Shadow price: Difference between revisions

Added commas for readability in first sentence. |

No edit summary |

||

| Line 1: | Line 1: | ||

{{IEP assignment|course=Wikipedia:India_Education_Program/Courses/Fall_2011/Development Economics_Year_3_Group_A|university=Symbiosis School of Economics|term=2011 Q3}} |

{{IEP assignment|course=Wikipedia:India_Education_Program/Courses/Fall_2011/Development Economics_Year_3_Group_A|university=Symbiosis School of Economics|term=2011 Q3}}The term '''shadow prices''' is used formally in economics to name the price paid for an increment of additional production. For example consider a firm that already has a widget factory full of equipment and talented staff. They might estimate the shadow price for a few more widgets as simply the cost of the overtime to pay the staff to stay and create them. Most day to day production decisions are made at the margin like that. Some kinds of goods have have near zero shadow prices, for example [[information goods]]. |

||

The term has come to be used more less formally to to discuss the cost of decisions made at the margin without consideration of the total cost. For example consider a trip in your car. You might estimate the shadow price of that trip by including the cost of gas; but you unlikely to include the wear on the tires or the cost of the money you might have borrowed to purchase the car. It is probably not too serious an exaggeration to say most decisions are made using shadow prices. |

|||

In [[constrained optimization]] in [[economics]], the '''shadow price''' is the instantaneous change, per unit of the constraint, in the objective value of the optimal solution of an [[optimization problem]] obtained by relaxing the [[Constraint (mathematics)|constraint]]. In other words, it is the [[marginal utility]] of relaxing the constraint, or, equivalently, the [[marginal cost]] of strengthening the constraint. |

In [[constrained optimization]] in [[economics]], the '''shadow price''' is the instantaneous change, per unit of the constraint, in the objective value of the optimal solution of an [[optimization problem]] obtained by relaxing the [[Constraint (mathematics)|constraint]]. In other words, it is the [[marginal utility]] of relaxing the constraint, or, equivalently, the [[marginal cost]] of strengthening the constraint. |

||

Revision as of 16:29, 8 February 2014

Template:IEP assignmentThe term shadow prices is used formally in economics to name the price paid for an increment of additional production. For example consider a firm that already has a widget factory full of equipment and talented staff. They might estimate the shadow price for a few more widgets as simply the cost of the overtime to pay the staff to stay and create them. Most day to day production decisions are made at the margin like that. Some kinds of goods have have near zero shadow prices, for example information goods.

The term has come to be used more less formally to to discuss the cost of decisions made at the margin without consideration of the total cost. For example consider a trip in your car. You might estimate the shadow price of that trip by including the cost of gas; but you unlikely to include the wear on the tires or the cost of the money you might have borrowed to purchase the car. It is probably not too serious an exaggeration to say most decisions are made using shadow prices.

In constrained optimization in economics, the shadow price is the instantaneous change, per unit of the constraint, in the objective value of the optimal solution of an optimization problem obtained by relaxing the constraint. In other words, it is the marginal utility of relaxing the constraint, or, equivalently, the marginal cost of strengthening the constraint.

In a business application, a shadow price is the maximum price that management is willing to pay for an extra unit of a given limited resource.[1] For example, if a production line is already operating at its maximum 40-hour limit, the shadow price would be the maximum price the manager would be willing to pay for operating it for an additional hour, based on the benefits he would get from this change.

More formally, the shadow price is the value of the Lagrange multiplier at the optimal solution, which means that it is the infinitesimal change in the objective function arising from an infinitesimal change in the constraint. This follows from the fact that at the optimal solution the gradient of the objective function is a linear combination of the constraint function gradients with the weights equal to the Lagrange multipliers. Each constraint in an optimization problem has a shadow price or dual variable.

The value of the shadow price can provide decision-makers with insights into problems. For instance if a constraint limits the amount of labor available to you to 40 hours per week, the shadow price will tell you how much you should be willing to pay for an additional hour of labor. If your shadow price is $10 for the labor constraint, for instance, you should pay no more than $10 an hour for additional labor. Labor costs of less than $10/hour will increase the objective value; labor costs of more than $10/hour will decrease the objective value. Labor costs of exactly $10 will cause the objective function value to remain the same.

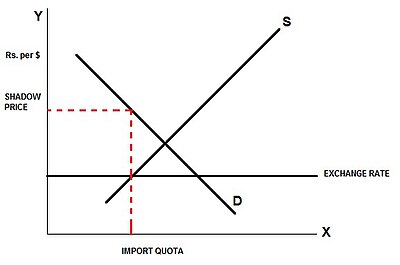

Shadow Price of Foreign Exchange

Illustration #1

Suppose a consumer faces prices and is endowed with income , then the consumer's problem is: . Forming the Lagrangian auxiliary function , taking first order conditions and solving for its saddle point we obtain which satisfy:

This gives us a clear interpretation of the Lagrange Multiplier in the context of consumer maximization. If the consumer is given an extra dollar (the budget constraint is relaxed) at the optimal consumption level where the marginal utility per dollar for each good is equal to as above, then the change in maximal utility per dollar of additional income will be equal to since at the optimum the consumer gets the same amount of marginal utility per dollar from spending his additional income on either goods. In this case the shadow price concept does not carry much importance because the objective function (utility) and the constraint (income) are measured in different units.

Illustration #2

Holding prices fixed, if we define

- ,

then we have the identity

- ,

where are the demand functions, i.e.

Now define the optimal expenditure function

Assume differentiability and that is the solution at , then we have from the multivariate chain rule:

Now we may conclude that

This again gives the obvious interpretation, one extra dollar of optimal expenditure will lead to units of optimal utility.

Control theory

In optimal control theory, the concept of shadow price is reformulated as costate equations, and one solves the problem by minimization of the associated Hamiltonian via Pontryagin's minimum principle.

See also

Further reading

- Ravi Kanbur (1987). "shadow pricing ," The New Palgrave: A Dictionary of Economics, v. 4, pp. 316-17.

- Economics of Development and Planning(Theory and Practice)- S.K Mishra, V.K Puri