Vicious circle

This article needs additional citations for verification. (March 2012) |

The terms virtuous circle and vicious circle (also referred to as virtuous cycle and vicious cycle) refer to complex chains of events which reinforce themselves through a feedback loop.[1] A virtuous circle has favorable results, while a vicious circle has detrimental results.

Both circles are complexes of events with no tendency towards equilibrium (at least in the short run). Both systems of events have feedback loops in which each iteration of the cycle reinforces the previous one (positive feedback). These cycles will continue in the direction of their momentum until an external factor intervenes and breaks the cycle. The prefix "hyper-" is sometimes used to describe these cycles if they are extreme. The best-known example of a vicious circle is hyperinflation.

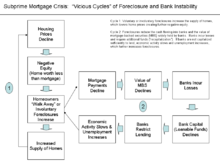

Vicious circles in the subprime mortgage crisis

The contemporary subprime mortgage crisis is a complex of vicious circles, both in its genesis and in its manifold outcomes, most notably the late 2000s recession. A specific example is the circle related to housing. As housing prices decline, more homeowners go "underwater", when the market value of a home drops below the mortgage on it. This provides an incentive to walk away from the home, increasing defaults and foreclosures. This, in turn, lowers housing values further from over-supply, reinforcing the cycle.[2]

The foreclosures reduce the cash flowing into banks and the value of mortgage-backed securities (MBS) widely held by banks. Banks incur losses and require additional funds, also called “recapitalization”. If banks are not capitalized sufficiently to lend, economic activity slows and unemployment increases, which further increase the number of foreclosures.

Economist Nouriel Roubini described the vicious circles within and across the housing market and financial markets during interviews with Charlie Rose in September and October 2008.[3][4][5]

Other examples

Other examples include the poverty cycle, sharecropping, and the intensification of drought. In climate change science, feedback loops involve positive feedbacks and negative feedbacks that respectively serve to intensify or dampen the effects of global warming.

See also

- Catch-22 (logic)

- Causal loop diagram

- Closed timelike curve

- Endogeneity (econometrics)

- List of economics topics

- List of finance topics

- List of management topics

- List of marketing topics

- List of production topics

- Positive feedback

- Reflexivity (sociology)

- Self-fulfilling prophecy

- Spiral of silence

- Subprime mortgage crisis

- Unintended consequences

Analogous concepts

References

- ^ Charles Webel, Johan Galtung (19 March 2012). Handbook of Peace and Conflict Studies. Routledge. Retrieved 19 March 2012.

- ^ "WSJ-Vicious Cycle in Subprime Crisis". Online.wsj.com. 2008-11-18. Retrieved 2013-09-05.

- ^ "Roubini & Panel". Charlie Rose. Retrieved 2013-09-05.

- ^ "Rose & Roubini Discussion". Charlierose.com. Retrieved 2013-09-05.

- ^ "Rose & Roubini". Charlierose.com. Retrieved 2013-09-05.

External sources

- Schlesinger, L. and Heskett, J. (1991) Breaking the cycle of failure in services, Sloan Management Review, vol. 31, spring 1991, pp. 17 – 28.

- http://william-king.www.drexel.edu/top/prin/txt/gro/gro21b.html – An introduction to 20th century virtuous circle theory.

- Rational Choice with Passion:Virtue in a Model of Rational Addiction – In this link the author uses Aristotelian virtue as a mediator between passion and reason in the construction of utility/consumption functions in an esoteric part of consumer behaviour theory related to decision making in addictive situations.

- China: A Stabilizing or Deflationary Influence in East Asia? The Problem of Conflicted Virtue – In this link the author is using virtue in the sense of a positive outcome (balance of payments surplus) that conflicts with long term regional growth and stability.

- http://www.bioenergycentres.com/resources.shtml – an essay in 3 parts by Polarity Therapist Andrew Harry, Bath, UK. Defining The Virtuous Cycle as an integrated healing process.