Paycheck: Difference between revisions

MrNonchalant (talk | contribs) |

MrNonchalant (talk | contribs) |

||

| Line 13: | Line 13: | ||

==Payroll Card== |

==Payroll Card== |

||

{{Context|date=October 2009}} |

|||

For employees that do not have access to a bank account (because, for example, they have a history of passing bad cheques, or do not live near a bank), there is a solution, offered by most major [[Payroll service bureau|payroll service providers]]. Instead of an employee receiving a cheque, and paying to cash the cheque, the employee can have his pay loaded onto a debit card. In this, a company can save money on printing cheques, and not have to worry about cheque fraud, due to a cheque being lost or stolen. |

For employees that do not have access to a bank account (because, for example, they have a history of passing bad cheques, or do not live near a bank), there is a solution, offered by most major [[Payroll service bureau|payroll service providers]]. Instead of an employee receiving a cheque, and paying to cash the cheque, the employee can have his pay loaded onto a debit card. In this, a company can save money on printing cheques, and not have to worry about cheque fraud, due to a cheque being lost or stolen. |

||

Revision as of 18:35, 4 May 2011

You must add a |reason= parameter to this Cleanup template – replace it with {{Cleanup|reason=<Fill reason here>}}, or remove the Cleanup template.

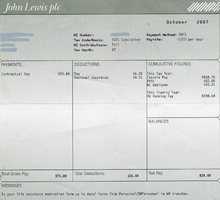

A paycheck is traditionally a paper document (a cheque) issued by an employer to pay an employee for services rendered. In recent times, the physical paycheck has been increasingly replaced by electronic direct deposit to bank accounts. Such employees may still receive a complete pay slip package, but any attached cheque is marked as non-negotiable and cannot be cashed.

A pay stub, paystub, payslip, pay advice, or sometimes paycheck stub, is a document an employee receives either as a notice that the direct deposit transaction has gone through, or as part of their paycheck. It will typically detail the gross income and all taxes and any other deductions such as retirement plan or pension contributions, insurances, garnishments, or charitable contributions taken out of the gross amount to arrive at the final net amount of the pay, also including the year to date totals in some circumstances. Pay slips are labor analogs of remittance advice letters (which are used for invoices) – they state "you have been paid X amount (paycheck) for Y services (hours worked)".

Electronic Paychecks

In most countries with a developed wire transfer system, using a physical cheque for paying wages and salaries has been less common for the past several decades. However, vocabulary referring to the figurative "pay cheque" persists in some languages, like German (Gehaltsscheck), but this commonly refers to a payslip or stub rather than an actual cheque. Some company payrolls have eliminated both the paper cheque and stub, in which case an electronic image of the stub is available on a website. Most of the provinces and territories in Canada allow employers to issue electronic payslips, if the employees have confidential access to it and are able to print it.

Payroll Card

For employees that do not have access to a bank account (because, for example, they have a history of passing bad cheques, or do not live near a bank), there is a solution, offered by most major payroll service providers. Instead of an employee receiving a cheque, and paying to cash the cheque, the employee can have his pay loaded onto a debit card. In this, a company can save money on printing cheques, and not have to worry about cheque fraud, due to a cheque being lost or stolen.

A payroll card is a plastic card allowing an employee to access their pay by using a debit card. A payroll card can be more convenient than using a cheque cashier, because it can be used at participating automatic teller machines to withdraw cash, or in stores to make purchases. Some payroll cards are cheaper than payday loans available from cheque cashing stores, but others are not. Most payroll cards will charge a fee if used at an ATM more than once per pay period.

The payroll card account may be held as a single account in the employer's name. In that case, the account holds the payroll funds for all employees using the payroll card system. Some payroll card programs establish a separate account for each employee, but others do not.

Many payroll cards are individually owned demand deposit accounts (DDAs) that are owned by the employee. These cards are more flexible, allowing the employee to use the card for paying bills, and the accounts are portable. Most payroll card accounts in the United States are FDIC-insured, but some are not.

Warrants

Payroll warrants look like checks and clear through the banking system like cheques, but are not drawn against cleared funds in a deposit account. Instead they are drawn against "available funds" that are not in a bank account, so the issuer can collect interest on the float and delay redemption. In the US, warrants are issued by government entities such as the military and state and county governments. Warrants are issued for payroll to individuals and for accounts payable to vendors. Technically a warrant is not payable on demand and may not be negotiable.[1] Deposited warrants are routed to a collecting bank which processes them as collection items like maturing treasury bills and presents the warrants to the government entity's Treasury Department for payment each business day.

In the UK, warrants are issued as payment by the NS&I when a Premium Bond is chosen.