Taxation in ancient Rome

This article, Taxation in ancient Rome, has recently been created via the Articles for creation process. Please check to see if the reviewer has accidentally left this template after accepting the draft and take appropriate action as necessary.

Reviewer tools: Inform author |

This article, Taxation in ancient Rome, has recently been created via the Articles for creation process. Please check to see if the reviewer has accidentally left this template after accepting the draft and take appropriate action as necessary.

Reviewer tools: Inform author |

There were four primary kinds of taxes in ancient Rome, these consisted of a cattle tax, a land tax, customs, and a tax on the profits of any profession. These taxes were typically collected by local aristocrats. The Roman state would set a fixed amount of money each region needed to provide in taxes, and the local officials would decided who paid the taxes and how much they paid. Once collected the taxes would be used to fund the military, create public works, establish trade networks, stimulate the economy, and the fund the cursus publicum. The Roman tax system may have contributed to the fall of the Western Roman Empire. As taxes increased, farmers and poorer citizens struggled to produce food and maintain their wealth. This resulted in a decreased level of food production, and therefore it caused famines, higher death rates, and a decreased population. As citizens became poorer, they agreed to work for aristocrats in exchange for protection. Thus forming the basis for serfdom.

Types

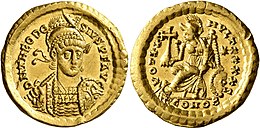

There were four kinds of taxes in ancient Rome. There was a cattle tax, a land tax, customs, and a tax on the profits of any profession. Cities may have occasionally levied other taxes, however they were usually temporary.[1] In ancient Rome there was no income tax, instead the primary tax was known as the portorium. This tax was imposed on goods exiting or entering the city. The size of the tax was based off of the value of the item itself. It was higher on luxurious or expensive items, but lower on basic necessities. Another type of tax was imposed to collect the finances necessary for war. This tax divided the citizenry into five brackets, each of which paid a different amount of money. Augustus created two new taxes to fund the aerarium militare, which was a service that provided money to veterans. These taxes were the centesima venalium and the vicesima hereditatium. They were a 1% sales tax and a 5% tax on inheritance and donations respectively. The centesima venalium was an unpopular policy that caused public unrest, resulting in Caligula abolishing the tax. During the late Roman empire there was an increased need for taxation as plagues reduced the population and threats to the Roman empire increased. The emperor Septimius Severus created a new tax known as the annona, which could be paid in kind. This policy was despised by the population, who preferred paying in money. During the reign of Diocletian, the annona was exclusively based off of land.[2] Caracalla granted Roman citizenship to all male residents of the empire, which was likely a method of increasing the taxable population of the empire. Under Constantine, it had become difficult to pay taxes due to the continued debasement of the solidus. Increasing the prevalence of payment in kind.[3]

Collection and management

Indiction

The indiction was a periodic reassessment for agricultural taxes and land taxes used throughout Roman history. During the Roman Republic this easement occurred every five years, during the empire the cycle lasted 15 years. Although in Roman Egypt a 14-year cycle used. If the emperors made any change to the tax policy it usually occurred at the beginning these cycles, and at the end it was common for the Emperors to forgive any arrears.[4]

The Chronicon Paschale, a 7th century Greek Christian chronicle claims that this system was established in 49 BCE by Julius Caesar, although it is also possible it began in 48 BC.[4] It also may have began in 58 CE when Nero issued a series of tax reforms in 58 CE.[4][5] The earliest known event associated with this cycle was in 42 BCE, when Claudius established a board of praetors to pursue arrears for it.[4][6] The cycle in Egypt only lasted fourteen years because in Egypt the liability for the poll tax began at the age of fourteen.[4]

Tax farming

Tax farming is a financial management technique in which a legal contract is assigns the management of a revenue source to a third party while the original holder of the revenue stream receives fixed periodic rents from the contractor. This practice was first developed by the Romans. Under their system, the Roman State reassigned the ability to collect taxes to private individuals or organizations. These private groups paid the taxes for the area, and they used the products and money that could be garnered from the area to cover the outlay.[7][8] By the time of the Roman Empire these private people or groups became known as the publicani. The Roman government assumed control of farming indirect taxes under the Flavian dynasty, by Trajan they controlled the collection of all vectigalia in all regions except Syria, Egypt, Judea.[9]

Administration

Taxation in ancient Rome was decentralized, with the government preferring to leave the task of collecting taxes to local elected magistrates.[1] Typically these magistrates were wealthy landowners. During the Roman Republic finances were stored inside of the temple of Saturn. Under the reign of Augustus a new institution was created, the fiscus. At first it only contained the wealth gained through taxes on Egypt, however it expanded to other sources later in Roman history. It also collected wealth from people who died without a will, half of the wealth of unclaimed property, and fines.[3] The censors were a political position in ancient Rome that helped manage taxation. The results of their census determined the amount of tax a citizen owned. They registered the value of each citizen's property, which determined the amount of property-tax they had to pay.[10] The censors also participated in tax farming through their auctions. They auctioned off the space of a lustrum to the highest bidder in return for tithes and taxes.[11][12][13] Censors also had similar duties to a modern minister of finance. They could impose new vectiglia,[14] sell government land,[15] and manage the budget. Rome had a regressive tax system, which is a tax system in which the the tax rate decreases as wealth of the taxpayer increases. In Rome, the upper classes payed the lowest amount in taxes while the lower classes paid the least in taxes.

Diocletian

Diocletian changed the method of collecting taxes in ancient Rome.[16] Under his reign, he replaced the local optimates with a bureaucracy. He established a new tax system known as the capitatio-Iugatio as a method of combatting the rampant inflation during the later parts of the empire.[17] This system combined the land rents, known as iugatio, and the capitatio, which affected individuals. Under this policy, arable land was divided into different regions according to their yield and crop. All land, income, and direct taxes were merged into a single tax. This policy tied the peasantry to their land, and those without land were taxed.[18]

Usage and effects

The wealth acquired through taxes were used to fund the military, public works, establish trade networks, and the fund the cursus publicum. Taxation may have contributed to increased economic development as it motivated citizens to work to produce more goods and trade them with others. The Roman government would set a fixed amount of wealth each region needed to pay in taxes, the magistrates were tasked with determining who would pay the taxes, and how much they would pay. However, many taxes, such as those on wheat and grain, were paid in kind. Which prevented them from being used to stimulate trade. This is because payment in kind can only travel from the tax-payer to the collector. Roman taxpayer money also used to fund other goals. Emperor Julian stopped the city of Corinth from taxing the city of Argos, which they had been given some power over, and using that money to fund wild beast hunts.[17] Excessive taxation may also have limited provinces such as Egypt's ability to provide goods to customers.[19] The Roman tax system also crippled the Egyptian peasantry, the poverty-stricken lower class often turned towards crime.[9] During the earlier parts of Roman history tax rates were low. Likely because the Roman state required little funding in order to preform its duties. This system resulted in a heavily increased level of local autonomy, often resulting in poor distribution of the tax money.[16] As the Roman empire expanded, it required more resources to maintain itself and continue growing, resulting in an increased level of taxation.

Fall of the Roman Empire

During the late Roman empire the level of taxation progressively needed to increase, as the Roman empire needed to continue funding the military despite the decreasing amount of resources available to the empire. Bureaucrats use their position of authority to evade taxes, leaving the burden of taxation to the poorer citizens. By this point in Roman history taxes consumed more than one third of most farmer's gross income.[20] People who were unable to bear this burden would have agreed to become indebted to landlords in exchange for protection. Effectively transforming the plebians into serfs.[21] These estates became far more popular than life in cities, and as they grew the usage of money became increasingly rarer. This crippled the economy and the ability of the military to gather the necessary funds.[1] Tax farming practices are believed to have contributed to the fall of the Western Roman Empire.[22][23] Most of the responsibility for taxation fell on the plebians and the farmers. By the reign of Diocletian 90% of the government's revenue came from taxation on agriculture, and the heavy tax burden on farmers created deficits in the production of food and an continued depopulation of the empire. This was probably a major factor in the inability of the empire to adequately man its legions.[17] Germanic incursions forced the emperors to lower tax rates in the year 413. The government of Rome also decreed that for five years, the tax rate of Italy was reduced by 80%. Despite these reductions, the provinces of Rome struggled to pay their taxes, and the Roman government was unable to receive the funding it needed.[24][25][26]

References

- ^ a b c Stephens, W. Richard (1982). "The Fall of Rome Reconsidered: A Synthesis of Manpower and Taxation Arguments". Mid-American Review of Sociology. 7 (2): 49–65. ISSN 0732-913X. JSTOR 23252728.

- ^ Temin, Peter (2013). The Roman Market Economy. Princeton University Press. p. 146. ISBN 978-0-691-14768-0.

- ^ a b Conti, Flavio (2003). A Profile of Ancient Rome. Getty Publications. pp. 148–149. ISBN 978-0-89236-697-2.

- ^ a b c d e Richard Duncan-Jones, Money and government in the Roman empire (Cambridge University Press, 1994) p. 59-63.

- ^ Tacitus, Annales 13.31, 50-51

- ^ Cassius Dio, Roman History 60.10.4

- ^ Howatson M. C.: Oxford Companion to Classical Literature, Oxford University Press, 1989, ISBN 0-19-866121-5

- ^ Balsdon J.: Roman Civilization, Pelican, 1965

- ^ a b Sidebotham, Steven E. (1986). Roman Economic Policy in the Erythra Thalassa: 30 B.C.-A.D. 217. BRILL. pp. 114, 164. ISBN 978-90-04-07644-0.

- ^ cf. Livy xxxix.44.

- ^ Macrobius Saturnalia i.12.

- ^ Cicero de Lege Agraria i.3, ii.21.

- ^ Cicero ad Qu. Fr. i.1 §12, In Verrem iii.7, De Natura Deorum iii.19, Varro de re rustica ii.1.

- ^ Livy xxix.37, xl.51.

- ^ Livy xxxii.7.

- ^ a b Hopkins, Keith (1980). "Taxes and Trade in the Roman Empire (200 B.C.-A.D. 400)". The Journal of Roman Studies. 70: 101–125. doi:10.2307/299558. ISSN 0075-4358. JSTOR 299558. S2CID 162507113.

- ^ a b c DeLorme, Charles D.; Isom, Stacey; Kamerschen *, David R. (2005-04-10). "Rent seeking and taxation in the Ancient Roman Empire". Applied Economics. 37 (6): 705–711. doi:10.1080/0003684042000323591. ISSN 0003-6846. S2CID 154784350.

- ^ Ostrogorsky (2004), History of the Byzantine State, p. 37

- ^ Erdkamp, Paul (2014-06-01). "How modern was the market economy of the Roman world?". Œconomia. History, Methodology, Philosophy (4–2): 225–235. doi:10.4000/oeconomia.399. ISSN 2113-5207.

- ^ Heather, Peter (2006). The Fall of the Roman Empire: A New History of Rome and the Barbarians. Oxford University Press, USA. p. 14. ISBN 978-0-19-532541-6.

- ^ Bagnall, Roger S. (1985). "Agricultural Productivity and Taxation in Later Roman Egypt". Transactions of the American Philological Association (1974-). 115: 289–308. doi:10.2307/284204. ISSN 0360-5949. JSTOR 284204.

- ^ Cahill, Thomas. How the Irish saved civilization: the untold story of Ireland's heroic role from the fall of Rome to the rise of medieval Europe. Anchor Books, Doubleday, 1996, p. 26.

- ^ Roman-taxes at unrv.com

- ^ Ward-Perkins, Bryan (2006-07-12). The Fall of Rome: And the End of Civilization. OUP Oxford. p. 43. ISBN 978-0-19-162236-6.

- ^ Temin, Peter. The Roman Market Economy. Core Textbook ed. Princeton University Press, 2012. Project MUSE muse.jhu.edu/book/36509.

- ^ Finley, M. I. (1999). The Ancient Economy: Updated with a new foreword by Ian Morris. Ian Morris. ISBN 978-0-520-21946-5.