Trickle-down economics: Difference between revisions

graphs from talk including censored report graph |

No edit summary |

||

| Line 2: | Line 2: | ||

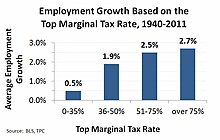

[[File:Employment_growth_by_top_tax_rate.jpg|thumb|right|Average annual growth in U.S. employment, by top income tax bracket rate, 1940-2011]] |

[[File:Employment_growth_by_top_tax_rate.jpg|thumb|right|Average annual growth in U.S. employment, by top income tax bracket rate, 1940-2011]] |

||

'''"Trickle-down economics"''' and '''"the trickle-down theory"''' are terms in United States politics to refer to the idea that [[tax breaks]] or other economic benefits provided by government to businesses and the wealthy will benefit poorer members of society by improving the economy as a whole.<ref>''Oxford English Dictionary'': "'''Trickle-down''', adj., of or based on the theory that economic benefits to particular groups will inevitably be passed on to those less well off...; orig. and chiefly U.S."</ref> The term has been attributed to humorist [[Will Rogers]], who said during the [[Great Depression]] that "money was all appropriated for the top in hopes that it would trickle down to the needy."<ref>{{cite book|first=D. M.|last=Giangreco|coauthors=Kathryn Moore|title=Dear Harry: Truman's Mailroom, 1945-1953|year=1999|isbn=0-8117-0482-3}}</ref> |

'''"Trickle-down economics"''' and '''"the trickle-down theory"''' are terms in United States politics to refer to the idea that [[tax breaks]] or other economic benefits provided by government to businesses and the wealthy will benefit poorer members of society by improving the economy as a whole.<ref>''Oxford English Dictionary'': "'''Trickle-down''', adj., of or based on the theory that economic benefits to particular groups will inevitably be passed on to those less well off...; orig. and chiefly U.S."</ref> The term has been attributed to humorist [[Will Rogers]], who said during the [[Great Depression]] that "money was all appropriated for the top in hopes that it would trickle down to the needy."<ref>{{cite book|first=D. M.|last=Giangreco|coauthors=Kathryn Moore|title=Dear Harry: Truman's Mailroom, 1945-1953|year=1999|isbn=0-8117-0482-3}}</ref> No economist has been known to claim or even support the so-called "theory" and thus the term is mostly used ironically or as pejorative.<ref>Albert H. Hunt, [http://www.nytimes.com/2011/09/12/us/12iht-letter12.html "The Right Moves, but the Wrong Words"], ''New York Times'' September 11, 2011: "Trickle down was the pejorative phrase attached a generation ago to Republican efforts to cut taxes for the rich, assuming the benefits would flow down to the masses."</ref> |

||

Proponents of tax cuts often claim that savings and investment are essential to the economy, and thus less taxes (for any and all income brackets) need not harm any other income bracket. It has been referred to as a [[straw-man argument]].<ref>Albert H. Hunt, [http://capitalismmagazine.com/2001/09/the-trickle-down-economics-straw-man/ "The “Trickle Down” Economics Straw Man"]</ref> Economist [[George Reisman]], a proponent of tax cuts, said the following: "Of course, many people will characterize the line of argument I have just given as the 'trickle-down' theory. There is nothing trickle-down about it. There is only the fact that capital accumulation and economic progress depend on saving and innovation and that these in turn depend on the freedom to make high profits and accumulate great wealth. The only alternative to improvement for all, through economic progress, achieved in this way, is the futile attempt of some men to gain at the expense of others by means of looting and plundering. This, the loot-and-plunder theory, is the alternative advocated by the critics of the misnamed trickle-down theory."<ref>{{cite book |title=Capitalism: A Treatise on Economics |last= |first= |authorlink= |year= |publisher= |location= |isbn=978-0915463732 |page=308 |chapter=The General Benefit from Reducing Taxes on the 'Rich' |accessdate=August 12, 2012 |url=}}</ref> |

Proponents of tax cuts often claim that savings and investment are essential to the economy, and thus less taxes (for any and all income brackets) need not harm any other income bracket. It has been referred to as a [[straw-man argument]].<ref>Albert H. Hunt, [http://capitalismmagazine.com/2001/09/the-trickle-down-economics-straw-man/ "The “Trickle Down” Economics Straw Man"]</ref> Economist [[George Reisman]], a proponent of tax cuts, said the following: "Of course, many people will characterize the line of argument I have just given as the 'trickle-down' theory. There is nothing trickle-down about it. There is only the fact that capital accumulation and economic progress depend on saving and innovation and that these in turn depend on the freedom to make high profits and accumulate great wealth. The only alternative to improvement for all, through economic progress, achieved in this way, is the futile attempt of some men to gain at the expense of others by means of looting and plundering. This, the loot-and-plunder theory, is the alternative advocated by the critics of the misnamed trickle-down theory."<ref>{{cite book |title=Capitalism: A Treatise on Economics |last= |first= |authorlink= |year= |publisher= |location= |isbn=978-0915463732 |page=308 |chapter=The General Benefit from Reducing Taxes on the 'Rich' |accessdate=August 12, 2012 |url=}}</ref> |

||

Revision as of 03:22, 10 November 2012

"Trickle-down economics" and "the trickle-down theory" are terms in United States politics to refer to the idea that tax breaks or other economic benefits provided by government to businesses and the wealthy will benefit poorer members of society by improving the economy as a whole.[1] The term has been attributed to humorist Will Rogers, who said during the Great Depression that "money was all appropriated for the top in hopes that it would trickle down to the needy."[2] No economist has been known to claim or even support the so-called "theory" and thus the term is mostly used ironically or as pejorative.[3]

Proponents of tax cuts often claim that savings and investment are essential to the economy, and thus less taxes (for any and all income brackets) need not harm any other income bracket. It has been referred to as a straw-man argument.[4] Economist George Reisman, a proponent of tax cuts, said the following: "Of course, many people will characterize the line of argument I have just given as the 'trickle-down' theory. There is nothing trickle-down about it. There is only the fact that capital accumulation and economic progress depend on saving and innovation and that these in turn depend on the freedom to make high profits and accumulate great wealth. The only alternative to improvement for all, through economic progress, achieved in this way, is the futile attempt of some men to gain at the expense of others by means of looting and plundering. This, the loot-and-plunder theory, is the alternative advocated by the critics of the misnamed trickle-down theory."[5]

Today, "trickle-down economics" is most closely identified with the economic policies known as Reaganomics or laissez-faire. David Stockman, who as Reagan's budget director championed these cuts at first but then became skeptical of them, told journalist William Greider that the "supply-side economics" is the trickle-down idea: "It's kind of hard to sell 'trickle down,' so the supply-side formula was the only way to get a tax policy that was really 'trickle down.' Supply-side is 'trickle-down' theory."[6][7]

Context

Economist Thomas Sowell has written that the actual path of money in a private enterprise economy is quite the opposite of that claimed by people who refer to the trickle-down theory. He noted that money invested in new business ventures is first paid out to employees, suppliers, and contractors. Only some time later, if the business is profitable, does money return to the business owners—but in the absence of a profit motive, which is reduced in the aggregate by a raise in marginal tax rates in the upper tiers, this activity does not occur. Sowell further has made the case[8] that no economist has ever advocated a "trickle-down" theory of economics, which is rather a misnomer attributed to certain economic ideas by political critics.[9]

Although the term "trickle down" is mainly political and does not denote a specific economic theory, some economic theories reflect the meaning of this pejorative. Some macro-economic models assume that a certain proportion of each dollar of income will be saved. This is called the marginal propensity to save. Many studies have found that the marginal propensity to save is considerably higher among wealthier people. Policies, including tax cuts, that seek to increase saving are often aimed at the wealthy for this reason.[10] Saving usually means some form of investment, as even money placed in savings accounts is ultimately invested by the banks.

In the early 1990s Congressional Records, non-pejorative uses of the term are rare but do appear.[11][12][13][14]

Criticisms

The economist John Kenneth Galbraith noted that "trickle-down economics" had been tried before in the United States in the 1890s under the name "horse and sparrow theory." He wrote, "Mr. David Stockman has said that supply-side economics was merely a cover for the trickle-down approach to economic policy—what an older and less elegant generation called the horse-and-sparrow theory: 'If you feed the horse enough oats, some will pass through to the road for the sparrows.'" Galbraith claimed that the horse and sparrow theory was partly to blame for the Panic of 1896.[15]

Proponents of Keynesian economics and related theories often criticize tax rate cuts for the wealthy as being "trickle down," arguing tax cuts directly targeting those with less income would be more economically stimulative. Keynesians generally argue for broad fiscal policies that are directed across the entire economy, not toward one specific group.

In the 1992 presidential election, Independent candidate Ross Perot called trickle-down economics "political voodoo."[16]

In New Zealand, Labour Party MP Damien O'Connor has, in the Labour Party campaign launch video for the 2011 general election, called trickle-down economics "the rich pissing on the poor".

A 2012 study by the Tax Justice Network indicates that wealth of the super-rich does not trickle down to improve the economy, but tends to be amassed and sheltered in tax havens with a negative effect on the tax bases of the home economy.[17]

History and usage of the term

In 1896, Democratic Presidential candidate William Jennings Bryan made reference to trickle-down theory in his famous "Cross of Gold" speech:

- There are two ideas of government. There are those who believe that if you just legislate to make the well-to-do prosperous, that their prosperity will leak through on those below. The Democratic idea has been that if you legislate to make the masses prosperous their prosperity will find its way up and through every class that rests upon it.[19]

The Merriam-Webster Dictionary notes that the first known use of trickle-down as an adjective meaning "relating to or working on the principle of trickle-down theory" was in 1944,[20] while the first known use of trickle-down theory was in 1954.[21]

After leaving the Presidency, Lyndon B. Johnson, a Democrat, alleged, "Republicans [...] simply don't know how to manage the economy. They're so busy operating the trickle-down theory, giving the richest corporations the biggest break, that the whole thing goes to hell in a handbasket." [1]

Speaking on the Senate floor in 1992, Sen. Hank Brown said, "Mr. President, the trickle-down theory attributed to the Republican Party has never been articulated by President Reagan and has never been articulated by President Bush and has never been advocated by either one of them. One might argue whether trickle down makes any sense or not. To attribute to people who have advocated the opposite in policies is not only inaccurate but poisons the debate on public issues."[22]

Thomas Sowell claimed that, despite its political prominence, no trickle-down theory has ever existed among economists.[23] In response, many critics referred him to Stockman's remarks to Greider. Sowell replied in his newspaper columns.[24] Stockman himself had not proposed or advocated the alleged theory, so Sowell rejected him as an example of someone who had done so. Additionally, Stockman had not specifically named anyone who, or quoted a source that, advocated the theory although he did claim that the theory was being adhered to by the Reagan administration. Sowell replied that Stockman "was not even among the first thousand people to make that claim" but that "not one of those who made the claim could provide a single quote from anybody who had advocated a 'trickle-down theory.'"[23]

See also

- A rising tide lifts all boats

- Economic inequality

- Keynesian economics

- Laffer curve

- Neoliberalism

- Progressive tax

- Supply-side economics

- Trickle up effect

- S corporation

References

- ^ Oxford English Dictionary: "Trickle-down, adj., of or based on the theory that economic benefits to particular groups will inevitably be passed on to those less well off...; orig. and chiefly U.S."

- ^ Giangreco, D. M. (1999). Dear Harry: Truman's Mailroom, 1945-1953. ISBN 0-8117-0482-3.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ Albert H. Hunt, "The Right Moves, but the Wrong Words", New York Times September 11, 2011: "Trickle down was the pejorative phrase attached a generation ago to Republican efforts to cut taxes for the rich, assuming the benefits would flow down to the masses."

- ^ Albert H. Hunt, "The “Trickle Down” Economics Straw Man"

- ^ "The General Benefit from Reducing Taxes on the 'Rich'". Capitalism: A Treatise on Economics. p. 308. ISBN 978-0915463732.

{{cite book}}:|access-date=requires|url=(help) - ^ "The Education of David Stockman" by William Greider

- ^ William Greider. The Education of David Stockman. ISBN 0-525-48010-2

- ^ Sowell, Thomas (Sept. 20, 2012). ""Trickle Down" Theory and "Tax Cuts for the Rich"". Hoover Institution Press. Archived from the original (PDF) on Sept. 24, 2012.

[footnote two says:] Some years ago, in my syndicated column, I challenged anyone to name any economist, of any school of thought, who had actually advocated a "trickle down" theory. No one quoted any economist, politician or person in any other walk of life who had ever advocated such a theory, even though many readers named someone who claimed that someone else had advocated it, without being able to quote anything actually said by that someone else.

{{cite web}}: Check date values in:|date=and|archivedate=(help); External link in|publisher=|quote=at position 109 (help) - ^ Thomas Sowell. Basic Economics: A Citizen's Guide to the Economy. ISBN 0-465-08138-X

- ^ Felix Paukert "Income Distributions at Different Levels of Development: a Survey of Evidence "http://scholar.google.com/scholar?hl=en&lr=&q=info:GQn1vpKFndUJ:scholar.google.com/&output=viewport&pg=1[dead link]

- ^ Lane Evans. Congressional Record, March 13, 1990.

- ^ Helen Delich Bentley. Congressional Record, July 24, 1989.

- ^ Jay Rockefeller. Congressional Record, July 26, 1991.

- ^ Sam Farr. Congressional Record, July 21, 1994.

- ^ Galbraith, John Kenneth (February 4, 1982) "Recession Economics." New York Review of Books Volume 29, Number 1.

- ^ "Trickle Down", Perot campaign ad

- ^ Heather Stewart (July 21, 2012). "Wealth doesn't trickle down – it just floods offshore, research reveals". The Guardian. Retrieved August 6, 2012.

- ^ Recent Trends in Household Wealth in the United States: Rising Debt and the Middle-Class Squeeze—an Update to 2007 by Edward N. Wolff, Levy Economics Institute of Bard College, March 2010

- ^ Bryan’s “Cross of Gold” Speech: Mesmerizing the Masses, historymatters.com

- ^ Merriam-Webster Dictionary (online edition) entry for "trickle-down." Accessed September 17, 2010.

- ^ Merriam-Webster Dictionary (online edition) entry for "trickle-down theory." Accessed September 17, 2010.

- ^ Hank Brown. Congressional Record, March 24, 1992.

- ^ a b Thomas Sowell. The "Trickle Down" Left: Preserving a Vision. June 2, 2006.

- ^ Thomas Sowell. "Trickle-Down Ignorance." April 2, 2005.

Further reading

- Aghion, Philippe (1997). "A Theory of Trickle-Down Growth and Development". Review of Economic Studies. 64 (2). The Review of Economic Studies Ltd.: 151–172. doi:10.2307/2971707. JSTOR 2971707.

{{cite journal}}: Cite has empty unknown parameter:|month=(help); Unknown parameter|coauthors=ignored (|author=suggested) (help) - Gerald Marvin Meier, Joseph E. Stiglitz (2001) Frontiers of Development Economics: The Future in Perspective p. 422

- Karla Hoff and Joseph E. Stiglitz (1998) Adverse Selection and Institutional Adaptation - Department of Economics Working Paper Series / University of Maryland, College Park, Dept. of Economics ; no. 98-02

- Randy P. Albelda, June Lapidus, Elaine McCrate, Edwin Melendez (1988) Mink Coats Don't Trickle Down: The Economic Attack on Women and People of Color ISBN 0-89608-328-4

External links

- Ronald Reagan's Legacy (A Dollars and Sense article by John Miller)

- Frank, Robert (2007-04-12). "In the Real World of Work and Wages, Trickle-Down Theories Don't Hold Up". New York Times. Retrieved 2008-03-05.