Gini coefficient: Difference between revisions

→Limitations of Gini coefficient: move table, to make space for another table and better layout |

→Gini coefficient of income distributions: Add section on education Gini and opportunity Gini; include citations for verifiability |

||

| Line 210: | Line 210: | ||

| 2005 || 0.68 |

| 2005 || 0.68 |

||

|} |

|} |

||

==Gini coefficients of social development== |

|||

Gini coefficiently is widely used in fields as diverse as sociology, economics, health science, ecology, engineering and [[agriculture]].<ref>{{cite journal |last=Sadras |first=V. O. |last2=Bongiovanni |first2=R. |year=2004 |title=Use of Lorenz curves and Gini coefficients to assess yield inequality within paddocks |journal=Field Crops Research |volume=90 |issue=2–3 |pages=303–310 |doi=10.1016/j.fcr.2004.04.003 }}</ref> Other than income Gini coefficients, scholars have published education Gini coefficients and opportunity Gini coefficients. |

|||

;Gini coefficient of education |

|||

Education Gini index estimates the inequality in education for a given population.<ref>{{cite web|title=Measuring education inequality - Gini coefficients of education|author=Thomas, Wang, Fan|date=January 2001|publisher=The World Bank|url=http://www-wds.worldbank.org/servlet/WDSContentServer/WDSP/IB/2001/02/17/000094946_01020605310354/Rendered/PDF/multi_page.pdf}}</ref> It is used to discern trends in social development through educational attainment over time. From a study of 85 countries, Thomas et al estimate [[Mali]] had the highest education Gini index of 0.92 in 1990 (implying very high inequality in education attainment across the population), while the [[United States]] had the lowest education inequality Gini index of 0.14. Between 1960 and 1990, [[South Korea]], [[China]] and [[India]] had the fastest drop in education inequality Gini Index. They also claim education Gini index for the United States slightly increased over the 1980 - 1990 period. |

|||

;Gini coefficient of opportunity |

|||

Similar in concept to income Gini coefficient, opportunity Gini coefficient measures inequality of opportunity.<ref name=roemer06>{{cite web|title=ECONOMIC DEVELOPMENT AS OPPORTUNITY EQUALIZATION|author=John E. Roemer|date=September 2006|publisher=Yale University|url=http://ssrn.com/abstract=931479}}</ref><ref>{{cite journal|title=Generalized Gini Indices of Equality of Opportunity|author=John Weymark|journal=JOURNAL OF ECONOMIC INEQUALITY|volume=1|number=1|year=2003|pages=5-24|doi=10.1023/A:1023923807503}}</ref><ref>{{cite web|title=Measurement of Inequality in Human Development – A Review|author=Milorad Kovacevic|publisher=United Nations Development Program|date=November 2010|url=http://hdr.undp.org/en/reports/global/hdr2010/papers/HDRP_2010_35.pdf}}</ref> The concept builds on Amartya Sen's suggestion that inequality coefficients of social development should be premised on the process of enlarging people’s choices and enhancing their capabilities, rather than process of reducing income inequality. Kovacevic in a review of opportunity Gini coefficient explains that the coefficient estimates how well a society enables its citizens to achieve success in life where the success is based on a person’s choices, efforts and talents, not his background defined by a set of predetermined circumstances at birth, such as, gender, race, place of birth, family origins, and circumstances beyond the control of that individual. |

|||

Roemer<ref name=roemer06/> reports that in advanced economies, Italy and Spain exhibited the largest opportunity inequality Gini index. |

|||

==Features of Gini coefficient== |

==Features of Gini coefficient== |

||

Revision as of 17:30, 31 July 2012

The Gini coefficient (also known as the Gini index or Gini ratio) is a measure of statistical dispersion developed by the Italian statistician and sociologist Corrado Gini and published in his 1912 paper "Variability and Mutability" (Italian: Variabilità e mutabilità).[1][2]

The Gini coefficient measures the inequality among values of a frequency distribution (for example levels of income). A Gini coefficient of zero expresses perfect equality where all values are the same (for example, where everyone has an exactly equal income). A Gini coefficient of one (100 on the percentile scale) expresses maximal inequality among values (for example where only one person has all the income).[3]

It has found application in the study of inequalities in disciplines as diverse as sociology, economics, health science, ecology, chemistry, engineering and agriculture.[4]

Gini coefficient is commonly used as a measure of inequality of income or wealth.[5] For OECD countries, over 2008-2009 period, without considering the effect of taxes, income Gini coefficient ranged between 0.34 to 0.53, with South Korea the lowest and Italy the highest.[6] The countries in Africa had the highest pre-tax Gini coefficients in 2008-2009, with South Africa the world's highest at 0.7.[7][8] The global income inequality Gini coefficient in 2005, for all human beings taken together, has been estimated to be between 0.61 and 0.68 by various sources.[9][10]

Gini coefficient is a controversial measure of income inequality. Not only does its value depend on income inequality within a country, its value depends on other factors such as the demographic structure. Countries with an aging population, or with a baby boom, experience increasing pre-tax Gini coefficient even if real income distribution for working adults remain constant. Scholars have devised over a dozen methods to calculate Gini, each of which gives a different value.[11][12][13]

Definition

The graph shows that the Gini coefficient is equal to the area marked A divided by the sum of the areas marked A and B. that is, Gini = A / (A + B). It is also equal to 2 * A, as A + B = 0.5 (since the axes scale from 0 to 1).

The Gini coefficient is usually defined mathematically based on the Lorenz curve, which plots the proportion of the total income of the population (y axis) that is cumulatively earned by the bottom x% of the population (see diagram). The line at 45 degrees thus represents perfect equality of incomes. The Gini coefficient can then be thought of as the ratio of the area that lies between the line of equality and the Lorenz curve (marked A in the diagram) over the total area under the line of equality (marked A and B in the diagram); i.e., G = A / (A + B).

The Gini coefficient can theoretically range from 0 to 1; it is sometimes expressed as a percentage ranging between 0 and 100. In a finite population both extreme values are not quite reached.

A low Gini coefficient indicates a more equal distribution, with 0 corresponding to complete equality, while higher Gini coefficients indicate more unequal distribution, with 1 corresponding to complete inequality. To be validly computed, no negative goods can be distributed. Thus, if the Gini coefficient is being used to describe household income inequality, then no household can have a negative income. When used as a measure of income inequality, the most unequal society will be one in which a single person receives 100% of the total income and the remaining people receive none (G = 1); and the most equal society will be one in which every person receives the same income (G = 0).

An alternative approach would be to consider the Gini coefficient as half of the relative mean difference, which is a mathematical equivalence. The mean difference is the average absolute difference between two items selected randomly from a population, and the relative mean difference is the mean difference divided by the average, to normalize for scale.

Calculation

The Gini index is defined as a ratio of the areas on the Lorenz curve diagram. If the area between the line of perfect equality and the Lorenz curve is A, and the area under the Lorenz curve is B, then the Gini index is A / (A + B). Since A + B = 0.5, the Gini index, G = 2 A = 1 - 2 B. If the Lorenz curve is represented by the function Y = L (X), the value of B can be found with integration and:

In some cases, this equation can be applied to calculate the Gini coefficient without direct reference to the Lorenz curve. For example:

- For a population uniform on the values yi, i = 1 to n, indexed in non-decreasing order (yi ≤ yi+1):

- This may be simplified to:

- For a discrete probability function f(y), where yi, i = 1 to n, are the points with nonzero probabilities and which are indexed in increasing order (yi < yi+1):

- where

- and

- For a cumulative distribution function F(y) that is piecewise differentiable, has a mean μ, and is zero for all negative values of y:

- Since the Gini coefficient is half the relative mean difference, it can also be calculated using formulas for the relative mean difference. For a random sample S consisting of values yi, i = 1 to n, that are indexed in non-decreasing order (yi ≤ yi+1), the statistic:

- is a consistent estimator of the population Gini coefficient, but is not, in general, unbiased. Like G, G (S) has a simpler form:

- .

There does not exist a sample statistic that is in general an unbiased estimator of the population Gini coefficient, like the relative mean difference.

For some functional forms, the Gini index can be calculated explicitly. For example, if y follows a lognormal distribution with the standard deviation of logs equal to , then where is the cumulative distribution function of the standard normal distribution.

Sometimes the entire Lorenz curve is not known, and only values at certain intervals are given. In that case, the Gini coefficient can be approximated by using various techniques for interpolating the missing values of the Lorenz curve. If (Xk, Yk) are the known points on the Lorenz curve, with the Xk indexed in increasing order (Xk - 1 < Xk), so that:

- Xk is the cumulated proportion of the population variable, for k = 0,...,n, with X0 = 0, Xn = 1.

- Yk is the cumulated proportion of the income variable, for k = 0,...,n, with Y0 = 0, Yn = 1.

- Yk should be indexed in non-decreasing order (Yk > Yk - 1)

If the Lorenz curve is approximated on each interval as a line between consecutive points, then the area B can be approximated with trapezoids and:

is the resulting approximation for G. More accurate results can be obtained using other methods to approximate the area B, such as approximating the Lorenz curve with a quadratic function across pairs of intervals, or building an appropriately smooth approximation to the underlying distribution function that matches the known data. If the population mean and boundary values for each interval are also known, these can also often be used to improve the accuracy of the approximation.

The Gini coefficient calculated from a sample is a statistic and its standard error, or confidence intervals for the population Gini coefficient, should be reported. These can be calculated using bootstrap techniques but those proposed have been mathematically complicated and computationally onerous even in an era of fast computers. Ogwang (2000) made the process more efficient by setting up a “trick regression model” in which the incomes in the sample are ranked with the lowest income being allocated rank 1. The model then expresses the rank (dependent variable) as the sum of a constant A and a normal error term whose variance is inversely proportional to yk;

Ogwang showed that G can be expressed as a function of the weighted least squares estimate of the constant A and that this can be used to speed up the calculation of the jackknife estimate for the standard error. Giles (2004) argued that the standard error of the estimate of A can be used to derive that of the estimate of G directly without using a jackknife at all. This method only requires the use of ordinary least squares regression after ordering the sample data. The results compare favorably with the estimates from the jackknife with agreement improving with increasing sample size. The paper describing this method can be found here: http://web.uvic.ca/econ/ewp0202.pdf

However it has since been argued that this is dependent on the model’s assumptions about the error distributions (Ogwang 2004) and the independence of error terms (Reza & Gastwirth 2006) and that these assumptions are often not valid for real data sets. It may therefore be better to stick with jackknife methods such as those proposed by Yitzhaki (1991) and Karagiannis and Kovacevic (2000). The debate continues.

The Gini coefficient can be calculated if you know the mean of a distribution, the number of people (or percentiles), and the income of each person (or percentile). Princeton development economist Angus Deaton (1997, 139) simplified the Gini calculation to one easy formula:

where u is mean income of the population, Pi is the income rank P of person i, with income X, such that the richest person receives a rank of 1 and the poorest a rank of N. This effectively gives higher weight to poorer people in the income distribution, which allows the Gini to meet the Transfer Principle. Note that the Deaton formulation rescales the coefficient so that its upper bound is always 1.

Gini coefficients of representative income distributions

| Income Distribution Function | Gini Coefficient |

|---|---|

| y = 1 for all x | 0.0 |

| y = log(x) | 0.130 |

| y = x⅓ | 0.138 |

| y = x½ | 0.194 |

| y = x + b (b = 10% of max income) | 0.273 |

| y = x + b (b = 5% of max income) | 0.297 |

| y = x | 0.327 |

| y = x2 | 0.493 |

| y = x3 | 0.592 |

| y = 2x | 0.960 |

Given the normalization of both the cumulative population and the cumulative share of income used to calculate the GINI coefficient, the measure is not overly sensitive to the specifics of the income distribution, but rather only on how incomes vary relative to the other members of a population. The exception to this is in the redistribution of wealth resulting in a minimum income for all people. When the population is sorted, if their income distribution were to approximate a well known function, than some representative values could be calculated. Some representative values of the Gini coefficient for income distributions approximated by some simple functions are tabulated below.

While the income distribution of any particular country need not follow such simple functions, these functions give a qualitative understanding of the income distribution in a nation given the Gini coefficient. The effects of minimum income policy due to redistribution can be seen in the linear relationships above.

Generalized inequality index

The Gini coefficient and other standard inequality indices reduce to a common form. Perfect equality—the absence of inequality—exists when and only when the inequality ratio, , equals 1 for all j units in some population; for example, there is perfect income equality when everyone’s income equals the mean income , so that for everyone). Measures of inequality, then, are measures of the average deviations of the from 1; the greater the average deviation, the greater the inequality. Based on these observations the inequality indices have this common form:[14]

where pj weights the units by their population share, and f(rj) is a function of the deviation of each unit’s rj from 1, the point of equality. The insight of this generalised inequality index is that inequality indices differ because they employ different functions of the distance of the inequality ratios (the rj) from 1.

Gini coefficient of income distributions

Gini coefficients of income are calculated on market income as well as disposable income basis. The Gini coefficient on market income - sometimes referred to as pre-tax Gini index - is calculated on income before taxes and transfers, and it measures inequality in income without considering the effect of taxes and social spending already in place in a country. The Gini coefficient on disposable income - sometimes referred to as after-tax Gini index - is calculated on income after taxes and transfers, and it measures inequality in income after considering the effect of taxes and social spending already in place in a country.[6][15][16]

The difference in Gini indices between OECD countries, on after-taxes and transfers basis, is significantly narrower.[16] For OECD countries, over 2008-2009 period, Gini coefficient on pre-taxes and transfers basis for total population ranged between 0.34 to 0.53, with South Korea the lowest and Italy the highest. Gini coefficient on after-taxes and transfers basis for total population ranged between 0.25 to 0.48, with Denmark the lowest and Mexico the highest. For United States, the country with the largest population in OECD countries, the pre-tax Gini index was 0.49, and after-tax Gini index was 0.38, in 2008-2009. The OECD averages for total population in OECD countries was 0.46 for pre-tax income Gini index and 0.31 for after-tax income Gini Index.[6][17] Taxes and social spending that were in place in 2008-2009 period in OECD countries significantly lowered effective income inequality.[18]

Using the Gini can help quantify differences in welfare and compensation policies and philosophies. However it should be borne in mind that the Gini coefficient can be misleading when used to make political comparisons between large and small countries or those with different immigration policies (see criticisms section).

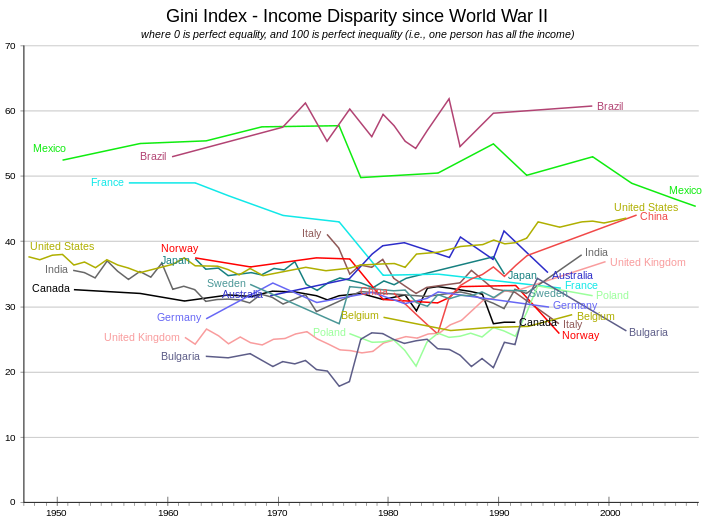

The Gini index for the entire world has been estimated by various parties to be between 0.61 and 0.68.[10][9][19] The graph shows the values expressed as a percentage, in their historical development for a number of countries.

US income Gini indices over time

Taxes and social spending in most countries have significant moderating effect on income inequality Gini indices. | |||||||||

The table below presents the Gini indices for household income, without including the effect of taxes and transfers, for the United States at various times, according to the US Census Bureau.[20][21][22] The Gini values are a national composite, with significant variations in Gini between the states. The states of Utah, Alaska and Wyoming have a pre-tax income inequality Gini coefficient that is 10% lower than the U.S. average, while Washington D.C. and Puerto Rico 10% higher. After including the effects of federal and state taxes, the U.S. Federal Reserve estimates 34 states in the USA have a Gini coefficient between 0.30 and 0.35, with the state of Maine the lowest.[23] At the county and municipality levels, the pre-tax Gini index ranged from 0.21 to 0.65 in 2010 across the United States, according to Census Bureau estimates.[24]

| Year | pre-tax Gini | Comments |

|---|---|---|

| 1947 | 0.413 | (estimated) |

| 1967 | 0.397 | (first year reported) |

| 1967 | 0.397 | (first year reported) |

| 1968 | 0.386 | |

| 1970 | 0.394 | |

| 1980 | 0.403 | |

| 1990 | 0.428 | |

| 2000 | 0.462 | |

| 2005 | 0.469 | |

| 2006 | 0.470 | |

| 2007 | 0.463 | |

| 2008 | 0.467 | |

| 2009 | 0.468 |

Regional income Gini indices

According to UNICEF, Latin America and the Caribbean region had the highest net income Gini index in the world at 48.3, on unweighted average basis in 2008. The remaining regional averages were: sub-Saharan Africa (44.2), Asia (40.4), Middle East and North Africa (39.2), Eastern Europe and Central Asia (35.4), and High-income Countries (30.9). Using the same method, the United States is claimed to have a Gini index of 36, while South Africa the highest income Gini index score of 67.8.[25]

World income Gini index since 1800s

The table below presents the estimated world income Gini index over the last 200 years, as calculated by Milanovic. Taking income distribution of all human beings, the worldwide income inequality has been constantly increasing since the early 19th century. There was a steady increase in global income inequality Gini score from 1820 to 2002, with a significant increase between 1980 and 2002. This trend appears to have peaked and begun a reversal with rapid economic growth in emerging economies, particularly in the large populations of BRIC countries.

| Year | World Gini index[25][9] |

|---|---|

| 1820 | 0.43 |

| 1850 | 0.53 |

| 1870 | 0.56 |

| 1913 | 0.61 |

| 1929 | 0.62 |

| 1950 | 0.64 |

| 1960 | 0.64 |

| 1980 | 0.66 |

| 2002 | 0.71 |

| 2005 | 0.68 |

Gini coefficients of social development

Gini coefficiently is widely used in fields as diverse as sociology, economics, health science, ecology, engineering and agriculture.[26] Other than income Gini coefficients, scholars have published education Gini coefficients and opportunity Gini coefficients.

- Gini coefficient of education

Education Gini index estimates the inequality in education for a given population.[27] It is used to discern trends in social development through educational attainment over time. From a study of 85 countries, Thomas et al estimate Mali had the highest education Gini index of 0.92 in 1990 (implying very high inequality in education attainment across the population), while the United States had the lowest education inequality Gini index of 0.14. Between 1960 and 1990, South Korea, China and India had the fastest drop in education inequality Gini Index. They also claim education Gini index for the United States slightly increased over the 1980 - 1990 period.

- Gini coefficient of opportunity

Similar in concept to income Gini coefficient, opportunity Gini coefficient measures inequality of opportunity.[28][29][30] The concept builds on Amartya Sen's suggestion that inequality coefficients of social development should be premised on the process of enlarging people’s choices and enhancing their capabilities, rather than process of reducing income inequality. Kovacevic in a review of opportunity Gini coefficient explains that the coefficient estimates how well a society enables its citizens to achieve success in life where the success is based on a person’s choices, efforts and talents, not his background defined by a set of predetermined circumstances at birth, such as, gender, race, place of birth, family origins, and circumstances beyond the control of that individual.

Roemer[28] reports that in advanced economies, Italy and Spain exhibited the largest opportunity inequality Gini index.

Features of Gini coefficient

Gini coefficient has features that make it useful as a measure of dispersion in a population, and inequalities in particular.[31] It is a ratio analysis method making it easier to interpret. It also avoids references to a statistical average or position unrepresentative of most of the population, such as per capita income or gross domestic product. For a given time interval, Gini coefficient can therefore be used to compare diverse countries and different regions or groups within a country; for example states, counties, urban versus rural areas, gender and ethnic groups. Gini coefficients can be used to compare income distribution over time, thus it is possible to see if inequality is increasing or decreasing independent of absolute incomes.

Other useful features of Gini coefficient include:[32][33][34]

- Anonymity: it does not matter who the high and low earners are.

- Scale independence: the Gini coefficient does not consider the size of the economy, the way it is measured, or whether it is a rich or poor country on average.

- Population independence: it does not matter how large the population of the country is.

- Transfer principle: if income (less than the difference), is transferred from a rich person to a poor person the resulting distribution is more equal.

Limitations of Gini coefficient

This section possibly contains original research. (December 2010) |

This section is in a state of significant expansion or restructuring. You are welcome to assist in its construction by editing it as well. If this section has not been edited in several days, please remove this template. If you are the editor who added this template and you are actively editing, please be sure to replace this template with {{in use}} during the active editing session. Click on the link for template parameters to use.

This article was last edited by ApostleVonColorado (talk | contribs) 11 years ago. (Update timer) |

Contributor note: this section needs a rewrite/split, and references from reliable sources etc. per wiki MOS, to address original research tag from December 2010 |

Income Gini coefficient is inherently limited because of its relative nature. Its proper use and interpretation of income Gini coefficient is controversial.[35][36][37] As example, Mellor explains, Gini index of developing countries can rise, that is the income distribution get more unequal at the same time that the numbers of people in absolute poverty are reduced substantially. Kwok claims income inequality implied by Gini coefficients over time is misleading because Gini ignores structural changes in a society, changes such as growing population (baby boom, elderly population households, increased divorces, extended family households splitting into nuclear families), population changes from emigration, immigration and income mobility. Gini coefficient is simple, and this simplicity encourages misunderstandings. The simplicity can confuse comparison of two different populations; for example, while both Bangladesh with per capita income of $1,693 and Netherlands with per capita income of $42,183 had an income Gini index of 0.31 in 2010,[38] it does not mean the quality of life, economic opportunities and income equality are same for Bangladesh and Netherlands. Countries may have identical Gini coefficients, but differ greatly in wealth. Basic necessities may be equal and available to all in a developed economy population, while in an undeveloped economy with same Gini coefficient, even basic necessities are unequally available.

| Household number |

Country A Annual Income ($) |

Country B Annual Income ($) |

|---|---|---|

| 1 | 20,000 | 9,000 |

| 2 | 30,000 | 40,000 |

| 3 | 40,000 | 48,000 |

| 4 | 50,000 | 48,000 |

| 5 | 60,000 | 55,000 |

| Total Income | $200,000 | $200,000 |

| Country's Gini | 0.2 | 0.2 |

- Income inequality, yet same Gini

Even when the total income of a population is same, in certain situations two countries with very different income distributions can have the same Gini index (e.g. cases when income Lorenz Curves cross).[31] The table below illustrates one such situation. Both countries have a Gini index of 0.2, but the income distributions are very different. As another example, a less equal society EE where bottom 50% of individuals had no income and the other 50% shared all the income equally has a Gini coefficient of 0.5; a more equal society FF where bottom 75% of people equally shared 25% of income while the top 25% equally shared 75% also has a Gini index of 0.5. Economies with similar incomes and Gini coefficients can still have very different income distributions. Bellù and Liberati comparing that ranking income inequality between two different populations with same or different Gini indices is sometimes not possible, or misleading.

- Extreme wealth inequality, yet low income Gini coefficient

Gini index loses information about absolute national and personal incomes. Populations can have very low income inequality Gini indices yet simultaneously very high wealth Gini index. By measuring inequality in income, the Gini ignores the differential efficiency of use of household income. By ignoring wealth (except as it contributes to income) the Gini can create the appearance of inequality when the people compared are at different stages in their life. Wealthy countries such as Sweden can show a low Gini coefficient for disposal income of 0.31 thereby appearing equal, yet have very high Gini coefficient for wealth of 0.79 to 0.86 thereby suggesting an extremely unequal wealth distribution in its society.[39][40] These factors are not assessed in income-based Gini.

- Small sample bias - sparsely populated regions more likely to have low Gini coefficient

Gini index has a downward-bias for small populations.[41] Counties or states or countries with small populations and less diverse economies will tend to report small Gini coefficients. For economically diverse large population groups, a much higher coefficient is expected than for each of its regions. Taking world economy as one, and income distribution for all human beings, for example, different scholars estimate global Gini index to range between 0.61 and 0.68.[9][10]

- Same population with same income, analyzed differently, yields different Gini coefficients

Too often only the Gini coefficient is quoted without describing the proportions of the quintiles used for measurement. As with other inequality coefficients, the Gini coefficient is influenced by the granularity of the measurements. For example, five 20% quantiles (low granularity) will usually yield a lower Gini coefficient than twenty 5% quantiles (high granularity) taken from the same distribution. This is an often encountered problem with measurements.

Gini has some mathematical limitations as well. It is not additive and different sets of people cannot be averaged to obtain the Gini coefficient of all the people in the sets.

Care should be taken in using the Gini coefficient as a measure of egalitarianism, as it is properly a measure of income dispersion. For example, if two equally egalitarian countries pursue different immigration policies, the country accepting a higher proportion of low-income or impoverished migrants will be assessed as less equal (gain a higher Gini coefficient).

- Gini coefficient is unable to discern the effects of structural changes in populations[36]

Expanding on the importance of life-span measures, the Gini coefficient as a point-estimate of equality at a certain time, ignores life-span changes in income. Typically, increases in the proportion of young or old members of a society will drive apparent changes in equality, simply because people generally have lower incomes and wealth when they are young than when they are old. Because of this, factors such as age distribution within a population and mobility within income classes can create the appearance of differential equality when none exist taking into account demographic effects. Thus a given economy may have a higher Gini coefficient at any one point in time compared to another, while the Gini coefficient calculated over individuals' lifetime income is actually lower than the apparently more equal (at a given point in time) economy's.[13] Essentially, what matters is not just inequality in any particular year, but the composition of the distribution over time.

General problems of measurement

- Comparing income distributions among countries may be difficult because benefits systems may differ. For example, some countries give benefits in the form of money while others give food stamps, which might not be counted by some economists and researchers as income in the Lorenz curve and therefore not taken into account in the Gini coefficient. The Soviet Union was measured to have relatively high income inequality: by some estimates, in the late 1970s, Gini coefficient of its urban population was as high as 0.38,[42] which is higher than many Western countries today. This number would not reflect those benefits received by Soviet citizens that were not monetized for measurement, which may include child care for children as young as two months, elementary, secondary and higher education, cradle-to-grave medical care, and heavily subsidized or provided housing. In this example, a more accurate comparison between the 1970s Soviet Union and Western countries may require one to assign monetary values to all benefits – a difficult task in the absence of free markets. Similar problems arise whenever a comparison between more liberalized economies and partially socialist economies is attempted. Benefits may take various and unexpected forms: for example, major oil producers such as Venezuela and Iran provide indirect benefits to its citizens by subsidizing the retail price of gasoline.

- Similarly, in some societies people may have significant income in other forms than money, for example through subsistence farming or bartering. Like non-monetary benefits, the value of these incomes is difficult to quantify. Different quantifications of these incomes will yield different Gini coefficients.

- The measure will give different results when applied to individuals instead of households. When different populations are not measured with consistent definitions, comparison is not meaningful.

- As for all statistics, there may be systematic and random errors in the data. The meaning of the Gini coefficient decreases as the data become less accurate. Also, countries may collect data differently, making it difficult to compare statistics between countries.

As one result of this criticism, in addition to or in competition with the Gini coefficient entropy measures are frequently used (e.g. the Theil Index and the Atkinson index). These measures attempt to compare the distribution of resources by intelligent agents in the market with a maximum entropy random distribution, which would occur if these agents acted like non-intelligent particles in a closed system following the laws of statistical physics.

Credit risk

The Gini coefficient is also commonly used for the measurement of the discriminatory power of rating systems in credit risk management.

The discriminatory power refers to a credit risk model's ability to differentiate between defaulting and non-defaulting clients. The above formula may be used for the final model and also at individual model factor level, to quantify the discriminatory power of individual factors. This is as a result of too many non defaulting clients falling into the lower points scale e.g. factor has a 10 point scale and 30% of non defaulting clients are being assigned the lowest points available e.g. 0 or negative points. This indicates that the factor is behaving in a counter-intuitive manner and would require further investigation at the model development stage.[43]

Relation to other statistical measures

Gini coefficient closely related to the AUC (Area Under receiver operating characteristic Curve) measure of performance[44]. The relation follows the formula . Gini coefficient is also closely related to Mann–Whitney U.

Other uses

Although the Gini coefficient is most popular in economics, it can in theory be applied in any field of science that studies a distribution. For example, in ecology the Gini coefficient has been used as a measure of biodiversity, where the cumulative proportion of species is plotted against cumulative proportion of individuals.[45] In health, it has been used as a measure of the inequality of health related quality of life in a population.[46] In education, it has been used as a measure of the inequality of universities.[47] In chemistry it has been used to express the selectivity of protein kinase inhibitors against a panel of kinases.[48] In engineering, it has been used to evaluate the fairness achieved by Internet routers in scheduling packet transmissions from different flows of traffic.[49] In statistics, building decision trees, it is used to measure the purity of possible child nodes, with the aim of maximising the average purity of two child nodes when splitting, and it has been compared with other equality measures.[50]

See also

|

|

References

- ^ Gini, C. (1912) (Italian: Variabilità e mutabilità (Variability and Mutability), C. Cuppini, Bologna, 156 pages. Reprinted in Memorie di metodologica statistica (Ed. Pizetti E, Salvemini, T). Rome: Libreria Eredi Virgilio Veschi (1955).

- ^ Gini, C (1909) Concentration and dependency ratios (in Italian). English translation in Rivista di Politica Economica, 87 (1997), 769-789.

- ^ "Current Population Survey (CPS) - Definitions and Explanations". US Census Bureau.

- ^ Sadras, V. O.; Bongiovanni, R. (2004). "Use of Lorenz curves and Gini coefficients to assess yield inequality within paddocks". Field Crops Research. 90 (2–3): 303–310. doi:10.1016/j.fcr.2004.04.003.

- ^ Gini, C. (1936) On the Measure of Concentration with Special Reference to Income and Statistics, Colorado College Publication, General Series No. 208, 73-79.

- ^ a b c d "Income distribution - Inequality : Income distribution - Inequality - Country tables". OECD. 2012.

- ^ "South Africa Overview". The World Bank. 2011.

- ^ Ali, Mwabu and Gesami (March 2002). "Poverty reduction in Africa: Challenges and policy options" (PDF). African Economic Research Consortium, Nairobi.

- ^ a b c d Evan Hillebrand (June 2009). "POVERTY, GROWTH, AND INEQUALITY OVER THE NEXT 50 YEARS" (PDF). FAO, United Nations - Economic and Social Development Department.

- ^ a b c "The Real Wealth of Nations: Pathways to Human Development, 2010" (PDF). United Nations Development Program. 2011. p. 72-74. ISBN 9780230284456.

- ^ Shlomo Yitzhaki (1998). "More than a Dozen Alternative Ways of Spelling Gini" (PDF). Economic Inequality. 8: 13–30.

- ^ Myung Jae Sung (August 2010). "Population Aging, Mobility of Quarterly Incomes, and Annual Income Inequality: Theoretical Discussion and Empirical Findings".

{{cite journal}}: Cite journal requires|journal=(help) - ^ a b Blomquist, N. (1981). "A comparison of distributions of annual and lifetime income: Sweden around 1970". Review of Income and Wealth. 27 (3): 243–264. doi:10.1111/j.1475-4991.1981.tb00227.x.

- ^ Firebaugh, Glenn (1999). "Empirics of World Income Inequality". American Journal of Sociology. 104 (6): 1597–1630. doi:10.1086/210218.. See also Firebaugh, Glenn (2003). "Inequality: What it is and how it is measured". The New Geography of Global Income Inequality. Cambridge, MA: Harvard University Press. ISBN 0-674-01067-1.

{{cite book}}: Unknown parameter|authormask=ignored (|author-mask=suggested) (help) - ^ N. C. Kakwani (April 1977). "Applications of Lorenz Curves in Economic Analysis". Econometrica. 45 (3): 719–728. JSTOR 1911684.

- ^ a b Chu, Davoodi, Gupta (March 2000). "Income Distribution and Tax and Government Social Spending Policies in Developing Countries" (PDF). International Monetary Fund.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ "Monitoring quality of life in Europe - Gini index". Eurofound. 26 August 2009.

- ^ Chen Wang, Koen Caminada, and Kees Goudswaard (July–September 2012). "The redistributive effect of social transfer programmes and taxes: A decomposition across countries". International Social Security Review. 65: 27–48. doi:10.1111/j.1468-246X.2012.01435.x.

{{cite journal}}: Unknown parameter|Issue=ignored (|issue=suggested) (help)CS1 maint: multiple names: authors list (link) - ^ Bob Sutcliffe (2007). "Postscript to the article 'World inequality and globalization' (Oxford Review of Economic Policy, Spring 2004)" (PDF). Retrieved 13 December 2007.

{{cite web}}: Unknown parameter|month=ignored (help) - ^ "A brief look at post-war U.S. Income Inequality" (PDF). United States Census Bureau. 1996.

- ^ "Table 3. Income Distribution Measures Using Money Income and Equivalence-Adjusted Income: 2007 and 2008" (PDF). Income, Poverty, and Health Insurance Coverage in the United States: 2008. United States Census Bureau. p. 17.

- ^ "Income, Poverty and Health Insurance Coverage in the United States: 2009". Newsroom. United States Census Bureau.

- ^ Daniel H. Cooper, Byron F. Lutz, and Michael G. Palumbo (September 22 2011). "Quantifying the Role of Federal and State Taxes in Mitigating Income Inequality" (PDF). Federal Reserve, Boston, United States.

{{cite web}}: Check date values in:|date=(help)CS1 maint: multiple names: authors list (link) - ^ Adam Bee (February 2012). "Household Income Inequality Within U.S. Counties: 2006–2010" (PDF). Census Bureau, U.S. Department of Commerce.

- ^ a b Isabel Ortiz and Matthew Cummins (April 2011). "GLOBAL INEQUALITY: BEYOND THE BOTTOM BILLION" (PDF). UNICEF.

- ^ Sadras, V. O.; Bongiovanni, R. (2004). "Use of Lorenz curves and Gini coefficients to assess yield inequality within paddocks". Field Crops Research. 90 (2–3): 303–310. doi:10.1016/j.fcr.2004.04.003.

- ^ Thomas, Wang, Fan (January 2001). "Measuring education inequality - Gini coefficients of education" (PDF). The World Bank.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ a b John E. Roemer (September 2006). "ECONOMIC DEVELOPMENT AS OPPORTUNITY EQUALIZATION". Yale University.

- ^ John Weymark (2003). "Generalized Gini Indices of Equality of Opportunity". JOURNAL OF ECONOMIC INEQUALITY. 1 (1): 5–24. doi:10.1023/A:1023923807503.

- ^ Milorad Kovacevic (November 2010). "Measurement of Inequality in Human Development – A Review" (PDF). United Nations Development Program.

- ^ a b c Lorenzo Giovanni Bellù and Paolo Liberati (2006). "Inequality Analysis - The Gini Index" (PDF). Food and Agriculture Organization, United Nations.

- ^ Julie A. Litchfield (March 1999). "Inequality: Methods and Tools" (PDF). The World Bank.

- ^ Stefan V. Stefanescu (2009). "Measurement of the Bipolarization Events". World Academy of Science, Engineering and Technology. 57: 929–936.

- ^ Ray, Debraj (1998). Development Economics. Princeton, NJ: Princeton University Press. p. 188. ISBN 0-691-01706-9.

- ^ John W. Mellor (June 2 1989). "Dramatic Poverty Reduction in the Third World: Prospects and Needed Action" (PDF). International Food Policy Research Institute.

{{cite journal}}: Check date values in:|date=(help); Cite journal requires|journal=(help) - ^ a b KWOK Kwok Chuen (2010). "Income Distribution of Hong Kong and the Gini Coefficient" (PDF). The Government of Hong Kong, China.

- ^ Thomas Garrett (Spring 2010). "U.S. Income Inequality: It's Not So Bad" (PDF). Inside the Vault. 14 (1). U.S. Federal Reserve, St Louis.

{{cite journal}}: line feed character in|title=at position 26 (help) - ^ "The Real Wealth of Nations: Pathways to Human Development (2010 Human Development Report - see Stat Tables)". United Nations Development Program. 2011. pp. 152–156.

- ^ Domeij and Floden (2010). "Inequality Trends in Sweden 1978-2004". Review of Economic Dynamics. 13 (1): 179–208. doi:10.1016/j.red.2009.10.005.

- ^ Domeij and Klein (January 2000). "Accounting for Swedish wealth inequality" (PDF).

- ^ George Deltas (February 2003). "The Small-Sample Bias of the Gini Coefficient: Results and Implications for Empirical Research". The Review of Economics and Statistics. 85 (1): 226–234. doi:10.1162/rest.2003.85.1.226.

- ^ Millar, James R. (1987). Politics, work, and daily life in the USSR. New York: Cambridge University Press. p. 193. ISBN 0-521-34890-0.

- ^ The Analytics of risk model validation [specify]

- ^ Hand, David J. (2001). "A Simple Generalisation of the Area Under the ROC Curve for Multiple Class Classification Problems". Machine Learning. 45 (2): 171–186. doi:10.1023/A:1010920819831.

{{cite journal}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ Wittebolle, Lieven (2009). "Initial community evenness favours functionality under selective stress". Nature. 458 (7238): 623–626. doi:10.1038/nature07840. PMID 19270679.

{{cite journal}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ Asada, Yukiko (2005). "Assessment of the health of Americans: the average health-related quality of life and its inequality across individuals and groups". Population Health Metrics. 3: 7. doi:10.1186/1478-7954-3-7. PMC 1192818. PMID 16014174.

{{cite journal}}: CS1 maint: unflagged free DOI (link) - ^ Halffman, Willem; Leydesdorff, L (2010). "Is Inequality Among Universities Increasing? Gini Coefficients and the Elusive Rise of Elite Universities". Minerva. 48 (1): 55–72. doi:10.1007/s11024-010-9141-3. PMC 2850525. PMID 20401157.

- ^ Graczyk, Piotr (2007). "Gini Coefficient: A New Way To Express Selectivity of Kinase Inhibitors against a Family of Kinases". Journal of Medicinal Chemistry. 50 (23): 5773–5779. doi:10.1021/jm070562u. PMID 17948979.

- ^ Shi, Hongyuan; Sethu, Harish (2003). "Greedy Fair Queueing: A Goal-Oriented Strategy for Fair Real-Time Packet Scheduling". Proceedings of the 24th IEEE Real-Time Systems Symposium. IEEE Computer Society. pp. 345–356. ISBN 0-7695-2044-8.

- ^ Gonzalez, Luis (2010). "The Similarity between the Square of the Coeficient of Variation and the Gini Index of a General Random Variable". Journal of Quantitative Methods for Economics and Business Administration. 10: 5–18. ISSN 1886-516X.

{{cite journal}}: Unknown parameter|coauthors=ignored (|author=suggested) (help)

Further reading

- Amiel, Y.; Cowell, F.A. (1999). Thinking about Inequality. Cambridge. ISBN 0-521-46696-2.

{{cite book}}: CS1 maint: multiple names: authors list (link) - Anand, Sudhir (1983). Inequality and Poverty in Malaysia. New York: Oxford University Press. ISBN 0-19-520153-1.

- Brown, Malcolm (1994). "Using Gini-Style Indices to Evaluate the Spatial Patterns of Health Practitioners: Theoretical Considerations and an Application Based on Alberta Data". Social Science Medicine. 38 (9): 1243–1256. doi:10.1016/0277-9536(94)90189-9. PMID 8016689.

- Chakravarty, S. R. (1990). Ethical Social Index Numbers. New York: Springer-Verlag. ISBN 0-387-52274-3.

- Deaton, Angus (1997). Analysis of Household Surveys. Baltimore MD: Johns Hopkins University Press. ISBN 0-585-23787-5.

- Dixon, PM, Weiner J., Mitchell-Olds T, Woodley R. (1987). "Bootstrapping the Gini coefficient of inequality". Ecology. 68 (5). Ecological Society of America: 1548–1551. doi:10.2307/1939238. JSTOR 1939238.

{{cite journal}}: CS1 maint: multiple names: authors list (link) - Dorfman, Robert (1979). "A Formula for the Gini Coefficient". The Review of Economics and Statistics. 61 (1). The MIT Press: 146–149. doi:10.2307/1924845. JSTOR 1924845.

- Firebaugh, Glenn (2003). The New Geography of Global Income Inequality. Cambridge MA: Harvard University Press. ISBN 0-674-01067-1.

- Gastwirth, Joseph L. (1972). "The Estimation of the Lorenz Curve and Gini Index". The Review of Economics and Statistics. 54 (3). The MIT Press: 306–316. doi:10.2307/1937992. JSTOR 1937992.

- Giles, David (2004). "Calculating a Standard Error for the Gini Coefficient: Some Further Results". Oxford Bulletin of Economics and Statistics. 66 (3): 425–433. doi:10.1111/j.1468-0084.2004.00086.x.

- Gini, Corrado (1912). "Variabilità e mutabilità" Reprinted in Memorie di metodologica statistica (Ed. Pizetti E, Salvemini, T). Rome: Libreria Eredi Virgilio Veschi (1955).

- Gini, Corrado (1921). "Measurement of Inequality of Incomes". The Economic Journal. 31 (121). Blackwell Publishing: 124–126. doi:10.2307/2223319. JSTOR 2223319.

- Giorgi, G. M. (1990). A bibliographic portrait of the Gini ratio, Metron, 48, 183-231.

- Karagiannis, E. and Kovacevic, M. (2000). "A Method to Calculate the Jackknife Variance Estimator for the Gini Coefficient". Oxford Bulletin of Economics and Statistics. 62: 119–122. doi:10.1111/1468-0084.00163.

{{cite journal}}: CS1 maint: multiple names: authors list (link) - Mills, Jeffrey A.; Zandvakili, Sourushe (1997). "Statistical Inference via Bootstrapping for Measures of Inequality". Journal of Applied Econometrics. 12 (2): 133–150. doi:10.1002/(SICI)1099-1255(199703)12:2<133::AID-JAE433>3.0.CO;2-H.

{{cite journal}}: CS1 maint: multiple names: authors list (link) - Modarres, Reza and Gastwirth, Joseph L. (2006). "A Cautionary Note on Estimating the Standard Error of the Gini Index of Inequality". Oxford Bulletin of Economics and Statistics. 68 (3): 385–390. doi:10.1111/j.1468-0084.2006.00167.x.

{{cite journal}}: CS1 maint: multiple names: authors list (link) - Morgan, James (1962). "The Anatomy of Income Distribution". The Review of Economics and Statistics. 44 (3). The MIT Press: 270–283. doi:10.2307/1926398. JSTOR 1926398.

- Ogwang, Tomson (2000). "A Convenient Method of Computing the Gini Index and its Standard Error". Oxford Bulletin of Economics and Statistics. 62: 123–129. doi:10.1111/1468-0084.00164.

- Ogwang, Tomson (2004). "Calculating a Standard Error for the Gini Coefficient: Some Further Results: Reply". Oxford Bulletin of Economics and Statistics. 66 (3): 435–437. doi:10.1111/j.1468-0084.2004.00087.x.

- Xu, Kuan (January 2004). "How Has the Literature on Gini's Index Evolved in the Past 80 Years?" (PDF). Department of Economics, Dalhousie University. Retrieved 1 June 2006.

{{cite journal}}: Cite journal requires|journal=(help) The Chinese version of this paper appears in Xu, Kuan (2003). "How Has the Literature on Gini's Index Evolved in the Past 80 Years?". China Economic Quarterly. 2: 757–778. - Yitzhaki, S. (1991). "Calculating Jackknife Variance Estimators for Parameters of the Gini Method". Journal of Business and Economic Statistics. 9 (2). American Statistical Association: 235–239. doi:10.2307/1391792. JSTOR 1391792.

External links

- Deutsche Bundesbank: Do banks diversify loan portfolios?, 2005 (on using e.g. the Gini coefficient for risk evaluation of loan portfolios)

- Forbes Article, In praise of inequality

- Measuring Software Project Risk With The Gini Coefficient, an application of the Gini coefficient to software

- The World Bank: Measuring Inequality

- Travis Hale, University of Texas Inequality Project:The Theoretical Basics of Popular Inequality Measures, online computation of examples: 1A, 1B

- Article from The Guardian analysing inequality in the UK 1974 - 2006

- World Income Inequality Database

- Income Distribution and Poverty in OECD Countries