Vehicle Excise Duty

Vehicle Excise Duty (VED) (also known as "vehicle tax", "car tax" or "road tax", and formerly as a "tax disc") is a tax that is levied as an excise duty and which must be paid for most types of vehicles which are to be used (or parked) on public roads in the United Kingdom.[1] Registered vehicles that are not being used or parked on public roads and which has been taxed since 31 January 1998, must be covered by a Statutory Off Road Notification (SORN) to avoid VED. In 2016, VED generated approximately £6 billion for the Exchequer.[2][3]

A vehicle tax was first introduced in Britain in 1888. In 1920, an excise duty was introduced that was specifically applied to motor vehicles; initially it was hypothecated (ring-fenced or earmarked) for road construction and paid directly into a special Road Fund. After 1937, this reservation of vehicle revenue for roads was ended, and instead the revenue was paid into the Consolidated Fund — the general pot of money held by government. Since then, maintenance of the UK road network has been funded out of general taxation, of which VED is a part.[4]

Current regulations

VED across the United Kingdom is collected and enforced by the Driver and Vehicle Licensing Agency (DVLA). Until 2014, VED in Northern Ireland was collected by the Driver and Vehicle Agency there; responsibility has since been transferred to the DVLA.[5]

The licence is issued upon payment of the appropriate VED amount (which may be zero). Owners of registered vehicles which have been licensed since 31 January 1998 and who do not now wish to use or store a vehicle on the public highway are not required to pay VED, but are required to submit an annual Statutory Off-Road Notification (SORN).[6] Failure to submit a SORN is punishable in the same manner as failure to pay duty when using the vehicle on public roads.

Until 1 October 2014 a vehicle licence (tax disc) had to be displayed on a vehicle (usually adhered inside the windscreen on the nearside thus easily visible to officials patrolling roads on foot) as evidence of having paid the duty. Since that date, the circular paper discs have not been issued and there is no longer a requirement to display a disc as the records are now stored in a centralised database and accessible using the vehicle registration plate details.[7]

Cars

There are currently two payment schedules in effect, depending whether the car was first registered before or after 1 April 2017.

Registered before 1 April 2017

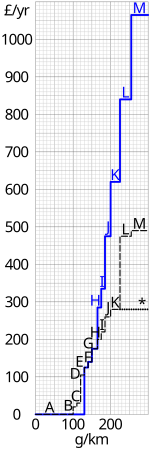

Charges as applicable from 1 April 2013.[8] For cars registered before 1 March 2001 the excise duty is based on engine size (£140 for vehicles with a capacity of less than 1549 cc, £225 for vehicles with larger engines). For vehicles registered on or after 1 March 2001 charges are based on theoretical CO2 emission rates per kilometre. The price structure was revised from 1 April 2013 to introduce an alternative charge for the first year (the standard cost was not changed, and remained the same as for 2001 onwards). The "first year rate" only applies in the year the vehicle was first registered and is said by the government to be designed to send "a stronger signal to the buyer about the environmental implications of their car purchase".[9] Charges as applicable from 1 April 2013 are:

| Car emission band | Standard cost (£) | Cost for first year (£) | Notes |

|---|---|---|---|

| Band A (up to 100 g/km) | 0 | 0 | |

| Band B (101–110 g/km) | 20 | 0 | |

| Band C (111–120 g/km) | 30 | 0 | |

| Band D (121–130 g/km) | 105 | 0 | |

| Band E (131–140 g/km) | 125 | 125 | |

| Band F (141- 150 g/km) | 140 | 140 | |

| Band G (151 to 165 g/km) | 175 | 175 | |

| Band H (166 to 175 g/km) | 200 | 285 | |

| Band I (176 to 185 g/km) | 220 | 335 | |

| Band J (186 to 200 g/km) | 260 | 475 | |

| Band K (201 to 225 g/km) | 280 | 620 | also vehicles with >225 g/km registered before 23 March 2006. |

| Band L (226 to 255 g/km) | 475 | 840 | |

| Band M (Over 255 g/km) | 490 | 1065 |

Registered after 1 April 2017

The biggest changes are that hybrid vehicles will no longer be rated at £0 and that cars with a retail price of £40,000 and over will pay a supplement for the first five years of the standard rate (e.g. any subsequent renewal, even if the change of owner is within the first year).

For example, the 2016 Range Rover Autobiography V8 diesel has an official CO2 figure of 219g/km. Under the previous rates, VED was £620 for the first year and then £280 for each subsequent year. For the same model registered after 1 April 2017, VED is £1,200 in year one, £450 in years 2 to 6 and then £140 from year 7. Assuming ten years of ownership, pre-2017 rates totalled £3,140. New rates total £4,010.

| Emissions rating (g/CO2/km) | First year rate | Standard rate | Notes |

|---|---|---|---|

| 0 | £0 | £0 | |

| 1–50 | £10 | £140 | |

| 51–75 | £25 | £140 | |

| 76–90 | £100 | £140 | |

| 91–100 | £120 | £140 | |

| 101–110 | £140 | £140 | |

| 111–130 | £160 | £140 | |

| 131–150 | £200 | £140 | |

| 151–170 | £500 | £140 | |

| 171–190 | £800 | £140 | |

| 191–225 | £1,200 | £140 | |

| 226–255 | £1,700 | £140 | |

| Over 255 | £2,000 | £140 |

In addition, cars with a list value of over £40,000 pay £310 supplement for five years of the standard rate.

The official government website details the following:

Policy objective

The pre-2017 VED structure based on CO2 bands was introduced in 2001 when average UK new car emissions ratings were 178 gCO2/km. The Band A threshold of 100 gCO2/km below which cars pay no VED was introduced in 2003 when average new car emissions ratings were 173 gCO2/km. Since then, to meet EU emissions ratings targets average new car emissions ratings have fallen to 125 gCO2/km. This means that an increasingly large number of ordinary cars fell into the zero- or lower-rated VED bands, creating a sustainability challenge and weakening the environmental signal in VED. This is set to continue as manufacturers meet further EU targets of 95 gCO2/km set for 2020.

The reformed VED system retains and strengthens the CO2-based First-Year-Rates to incentivise uptake of the very cleanest cars whilst moving to a flat Standard Rate in order to make the tax fairer, simpler and sustainable. To ensure those who can afford the most expensive cars make a fair contribution, a supplement of £310 will be applied to the Standard Rate of cars with a list price (not including VED) over £40,000, for the first five years in which a Standard Rate is paid.

Heavy goods vehicles

Taxation for use of heavy goods vehicles on UK roads are based on the size, weight per axle. For full details refer to the source reference:[10]

| HGV tax band | Standard | Reduced emission rating | Example vehicle in this category |

|---|---|---|---|

| A | £165 | £160 | HGV weighing less than 7.5 tonnes |

| B | £200 | £160 | HGV weighing less than 15 tonnes |

| C | £450 | £210 | Three and four axle vehicles weighing less than 21 tonnes |

| D | £650 | £280 | Four axle vehicles weighing less than 27 tonnes |

| E | £1,200 | £700 | Semi-trailer with two or more axles weighing less than 34 tonnes |

| F | £1,500 | £1,000 | Semi-trailer with two or more axles weighing less than 38 tonnes |

| G | £1,850 | £1,350 | Semi-trailer with three or more axles weighing less than 44 tonnes |

Exempt vehicles

Various classes and uses of vehicle are exempt, including electrically propelled vehicles, vehicles older than 40 years (see below), trams, vehicles which cannot convey people, police vehicles, fire engines, ambulances and health service vehicles, mine rescue vehicles, lifeboat vehicles, certain road construction and maintenance vehicles, vehicles for disabled people, certain agricultural and land maintenance vehicles, road gritters and snow ploughs, vehicles undergoing statutory tests, vehicles imported by members of foreign armed forces, and crown vehicles.[11]

Each year on 1 April, vehicles constructed more than forty years before the start of that year become eligible for a free vehicle licence under "historic vehicle" legislation. This is due to the age of the vehicle and a presumption of limited mileage. Initially this was a rolling exemption applied to any vehicles over 25 years old, however in 1997 the cutoff date was frozen at 1 January 1973. The change to "pre-1973" was unpopular in the classic motoring community, and a number of classic car clubs campaigned for a change back to the previous system.[12] In 2006 there were 307,407 vehicles in this category:[13]

As of 1 April 2014, vehicles manufactured before 1 January 1974 became exempt from the VED (Finance Act 2014, as set out in the 2013 Budget, 20 March 2013).

In the 2014 Budget, the government introduced a forty-year rolling exemption, with vehicles built before 1 January 1975 becoming exempt on 1 April 2015 and so on.[14]

Other vehicles

Motorcycle

Motorcycles are taxed on engine capacity rather than CO2 emissions ratings.[15] Zero-emission motorcycles and tricycles, such as electrically-powered bikes, are not subject to the tax.[16]

| Engine size (cc) | 12 month rate | 6 month rate |

|---|---|---|

| Not over 150 | £18.00 | Not available |

| 151–400 | £41.00 | Not available |

| 401–600 | £62.00 | £34.10 |

| Over 600 | £85.00 | £46.75 |

Tricycles

| Engine size (cc) | 12 month rate | 6 month rate |

|---|---|---|

| Not over 150 | £17.00 | Not available |

| Over 150 | £82.00 | £45.10 |

Enforcement

In 2008 it was reported that flaws in DVLA enforcement practices have meant that more than a million late-paying drivers per year have evaded detection, which lost £214 million in VED revenue during 2006.[17] It was estimated that 6.7% of motorcycles were not taxed in 2007. Since then better systems reduced the loss to an estimated £33.9 million in 2009/2010.[18]

Automatic number plate recognition (ANPR) systems are being used to identify untaxed, uninsured vehicles and stolen cars.[19][20]

Rates since April 2005

All rates are in pounds sterling.

| 05–06[21] | 06–07[21] | 07–08[22] | 08–09[23] | 09–10[24] | 10–11[24] | 11–12[25] | 12–13[25] | 13–14[25] | 14–15[25] | 15–16 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Petrol | Diesel | Petrol/

diesel |

Alt. fuel | Petrol/

diesel |

Alt. fuel | Petrol/

diesel |

Alt. fuel | Petrol/

diesel |

Alt. fuel | |||||||

| Engine size of vehicles registered before 1 March 2001 | ||||||||||||||||

| <=1549cc | 110 | 110 | 110 | 115 | 120 | 125 | 125 | 130 | 135 | 140 | 145 | 145 | ||||

| >1549cc | 170 | 175 | 175 | 180 | 185 | 190 | 205 | 215 | 220 | 225 | 230 | 235 | ||||

| Based on CO2 emission ratings for vehicles registered on or after 1 March 2001 | ||||||||||||||||

| Band A (up to 100g/km) | 65 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Band B (101–110g/km) | 75 | 40 | 50 | 35 | 35 | 35 | 20 | 20 | 20 | 10 | 20 | 10 | 20 | 10 | 20 | 10 |

| Band C (111–120g/km) | 75 | 40 | 50 | 35 | 35 | 35 | 30 | 30 | 30 | 20 | 30 | 20 | 30 | 20 | 30 | 20 |

| Band D (121–130g/km) | 105 | 100 | 110 | 115 | 120 | 120 | 90 | 95 | 100 | 90 | 105 | 95 | 110 | 100 | 110 | 100 |

| Band E (131–140g/km) | 105 | 100 | 110 | 115 | 120 | 120 | 110 | 115 | 120 | 110 | 125 | 115 | 130 | 120 | 130 | 120 |

| Band F (141–150g/km) | 100 | 100 | 110 | 115 | 120 | 125 | 125 | 130 | 135 | 125 | 140 | 130 | 145 | 135 | 145 | 135 |

| Band G (151–165g/km) | 125 | 125 | 135 | 140 | 145 | 150 | 155 | 165 | 170 | 160 | 175 | 165 | 180 | 170 | 185 | 175 |

| Band H (166–175g/km) | 150 | 150 | 160 | 165 | 170 | 175 | 180 | 190 | 195 | 185 | 200 | 190 | 205 | 195 | 210 | 200 |

| Band I (176–185g/km) | 150 | 150 | 160 | 165 | 170 | 175 | 200 | 210 | 215 | 205 | 220 | 210 | 225 | 215 | 230 | 220 |

| Band J (186–200g/km) | 165 | 190 | 195 | 205 | 210 | 215 | 235 | 245 | 250 | 240 | 260 | 250 | 265 | 255 | 270 | 260 |

| Band K∞ (201–225g/km) | 165 | 190 | 195 | 205 | 210 | 215 | 245 | 260 | 270 | 260 | 280 | 270 | 285 | 275 | 295 | 285 |

| Band L (226–255g/km) | 165 | 210 | 215 | 300 | 400 | 405 | 425 | 445 | 460 | 450 | 475 | 465 | 485 | 475 | 500 | 490 |

| Band M (over 255g/km) | 165 | 210 | 215 | 300 | 400 | 405 | 435 | 460 | 475 | 465 | 490 | 480 | 500 | 490 | 515 | 505 |

∞Band K includes cars that have a CO2 figure over 225g/km but were registered before 23 March 2006.

History

This section needs additional citations for verification. (November 2010) |

Following the 1888 budget, two new vehicle duties were introduced — the locomotive duty and the trade cart duty (a general wheel-tax also announced in the same budget was abandoned). The locomotive duty was levied at £5 (equivalent to £703.52 as of 2023),[27]for each locomotive used on the public roads and the trade cart duty was introduced for all trade vehicles (including those which were mechanically powered) not subject to the existing carriage duty, with the exception of those used in agriculture and those weighing less than 10 cwt-imperial, at the rate of 5s. (£0.25) per wheel.[28][29]

The Road Fund

In the budget of 1909, the then Chancellor of the Exchequer, David Lloyd George announced that the roads system would be self-financing,[30] and so from 1910 the proceeds of road vehicle excise duties were dedicated to fund the building and maintenance of the road system.[31] Even during this period the majority of the cost of road building and improvement came from general and local taxation owing to the tax being too low for the upkeep of the roads.[32]

The Roads Act 1920 required councils to 'register all new vehicles and to allocate a separate number to each vehicle' and 'make provision for the collection and application of the excise duties on mechanically propelled vehicles and on carriages'. The Finance Act 1920 introduced a 'Duty on licences for mechanically propelled vehicles' which was to be hypothecated — that is, the revenue would be exclusively dedicated to a particular expenditure, namely the newly established Road Fund.[33] Excise duties specifically for mechanically propelled vehicles were first imposed in 1921, along with the requirement to display a vehicle licence (tax disc) on the vehicle.[31]

End of hypothecation

The accumulated Road Fund was never fully spent on roads (most of it was spent on resurfacing, not the building of new roads), and became notorious for being used for other government purposes, a practice introduced by Winston Churchill, when he was Chancellor of the Exchequer.[citation needed] In 1926, by which time the direct use of taxes collected from motorists to fund the road network was already opposed by many in government, the Chancellor Winston Churchill is reported to have said in a memo: "Entertainments may be taxed; public houses may be taxed...and the yield devoted to the general revenue. But motorists are to be privileged for all time to have the tax on motors devoted to roads? This is an outrage upon...common sense."[34] Hypothecation came to an end in 1937 under the 1936 Finance Act, and the proceeds of the vehicle road taxes were paid directly into the Exchequer. The Road Fund itself, then funded by government grants, was not abolished until 1955.[30]

1990s

Since 1998, keepers of registered vehicles which had been licensed since 1998, but which were not currently using the public roads, have been required to submit an annual Statutory Off-Road Notification (SORN).[35] Failure to submit a SORN is punishable in the same manner as failure to pay duty when using the vehicle on public roads. It was announced in the 2013 Budget that SORN declarations would become perpetual, thus removing the need for annual renewal after the initial declaration has been made. In June 1999, a reduced VED band was introduced for cars with an engine capacity up to 1100cc.[36] The cost of 12 months tax for cars up to 1100cc was £100, and for those above 1100cc was £155.

Emissions ratings tax

During the 1990s, political arguments were put forward for the abolition of VED. Among the proposals was a suggestion that VED could be replaced by increased fuel duty as an incentive for consumers to purchase vehicles with lower emission ratings. The proposal was politically unappealing, as it would increase costs for businesses and for people living in rural areas. Rather than abolish VED, the Labour government under Tony Blair introduced a new system for calculating of VED that was linked explicitly with a vehicle's carbon emissions ratings, as a means for vehicle emissions control. Since then, VED was levied in a system of tax bands based on CO2 ratings.[4]

In the pre-budget report of 27 November 2001 the Government announced that VED for HGVs could be replaced, by a new tax based on distance travelled, the Lorry Road-User Charge (LRUC).[37] At the same time, the rate of fuel duty would be cut for such vehicles. As at the start of 2007 this scheme is still at a proposal stage and no indicated start date has been given. The primary aim of the proposed change was that HGVs from the UK and the continent would pay exactly the same to use British roads (removing the ability of foreign vehicles to pay no UK tax). However, it was also expected that the tax would be used to influence routes taken (charging lower rates to use motorways), reduce congestion (by varying the charge with time of day), and encourage low emissions ratings vehicles.

In tax year 2002–2003, it is estimated that evasion of the tax equated to a loss to the Exchequer of £206 million. In an attempt to reduce this, from 2004 an automatic £80 penalty (halved if paid within 28 days) is issued by the DVLA computer for failure to pay the tax within one month of expiry. A maximum fine of £1,000 applies for failure to pay the tax, though in practice fines are normally much lower.

In June 2005 the government announced plans to adopt a road user charging scheme for all road vehicles, which would work by tracing the movement of vehicles using a telematics system. The idea raised objections on civil and human rights grounds that it would amount to mass surveillance. An online petition protesting this was started and reached over 1.8 million signatures by the closing date of 20 February 2007.

In April 2009 there was a reclassification to the CO2 rating based bandings with the highest set at £455 per year and the lowest at £0, the bandings have also been backdated to cover vehicles registered on or after 1 March 2001, meaning that vehicles with the highest emissions ratings registered after this date pay the most. Vehicles registered before 1 March 2001 will still continued to be charged according to engine size, above or below 1549cc.

In 2009 a consultation document from the Scottish Government raised the possibility of a VED on all road users including cyclists, but there was a strong consensus against this.[38][39]

From 2010 a new first year rate is to be introduced – dubbed a showroom tax. This new tax was announced in the 2008 budget, and the level of tax payable will be based on the vehicle excise duty band, ranging from £0 for vehicles in the lower bands, up to £950 for vehicles in the highest band.[40][41]

See also

- Motoring taxation in the United Kingdom

- Road fund

- Vehicle registration plates of the United Kingdom

- London congestion charge

- Vignette (road tax)

- Velology – the study and collection of tax discs

- Automobile costs

References

- ^ "The road user and the law". Direct.gov.uk.

Most of the provisions apply on all roads throughout Great Britain, although there are some exceptions.

- ^ "FAQs about motoring taxation and cost of running a car". www.racfoundation.org. Archived from the original on 28 March 2018. Retrieved 28 March 2018.

{{cite web}}: Unknown parameter|dead-url=ignored (|url-status=suggested) (help) - ^ "Transport Statistics Great Britain 2017" (PDF). Department for Transport. November 2017. p. 25. Retrieved 28 March 2018.

- ^ a b Butcher, Louise (23 November 2017). "Parliamentary Briefing Paper: Vehicle Excise Duty (VED)" (PDF). House of Commons Library. Retrieved 13 February 2013.

- ^ "DVA Issues Reminder that all Motor Tax Offices in Northern Ireland Close on 17 July 2014". Northern Ireland Executive. Archived from the original on 16 April 2016.

{{cite web}}: Unknown parameter|dead-url=ignored (|url-status=suggested) (help) - ^ How to make a SORN (Statutory Off Road Notification) : Directgov – Motoring

- ^ "Paper tax discs abolished". Gov.uk. Retrieved 22 January 2014.

- ^ "Vehicle tax rate tables". Direct Gov. Retrieved 7 August 2013.

- ^ "The cost of vehicle tax for cars, motorcycles, light goods vehicles and trade licences". Direct Gov. Retrieved 2 June 2011.

- ^ "V149 Rates of vehicle tax". VOSA.

- ^ "Vehicle Excise and Registration Act 1994: Schedule 2". The Crown.

- ^ "Classic Car VED Exemption". Your Government. Archived from the original on 13 September 2011. Retrieved 12 February 2011.

{{cite web}}: Unknown parameter|dead-url=ignored (|url-status=suggested) (help) - ^ "Motor Vehicles: Excise Duties". TheyWorkForYou. Retrieved 30 March 2010.[permanent dead link]

- ^ "Vehicle Excise Duty: 40 year rolling exemption for classic vehicles" (PDF). HM Revenue and Customs. Retrieved 15 June 2014.

- ^ https://www.gov.uk/vehicle-tax-rate-tables

- ^ "Vehicles exempt from vehicle tax - GOV.UK". www.gov.uk. Retrieved 2 December 2017.

- ^ "A million drivers are exploiting loophole in road tax payments". The Times. London.

- ^ "Vehicle excise duty evasion: 2009". Department for Transport. Archived from the original on 2 November 2010.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ John Lettice (15 September 2005). "Gatso 2: rollout of UK's '24x7 vehicle movement database' begins". The Register. Retrieved 14 October 2008.

- ^ Chris Williams (15 September 2008). "Vehicle spy-cam data to be held for five years". The Register. Retrieved 15 October 2008.

- ^ a b http://www.bytestart.co.uk/content/taxlegal/9_15/vehicle-excise-duty-rates-2006-7.shtml (2005–06 figures calculated from 2006–07 figures and changes)

- ^ "Tax Rates 2011–12 – Corporation Tax, Income Tax Bands & Allowances, National Insurance Rates, Dividend Tax Rates". Bytestart.co.uk. Retrieved 22 August 2013.

- ^ "VED Rates (Vehicle Excise Duty) for 2011/12 tax year". Bytestart.co.uk. Retrieved 22 August 2013.

- ^ a b "VED Rates (Vehicle Excise Duty) for 2011/12 tax year". Bytestart.co.uk. Retrieved 22 August 2013.

- ^ a b c d "Calculate vehicle tax rates – GOV.UK". Direct.gov.uk. 30 May 2013. Retrieved 22 August 2013.

- ^ Savage, Christopher; Barker, T. C. (2012). Economic History of Transport in Britain. Routledge. ISBN 9781135654559. Retrieved 27 March 2018.

- ^ UK Retail Price Index inflation figures are based on data from Clark, Gregory (2017). "The Annual RPI and Average Earnings for Britain, 1209 to Present (New Series)". MeasuringWorth. Retrieved 7 May 2024.

- ^ "The speech of the Chancellor of the Exchequer". The Times. 27 March 1888.

- ^ "The Excise Duties (Local)". The Times. 27 March 1888.

- ^ a b "Louise Butcher" (25 November 2008). "Vehicle excise duty (VED)". "House of Commons Library".

{{cite journal}}: Cite journal requires|journal=(help) - ^ a b "House of Commons Environmental Audit Committee" (22 July 2008). "Vehicle Excise Duty as an environmental tax" (PDF). "The Stationery Office Limited".

{{cite journal}}: Cite journal requires|journal=(help) - ^ Plowden, William (1971). The Motor Car And Politics 1896–1970. London: The Bodley Head. ISBN 0-370-00393-4.

{{cite book}}: Cite has empty unknown parameter:|month=(help) - ^ C.D. Buchanan (1958). Mixed Blessing: The Motor in Britain. Leonard Hill.

- ^ Harrabin, Roger (15 August 2013). "Is there any such thing as 'road tax'?". BBC News. Archived from the original on 27 March 2018. Retrieved 27 March 2018.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ How to make a SORN (Statutory Off Road Notification) : Directgov – Motoring

- ^ : Budget Report 1999 Archived 20 November 2008 at the Wayback Machine

- ^ "The Pre-Budget Report: Building a stronger, fairer Britain in an uncertain world" (Press release). UK HM Treasury. 27 November 2001. Archived from the original on 5 February 2007.

{{cite press release}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Dynesh Vijayaraghavan (2009). "Cycling Action Plan for Scotland: Analysis of Consultation Responses" (PDF). Sustainable Transport Team, Scottish Government. p. 3.

- ^ "A road tax for cyclists On your bike". The Scotsman. Edinburgh. 12 January 2010.

- ^ Robert Winnett (13 March 2008). "Budget 2008: Motorists suffer tax hits in 'green' budget". The Daily Telegraph. London: Telegraph Media Group. Retrieved 14 May 2008.

- ^ "Budget 2008 – motoring taxes". DirectGov. Archived from the original on 18 May 2008. Retrieved 14 May 2008.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help)

External links

- UK vehicle tax information on Directgov

- Apply online

- VED Calculator (for cars registered after April 2017)