Line break chart: Difference between revisions

HenryStogden (talk | contribs) m Fixed grammar |

WP:SINGULAR, fixed case, links |

||

| Line 1: | Line 1: | ||

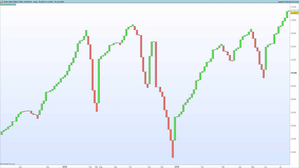

A '''line break chart''', sometimes known as a '''three-line break chart''', is a Japanese trading indicator and [[financial chart]] used to analyse the [[financial markets]].<ref name=":0">{{Cite web |last=Geek |first=The Forex |date=2022-09-29 |title=What Are Line Break Charts & How To Trade Them |url=https://theforexgeek.com/line-break-charts/ |access-date=2023-07-27 |website=The Forex Geek |language=en-US}}</ref> Invented in Japan these charts had been used for over 150 years by traders in Japan before being popularised by Steve Nison in the book “Beyond Candlesticks.”<ref name=":0" /> <ref>{{Cite book |last=Nison |first=Steve |title=Beyond Candlesticks |publisher=Wiley |year=1994 |isbn=9780471007203 |pages=167}}</ref> The chart is made up of vertical blocks or bars called "lines", which indicate the direction of the market.<ref name=":1">{{Cite web |title=Three Line Break Charts [ChartSchool] |url=https://school.stockcharts.com/doku.php?id=chart_analysis:three_line_break |access-date=2023-07-27 |website=school.stockcharts.com}}</ref> |

|||

== Function == |

|||

As with many other financial charts invented in Japan such as Heikin-Ashi and Renko |

As with many other financial charts invented in Japan such as [[Heikin-Ashi]] and [[Renko chart]]s, line break charts evolve based on price and not time.<ref name=":1" />The more widely used [[candlestick chart]]s are based on time and so for these charts each new candle evolves after a certain time period.<ref>{{Cite web |last=https://www.facebook.com/alan.farley.5 |title=What Is a Candlestick Pattern? |url=https://www.investopedia.com/articles/active-trading/092315/5-most-powerful-candlestick-patterns.asp |access-date=2023-07-27 |website=Investopedia |language=en}}</ref> Unlike candlesticks however, line break charts also do not contain "wicks" on each bar or line as the open and close of these bars/lines do not depend on time.<ref>{{Cite web |last=NetPicks |date=2017-03-20 |title=Line Break Charts Explained Plus A Simple Trading Strategy |url=https://www.netpicks.com/line-break-charts/ |access-date=2023-07-27 |website=Options And Active Day Trading Specialists - Netpicks |language=en-US}}</ref> |

||

[[File:Line Break Chart.webp|thumb|299x299px|Line Break Chart ]] |

[[File:Line Break Chart.webp|thumb|299x299px|Line Break Chart ]] |

||

Line break charts contain an “up line” and a “down line” which are normally distinguished using different colours, e.g. an up line can be represented by a green line and a down line can be represented by a red line.<ref>{{Cite web |title=Site Education |url=https://www.barchart.com/education/site-features/line-break-charts |access-date=2023-07-27 |website=Barchart.com |language=en}}</ref> A new up line is added when the previous high is exceeded and a down line is added when the previous low is exceeded, (market reaches a new low in the move).<ref name=":2">{{Cite web |title=Line Break Chart |url=https://help.tradestation.com/09_01/tradestationhelp/charting/linebreak_chart.htm |access-date=2023-07-27 |website=help.tradestation.com}}</ref> If neither a new high or new low is reached, nothing is drawn on the chart. The closing price is what dictates whether or not a previous line has been exceeded. If the price of the market closes above the previous high, then a new up line is drawn, and vice versa.<ref>{{Cite book |last=Nison |first=Steve |title=Beyond Candlesticks |publisher=Wiley |year=1994 |isbn=9780471007203 |pages=169-172}}</ref><ref name=":2" /> |

Line break charts contain an “up line” and a “down line” which are normally distinguished using different colours, e.g. an up line can be represented by a green line and a down line can be represented by a red line.<ref>{{Cite web |title=Site Education |url=https://www.barchart.com/education/site-features/line-break-charts |access-date=2023-07-27 |website=Barchart.com |language=en}}</ref> A new up line is added when the previous high is exceeded and a down line is added when the previous low is exceeded, (market reaches a new low in the move).<ref name=":2">{{Cite web |title=Line Break Chart |url=https://help.tradestation.com/09_01/tradestationhelp/charting/linebreak_chart.htm |access-date=2023-07-27 |website=help.tradestation.com}}</ref> If neither a new high or new low is reached, nothing is drawn on the chart. The closing price is what dictates whether or not a previous line has been exceeded. If the price of the market closes above the previous high, then a new up line is drawn, and vice versa.<ref>{{Cite book |last=Nison |first=Steve |title=Beyond Candlesticks |publisher=Wiley |year=1994 |isbn=9780471007203 |pages=169-172}}</ref><ref name=":2" /> |

||

==== Three- |

==== Three-line break ==== |

||

the more common version of |

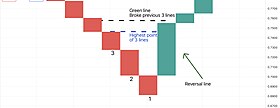

the more common version of line break charts are “Three-line break” which indicate that for a market reversal to occur (new line that forms in the opposite direction to the previous lines), the price will have to break above or below the previous three lines depending on the direction of the lines.<ref>{{Cite web |last=https://www.facebook.com/tradinformed |date=2015-06-15 |title=How To Trade 3 Line Break Charts Profitably - Tradinformed |url=https://www.tradinformed.com/how-to-trade-3-line-break-charts-profitably/ |access-date=2023-07-27 |website=www.tradinformed.com |language=en-GB}}</ref> This therefore ensures that market reversals are determined only by the action of the market <ref>{{Cite web |title= |url=https://www.stockmaniacs.net/three-line-break-chart-strategy/ |url-status=live |website=stockmaniacs.net}}</ref>and only a large move in price will warrant a reversal to be shown on the chart.<ref name=":0" /> <ref name=":1" />A market reversal is defined as when the direction of a market trend has changed, e.g. an uptrend changes into a downtrend.<ref>{{Cite web |last=https://www.facebook.com/tradethatswing |title=Reversal: Definition, Example, and Trading Strategies |url=https://www.investopedia.com/terms/r/reversal.asp |access-date=2023-07-27 |website=Investopedia |language=en}}</ref> |

||

[[File:LBCR.jpg|thumb|280x280px|Reversal pattern on line break charts ]] |

[[File:LBCR.jpg|thumb|280x280px|Reversal pattern on line break charts ]] |

||

A trend is confirmed after three consecutive lines going in the same direction.<ref>{{Cite book |last=Nison |first=Steve |title=Beyond candlesticks |publisher=Wiley |year=1994 |isbn=9780471007203 |pages=172-173}}</ref> For example, an uptrend will be confirmed once three consecutive up lines are formed.<ref name=":1" /> This shows that each new line has extended the trend and so the price continues in the same direction.<ref name=":3">{{Cite web |date=2019-02-11 |title=Three Line Break Chart Review {{!}} How to Trade Profitably with Charts? |url=https://www.adigitalblogger.com/charts/three-line-break-chart/ |access-date=2023-07-27 |website=A Digital Blogger |language=en-US}}</ref> In three line break charts, for an uptrend to be reversed, a new line that closes below the previous three up lines will have to form and vice versa for a downtrend to be reversed.<ref name=":3" /> |

A trend is confirmed after three consecutive lines going in the same direction.<ref>{{Cite book |last=Nison |first=Steve |title=Beyond candlesticks |publisher=Wiley |year=1994 |isbn=9780471007203 |pages=172-173}}</ref> For example, an uptrend will be confirmed once three consecutive up lines are formed.<ref name=":1" /> This shows that each new line has extended the trend and so the price continues in the same direction.<ref name=":3">{{Cite web |date=2019-02-11 |title=Three Line Break Chart Review {{!}} How to Trade Profitably with Charts? |url=https://www.adigitalblogger.com/charts/three-line-break-chart/ |access-date=2023-07-27 |website=A Digital Blogger |language=en-US}}</ref> In three line break charts, for an uptrend to be reversed, a new line that closes below the previous three up lines will have to form and vice versa for a downtrend to be reversed.<ref name=":3" /> |

||

Revision as of 04:23, 28 July 2023

A line break chart, sometimes known as a three-line break chart, is a Japanese trading indicator and financial chart used to analyse the financial markets.[1] Invented in Japan these charts had been used for over 150 years by traders in Japan before being popularised by Steve Nison in the book “Beyond Candlesticks.”[1] [2] The chart is made up of vertical blocks or bars called "lines", which indicate the direction of the market.[3]

Function

As with many other financial charts invented in Japan such as Heikin-Ashi and Renko charts, line break charts evolve based on price and not time.[3]The more widely used candlestick charts are based on time and so for these charts each new candle evolves after a certain time period.[4] Unlike candlesticks however, line break charts also do not contain "wicks" on each bar or line as the open and close of these bars/lines do not depend on time.[5]

Line break charts contain an “up line” and a “down line” which are normally distinguished using different colours, e.g. an up line can be represented by a green line and a down line can be represented by a red line.[6] A new up line is added when the previous high is exceeded and a down line is added when the previous low is exceeded, (market reaches a new low in the move).[7] If neither a new high or new low is reached, nothing is drawn on the chart. The closing price is what dictates whether or not a previous line has been exceeded. If the price of the market closes above the previous high, then a new up line is drawn, and vice versa.[8][7]

Three-line break

the more common version of line break charts are “Three-line break” which indicate that for a market reversal to occur (new line that forms in the opposite direction to the previous lines), the price will have to break above or below the previous three lines depending on the direction of the lines.[9] This therefore ensures that market reversals are determined only by the action of the market [10]and only a large move in price will warrant a reversal to be shown on the chart.[1] [3]A market reversal is defined as when the direction of a market trend has changed, e.g. an uptrend changes into a downtrend.[11]

A trend is confirmed after three consecutive lines going in the same direction.[12] For example, an uptrend will be confirmed once three consecutive up lines are formed.[3] This shows that each new line has extended the trend and so the price continues in the same direction.[13] In three line break charts, for an uptrend to be reversed, a new line that closes below the previous three up lines will have to form and vice versa for a downtrend to be reversed.[13]

Other forms

Line break charts can be adjusted depending on the trading strategy, this is knows as “adjusting the sensitivity.”[14] Adjusting the sensitivity involves changing the number of lines the market has to break before a reversal line is drawn.[15] The less common two line break chart indicates that the trend has reversed once the previous two up or down lines have been broken. Charts with higher sensitivity such as two line break and three line break are generally used by shorter time frame traders looking for small and quick market reversals such as in scalping[16] and swing trading.[15] Charts with lower sensitivity such as five line break or more are generally used by long term traders such as investors where only the major moves in the market are targeted.[14]

Types of lines:

A short down line is called a shoe, an upwards reversal line (up line that broke the previous three down lines) is called a suit, and a short up line that emerges immediately from an upwards reversal line is called a neck.[17] In some strategies traders will look for a neck as a buy signal as an up line after a market reversal indicates that the trend has changed from a downtrend to an uptrend with the neck serving as extra "bullish confirmation".[17]

References:

- ^ a b c Geek, The Forex (2022-09-29). "What Are Line Break Charts & How To Trade Them". The Forex Geek. Retrieved 2023-07-27.

- ^ Nison, Steve (1994). Beyond Candlesticks. Wiley. p. 167. ISBN 9780471007203.

- ^ a b c d "Three Line Break Charts [ChartSchool]". school.stockcharts.com. Retrieved 2023-07-27.

- ^ https://www.facebook.com/alan.farley.5. "What Is a Candlestick Pattern?". Investopedia. Retrieved 2023-07-27.

{{cite web}}:|last=has generic name (help); External link in|last= - ^ NetPicks (2017-03-20). "Line Break Charts Explained Plus A Simple Trading Strategy". Options And Active Day Trading Specialists - Netpicks. Retrieved 2023-07-27.

- ^ "Site Education". Barchart.com. Retrieved 2023-07-27.

- ^ a b "Line Break Chart". help.tradestation.com. Retrieved 2023-07-27.

- ^ Nison, Steve (1994). Beyond Candlesticks. Wiley. pp. 169–172. ISBN 9780471007203.

- ^ https://www.facebook.com/tradinformed (2015-06-15). "How To Trade 3 Line Break Charts Profitably - Tradinformed". www.tradinformed.com. Retrieved 2023-07-27.

{{cite web}}:|last=has generic name (help); External link in|last= - ^ stockmaniacs.net https://www.stockmaniacs.net/three-line-break-chart-strategy/.

{{cite web}}: Missing or empty|title=(help)CS1 maint: url-status (link) - ^ https://www.facebook.com/tradethatswing. "Reversal: Definition, Example, and Trading Strategies". Investopedia. Retrieved 2023-07-27.

{{cite web}}:|last=has generic name (help); External link in|last= - ^ Nison, Steve (1994). Beyond candlesticks. Wiley. pp. 172–173. ISBN 9780471007203.

- ^ a b "Three Line Break Chart Review | How to Trade Profitably with Charts?". A Digital Blogger. 2019-02-11. Retrieved 2023-07-27.

- ^ a b "Three Line Break". www.marketinout.com. Retrieved 2023-07-27.

- ^ a b Nison, Steve (1994). Beyond Candlesticks. Wiley. pp. 181–184. ISBN 9780471007203.

- ^ "What is scalping? A beginners' guide to scalping trading strategies". www.cityindex.com. Retrieved 2023-07-27.

- ^ a b Nison, Steve (1994). Beyond Candlesticks. Wiley. pp. 184–187. ISBN 9780471007203.