Cheque truncation

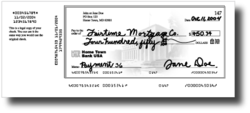

Cheque truncation (check truncation in American English) is a cheque clearance system that involves the digitalisation of a physical paper cheque into a substitute electronic form for transmission to the paying bank. The process of cheque clearance, involving data matching and verification, is done using digital images instead of paper copies.

Cheque truncation reduces or eliminates the physical movement of paper cheques and reduces the time and cost of cheque clearance. Cheque truncation also offers the potential reduction in settlement periods with the electronic processing of the cheque payment system.

History

For cheque clearance, a cheque has to be presented to the drawee bank for payment. Originally this was done by taking the cheque to the drawee bank, but as cheque usage increased this became cumbersome and banks arranged to meet each day at a central location to exchange cheques and receive payment in money. This became known as central clearing. Bank customers who received cheques could deposit them at their own bank, who would arrange for the cheque to be forwarded to the drawee bank and the money credited to and debited from the appropriate accounts. If a cheque was dishonoured it would be physically returned to the original bank marked as such.

This process would take several days, as the cheques had to be transported to the central clearing location, from where they were taken to the payee bank. If the cheque was dishonoured, it would be sent back to the bank where the cheque was deposited. This is known as the clearing cycle.

Cheques had to be examined by hand at each stage, which required a large amount of manpower.

In the 1960s, machine readable codes were added to the bottom of cheques in MICR format, which speeded up the clearing and sorting process. However, the law in most countries still required cheques to be delivered to the payee bank, and so physical movement of the paper continued.

Starting in the mid-1990s, some countries started to change their laws to allow "truncation": cheques would be imaged and a digital representation of the cheque would be transmitted to the drawee bank, and the original cheques destroyed. The MICR codes and cheque details are normally encoded as text in addition to the image.[citation needed] The bank where the cheque was deposited would typically do the truncation and this dramatically decreased the time it took to clear a cheque. In some cases, large retailers that received large volumes of cheques would do the truncation.

Once the cheque has been turned into a digital document, it can be processed through the banking system just like any other electronic payment.

Laws

Although technology needed to exist to enable cheque truncation, the laws related to cheques were the main impediment to its introduction. New Zealand was one of the first countries to introduce truncation and imaging of cheques, when in 1995 the Cheques Act 1960 was amended to provide for the electronic presentation of cheques. A number of other countries also adopted the system over the next few years, but progress was mixed due to the decline in the use of cheques generally in favour of electronic payment systems. Some countries decided that the effort to implement truncation could not be justified for a declining payment method, and instead phased out the use of cheques altogether.[1]

In 2004, the United States enacted the Check 21 Act to authorize cheque truncation by the conversion of an original paper check into an electronic image for presentation through the clearing process. The law also enacted the recognition and acceptance of a “substitute check" created by a financial institution in lieu of the original paper check. Any bank that receives the original paper check can remove or "truncate" the paper check from the clearing process.

New laws needed to address ways to make sure that the digital image was a true and accurate copy of the original cheque, as well as a mechanism to enable the process to be audited to protect consumers. It also needed to address the process for dishonoured cheques, as paper cheques could no longer be returned. A typical solution, as defined by the Monetary Authority of Singapore for the Singapore cheque truncation system, was that a special 'Image Return Document' was created and sent back to the bank that had truncated the cheque.[2]

Operations and clearing

Security related to imaging and creating an electronic cheque is defined and the cheque clearing process adjusted to accommodate electronic cheques. Banks and financial institutions use cheque truncation systems (CTS) as part of this process. These systems deal with two main processes, outward clearing and inward clearing:

- outward clearing takes place at the branch level, where deposited cheques are scanned and an operator performs amount entry, account entry, verification, balancing and bundling. The cheques are then sent to a service branch.

- inward clearing takes place in the service branch, where cheques received from branches are processed and an operator performs amount entry, account entry, verification, balancing and bundling of the cheques. Once verification is complete, the cheques are sent to the clearing house.

Those cheques that failed validation due to discrepancies are sent back to the originating branch to be corrected.

Truncation software

Some banks have modified their bank systems or built proprietary system to handle truncation. There are also a number of software companies that provide commercial solutions and services, including:

| Provider | Package |

|---|---|

| VSoft | OnView Cheque Truncation System[3] |

| IBM | Financial Transaction Manager for Check Services |

| BankServ | DepositNow |

| C&A Associates | ImageChex32 |

| CSC | Checkvision |

| Dess Technologies | DessCTS |

| Image InfoSystems | ExpressClear |

| Data Support Systems | Sierra T.R.I.P.S |

| Fiserv | Director Check Imaging |

| IndiaPaya | iCheq and mCheq |

| Infosys | - |

| Jack Henry & Associates | Alogent Solutions[4] |

| Open Solutions | OpenCheck (IsCheck) |

| Polaris Financial Technology | Intellect Business Process Studio |

| ProgressSoft Corporation | PS-ECC Electronic Check Clearing [5] |

| Sybrin | Cheque Solution[6] |

| Tata Consultancy Services | - |

| WAUSAU Financial Systems | Optima3 |

| Zylog Systems Limited | CTS |

National systems

See also

References

- ^ "CHEQUE TRUNCATION ABRIDGED REPORT - 2008" (PDF). Irish Payment Services Organisation. 2008. Archived from the original (PDF) on 12 January 2011. Retrieved 1 August 2010.

- ^ "Bills of Exchange (Cheque Truncation) Regulations 2002". Monetary Authority of Singapore. September 17, 2002. Archived from the original on November 22, 2009. Retrieved August 1, 2010.

- ^ "VSoft". www.vsoftcorp.com. vsoft. Archived from the original on August 29, 2018. Retrieved March 9, 2016.

- ^ "Alogent Commercial Remote Deposit". Jack Henry & Associates. Archived from the original on 2013-06-30. Retrieved April 19, 2013.

- ^ "ProgressSoft Electronic Check Clearing". ProgressSoft. Retrieved February 11, 2016.

- ^ "Sybrin Cheque Solution". www.sybrin.com. Sybrin. Archived from the original on March 9, 2016. Retrieved March 9, 2016.