Credit score in the United States

In the United States, a credit score is a number that is based on a statistical analysis of a person's credit report, and is used to represent the creditworthiness of that person—the likelihood that the person will pay his or her debts. A credit score is primarily based on credit report information, typically from the three major credit bureaus.

Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk posed by lending money to consumers and to mitigate losses due to bad debt. Using credit scores, lenders determine who qualifies for a loan, at what interest rate, and to what credit limits. The use of credit- or identity-scoring before authorizing access to or granting credit is an implementation of a trusted system. While the most widely known score in the United States is FICO (the most widely used in the mortgage industry), there are many others, such as NextGen, VantageScore, and the CE Score.

FICO score and others

This section needs to be divided into subsections. |

FICO is the acronym for Fair Isaac Corporation, a publicly-traded corporation (under the symbol "FIC") that created the best-known and most widely used credit score model in the United States. The FICO Score is calculated statistically, with information from a consumer's credit files. The FICO score is primarily used in credit decisions made by banks and other providers of secured and unsecured credit. Banks and other institutions using such scores as a factor in their lending decisions may deny credit, charge higher interest rates, demand more collateral, or require extensive income and asset verification if the applicant's FICO credit score is low.

FICO scores are intended to show the likelihood that a borrower will default on a loan; a separate score, the BNI, is used to determine the likelihood of a borrower's declaring bankruptcy.

Although the Fair Isaac Corporation's web site offers to sell borrowers their FICO Score, that company uses different scoring methods to rate a borrower's suitability for three types of credit—mortgages, automobile loans, and consumer credit— reflecting the loan default risks inherent to these different types of money lending. It is not unusual for these scores to differ—by 50 points or more—for the same borrower (the score offered to borrowers is their consumer credit score).

In the U.S., three credit reporting agencies (incorrectly called credit bureaus), Equifax, Experian, and TransUnion, calculate a borrower's credit score using their own different computation formulae. The scores they generate (with trademarked names), differ in what they mean to predict, the statistical methods used to determine a credit-worthiness score, and what data are used and how they are weighted. For example: Beacon, Beacon 5.0, Beacon 96, and Pinnacle scores are available only from Equifax; Empirica, Empirica Auto 95, Precision Score, and Precision 03 from TransUnion; and the Fair Isaac Risk Score is available from Experian. Although the Fair Isaac Corporation develops these credit score versions for the different agencies, they are different numbers, and are periodically updated to reflect current consumer loan repayment rates.

NextGen score

The NextGen Score is a scoring model designed for consumers; other credit consumer scores are published by MyFICO.com and by Community Empower, as the CE Score.

VantageScore

In 2006, in attempting to make scoring consistent, the three major credit-reporting agencies introduced VantageScore. VantageScore uses a number range (501 to 990), which is different from FICO's, and assigns letter grades (A to F) to specific score ranges. A borrower's VantageScore may differ from agency to agency, but discrepancies stem from data differences in the reported credit information, not because of differences among credit-scoring mathematical models. Since FICO remains as the widely-used score by money lenders, the agencies continue offering FICO scores (or the closest equivalents).

Score facts

Most scores use a multiple-scorecard design. Each version may use individual scorecards. Typically, a given borrower is compared with other consumers, (e.g. a borrower with two 30-day late payments will be scored against a similar delinquent-payer population). The borrower then is graded according to the repayment risk-determining mathematical variables in order to place him-her within that group of like borrowers. Most large banks build and use their own proprietary statistical credit-scoring models, often in conjunction with outside scoring formulae.

The statistical models for generating credit scores are subject to federal regulation. The Federal Reserve Board's Regulation B (implementing the Equal Credit Opportunity Act), expressly prohibits a credit-scoring model considering "prohibited bases" such as race, skin color, religion, national origin, sex, and marital status. It also states that credit-scoring models must be empirical and statistically sound. Furthermore, if negative action results from a credit score (i.e. a denied application for credit), the lender must state to the borrower the specific reasons for the denial. A statement that the person "failed to score high enough" is insufficient; the reasons must be specific (e.g. "too many delinquencies of 60 days or greater").

There are several, generally-accepted algorithms for extrapolating the primary factors generating a low credit score. Typically, one or more of these algorithms is used to list reasons for when a loan applicant is denied credit, in satisfaction of the Regulation B requirement that specific reasons be given to the applicant.

For easy use, most scores are mathematically scaled so that they fall in the general range used by prominent scoring model competitors. Since the Fair Isaac Corp. provides the dominant scoring method, non-Fair Isaac method-generated scores often mimic FICO scores, (they often are derisively called "FAKO" scores).[1] Although not as widely used, these scores (e.g. TransUnion's "TransRisk", Experian's "ScoreX", and "PLUS" scores), are less expensive for borrowers to buy than is the FICO score. The business cost savings of buying and using non-FICO scores is financially tempting to some banks and credit card companies to use, as they need accurate risk assessment of millions of accounts.

The Fair Isaac Corp. offers scoring models for the U.S., Canada, and South Africa, and offers a Global FICO score for other countries.

Makeup of the credit score

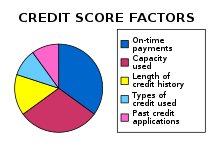

Credit scores are designed to measure the risk of default by taking into account various factors in a person's financial history. Although the exact formulas for calculating credit scores are closely guarded secrets, the Fair Isaac Corporation has disclosed the following components and the approximate weighted contribution of each:

- 35% — punctuality of payment in the past (only includes payments later than 30 days past due)[citation needed]

- 30% — the amount of debt, expressed as the ratio of current revolving debt (credit card balances, etc.) to total available revolving credit (credit limits)

- 15% — length of credit history

- 10% — types of credit used (installment, revolving, consumer finance)

- 10% — recent search for credit and/or amount of credit obtained recently

The above percentages provide very limited guidance in understanding a credit score. For example, the 10% of the score allocated to "types of credit used" is undefined, leaving consumers unaware what type of credit mix to pursue. "Length of credit history" is also a murky concept; it consists of multiple factors — two being the oldest account open and the average length of time an account has been open. Although only 35% is attributed to punctuality, if a consumer is substantially late on numerous accounts, his score will fall far more than 35%. Bankruptcies, foreclosures, and judgments affect scores substantially, but are not included in the somewhat simplistic pie chart provided by Fair Isaac.

Current income and employment history do not influence the FICO score, but they are weighed when applying for credit. For instance, an unemployed individual with no other sources of income will not usually be approved for a home mortgage, regardless of his or her FICO score.

There are other special factors which can weigh on the FICO score.

- Any monies owed because of a court judgment, tax lien, or similar carry an additional negative penalty, especially when recent.

- Having more than a certain number of consumer finance credit accounts also carries a negative weight (critics say that this causes a vicious cycle, locking people into continuing to use consumer finance companies).

- The number of recent credit checks also can weigh down the score, although credit agencies usually claim to allow for credit checks made within a certain window of time not to aggregate, so as to allow the consumer to shop around for rates.

For more information about factors that may influence your credit score read the credit rating section of the credit history page.

Range of scores

A FICO score is between 300 and 850, exhibiting a left-skewed distribution with 60% of scores between 650 and 799.[2] According to Fair Isaac the median score is 723 (half of scores above and below)[3] whereas according to Experian (using the Fair Isaac risk model) the average credit score is 678 (lowest scores are farther from the median than the highest scores).[4] The performance of the scores is monitored and the scores are periodically aligned so that a credit grantor normally does not need to be concerned about which score card was employed.

Each individual actually has three credit scores for any given scoring model because the three credit agencies have their own, independent databases. As these databases are independent of each other, they may contain entirely different data. Many lenders will check an applicant's score from each bureau and use the median score to determine the applicant's credit worthiness.[citation needed]

VantageScore ranges from 501 to 990 and offers letter grades as well: A (901-990), B (801-900), C (701-800), D (601-700), and F (501-600).

Free annual credit reports

As a result of the FACT Act (Fair and Accurate Credit Transactions Act), each legal U.S. resident is entitled to one free copy of his or her credit report from each credit reporting agency once every twelve months. This information is available at the only government-sanctioned credit reporting agency-operated website, annualcreditreport.com, by calling 1-877-322-8228, or by mailing the Annual Credit Report Request Form. To guard against inaccurate information or fraud more often than yearly, one can request a report from a different credit reporting agency each four months. However, the free report does not contain a credit score, though a credit score may be purchased at the time of access. Requesting a credit report will subject you to "pre-screened" offers of credit cards. To prevent all three credit bureaus from making your address available to credit card companies for this purpose, you may opt out by calling 1-888-5-OPT-OUT (1-888-567-8688).

Equifax and Fair Isaac teamed up to provide consumers with their FICO credit scores. The other two credit bureaus, TransUnion and Experian, also sell their scores to consumers. Experian calls its credit score product PLUS Score. The PLUS Score ranges from 330 to 830.

Non-traditional uses of credit scores

In September 2004, TXU (a Texas utility company) announced it would begin setting individualized electricity prices based on credit score. However, due to negative press and pressure from the Texas Public Utility Commission, the plan was not implemented.[1]

Credit scores are often used in determining prices for auto and homeowner insurance. Recently, some of the agencies that generate credit scores have also been generating more specialized insurance scores, which insurance companies then use to rate the quality of potential customers. These scores are unavailable to consumers.

Many employers require job applicants to give permission for them to run a credit check as part of the application process. This credit information can be used as a signal of a person's level of responsibility. Note that job applicants have certain rights under the Fair Credit Reporting Act and are not required to consent to credit check.[citation needed]

References

See also

- Fair Credit Reporting Act (FCRA)

- Credit reference

- Credit score, international article

- Credit Scorecards

- Adverse Credit History

- Credit rating agency

- Identity theft

- Seasoned trade lines, sometimes used to artificially increase FICO scores

- FICA, a similar-sounding acronym in the world of personal finance that people sometimes confuse with FICO