials, commercial aviation. 2001:Computers, fiber optics 2000s: Crop yields approach limits of photosynthesis. 2008: Developed world on verge of depression. Widespread overcapacity except some nonferrous metals and oil. Large housing and commercial real estate surplus. GDP no longer responds to increases in debt. Total debt exceeds 360% of GDP by late 2009. |

Other researchers

Several papers on the relationship between technology and the economy were written by researchers at the International Institute for Applied Systems Analysis (IIASA). A concise version of Kondratiev cycles can be found in Robert Ayres (1989) in which he gives a historical overview of the relationships of the most significant technologies.[29] Cesare Marchetti published on Kondretiev waves and on diffusion of innovations.[30][31] Arnulf Grübler’s book (1990) gives a detailed account of the diffusion of infrastructures including canals, railroads, highways and airlines, with findings that the principle infrastructures have midpoints spaced in time corresponding to 55 year K wavelengths, with railroads and highways taking almost a century to complete. Grübler devotes a chapter to the long economic wave. [18]

Korotayev et al. recently employed spectral analysis and claimed that it confirmed the presence of Kondratiev waves in the world GDP dynamics at an acceptable level of statistical significance.[32][33] Korotayev et al. also detected shorter business cycles, dating the Kuznets to about 17 years and calling it the third harmonic of the Kondratiev, meaning that there are three Kuznets cycles per Kondratiev.

More recently the physicist and systems scientist Tessaleno Devezas advanced a causal model for the long wave phenomenon based on a generation-learning model[34] and a nonlinear dynamic behaviour of information systems.[35] In both works a complete theory is presented containing not only the explanation for the existence of K-Waves, but also and for the first time an explanation for the timing of a K-Wave (≈60 years = two generations).

A specific modification of the theory of Kondratiev cycles was developed by Daniel Šmihula.[36] For the modern era and the capitalist economy he defined six long economic waves (cycles) and each of them was initiated by a specific technological revolution:

- 1. (1600–1780) The wave of the Financial-agricultural revolution

- 2. (1780–1880) The wave of the Industrial revolution

- 3. (1880–1940) The wave of the Technical revolution

- 4. (1940–1985) The wave of the Scientific-technical revolution

- 5. (1985–2015) The wave of the Information and telecommunications revolution

- 6. (2015–2035?) The hypothetical wave of the post-informational technological revolution

Unlike original Kondratiev's and Schumpeter's views, in Šmihula's conception each new "wave" due to acceleration of scientific and technological progress) is shorter than a previous one. The main stress is put on technological progress and new technologies as decisive factors of any long-time economic development. Each of these waves has its innovation phase (there occur innovations in a form applicable in practical life and also their first real application) which is described as a technological revolution and an application phase in which the number of revolutionary innovations falls and attention focuses on exploiting and extending existing innovations. (As soon as an innovation or a "chain of innovations" becomes available, it becomes more efficient to invest in its adoption, extension and use than in creating new innovations.) Each wave (each cycle) of technological innovations can be characterized by the area in which the most revolutionary changes took place ("leading sectors").

Every wave of innovations lasts approximately until the profits from the new innovation or sector fall to the level of other, older, more traditional sectors. It is a situation when the new technology, which originally increased a capacity to utilize new sources from nature, reached its limits and it is not possible to overcome this limit without an application of another new technology.

For the end of an application phase of any wave there are typical an economic crisis and stagnation. The economic crisis in 2007–2010 is a result of the coming end of the "wave of the Information and telecommunications technological revolution". Some authors have started to predict what the sixth wave might be, such as James Bradfield Moody and Bianca Nogrady who forecast that it will be driven by resource efficiency and clean technology.[37] On the other hand, Šmihula himself considers the waves of technological innovations during the modern age (after 1600 AD) only as a part of a much longer „chain“ of technological revolutions going back to the pre-modern era.[38] It means he believes that we can find long economic cycles (analogical to Kondratiev cycles in modern economy) dependent on technological revolutions even in the Middle Ages and the Ancient era.

Criticism of long cycles

Long wave theory is not accepted by most academic economists, but it is important for innovation-based, development, and evolutionary economics. Among economists who accept it, there has been no universal agreement about the start and the end years of particular waves. This points to a major criticism of the theory: that it amounts to seeing patterns in a mass of statistics that aren't really there. Moreover, there is a lack of agreement over the cause of this phenomenon.

See also

- Business cycles

- Kuznets swing

- Market trends

- Grand Supercycle (Elliott Wave theory)

- Martin A. Armstrong

- Clustering illusion

- Second Industrial Revolution

- Mass production

- Productivity improving technologies (historical)

References

- ^ The term long wave originated from a poor early translation of long cycle from Russian to German. Freeman, Chris; Louçã, Francisco (2001) pp 70

- ^ See, e.g. Korotayev, Andrey V., & Tsirel, Sergey V.(2010). A Spectral Analysis of World GDP Dynamics: Kondratiev Waves, Kuznets Swings, Juglar and Kitchin Cycles in Global Economic Development, and the 2008–2009 Economic Crisis. Structure and Dynamics. Vol.4. #1. P.3-57.

- ^ a b Vincent Barnett, Nikolai Dmitriyevich Kondratiev, Encyclopedia of Russian History, 2004, at Encyclopedia.com.

- ^ a b Erik Buyst, Kondratiev, Nikolai (1892–1938), Encyclopedia of Modern Europe: Europe Since 1914: Encyclopedia of the Age of War and Reconstruction, Gale Publishing, January 1, 2006.

- ^ e.g.: Lewy Land: Kondratieff Waves… Crashed Our Economy!

- ^ Hobsbawm (1999), pp. 87f.

- ^ a b Perez, Carlota (2002). Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages. UK: Edward Elgar Publishing Limited. ISBN 1-84376-331-1.

{{cite book}}: Check|authorlink=value (help); Cite has empty unknown parameter:|coauthors=(help); External link in|authorlink= - ^ Tylecote, Andrew (1991). The Long Wave in the World Economy. London: Routledge. pp. Chapter 5: Population feedback. ISBN 0-415-03690-9.

- ^ Table 7: Ten leading industries in America, by value added, 1914 prices (millions of 1914 $'s

- ^

North, Douglas C. (1966). The Economic Growth of the United States 1790–1860. New York, London: W. W. Norton & Company. ISBN 978-0-393-00346-8.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - ^ See: Joseph Whitworth's quote under American system of manufacturing#Use of machinery.

- ^ Mensch, Gerhard (1979). Stalemate in Technology: Innovations Overcome the Depression. ISBN 0-88410-611-X. The general basis of dates for this table through 1939 is Table 2.1 from Mensch (1979) which is based on a table from Simon Kuznets, to which was added the last upswing, which either began around 1975 or 1982. (Some argue that the cycle did not end until 2000 or 2008.) Saturation points were added and the driving technologies of the various waves were expanded.

- ^ Roe, Joseph Wickham (1916), English and American Tool Builders, New Haven, Connecticut: Yale University Press, LCCN 16011753. Reprinted by McGraw-Hill, New York and London, 1926 (LCCN 27-24075); and by Lindsay Publications, Inc., Bradley, Illinois (ISBN 978-0-917914-73-7).

- ^ a b

Taylor, George Rogers (1951). The Transportation Revolution, 1815–1860. New York, Toronto: Rinehart & Co. ISBN 978-0-87332-101-3.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - ^ a b McNeil, Ian (1990). An Encyclopedia of the History of Technology. London: Routledge. ISBN 0-415-14792-1.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - ^ Engels, Fredrick (1892). The Condition of the Working-Class in England in 1844. London: Swan Sonnenschein & Co. pp. 45, 48–53.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) Engels wrote about the extremely impoverished conditions of the mill workers in 1844, at which time the cotton textiles market was saturated and the railroad and steam engine was in its emerging growth stage. In the preface to the 1892 edition Engels wrote that the conditions he wrote about in 1844 had largely disappeared. - ^ Hounshell, David A. (1984), From the American System to Mass Production, 1800–1932: The Development of Manufacturing Technology in the United States, Baltimore, Maryland: Johns Hopkins University Press, ISBN 978-0-8018-2975-8, LCCN 83016269, OCLC 1104810110

- ^ a b c Grübler, Arnulf (1990). The Rise and Fall of Infrastructures: Dynamics of Evolution and Technological Change in Transport (PDF). Heidelberg and New York: Physica-Verlag.

- ^ Ayres, Robert U.; Warr, Benjamin (2004). "Accounting for Growth: The Role of Physical Work" (PDF).

{{cite journal}}: Cite journal requires|journal=(help) - ^ Devine, Jr., Warren D. (1983). "From Shafts to Wires: Historical Perspective on Electrification, Journal of Economic History, Vol. 43, Issue 2" (PDF): 355.

{{cite journal}}: Cite journal requires|journal=(help) - ^ a b c Constable, George (2003). A Century of Innovation: Twenty Engineering Achievements That Transformed Our Lives. Washington, DC: Joseph Henry Press. ISBN 0-309-08908-5.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ Constable, George (2003). A Century of Innovation: Twenty Engineering Achievements That Transformed Our Lives, Chapter 11, Water supply and distribution. Washington, DC: Joseph Henry Press. ISBN 0-309-08908-5.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ Bell, Spurgeon (1940). "Productivity, Wages and National Income , The Institute of Economics of the Brookings Institution".

{{cite journal}}: Cite journal requires|journal=(help) - ^ Moore, Stephen; Simon, Julian (Dec. 15, 1999). "The Greatest Century That Ever Was: 25 Miraculous Trends of the last 100 Years, The Cato Institute: Policy Analysis, No. 364" (PDF).

{{cite journal}}: Check date values in:|year=(help); Cite journal requires|journal=(help)CS1 maint: year (link)Fig 13. - ^ Ayres, R. U.; Ayres, L. W.; Warr, B. (2002). "Exergy, Power and Work in the U. S. Economy 1900–1998, Insead's Center For the Management of Environmental Resources, 2002/52/EPS/CMER" (PDF)<Fig. 11 in Appendix>

{{cite journal}}: Cite journal requires|journal=(help)CS1 maint: postscript (link) - ^

Smil, Vaclav (2006). Transforming the Twentieth Century: Technical Innovations and Their Consequences. Oxford, New York: Oxford University Press. p. 112.

{{cite book}}: Check|authorlink=value (help); Cite has empty unknown parameter:|coauthors=(help); External link in|authorlink= - ^ [www.bts.gov/publications/national_transportation_statistics/html/table_01_01.html]

- ^ Grove, Andy (2010, Jly 1). "How America Can Create Jobs , Bloomberg Business Week".

{{cite journal}}: Check date values in:|year=(help); Cite journal requires|journal=(help)CS1 maint: year (link) - ^ Ayres, Robert (1989). "Technological Transformations and Long Waves" (PDF).

{{cite journal}}: Cite journal requires|journal=(help) - ^ Marchetti, Cesare (1996). "Pervasive Long Waves: Is Society Cyclotymic" (PDF).

{{cite journal}}: Check|author1-link=value (help); Cite journal requires|journal=(help); External link in|author1-link= - ^ Marchetti, Cesare (1988). "Kondratiev Revisited-After One Cycle" (PDF).

{{cite journal}}: Check|author1-link=value (help); Cite journal requires|journal=(help); External link in|author1-link= - ^ See, e.g. Korotayev, Andrey V., & Tsirel, Sergey V. A Spectral Analysis of World GDP Dynamics: Kondratieff Waves, Kuznets Swings, Juglar and Kitchin Cycles in Global Economic Development, and the 2008–2009 Economic Crisis. Structure and Dynamics: eJournal of Anthropological and Related Sciences. 2010. Vol.4. #1. P.3-57.

- ^ Spectral analysis is a mathematical technique that is used in such fields as electrical engineering for analyzing electrical circuits and radio waves to deconstruct a complex signal to determine the main frequencies and their relative contribution. Signal analysis is usually done with equipment. Data analysis is done with special computer software.

- ^ Devezas, Tessaleno (2001). "The Biological Determinants of long-wave behaviour in socioeconomic growth and development, Technological Forecasting & Social Change 68, pp. 1–57".

{{cite journal}}: Cite journal requires|journal=(help) - ^ Devezas, Tessaleno; Corredine, James (2002). "The nonlinear dynamics of technoeconomic systems - An informational interpretation, Technological Forecasting and Social Change, 69, pp. 317–357".

{{cite journal}}: Cite journal requires|journal=(help) - ^ Šmihula, Daniel (2009): The waves of the technological innovations of the modern age and the present crisis as the end of the wave of the informational technological revolution, Studia politica Slovaca, 1/2009, Bratislava, ISSN-1337-8163, pp. 32–47 [1]

- ^ Moody, J. B. and Nogrady, B (2010): The Sixth Wave: How to succeed in a resource-limited world, Random House, Sydney, ISBN-9781741668896 [2]

- ^ Šmihula, Daniel (2011): Long waves of technological innovations, Studia politica Slovaca, 2/2011, Bratislava, ISSN-1337-8163, pp. 50–69 [3]

Further reading

- Barnett, Vincent (1998). Kondratiev and the Dynamics of Economic Development. London: Macmillan. ISBN 0-312-21048-5.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - Beaudreau, Bernard C. (1996). Mass Production, the Stock Market Crash and the Great Depression. New York, Lincoln, Shanghi: Authors Choice Press.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - Cheung, Edward (1995, 2007). Baby Boomers, Generation X and Social Cycles, Volume 1: North American Long-waves (PDF). Toronto: Longwave Press. ISBN 978-1-896330-00-6.

{{cite book}}: Check date values in:|year=(help); Cite has empty unknown parameter:|coauthors=(help)CS1 maint: year (link) - Devezas, Tessaleno (2006). Kondratieff Waves, Warfare and World Security. Amsterdam: IOS Press. ISBN 1-58603-588-6.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - Freeman, Chris (2001). As Time Goes By. From the Industrial Revolutions to the Information Revolution. Oxford: Oxford University Press. ISBN 0-19-924107-4.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - Goldstein, Joshua (1988). Long Cycles: Prosperity and War in the Modern Age. New Haven: Yale University Press. ISBN 0-300-03994-8.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - Grinin, L. (2006). History and mathematics: Analyzing and Modeling Global Development. Moscow: URSS. ISBN 5-484-01001-2.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - Hobsbawm, Eric (1999). Age of Extremes: The Short Twentieth Century 1914–1991. London: Abacus. ISBN 0-349-10671-1.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - Korotayev, Andrey V., & Tsirel, Sergey V.(2010). A Spectral Analysis of World GDP Dynamics: Kondratieff Waves, Kuznets Swings, Juglar and Kitchin Cycles in Global Economic Development, and the 2008–2009 Economic Crisis. Structure and Dynamics. Vol.4. #1. P.3-57.

- Kohler, Gernot (2003). Globalization: Critical Perspectives. Hauppauge, New York: Nova Science Publishers. ISBN 1-59033-346-2.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) With contributions by Samir Amin, Christopher Chase Dunn, Andre Gunder Frank, Immanuel Wallerstein. - Mandel, Ernest (1964). "The Economics of Neocapitalism". The Socialist Register.

{{cite journal}}: Cite has empty unknown parameters:|month=and|coauthors=(help) - Mandel, Ernest (1980). Long waves of capitalist development: the Marxist interpretation. New York: Cambridge University Press. ISBN 0-521-23000-4.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - McNeil, Ian (1990). An Encyclopedia of the History of Technology. London: Routledge. ISBN 0-415-14792-1.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - Marchetti, Cesare (1986). "Fifty-Year Pulsation in Human Affairs, Analysis of Some Physical Indicators". Futures. 17 (3): 376–388.

{{cite journal}}: Cite has empty unknown parameters:|month=and|coauthors=(help) - Modis, Theodore (1992). Predictions: Society's Telltale Signature Reveals the Past and Forecasts the Future. New York: Simon & Schuster. ISBN 0-671-75917-5.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - Nyquist, Jeffrey (2007). "Cycles of History, Boom and Bust". San Diego: Financial Sense. Weekly Column from 11.09.2007 predicting a major turning-point between 2007 to 2009 and the start of a Great Depression.

- Rothbard, Murray (1984). The Kondratieff Cycle: Real or Fabricated?. Ludwig von Mises Institute.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - Silverberg, Gerald (2000). Breaking the Waves: A Poisson Regression Approach to Schumpeterian Clustering of Basic Innovations. Maastricht: MERIT.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - Šmihula, Daniel (2009). The waves of the technological innovations of the modern age and the present crisis as the end of the wave of the informational technological revolution:. Bratislava: in Studia politica Slovaca, 1/2009 SAS. pp. 32–47. ISSN 1337-8163.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help); Unknown parameter|unused_data=ignored (help) - Šmihula, Daniel (2011). Long waves of technological innovations:. Bratislava: in Studia politica Slovaca, 1/2011 SAS. pp. 50–69. ISSN 1337-8163.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help); Unknown parameter|unused_data=ignored (help) - Solomou, Solomos (1989). Phases of Economic Growth, 1850–1973: Kondratieff Waves and Kuznets Swings. Cambridge: Cambridge University Press. ISBN 0-521-33457-8.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help) - Tausch, Arno (2007). From the 'Washington' Towards a 'Vienna Consensus'? A Quantitative Analysis on Globalization, Development and Global Governance. Hauppauge, New York: Nova Science Publishers. ISBN 1-60021-422-3.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - Turchin, Peter (2006). History & Mathematics: Historical Dynamics and Development of Complex Societies. Moscow: KomKniga. ISBN 5-484-01002-0.

{{cite book}}: Invalid|display-authors=1(help) - The Kondratieff Wave. Dell Publishing Co. Inc. New York, N.Y., USA. 1972. p. 198.

- Shuman, James B. (1972). The Kondratieff Wave. The Future of America Until 1984 and Beyond. New York: Dell.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) This book provides the history of the many ups and downs of the economies. - Tylecote, Andrew (1991). The Long Wave in the World Economy: The Current Crisis in Historical Perspective. London and New York: Routledge.

{{cite book}}: Cite has empty unknown parameter:|coauthors=(help)

External links

- Smith, Marx, Kondratieff and Keynes; R. L. Norman, Jr.

- Theories of the Great Depression, R. L. Norman, Jr.

- Revista Entelequia

- "Kondratieff waves" on faculty.Washington.edu (The Evolutionary World Politics Homepage).

- "Kondratieff theory explained" on Kondratyev.com (Kondratyev Theory Letters).

- Kondratieff winter perspective on current place in business cycles

- The Kondratieff Cycle: Real or Fabricated? by Murray Rothbard

- The Sixth Wave: How to succeed in a resource-limited world on the hypothetical sixth Kontratiev Wave

- The Joshua Goldstein archives