Price elasticity of demand

Price elasticity of demand (Epd), or elasticity, is the degree to which the effective desire for something changes as its price changes. In general, people desire things less as those things become more expensive. However, for some products, the customer's desire could drop sharply even with a little price increase, and for other products, it could stay almost the same even with a big price increase. Economists use the term elasticity to denote this sensitivity to price increases. More precisely, price elasticity gives the percentage change in quantity demanded when there is a one percent increase in price, holding everything else constant.

Price elasticities are almost always negative, although analysts tend to ignore the sign even though this can lead to ambiguity. Only goods which do not conform to the law of demand, such as Veblen and Giffen goods, have a positive elasticity. In general, the demand for a good is said to be inelastic (or relatively inelastic) when the elasticity is less than one (in absolute value): that is, changes in price have a relatively small effect on the quantity of the good demanded. The demand for a good is said to be elastic (or relatively elastic) when its elasticity is greater than one.

Revenue is maximised when price is set so that the elasticity is exactly one. The good's elasticity can also be used to predict the incidence (or "burden") of a tax on that good. Various research methods are used to determine price elasticity, including test markets, analysis of historical sales data and conjoint analysis. Price elasticity of demand further divided into: Perfectly Elastic Demand (∞), Perfectly Inelastic Demand ( 0 ), Relatively Elastic Demand (> 1), Relatively Inelastic Demand (< 1), Unitary Elasticity Demand (= 1).

Definition

The variation in demand in response to a variation in price is called price elasticity of demand. It may also be defined as the ratio of the percentage change in demand to the percentage change in price of particular commodity.[1] The formula for the coefficient of price elasticity of demand for a good is:[2][3][4]

where P is the price of the demanded good and Q is the quantity of the demanded good. In other words we can say that the price elasticity of demand is the change in demand for a commodity due to a given change in the price of that commodity.

The above formula usually yields a negative value, due to the inverse nature of the relationship between price and quantity demanded, as described by the "law of demand".[3] For example, if the price increases by 5% and quantity demanded decreases by 5%, then the elasticity at the initial price and quantity = −5%/5% = −1. The only classes of goods which have elasticity greater than 0 are Veblen and Giffen goods.[5] Although the elasticity is negative for the vast majority of goods and services, economists often refer to price elasticity of demand as a positive value (i.e., in absolute value terms).[4]

This measure of elasticity is sometimes referred to as the own-price elasticity of demand for a good, i.e., the elasticity of demand with respect to the good's own price, in order to distinguish it from the elasticity of demand for that good with respect to the change in the price of some other good, i.e., a complementary or substitute good.[1] The latter type of elasticity measure is called a cross-price elasticity of demand.[6][7]

As the difference between the two prices or quantities increases, the accuracy of the PED given by the formula above decreases for a combination of two reasons. First, a good's elasticity is not necessarily constant; as explained below,it varies at different points along the demand curve, due to its percentage nature.[8][9] Elasticity is not the same thing as the slope of the demand curve, which is dependent on the units used for both price and quantity.[10][11] Second, percentage changes are not symmetric; instead, the percentage change between any two values depends on which one is chosen as the starting value and which as the ending value. For example, if quantity demanded increases from 10 units to 15 units, the percentage change is 50%, i.e., (15 − 10) ÷ 10 (converted to a percentage). But if quantity demanded decreases from 15 units to 10 units, the percentage change is −33.3%, i.e., (10 − 15) ÷ 15.[12][13]

Two alternative elasticity measures avoid or minimise these shortcomings of the basic elasticity formula: point-price elasticity and arc elasticity.

Contrary to common misconception, price elasticity is not constant, but rather varies along the curve.[14]

Point-price elasticity of demand

The point elasticity of demand method is used to determine change in demand within the same demand curve, basically a very small amount of change in demand is measured through point elasticity. One way to avoid the accuracy problem described above is to minimize the difference between the starting and ending prices and quantities. This is the approach taken in the definition of point-price elasticity, which uses differential calculus to calculate the elasticity for an infinitesimal change in price and quantity at any given point on the demand curve:[15]

In other words, it is equal to the absolute value of the first derivative of quantity with respect to price multiplied by the point's price (P) divided by its quantity (Qd).[16] However, the point-price elasticity can be computed only if the formula for the demand function, , is known so its derivative with respect to price, , can be determined.

In terms of partial-differential calculus, point-price elasticity of demand can be defined as follows:[17] let be the demand of goods as a function of parameters price and wealth, and let be the demand for good . The elasticity of demand for good with respect to price is

Arc elasticity

Arc elasticity was introduced very early on by Hugh Dalton. It is very similar to an ordinary elasticity problem, but it adds in the index number problem. Arc Elasticity is a second solution to the asymmetry problem of having an elasticity dependent on which of the two given points on a demand curve is chosen as the "original" point will and which as the "new" one is to compute the percentage change in P and Q relative to the average of the two prices and the average of the two quantities, rather than just the change relative to one point or the other. Loosely speaking, this gives an "average" elasticity for the section of the actual demand curve—i.e., the arc of the curve—between the two points. As a result, this measure is known as the arc elasticity, in this case with respect to the price of the good. The arc elasticity is defined mathematically as:[13][18][19]

This method for computing the price elasticity is also known as the "midpoints formula", because the average price and average quantity are the coordinates of the midpoint of the straight line between the two given points.[12][19] This formula is an application of the midpoint method. However, because this formula implicitly assumes the section of the demand curve between those points is linear, the greater the curvature of the actual demand curve is over that range, the worse this approximation of its elasticity will be.[18][20]

History

Together with the concept of an economic "elasticity" coefficient, Alfred Marshall is credited with defining "elasticity of demand" in Principles of Economics, published in 1890.[21] Alfred Marshall invented price elasticity of demand only four years after he had invented the concept of elasticity. He used Cournot's basic creating of the demand curve to get the equation for price elasticity of demand. He described price elasticity of demand as thus: "And we may say generally:— the elasticity (or responsiveness) of demand in a market is great or small according as the amount demanded increases much or little for a given fall in price, and diminishes much or little for a given rise in price".[22] He reasons this since "the only universal law as to a person's desire for a commodity is that it diminishes ... but this diminution may be slow or rapid. If it is slow... a small fall in price will cause a comparatively large increase in his purchases. But if it is rapid, a small fall in price will cause only a very small increase in his purchases. In the former case... the elasticity of his wants, we may say, is great. In the latter case... the elasticity of his demand is small."[23] Mathematically, the Marshallian PED was based on a point-price definition, using differential calculus to calculate elasticities.[24]

Determinants:- The overriding factor in determining the elasticity is the willingness and ability of consumers after a price change to postpone immediate consumption decisions concerning the good and to search for substitutes ("wait and look").[25] A number of factors can thus affect the elasticity of demand for a good:[26]

- Availability of substitute goods

- The more and closer the substitutes available, the higher the elasticity is likely to be, as people can easily switch from one good to another if an even minor price change is made;[26][27][28] There is a strong substitution effect.[29] If no close substitutes are available, the substitution effect will be small and the demand inelastic.[29]

- Breadth of definition of a good

- The broader the definition of a good (or service), the lower the elasticity. For example, Company X's fish and chips would tend to have a relatively high elasticity of demand if a significant number of substitutes are available, whereas food in general would have an extremely low elasticity of demand because no substitutes exist.[30]

- Percentage of income

- The higher the percentage of the consumer's income that the product's price represents, the higher the elasticity tends to be, as people will pay more attention when purchasing the good because of its cost;[26][27] The income effect is substantial.[31] When the goods represent only a negligible portion of the budget the income effect will be insignificant and demand inelastic,[31]

- Necessity

- The more necessary a good is, the lower the elasticity, as people will attempt to buy it no matter the price, such as the case of insulin for those who need it.[10][27]

- Duration

- For most goods, the longer a price change holds, the higher the elasticity is likely to be, as more and more consumers find they have the time and inclination to search for substitutes.[26][28] When fuel prices increase suddenly, for instance, consumers may still fill up their empty tanks in the short run, but when prices remain high over several years, more consumers will reduce their demand for fuel by switching to carpooling or public transportation, investing in vehicles with greater fuel economy or taking other measures.[27] This does not hold for consumer durables such as the cars themselves, however; eventually, it may become necessary for consumers to replace their present cars, so one would expect demand to be less elastic.[27]

- Brand loyalty

- An attachment to a certain brand—either out of tradition or because of proprietary barriers—can override sensitivity to price changes, resulting in more inelastic demand.[30][32]

- Who pays

- Where the purchaser does not directly pay for the good they consume, such as with corporate expense accounts, demand is likely to be more inelastic.[32]

Whether it is addictive or not

Goods that are more addictive in nature tend to have an inelastic PED (absolute value of PED < 1). Examples of such include cigarettes, heroin and alcohol. This is because consumers view such goods as necessities and hence are forced to purchase them, despite even significant price changes.

Relation to marginal revenue

The following equation holds:

where

- R′ is the marginal revenue

- P is the price

Proof:

- TR = R = total revenue

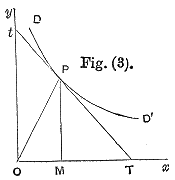

On a graph with both a demand curve and a marginal revenue curve, demand will be elastic at all quantities where marginal revenue is positive. Demand is unit elastic at the quantity where marginal revenue is zero. Demand is inelastic at every quantity where marginal revenue is negative.[33]

Effect on entire revenue

A firm considering a price change must know what effect the change in price will have on total revenue. Revenue is simply the product of unit price times quantity:

Generally any change in price will have two effects:[34]

- The price effect

- For inelastic goods, an increase in unit price will tend to increase revenue, while a decrease in price will tend to decrease revenue. (The effect is reversed for elastic goods.)

- The quantity effect

- An increase in unit price will tend to lead to fewer units sold, while a decrease in unit price will tend to lead to more units sold.

For inelastic goods, because of the inverse nature of the relationship between price and quantity demanded (i.e., the law of demand), the two effects affect total revenue in opposite directions. But in determining whether to increase or decrease prices, a firm needs to know what the net effect will be. Elasticity provides the answer: The percentage change in total revenue is approximately equal to the percentage change in quantity demanded plus the percentage change in price. (One change will be positive, the other negative.)[35] The percentage change in quantity is related to the percentage change in price by elasticity: hence the percentage change in revenue can be calculated by knowing the elasticity and the percentage change in price alone.

As a result, the relationship between elasticity and revenue can be described for any good:[36][37]

- When the price elasticity of demand for a good is perfectly inelastic (Ed = 0), changes in the price do not affect the quantity demanded for the good; raising prices will always cause total revenue to increase. Goods necessary to survival can be classified here; a rational person will be willing to pay anything for a good if the alternative is death. For example, a person in the desert weak and dying of thirst would easily give all the money in his wallet, no matter how much, for a bottle of water if he would otherwise die. His demand is not contingent on the price.

- When the price elasticity of demand is relatively inelastic (−1 < Ed < 0), the percentage change in quantity demanded is smaller than that in price. Hence, when the price is raised, the total revenue increases, and vice versa.

- When the price elasticity of demand is unit (or unitary) elastic (Ed = −1), the percentage change in quantity demanded is equal to that in price, so a change in price will not affect total revenue.

- When the price elasticity of demand is relatively elastic (−∞ < Ed < −1), the percentage change in quantity demanded is greater than that in price. Hence, when the price is raised, the total revenue falls, and vice versa.

- When the price elasticity of demand is perfectly elastic (Ed is − ∞), any increase in the price, no matter how small, will cause the quantity demanded for the good to drop to zero. Hence, when the price is raised, the total revenue falls to zero. This situation is typical for goods that have their value defined by law (such as fiat currency); if a five-dollar bill were sold for anything more than five dollars, nobody would buy it, so demand is zero.

Hence, as the accompanying diagram shows, total revenue is maximized at the combination of price and quantity demanded where the elasticity of demand is unitary.[37]

It is important to realize that price-elasticity of demand is not necessarily constant over all price ranges. The linear demand curve in the accompanying diagram illustrates that changes in price also change the elasticity: the price elasticity is different at every point on the curve.

Effect on tax incidence

Demand elasticity, in combination with the price elasticity of supply can be used to assess where the incidence (or "burden") of a per-unit tax is falling or to predict where it will fall if the tax is imposed. For example, when demand is perfectly inelastic, by definition consumers have no alternative to purchasing the good or service if the price increases, so the quantity demanded would remain constant. Hence, suppliers can increase the price by the full amount of the tax, and the consumer would end up paying the entirety. In the opposite case, when demand is perfectly elastic, by definition consumers have an infinite ability to switch to alternatives if the price increases, so they would stop buying the good or service in question completely—quantity demanded would fall to zero. As a result, firms cannot pass on any part of the tax by raising prices, so they would be forced to pay all of it themselves.[38]

In practice, demand is likely to be only relatively elastic or relatively inelastic, that is, somewhere between the extreme cases of perfect elasticity or inelasticity. More generally, then, the higher the elasticity of demand compared to PES, the heavier the burden on producers; conversely, the more inelastic the demand compared to supply, the heavier the burden on consumers. The general principle is that the party (i.e., consumers or producers) that has fewer opportunities to avoid the tax by switching to alternatives will bear the greater proportion of the tax burden.[38] In the end the whole tax burden is carried by individual households since they are the ultimate owners of the means of production that the firm utilises (see Circular flow of income).

PED and PES can also have an effect on the deadweight loss associated with a tax regime. When PED, PES or both are inelastic, the deadweight loss is lower than a comparable scenario with higher elasticity.

Optimal pricing

Among the most common applications of price elasticity is to determine prices that maximize revenue or profit.

Constant elasticity and optimal pricing

If one point elasticity is used to model demand changes over a finite range of prices, elasticity is implicitly assumed constant with respect to price over the finite price range. The equation defining price elasticity for one product can be rewritten (omitting secondary variables) as a linear equation.

where

- is the elasticity, and is a constant.

Similarly, the equations for cross elasticity for products can be written as a set of simultaneous linear equations.

where

- and , and are constants; and appearance of a letter index as both an upper index and a lower index in the same term implies summation over that index.

This form of the equations shows that point elasticities assumed constant over a price range cannot determine what prices generate maximum values of ; similarly they cannot predict prices that generate maximum or maximum revenue.

Constant elasticities can predict optimal pricing only by computing point elasticities at several points, to determine the price at which point elasticity equals -1 (or, for multiple products, the set of prices at which the point elasticity matrix is the negative identity matrix).

Non-constant elasticity and optimal pricing

If the definition of price elasticity is extended to yield a quadratic relationship between demand units () and price, then it is possible to compute prices that maximize , , and revenue. The fundamental equation for one product becomes

and the corresponding equation for several products becomes

Excel models are available that compute constant elasticity, and use non-constant elasticity to estimate prices that optimize revenue or profit for one product[39] or several products.[40]

Limitations of revenue-maximizing and profit-maximizing pricing strategies

In most situations, revenue-maximizing prices are not profit-maximizing prices. For example, if variable costs per unit are nonzero (which they almost always are), then a more complex computation of a similar kind yields prices that generate optimal profits.

In some situations, profit-maximizing prices are not an optimal strategy. For example, where scale economies are large (as they often are), capturing market share may be the key to long-term dominance of a market, so maximizing revenue or profit may not be the optimal strategy.

Selected price elasticities

Various research methods are used to calculate the price elasticities in real life, including analysis of historic sales data, both public and private, and use of present-day surveys of customers' preferences to build up test markets capable of modelling such changes. Alternatively, conjoint analysis (a ranking of users' preferences which can then be statistically analysed) may be used.[41] Approximate estimates of price elasticity can be calculated from the income elasticity of demand, under conditions of preference independence. This approach has been empirically validated using bundles of goods (e.g. food, healthcare, education, recreation, etc.).[42]

Though elasticities for most demand schedules vary depending on price, they can be modeled assuming constant elasticity.[43] Using this method, the elasticities for various goods—intended to act as examples of the theory described above—are as follows. For suggestions on why these goods and services may have the elasticity shown, see the above section on determinants of price elasticity.

|

|

See also

- Arc elasticity

- Cross elasticity of demand

- Income elasticity of demand

- Price elasticity of supply

- Supply and demand

Notes

- ^ a b Png, Ivan (1989). p.57.

- ^ Parkin; Powell; Matthews (2002). pp.74-5.

- ^ a b Gillespie, Andrew (2007). p. 43.

- ^ a b Gwartney, Yaw Bugyei-Kyei.James D.; Stroup, Richard L.; Sobel, Russell S. (2008). p. 425.

- ^ Gillespie, Andrew (2007). p.57.

- ^ Ruffin; Gregory (1988). p.524.

- ^ Ferguson, C.E. (1972). p.106.

- ^ Ruffin; Gregory (1988). p.520

- ^ McConnell; Brue (1990). p.436.

- ^ a b Parkin; Powell; Matthews (2002). p.75.

- ^ McConnell; Brue (1990). p.437

- ^ a b Ruffin; Gregory (1988). pp.518-519.

- ^ a b Ferguson, C.E. (1972). pp.100-101.

- ^ Economics, Tenth edition, John Sloman

- ^ Sloman, John (2006). p.55.

- ^ Wessels, Walter J. (2000). p. 296.

- ^ Mas-Colell; Winston; Green (1995).

- ^ a b Wall, Stuart; Griffiths, Alan (2008). pp.53-54.

- ^ a b McConnell;Brue (1990). pp.434-435.

- ^ Ferguson, C.E. (1972). p.101n.

- ^ Taylor, John (2006). p.93.

- ^ Marshall, Alfred (1890). III.IV.2.

- ^ Marshall, Alfred (1890). III.IV.1.

- ^ Schumpeter, Joseph Alois; Schumpeter, Elizabeth Boody (1994). p. 959.

- ^ Negbennebor (2001).

- ^ a b c d Parkin; Powell; Matthews (2002). pp.77-9.

- ^ a b c d e Walbert, Mark. "Tutorial 4a". Retrieved 27 February 2010.

- ^ a b Goodwin, Nelson, Ackerman, & Weisskopf (2009).

- ^ a b Frank (2008) 118.

- ^ a b Gillespie, Andrew (2007). p.48.

- ^ a b Frank (2008) 119.

- ^ a b Png, Ivan (1999). p.62-3.

- ^ Reed, Jacob (2016-05-26). "AP Microeconomics Review: Elasticity Coefficients". APEconReview.com. Retrieved 2016-05-27.

- ^ Krugman, Wells (2009). p. 151.

- ^ Goodwin, Nelson, Ackerman & Weisskopf (2009). p. 122.

- ^ Gillespie, Andrew (2002). p. 51.

- ^ a b Arnold, Roger (2008). p. 385.

- ^ a b Wall, Stuart; Griffiths, Alan (2008). pp.57-58.

- ^ "Pricing Tests and Price Elasticity for one product". Archived from the original on 2012-11-13. Retrieved 2013-03-03.

- ^ "Pricing Tests and Price Elasticity for several products". Archived from the original on 2012-11-13. Retrieved 2013-03-03.

- ^ Png, Ivan (1999). pp.79-80.

- ^ Sabatelli, Lorenzo (2016-03-21). "Relationship between the Uncompensated Price Elasticity and the Income Elasticity of Demand under Conditions of Additive Preferences". PLOS ONE. 11 (3): e0151390. arXiv:1602.08644. Bibcode:2016PLoSO..1151390S. doi:10.1371/journal.pone.0151390. ISSN 1932-6203. PMC 4801373. PMID 26999511.

{{cite journal}}: CS1 maint: unflagged free DOI (link) - ^ "Constant Elasticity Demand and Supply Curves (Q=A*P^c)". Archived from the original on 13 January 2011. Retrieved 26 April 2010.

- ^ Perloff, J. (2008). p.97.

- ^ Chaloupka, Frank J.; Grossman, Michael; Saffer, Henry (2002); Hogarty and Elzinga (1972) cited by Douglas (1993).

- ^ Pindyck; Rubinfeld (2001). p.381.; Steven Morrison in Duetsch (1993), p. 231.

- ^ Richard T. Rogers in Duetsch (1993), p.6.

- ^ Havranek, Tomas; Irsova, Zuzana; Janda, Karel (2012). "Demand for gasoline is more price-inelastic than commonly thought" (PDF). Energy Economics. 34: 201–207. doi:10.1016/j.eneco.2011.09.003.

- ^ Algunaibet, Ibrahim; Matar, Walid (2018). "The responsiveness of fuel demand to gasoline price change in passenger transport: a case study of Saudi Arabia". Energy Efficiency. 11 (6): 1341–1358. doi:10.1007/s12053-018-9628-6.

- ^ Rich, J.; Holmblad, M.; Hansen, C.O. (2009). "A weighted Logit Freight Mode Choice Model". Transportation Research Part E. 45 (6): 1006–1019. doi:10.1016/j.tre.2009.02.001.

- ^ Rich, J.; Kveiborg, O.; Hansen, C.O. (2009). "On structural inelasticity of modal substitution in freight transport". Journal of Transport Geography. 19 (1): 134–146. doi:10.1016/j.jtrangeo.2009.09.012.

- ^ a b c Samuelson; Nordhaus (2001).

- ^ Goldman and Grossman (1978) cited in Feldstein (1999), p.99

- ^ de Rassenfosse and van Pottelsberghe (2007, p.598; 2012, p.72)

- ^ Perloff, J. (2008).

- ^ Heilbrun and Gray (1993, p.94) cited in Vogel (2001)

- ^ Goodwin; Nelson; Ackerman; Weissskopf (2009). p.124.

- ^ Lehner, S.; Peer, S. (2019), The price elasticity of parking: A meta-analysis, Transportation Research Part A: Policy and Practice, Volume 121, March 2019, Pages 177-191" web|url=https://doi.org/10.1016/j.tra.2019.01.014

- ^ Davis, A.; Nichols, M. (2013), The Price Elasticity of Marijuana Demand"

- ^ Brownell, Kelly D.; Farley, Thomas; Willett, Walter C. et al. (2009).

- ^ a b Ayers; Collinge (2003). p.120.

- ^ a b Barnett and Crandall in Duetsch (1993), p.147

- ^ "Valuing the Effect of Regulation on New Services in Telecommunications" (PDF). Jerry A. Hausman. Retrieved 29 September 2016.

- ^ "Price and Income Elasticity of Demand for Broadband Subscriptions: A Cross-Sectional Model of OECD Countries" (PDF). SPC Network. Retrieved 29 September 2016.

- ^ Krugman and Wells (2009) p.147.

- ^ "Profile of The Canadian Egg Industry". Agriculture and Agri-Food Canada. Archived from the original on 8 July 2011. Retrieved 9 September 2010.

- ^ Cleasby, R. C. G.; Ortmann, G. F. (1991). "Demand Analysis of Eggs in South Africa". Agrekon. 30 (1): 34–36. doi:10.1080/03031853.1991.9524200.

- ^ Havranek, Tomas; Irsova, Zuzana; Zeynalova, Olesia (2018). "Tuition Fees and University Enrolment: A Meta‐Regression Analysis". Oxford Bulletin of Economics and Statistics. 80 (6): 1145–1184. doi:10.1111/obes.12240.

References

- Arnold, Roger A. (17 December 2008). Economics. Cengage Learning. ISBN 978-0-324-59542-0. Retrieved 28 February 2010.

- Ayers; Collinge (2003). Microeconomics. Pearson. ISBN 978-0-536-53313-5.

- Brownell, Kelly D.; Farley, Thomas; Willett, Walter C.; Popkin, Barry M.; Chaloupka, Frank J.; Thompson, Joseph W.; Ludwig, David S. (15 October 2009). "The Public Health and Economic Benefits of Taxing Sugar-Sweetened Beverages". New England Journal of Medicine. 361 (16): 1599–1605. doi:10.1056/NEJMhpr0905723. PMC 3140416. PMID 19759377.

- Case, Karl; Fair, Ray (1999). Principles of Economics (5th ed.). Prentice-Hall. ISBN 978-0-13-961905-2.

- Chaloupka, Frank J.; Grossman, Michael; Saffer, Henry (2002). "The effects of price on alcohol consumption and alcohol-related problems". Alcohol Research and Health.

- de Rassenfosse, Gaetan; van Pottelsberghe, Bruno (2007). "Per un pugno di dollari: a first look at the price elasticity of patents". Oxford Review of Economic Policy. 23 (4): 588–604. doi:10.1093/oxrep/grm032. Working paper on RePEc

- de Rassenfosse, Gaetan; van Pottelsberghe, Bruno (2012). "On the price elasticity of demand for patents". Oxford Bulletin of Economics and Statistics. 74 (1): 58–77. doi:10.1111/j.1468-0084.2011.00638.x. Working paper on RePEc

- Duetsch, Larry L. (1993). Industry Studies. Englewood Cliffs, NJ: Prentice Hall. ISBN 978-0-585-01979-6.

- Feldstein, Paul J. (1999). Health Care Economics (5th ed.). Albany, NY: Delmar Publishers. ISBN 978-0-7668-0699-3.

- Ferguson, Charles E. (1972). Microeconomic Theory (3rd ed.). Homewood, Illinois: Richard D. Irwin. ISBN 978-0-256-02157-8.

- Frank, Robert (2008). Microeconomics and Behavior (7th ed.). McGraw-Hill. ISBN 978-0-07-126349-8.

- Gillespie, Andrew (1 March 2007). Foundations of Economics. Oxford University Press. ISBN 978-0-19-929637-8. Retrieved 28 February 2010.

- Goodwin; Nelson; Ackerman; Weisskopf (2009). Microeconomics in Context (2nd ed.). Sharpe. ISBN 978-0-618-34599-1.

- Gwartney, James D.; Stroup, Richard L.; Sobel, Russell S.; David MacPherson (14 January 2008). Economics: Private and Public Choice. Cengage Learning. ISBN 978-0-324-58018-1. Retrieved 28 February 2010.

- Krugman; Wells (2009). Microeconomics (2nd ed.). Worth. ISBN 978-0-7167-7159-3.

- Landers (February 2008). Estimates of the Price Elasticity of Demand for Casino Gaming and the Potential Effects of Casino Tax Hikes.

- Marshall, Alfred (1920). Principles of Economics. Library of Economics and Liberty. ISBN 978-0-256-01547-8. Retrieved 5 March 2010.

- Mas-Colell, Andreu; Winston, Michael D.; Green, Jerry R. (1995). Microeconomic Theory. New York: Oxford University Press. ISBN 978-1-4288-7151-9.

- McConnell, Campbell R.; Brue, Stanley L. (1990). Economics: Principles, Problems, and Policies (11th ed.). New York: McGraw-Hill. ISBN 978-0-07-044967-1.

- Negbennebor (2001). "The Freedom to Choose". Microeconomics. ISBN 978-1-56226-485-7.

- Parkin, Michael; Powell, Melanie; Matthews, Kent (2002). Economics. Harlow: Addison-Wesley. ISBN 978-0-273-65813-9.

- Perloff, J. (2008). Microeconomic Theory & Applications with Calculus. Pearson. ISBN 978-0-321-27794-7.

- Pindyck; Rubinfeld (2001). Microeconomics (5th ed.). Prentice-Hall. ISBN 978-1-4058-9340-4.

- Png, Ivan (1999). Managerial Economics. Blackwell. ISBN 978-0-631-22516-4. Retrieved 28 February 2010.

- Ruffin, Roy J.; Gregory, Paul R. (1988). Principles of Economics (3rd ed.). Glenview, Illinois: Scott, Foresman. ISBN 978-0-673-18871-7.

- Samuelson; Nordhaus (2001). Microeconomics (17th ed.). McGraw-Hill. ISBN 978-0-07-057953-8.

- Schumpeter, Joseph Alois; Schumpeter, Elizabeth Boody (1994). History of economic analysis (12th ed.). Routledge. ISBN 978-0-415-10888-1. Retrieved 5 March 2010.

- Sloman, John (2006). Economics. Financial Times Prentice Hall. ISBN 978-0-273-70512-3. Retrieved 5 March 2010.

- Taylor, John B. (1 February 2006). Economics. Cengage Learning. ISBN 978-0-618-64085-0. Retrieved 5 March 2010.

- Vogel, Harold (2001). Entertainment Industry Economics (5th ed.). Cambridge University Press. ISBN 978-0-521-79264-6.

- Wall, Stuart; Griffiths, Alan (2008). Economics for Business and Management. Financial Times Prentice Hall. ISBN 978-0-273-71367-8. Retrieved 6 March 2010.

- Wessels, Walter J. (1 September 2000). Economics. Barron's Educational Series. ISBN 978-0-7641-1274-4. Retrieved 28 February 2010.

External links

- A Lesson on Elasticity in Four Parts, Youtube, Jodi Beggs

- Price Elasticity Models and Optimization

- Approx. PED of Various Products (U.S.)

- Approx. PED of Various Home-Consumed Foods (U.K.)