Jane Street Capital: Difference between revisions

Tags: Reverted Visual edit |

Undid revision 1220519758 by 115.110.209.99 (talk) |

||

| Line 61: | Line 61: | ||

*[[Sam Bankman-Fried]]<ref>{{Cite web |last=Parloff |first=Roger |author-link=Roger Parloff |date=August 12, 2021 |title=Portrait of a 29-year-old billionaire: Can Sam Bankman-Fried make his risky crypto business work? |url=https://finance.yahoo.com/news/ftx-ceo-sam-bankman-fried-profile-085444366.html |url-status=live |archive-url=https://web.archive.org/web/20220624134430/https://finance.yahoo.com/news/ftx-ceo-sam-bankman-fried-profile-085444366.html |archive-date=June 24, 2022 |access-date=September 6, 2021 |website=Yahoo!Finance |language=en-US}}</ref> and [[Caroline Ellison]],<ref name="Washington Post">{{Cite news |last=De Vynck |first=Gerrit |date=2 January 2023 |title=Caroline Ellison wanted to make a difference. Now she's facing prison. |work=Washington Post |url=https://www.washingtonpost.com/business/2023/01/02/caroline-ellison-ftx/ |access-date=4 January 2023}}</ref> recipients of [[United States v. Bankman-Fried|misappropriated]] [[FTX]] customer funds, were once employed by the company.<ref>{{Cite web |last=Wise |first=Aaron |date=2023-01-30 |title=How did so many Jane Street traders wind up at FTX? |url=https://protos.com/how-did-so-many-jane-street-traders-wind-up-at-ftx/ |access-date=2023-10-18 |website=Protos |language=en-US}}</ref> |

*[[Sam Bankman-Fried]]<ref>{{Cite web |last=Parloff |first=Roger |author-link=Roger Parloff |date=August 12, 2021 |title=Portrait of a 29-year-old billionaire: Can Sam Bankman-Fried make his risky crypto business work? |url=https://finance.yahoo.com/news/ftx-ceo-sam-bankman-fried-profile-085444366.html |url-status=live |archive-url=https://web.archive.org/web/20220624134430/https://finance.yahoo.com/news/ftx-ceo-sam-bankman-fried-profile-085444366.html |archive-date=June 24, 2022 |access-date=September 6, 2021 |website=Yahoo!Finance |language=en-US}}</ref> and [[Caroline Ellison]],<ref name="Washington Post">{{Cite news |last=De Vynck |first=Gerrit |date=2 January 2023 |title=Caroline Ellison wanted to make a difference. Now she's facing prison. |work=Washington Post |url=https://www.washingtonpost.com/business/2023/01/02/caroline-ellison-ftx/ |access-date=4 January 2023}}</ref> recipients of [[United States v. Bankman-Fried|misappropriated]] [[FTX]] customer funds, were once employed by the company.<ref>{{Cite web |last=Wise |first=Aaron |date=2023-01-30 |title=How did so many Jane Street traders wind up at FTX? |url=https://protos.com/how-did-so-many-jane-street-traders-wind-up-at-ftx/ |access-date=2023-10-18 |website=Protos |language=en-US}}</ref> |

||

*[[Brett Harrison]]. |

*[[Brett Harrison]]. |

||

*Vishwanth Kb was once employed by Jane Street. |

|||

==References== |

==References== |

||

Revision as of 12:24, 26 April 2024

| |

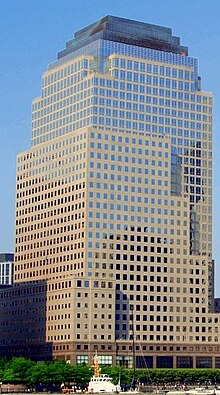

Headquarters at 250 Vesey Street | |

| Industry | Financial services |

|---|---|

| Founded | August 31, 1999[1] |

| Founders |

|

| Headquarters | 250 Vesey Street, , U.S. |

| Products | High-frequency trading, Market maker[2] |

Number of employees | 2,631[3] |

| ASN | |

| Website | www |

Jane Street Capital, typically referred to as Jane Street, is a global proprietary trading firm.[4] Jane Street Capital employs more than 2,000 people in five offices in New York, London, Hong Kong, Amsterdam, and Singapore. The firm trades a broad range of asset classes on more than 200 venues in 45 countries.[5]

The company is one of the largest market-makers, trading more than $17 trillion worth of securities in 2020. It was considered to have helped keep bond exchange-traded funds (ETFs) liquid during the market turmoil in 2020.[6]

History

Jane Street was co-founded by Tim Reynolds, Rob Granieri, Marc Gerstein, and Michael Jenkins.[6][7] Reynolds, Granieri, and Jenkins were formerly traders at Susquehanna International Group.[8]

Jane Street's website says the firm was founded in 2000.[4] However, Reynolds reports it to have been founded in 1999, and the date varies between sources.[1][7][9] According to Delaware state records, Jane Street Capital, LLC was incorporated in August 1999.[10]

In 2012, Tim Reynolds stepped down from his position running the firm to focus on philanthropy.[8]

Activities

By 2018, Jane Street reportedly traded an average of $13 billion in global equities every day and handled 7 percent of ETF volume worldwide.[8]

The firm ended 2020 having traded $4 trillion in global equities, $1.4 trillion in bonds, and $3.9 trillion in ETFs.[11] During the COVID-19 pandemic, the firm saw its revenue jump 54% to a record of $10.6 billion during the year ended in March 2021.[12]

As of 2021, Jane Street’s trading capital was about $15bn. As well as high-frequency trading, it in some cases maintained positions for hours, even days or sometimes weeks, which is essential for ETFs that track less-traded markets. On any given day, Jane Street was holding about $50bn of securities. In ETFs, it is an authorised participant[13] in 2,600 ETFs and lead market-maker on 506 ETFs, and plays an important role in maintaining ETF liquidity.[14]

In 2023, Jane Street generated $10.6bn in net trading revenue with adjusted earnings of $7.4bn. It released these numbers as part of a debt deal which aimed to expand the amount of cash on Jane Street's balance sheet from $4.3bn to $5.6bn.[15]

Technology

Jane Street writes almost all of its software in the OCaml programming language.[16][14][17][18][19]

Leadership and culture

Jane Street is informally led by a group of 30 or 40 senior executives.

The firm's culture includes a focus on the risks of improbable but catastrophic crashes. In addition to hedging at trading desk level, Jane Street at company level spends $50m-$75m a year on put options.[14]

Lawsuits

In April 2024, the firm brought a lawsuit against Millennium Management alleging that Millennium stole its trading strategy through engaging two of its former traders, Douglas Schadewald and Daniel Spottiswood.[20] The firm claimed the strategy, which traded options in India, earned about $1 billion in 2023.[21]

Notable past employees

- Sam Bankman-Fried[22] and Caroline Ellison,[23] recipients of misappropriated FTX customer funds, were once employed by the company.[24]

- Brett Harrison.

References

- ^ a b "Jane Street Capital, LLC :: Delaware (US) :: OpenCorporates". opencorporates.com.

- ^ Patterson, Scott; Rogow, Geoffrey (August 1, 2009). "What's Behind High-Frequency Trading". The Wall Street Journal.

- ^ "Jane Street Scores $10.6 Billion Trading Haul". Bloomberg.com. 17 April 2024.

- ^ a b "Our Story". Jane Street Capital. Archived from the original on August 31, 2017. Retrieved August 1, 2014.

- ^ "What We Do :: Jane Street". www.janestreet.com. Retrieved 2018-08-08.

- ^ a b Wigglesworth, Robin (28 January 2021). "Jane Street: the top Wall Street firm 'no one's heard of'". Financial Times. Retrieved 29 January 2021.

- ^ a b "Jane Street's Reynolds Turns to Art With Trading Fortune". Bloomberg.com. 14 June 2019 – via www.bloomberg.com.

- ^ a b c "The Poker Aces Playing a Key Hand in the $5 Trillion ETF Market". 20 November 2018.

- ^ "Jane Street Capital, LLC: Private Company Information". www.bloomberg.com.

- ^ "Division of Corporations - Filing". icis.corp.delaware.gov.

- ^ "Financial Times". 28 January 2021.

- ^ "Jane Street, DRW Traders Made Billions as Virus Hit Markets". Bloomberg.com. 18 June 2021.

- ^ Boyde, Emma (September 28, 2020). "What are authorised participants?".

- ^ a b c Wigglesworth, Robin (January 28, 2021). "Jane Street: the top Wall Street firm 'no one's heard of'".

- ^ "Jane Street Scores $10.6 Billion Trading Haul". Bloomberg.com. 17 April 2024.

- ^ "Automated Trading and OCaml with Yaron Minsky". Software Engineering Daily. November 9, 2015.

- ^ "Technology :: Jane Street". Jane Street Capital. Retrieved 15 August 2023.

- ^ "Jane and the Compiler". Jane Street Capital. Retrieved 15 August 2023.

- ^ "Jane Street Open Source". Jane Street Capital. Retrieved 15 August 2023.

- ^ "Big hedge fund firm Millennium sued by Jane Street for allegedly stealing strategy". Reuters.

- ^ "Jane Street Strategy in Millennium Suit Involved India Trading, Hearing Reveals". Bloomberg.

- ^ Parloff, Roger (August 12, 2021). "Portrait of a 29-year-old billionaire: Can Sam Bankman-Fried make his risky crypto business work?". Yahoo!Finance. Archived from the original on June 24, 2022. Retrieved September 6, 2021.

- ^ De Vynck, Gerrit (2 January 2023). "Caroline Ellison wanted to make a difference. Now she's facing prison". Washington Post. Retrieved 4 January 2023.

- ^ Wise, Aaron (2023-01-30). "How did so many Jane Street traders wind up at FTX?". Protos. Retrieved 2023-10-18.