Interest rate: Difference between revisions

m Reverted edits by 24.62.114.248 to last revision by 116.250.36.6 (HG) |

|||

| Line 3: | Line 3: | ||

{{Finance sidebar}} |

{{Finance sidebar}} |

||

An '''[[interest]] rate''' is the price a borrower pays for the use of [[money]] they |

An '''[[interest]] rate''' is the price a borrower pays for the use of [[money]] they borrow from another burrowee, for instance a small company might borrow from a bank to kick start their business, and the return a lender receives for deferring the use of funds, by lending it to the borrower. Interest rates are normally expressed as a [[percentage]] rate over the period of one year. |

||

Interest rates targets are also a vital tool of [[monetary policy]] and are used to control variables like [[investment]], [[inflation]], and [[unemployment]]. |

Interest rates targets are also a vital tool of [[monetary policy]] and are used to control variables like [[investment]], [[inflation]], and [[unemployment]]. |

||

Revision as of 23:45, 4 November 2009

This article needs additional citations for verification. (October 2008) |

The examples and perspective in this article may not represent a worldwide view of the subject. |

| Part of a series on |

| Finance |

|---|

|

An interest rate is the price a borrower pays for the use of money they borrow from another burrowee, for instance a small company might borrow from a bank to kick start their business, and the return a lender receives for deferring the use of funds, by lending it to the borrower. Interest rates are normally expressed as a percentage rate over the period of one year.

Interest rates targets are also a vital tool of monetary policy and are used to control variables like investment, inflation, and unemployment.

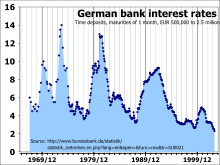

Historical interest rates

Interest rates throughout history have been variously set either by national governments or central banks. For example, the Federal Reserve federal funds rate in the United States has varied between about 0.25% to 19% from 1954 to 2008, while the Bank of England base rate varied between 0.5% and 15% from 1989 to 2009,[1] [2]and Germany experienced rates close to 90% in the 1920s down to about 2% in the 2000s.[3][4] During an attempt to tackle spiralling hyperinflation in 2007, the Central Bank of Zimbabwe increased interest rates for borrowing to 800%.[5]

This section needs expansion. You can help by adding to it. (October 2008) |

Reasons for interest rate change

- Deferred consumption. When money is loaned the lender delays spending the money on consumption goods. Since according to time preference theory people prefer goods now to goods later, in a free market there will be a positive interest rate.

- Inflationary expectations. Most economies generally exhibit inflation, meaning a given amount of money buys fewer goods in the future than it will now. The borrower needs to compensate the lender for this.

- Alternative investments. The lender has a choice between using his money in different investments. If he chooses one, he forgoes the returns from all the others. Different investments effectively compete for funds.

- Risks of investment. There is always a risk that the borrower will go bankrupt, abscond, or otherwise default on the loan. This means that a lender generally charges a risk premium to ensure that, across his investments, he is compensated for those that fail.

- Liquidity preference. People prefer to have their resources available in a form that can immediately be exchanged, rather than a form that takes time or money to realise.

- Taxes. Because some of the gains from interest may be subject to taxes, the lender may insist on a higher rate to make up for this loss.

Real vs nominal interest rates

The nominal interest rate is the amount, in money terms, of interest payable.

For example, suppose a household deposits $100 with a bank for 1 year and they receive interest of $10. At the end of the year their balance is $110. In this case, the nominal interest rate is 10% per annum.

The real interest rate, which measures the purchasing power of interest receipts, is calculated by adjusting the nominal rate charged to take inflation into account. (See real vs. nominal in economics.)

If inflation in the economy has been 10% in the year, then the $110 in the account at the end of the year buys the same amount as the $100 did a year ago. The real interest rate, in this case, is zero.

After the fact, the 'realized' real interest rate, which has actually occurred, is:

where p = the actual inflation rate over the year.

The expected real returns on an investment, before it is made, are:

where:

- = nominal interest rate

- = real interest rate

- = expected or projected inflation over the year

Market interest rates

There is a market for investments which ultimately includes the money market, bond market, stock market and currency market as well as retail financial institutions like banks.

Exactly how these markets function is a complex question. However, economists generally agree that the interest rates yielded by any investment take into account:

- The risk-free cost of capital

- Inflationary expectations

- The level of risk in the investment

- The costs of the transaction

This rate incorporates the deferred consumption and alternative investments elements of interest.

Inflationary expectations

According to the theory of rational expectations, people form an expectation of what will happen to inflation in the future. They then ensure that they offer or ask a nominal interest rate that means they have the appropriate real interest rate on their investment.

This is given by the formula:

where:

- = offered nominal interest rate

- = desired real interest rate

- = inflationary expectations

Risk

The level of risk in investments is taken into consideration. This is why very volatile investments like shares and junk bonds have higher returns than safer ones like government bonds.

The extra interest charged on a risky investment is the risk premium. The required risk premium is dependent on the risk preferences of the lender.

If an investment is 50% likely to go bankrupt, a risk-neutral lender will require their returns to double. So for an investment normally returning $100 they would require $200 back. A risk-averse lender would require more than $200 back and a risk-loving lender less than $200. Evidence suggests that most lenders are in fact risk-averse.

Generally speaking a longer-term investment carries a maturity risk premium, because long-term loans are exposed to more risk of default during their duration.

Liquidity preference

Most investors prefer their money to be in cash than in less fungible investments. Cash is on hand to be spent immediately if the need arises, but some investments require time or effort to transfer into spendable form. This is known as liquidity preference. A 1-year loan, for instance, is very liquid compared to a 10-year loan. A 10-year US Treasury bond, however, is liquid because it can easily be sold on the market.

A market interest-rate model

A basic interest rate pricing model for an asset

Assuming perfect information, pe is the same for all participants in the market, and this is identical to:

where

- in is the nominal interest rate on a given investment

- ir is the risk-free return to capital

- i*n = the nominal interest rate on a short-term risk-free liquid bond (such as U.S. Treasury Bills).

- rp = a risk premium reflecting the length of the investment and the likelihood the borrower will default

- lp = liquidity premium (reflecting the perceived difficulty of converting the asset into money and thus into goods).

Interest rate notations

What is commonly referred to as the interest rate in the media is generally the rate offered on overnight deposits by the Central Bank or other authority, annualised.

The total interest on an investment depends on the timescale the interest is calculated on, because interest paid may be compounded.

In finance, the effective interest rate is often derived from the yield, a composite measure which takes into account all payments of interest and capital from the investment.

In retail finance, the annual percentage rate and effective annual rate concepts have been introduced to help consumers easily compare different products with different payment structures.

Money market mutual funds quote their rate of interest as the 7 Day SEC Yield.

Interest rates in macroeconomics

Output and unemployment

Interest rates are the main determinant of investment on a macroeconomic scale. Broadly speaking, if interest rates increase across the board, then investment decreases, causing a fall in national income.

A government institution, usually a central bank, can lend money to financial institutions to influence their interest rates as the main tool of monetary policy. Usually central bank interest rates are lower than commercial interest rates since banks borrow money from the central bank then lend the money at a higher rate to generate most of their profit.

By altering interest rates, the government institution is able to affect the interest rates faced by everyone who wants to borrow money for economic investment. Investment can change rapidly in response to changes in interest rates and the total output.

Open Market Operations in the United States

The Federal Reserve (often referred to as 'The Fed') implements monetary policy largely by targeting the federal funds rate. This is the rate that banks charge each other for overnight loans of federal funds, which are the reserves held by banks at the Fed. Open market operations are one tool within monetary policy implemented by the Federal Reserve to steer short-term interest rates. Using the power to buy and sell treasury securities, the Open Market Desk at the Federal Reserve Bank of New York can supply the market with dollars by purchasing Treasury-notes, hence increasing the nation's money supply. By increasing the money supply or Aggregate Supply of Funding (ASF), interest rates will fall due to the excess of dollars banks will end up with in their reserves. Excess reserves may be lent in the Fed funds market to other banks, thus driving down rates.

Money and inflation

Loans, bonds, and shares have some of the characteristics of money and are included in the broad money supply.

By setting i*n, the government institution can affect the markets to alter the total of loans, bonds and shares issued. Generally speaking, a higher real interest rate reduces the broad money supply.

Through the quantity theory of money, increases in the money supply lead to inflation.

Mathematical note

Because interest and inflation are generally given as percentage increases, the formulas above are (linear) approximations.

For instance,

is only approximate. In reality, the relationship is

so

The two approximations, eliminating higher order terms, are:

The formulas in this article are exact if logarithms of indices are used in place of rates.

Negative interest rates

Interest rates are usually positive, but not always. Given the alternative of holding cash (thus earning 0%) rather than lending it out, profit-seeking lenders will not lend below 0%, as they will guarantee a loss, and a bank offering a negative deposit rate will find few takers, as savers will instead hold cash.[6]

However, central bank rates can be negative; in July 2009 Sweden's Riksbank was the first central bank to use negative interest rates, lowering its deposit rate to −0.25%, a policy advocated by deputy governor Lars E. O. Svensson.[7] This negative interest rate is possible because Swedish banks, as regulated companies, must hold these reserves with the central bank – they do not have the option of holding cash.

Negative interest rates have been proposed in the past, notably in the late 19th century by Silvio Gesell.[8] A negative interest rate can be described (as by Gesell) as a "tax on holding money"; he proposed it as the Freigeld (free money) component of his Freiwirtschaft (free economy) system. To prevent people from holding cash (and thus earning 0%), Gesell suggested issuing money for a limited duration, after which it must be exchanged for new bills – attempts to hold money thus result in it expiring and becoming worthless.

Notes

- ^ moneyextra.com Interest Rate History. Retrieved 2008-10-27

- ^ news.bbc.co.uk UK interest rates lowered to 0.5%

- ^ Sidney Homer, Richard Eugene Sylla, Richard Sylla (1996). A History of Interest Rates. Rutgers University Press. p. 509. ISBN 0813522889. Retrieved 2008-10-27.

{{cite book}}: CS1 maint: multiple names: authors list (link) (also ISBN 9780813522883) - ^ Bundesbank. BBK - Statistics - Time series database. Retrieved 2008-10-27

- ^ worldeconomies.co.uk Zimbabwe currency revised to help inflation

- ^ Buiter, Willem (2009-05-07), Negative interest rates: when are they coming to a central bank near you?, Financial Times

- ^ Ward, Andrew; Oakley, David (2009-08-27). "Bankers watch as Sweden goes negative". Financial Times.

- ^ Mankiw, Gregory (2009-04-18). "It May Be Time for the Fed to Go Negative". New York Times.