Australian property bubble

The Australian property bubble is the economic theory that the Australian property market has become or is becoming significantly overpriced and due for a significant downturn (also called a correction or collapse). Since the early 2010s, various commentators, including one Treasury official,[1] have claimed the Australian property market is in a significant bubble.

Various industry professionals have argued that it is not a bubble and that house prices have the potential to keep rising in line with income growth. The RBA believe that most of the recent rise in property prices since the 1980s, when interest rates have decreased from medium term record highs to record lows, as a transmission mechanism to generate the wealth effect and stimulate the economy.[2]

A property bubble is a form of economic bubble normally characterised by a rapid increase in market prices of real property until they reach unsustainable levels relative to incomes and rents, and then decline. Australian house prices rose strongly relative to incomes and rents during the late 1990s and early 2000s; however, from 2003 to 2012 the price to income ratio and price to rent ratio both remained fairly steady, with house prices tracking income and rent growth during that decade. Since 2012 prices have once again risen strongly relative to incomes and rents.[3] In June 2014, the International Monetary Fund (IMF) reported that house prices in several developed countries are "well above the historical averages" and that Australia had the third highest house price-to-income ratio in the world.[4] In June 2016, the Organisation for Economic Co-operation and Development (OECD) reported that Australia's housing boom could end in 'dramatic and destabilising' real estate hard landing.[5]

Australian property market[edit]

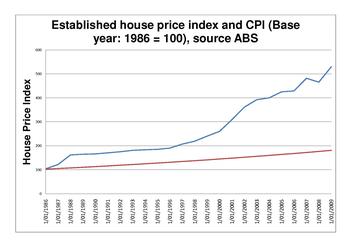

The Australian property market saw an average real price increase of around 0.5% per annum from 1890 to 1990, approximately matching CPI. Since the 1990s, however, prices have risen faster resulting in an elevated price to income ratio.[6]

In the late 2000s, house prices in Australia, relative to incomes, were at elevated levels similar to many comparable countries, prompting speculation that Australia was experiencing a real estate bubble like other comparable countries. Since then, several comparable countries have experienced property crashes.

Rising house prices[edit]

All capital cities have seen strong increases in property prices since about 1998. Sydney and Melbourne have seen the largest price increases, with house prices rising 105% and 93.5% respectively since 2009. These massive increases in house prices coincide with record low wage growth, record low interest rates and record household debt equal to 130% of GDP. This indicates unsustainable growth in property, driven by ever higher debt levels fuelled by the RBA's then chief, Glenn Stevens who began cutting rates beginning in 2011.

The Housing Affordability in Australia - Good house is hard to find report stated that "the average house price in the capital cities is now equivalent to over eight years of average earnings; up from three in the 1950s to the early 1980s.[7] Some factors that may have contributed to the increase in property prices include:

- greater availability of credit due to financial deregulation.

- low interest rates since 2008, increasing borrowing capacity to borrow due to lower repayments.

- limited government release of new land (reducing supply).[8]

- the average floor area of new houses has increased by up to 53.8% in the 18 years from 1984–85 to 2002–03.[9]

- a tax system that favours investors and existing home owners, with policies such as negative gearing and capital gain tax discounts.

- government restrictions on the use of land preventing higher density land use.

- government restrictions on greenfield development designed to encourage "urban densification".

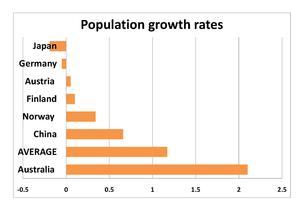

- high population growth (about double the world average in 2010- see Population growth rates chart).[10][11]

- 2008 foreign investment rule changes for temporary visa holders.[12]

- introduction by local councils of upfront infrastructure levies in the early 2000s.

- implementation of government schemes such as the first home buyers and first home builders schemes, which increase demand and therefore prices (supply and demand).

Influence of planning laws[edit]

Beginning in the 1980s, Australian states (who under the Constitution have control of environmental and land use issues) started progressively implementing more rigid planning laws that regulated the use of land.[13] Planning laws often concentrated, after the 1990s, on restricting greenfield development in favour of "urban densification", or infill development.[14][15] Land rationing is a system of banning development in all but designated areas, and can lead to extreme land price inflation if insufficient land is designated as allowed to be developed.[15] The restrictive planning laws in Australia have used land rationing systems as part of the goal of restricting greenfield development in favour of infill development, but this inevitably lead to land prices, and thus house prices, rising significantly.[16] There is good evidence to suggest that the price of a new unit of housing is the ultimate anchor of all housing in an area, so when planning laws that implemented land rationing severely drove up the cost of new homes, all other homes followed suit.[citation needed]

Influence of tax system[edit]

The Reserve Bank of Australia has noted that there are "a number of areas in which the taxation treatment in Australia is more favourable to investors than is the case in other countries."[17] The main tax incentives include tax deductions for losses on investment properties, even those that have been negatively geared, and the 50% discount on capital gains on sale of investments properties.

Investors using their superannuation for property investments have a tax advantage compared to 'savers' who are effectively taxed up to 45% (the top marginal taxation rate) on income from bank interest or bonds, as superannuation contributions are normally only taxed at around 15%.

The list of tax payer funded supports to the property market are numerous

- Federal

- Capital Gains Discount

- Negative Gearing

- Aged Pension Asset Test exclusion of Principal Home

- First Home Super Scheme (Discounted Tax Treatment of Voluntary Contributions)

- State

- Stamp Duty Discounts

- First Home Owner Stamp Duty Exemption

- Land tax option alternative to Stamp Duty

- Stamp Duty Discounts

- Temporary supports

- HomeBuilder (Federal) - originally budgeted at $680m, estimated actual cost over $2 billion due to oversubscription

Influence of banking system[edit]

The influence of interest rates and banking policy on property prices has been noted. The financial deregulation has led to greater availability of credit and a variety of financial products and options. Presently the Reserve Bank of Australia has maintained for some time a low cash interest rate policy which has also reduced the cost of financing property purchase. In addition, the easy availability of interest-only loans has also made possible for property investors to borrow to purchase a property and compounding the benefits of negative gearing.

Housing costs excluded from the CPI[edit]

One of the market distortions in the housing market relates to the calculation of the Consumer Price Index [CPI], a key metric the RBA uses to make fiscal policy decisions such as setting interest rates. One senior economist noted "The index ignores price changes in the single biggest purchase a person (or household) is likely to make in their lifetime – a dwelling″. This implies that Australia's main official cost of living measure is failing to represent actual living costs, particularly for younger Australians who may incur substantial costs of purchasing a home.[18]

Immigration to Australia[edit]

A number of economists, such as Macquarie Bank analyst Rory Robertson, assert that high immigration and the propensity of new arrivals to cluster in the capital cities is exacerbating the nation's housing affordability problem.[19] According to Robertson, Federal Government policies that fuel demand for housing, such as the currently high levels of immigration, as well as capital gains tax discounts and subsidies to boost fertility, have had a greater impact on housing affordability than land release on urban fringes.[20]

The Productivity Commission Inquiry Report No. 28 First Home Ownership (2004) also stated, in relation to housing, "that Growth in immigration since the mid-1990s has been an important contributor to underlying demand, particularly in Sydney and Melbourne."[21] This has been exacerbated by Australian lenders relaxing credit guidelines for temporary residents, allowing them to buy a home with a 10 per cent deposit.

The RBA in its submission to the same PC Report also stated "rapid growth in overseas visitors such as students may have boosted demand for rental housing".[21] However, in question in the report was the statistical coverage of resident population. The "ABS population growth figures omit certain household formation groups – namely, overseas students and business migrants who do not continuously stay for 12 months in Australia."[21] This statistical omission lead to the admission: "The Commission recognises that the ABS resident population estimates have limitations when used for assessing housing demand. Given the significant influx of foreigners coming to work or study in Australia in recent years, it seems highly likely that short-stay visitor movements may have added to the demand for housing. However, the Commissions are unaware of any research that quantifies the effects."[21]

Some individuals and interest groups have also argued that immigration causes overburdened infrastructure.[22]

Foreign investment in residential property[edit]

In December 2008, the federal government introduced legislation relaxing rules for foreign buyers of Australian property. According to FIRB (Foreign Investment Review Board) data released in August 2009, foreign investment in Australian real estate had increased by more than 30% year to date. One agent said that "overseas investors buy them to land bank, not to rent them out. The houses just sit vacant because they are after capital growth."[23]

In April 2010, the government announced amendments to policies to "ensure that foreign non-residents can only invest in Australian real estate if that investment adds to the housing stock, and that investments by temporary residents in established properties are only for their use whilst they live in Australia."[24][25]

Under the rules, temporary residents and foreign students will be:

- Screened by the Foreign Investment Review Board to determine if they will be allowed to buy a property.

- Forced to sell property when they leave Australia.

- Punished if they do not sell by a government-ordered sale plus confiscation of any capital gain.

- Required to build on vacant land within two years of purchase to stop "land banking".

Failure to do this would also lead to a government-ordered sale.[26]

Several Australian Banks and lenders provide home loans to non-residents for the purchase of Australian real estate. This is also thought by some to have contributed to the increases in Australia's property prices.

[edit]

In 2002, the government initiated a Productivity Commission Inquiry into the homes ownership in Australia. The commission's report entitled "First Home Ownership"[27] observed inter alia that "general taxation arrangements [capital gains tax, negative gearing, capital works deductions and depreciation provisions] have lent impetus to the recent surge in investment in rental housing and consequent house price increases."

The government's response to the report stated that "There is no conclusive evidence that the tax system has had a significant impact on house prices."[28]

In 2008, another study was commissioned – the 2008 Senate Select Committee on Housing Affordability in Australia.[29] The report noted that "On some measures, housing affordability is at a record low.

"Australia's Future Tax System" (AFTS) review, more commonly known as the "Henry Tax Review", made a number of recommendations that would have impacted on the housing market, including:

- introduction of land tax "on all land ... removing disincentives for institutional investment in rental property",

- that "transfer taxes on property should be reduced, and ultimately removed",

- a move to "more neutral personal income tax treatment of private residential rental investment . . through a 40 per cent discount on all net residential rental income and losses, and capital gains."[30]

In regard to recommendations of changes to tax policy that might impact the housing market, the Government advised "that it will not implement the following policies at any stage" (excerpt of list):

- include the family home in means tests (see Rec 88c),

- introduce land tax on the family home – this is a state tax and thus an issue for the states (see Rec 52 & 53),

- reduce the CGT discount, apply a discount to negative gearing deductions, or change grandfathering arrangements for CGT (see Rec 14 & 17c)[31]

In May 2015, the House of Representatives Standing Committee on Economics started an Inquiry into Home Ownership. Almost two years later the announcement was made that the Inquiry had made no recommendations whatsoever.[32]

In 2017, a Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry was established. Hearings into banking misconduct began on 13 March.

Effect of inflated housing prices on the greater economy[edit]

Diverting capital away from the rest of the economy[edit]

Increased residential housing costs can cause excessive lending to the residential housing sector, at the expense of businesses. This can lead to "a banking system which allocated capital away from the most productive areas of the economy — business — is ultimately bad for growth, bad for competition, bad for jobs, bad for business and in the end, bad for Australia."[33]

Research conducted in overseas markets confirms that "in areas with high housing appreciation, banks increase the amount of mortgage lending and decrease the amount of commercial lending as a fraction of their total assets. This allocation results in firms receiving reduced loan amounts, paying higher interest rates, and reducing investment."[34]

Mortgage and rent stress[edit]

Increased housing prices and therefore increased borrowings can lead to difficulty in meeting housing payments. According to Ratings agency Standard & Poor's (S&P), "Arrears for sub-prime loans backing RMBS [residential mortgage-backed securities] jumped 126 basis points to 11.45 per cent"[35]

Australian specific market factors[edit]

The Australian market had several features either singly or together are not typical in other housing markets, being;

- Very constricted land supply and extremely onerous planning approval processes

- Unusually high stamp duties

- High proportion of variable rate mortgage loans compares to past housing bubbles outside of Australia, making borrowers more vulnerable to rising interest rates

- Income Tax relief through negative gearing

- Social security (Centrelink) that offers payment including rent assistance that is calculated on the amount of rent paid

- Only recourse loans

- One of the most highly urbanised populations

- Large areas of rural and remote Australia can not secure loans from banks against land in those areas.

Timeline[edit]

1980s–2009[edit]

- 1985: Australian government quarantines interest expenses, so that interest can only be claimed against rental income, not other income.[36]

- 1987: Negative gearing is reintroduced.[36]

- 1998 : The ABS changed the CPI calculation from a cost of living "outlays" index which included mortgage servicing costs to pure price "acquisitions" index including the cost of a new dwelling (excluding land), thereby creating a disconnect between the cost of housing (asset) and the health of the economy (inflation)[37]

- 1998 to 2008: real net national disposable incomes increase by 2.8% a year on average from about $32,000 to about $42,000 per year.[38] There is a rise in the number of two-income households, relaxation of lending standards, active promotion of real estate as an investment, population growth creating demand that was not matched by supply, planning and land release issues and a tax system that was skewed in favour of property investors.

- 1999: Property sale proceeds subject to Capital Gains Tax reduced from 100 to 50 per cent (for property held at least one year), while 100 per cent of costs remained deductible.

- 2000: July - The Federal government introduces the First Home Owners Grant of $7,000 for established homes, and $14,000 for newly built homes.[39]

- 2002: Urban Growth Boundary introduced for Melbourne, severely limiting land supply.[40]

- 2002: While working for the Bank for International Settlements, Philip Lowe warned low rates could fuel risky credit growth and asset price rises that may need to be counteracted by tighter monetary policy.[41]

- 2003: Significant amendments to Queensland's planning law, the Integrated Planning Act, are made by state government.[42] These amendments aimed to better protect the environment by stopping "urban sprawl", and lead to massive land price inflation.[43] Queensland's property prices start to rise quickly at this point.

- 2004: The Productivity Commission Inquiry on 'First Home Ownership' published its findings (No. 28, 31 March 2004). It identified several factors that had contributed to the rapid increase in real estate prices, including overall fairness of the tax system, lending regulations, lower interest rates and planning issues.[27]

- 2008: A Senate Select Committee on Housing Affordability was established. Its final report 'A good house is hard to find' included dozens of recommendations.[44]

- 2008: October - The First Home Owners Grant Boost is introduced as an addition to the First Home Owners Grant. This consisted of an extra $14000 available to first home owners buying or building a new home, as well as an extra $7000 made available for established homes. First Home Saver Accounts are also introduced, where the Federal Government will contribute up to $850 per annum towards savings for a deposit to purchase housing.

- 2008: December - FIRB rules allow temporary visa holders including students, to more easily buy up 'second-hand dwellings'. Changes did not require notification of sales be made to the FIRB and the $300,000 cap on price was removed.[45]

- 2009: April - The Federal government announces Responsible Lending Obligations (RLOs) under the National Consumer Credit Protection Act 2009 (Cth)

- 2009: October - First Home Owners Grant Boost is withdrawn. The UNSW City Futures Research Centre director said "the boost has resulted in inflated prices" and had created "a bit of a mini-bubble". A senior economist of Housing Industry Association (HIA) said the boost has not pushed prices up significantly.[46]

- 2009: November - "capital city house prices . . climbed average 10 per cent" in 2009. Melbourne led the "house price boom, with values up 14.9 per cent in the 10 months . . to an average of $481,247."[47]

- 2009: December - Reporting of RE data was questioned by one source: "AVERAGE house prices have been overstated by up to 18 per cent by the real estate industry . . . In September the average house price quoted by the Real Estate Institute of Victoria was $67,000 higher than the official figure, based on preliminary valuer-general data . . "[48]

2010s[edit]

2010[edit]

- January - The removal of First Home Owners Grant Boost. Mortgage applications reduce by 21.2%.[49] First-home buyers account for 13.1 per cent of new loan applications in December, whereas nine months previously they were at 28.1 per cent.

- March: ABS declares that house prices "soared 20 per cent in the 12 months to March" - a rate that was described as the "fastest ever recorded" in Australian history. The Head of Australian economics at National Australia Bank admits "This is a shocker".[50]

- April - Rules allowing foreign investment in real estate that were introduced in 2008 are withdrawn. Temporary residents are required to sell their Australian property when they leave Australia.[51]

- May - 'Australia's Future Tax System' (AFTS) Review (aka 'Henry Tax Review') makes a number of recommendations on policies that could affect the housing market.[52]

- The government responds to the AFTS review findings with a report 'Stronger, Fairer, Simpler: A Tax Plan for our Future'.[31]

2011[edit]

- February - New housing loans approved by Australian banks fall 5.6 per cent to a 10-year low in February.[53]

2012[edit]

- October - The RBA cuts interest rates to 3.25%.

- December - The RBA cuts interest rates to 3.00%.

2013[edit]

- April - Glenn Stevens is re-appointed as RBA Governor for 3 more years.

- May - The RBA cuts interest rates to 2.75%.

- August - The RBA cuts interest rates to 2.50%.

- November - Statistics released by the Australian Prudential Regulation Authority revealed that the total amount of residential term loans to households held by all ADIs (authorised deposit taking institutions) was $1.15 trillion. This was an increase of 1.7% on 30 June 2013 and an increase of 7.5 in September 2012. Furthermore, investment loans accounted for 33.1 per cent of the loans. Major banks held $933 billion of these loans.[54]

2014[edit]

- 1 January - RP Data reveals that national residential prices increased by 9.8% in 2013, with Sydney increasing by 15.2%.[55]

- 13 January - Housing Finance statistics released by the Australian Bureau of Statistics shows the value of outstanding home loans financed by the ADIs was $1.27 trillion. $849 billion of that amount was for owner occupied housing and $419 billion was for investment housing loans.[56]

- Data released by RP Data, APM, Residex and ABS in 2014 showed that Australian house prices continued to rise strongly throughout 2013 and 2014.[57]

2015[edit]

- The International Monetary Fund sends an economic team to Australia to examine "the risks posed by property speculation and record-high household debt as part of a broad health check-up of the sagging domestic economy."[58]

- The head of the Federal Treasury Department, and the Federal government's most senior economic adviser, John Fraser publicly warned that Sydney and more expensive parts of Melbourne were experiencing a bubble. This was disputed by members of the government including the Prime Minister and Assistant Treasurer.[59]

- June - APRA 10% investment credit growth limit introduced.

- October - Macquarie Bank, a major Australian investment bank forecasted an end to property prices with "quarter-on-quarter house prices to fall from the March 2016 quarter before beginning to recover from June 2017, with a 7.5 per cent fall from peak to trough".[60] Westpac Bank independently raised the rates on its standard variable mortgage by 20 basis points against the Australian Reserve Bank. This was the first rate rise by an Australian bank in five years.[61][62]

2016[edit]

- 5 May - Philip Lowe appointed by Treasurer Scott Morrison as head of the RBA.[63]

- May - From 1 July, "Foreign buyers will have to provide citizenship and visa details, as well as Foreign Investment Review Board clearance, through the stamp duty process." "The ATO will match data to ensure foreign buyers have paid a $5000 fee for any property sold for less than $1 million, and $10,000 for properties over $1 million."[64]

- June - "In NSW, foreign buyers will be hit with a 4 per cent stamp duty surcharge from 21 June and 0.75 per cent land tax surcharge starting in 2017. Victoria will raise its existing 3 per cent stamp duty surcharge and 0.5 per cent land tax surcharge to 7 per cent and 1.5 per cent respectively on 1 July, while Queensland's 3 per cent stamp duty surcharge kicks in on 1 October."[65]

- 3 August - The official cash rate drops to 1.5%, the lowest cash rate on record.[66] The cash rate remains at 1.5% as of 1 July 2018.

2017[edit]

- March - APRA limits interest only lending to 30% of new loans.

- March - The four major banks, NAB, Westpac, ANZ and Commonwealth Bank increase home loan rates despite Reserve Bank rates citing the rising costs and regulatory responsibilities. These four banks controls more than 80 per cent of the $1.6 trillion mortgage market. Owner-occupier customers repaying principal and interest experiences the smallest rise while investors with interest-only loans get the largest hike. The changes effective in April–May.[67]

- April - The Governor of the RBA Philip Lowe states that increasing debt and rising house prices were risking the future health of the Australian economy. He noted that slow wage growth was making it harder for people to pay down their debt and attacked banks for lending to people with too little income buffer after interest.[68]

- July - Stamp duty abolished for first home buyers in Victoria, Queensland and Western Australia. Investor tax deductions for depreciation and travel abolished.

- September - The market reached its most recent peak in September 2017, according to Corelogic data.[69]

- 14 December - Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry established.

2018[edit]

- 13 March - hearings into the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry begin.

- 1 July - Since the previous peak in September 2017, the combined capital 5 city property market has declined by -1.3% according to Corelogic.[69]

- 11 July - It is estimated by Digital Finance Analytics that there are approximately 1 million households in mortgage stress. These households risk defaulting on their mortgages in the event of interest rate rises of as little as 0.15%.[70] APRA chairman Wayne Byres announced that the "heavy lifting on lending standards has largely been done", and that there was unlikely to be any further tightening of macroprudential policy.[71]

- 16 July - Pressure is growing on the big four banks to follow smaller lenders (including ME, AMP, Suncorp, Bendigo Bank, Macquarie Bank, Bank of Queensland, ING, Pepper Group, IMB, Auswide and Teachers Mutual Bank) who have been raising interest rates on mortgage products from April 2018 onwards.[72] This is due to a rise in the inter-bank Bank Bill Swap Rate (BBSW). It is speculated that the causes for BBSW changes include the US Federal reserve's increases in US rates and poor returns on Australian deposits drawing funds away to international markets and Australian equities for better returns, as well as income repatriation of large American companies following tax changes of Donald Trump.[73] The funding gap between deposits and funds lent in Australia is estimated to have grown to A$457 billion in the first quarter of 2018.[74] This is putting pressure on bank wholesale lending and profit margins, raising the likelihood of interest rate rises independently of the Reserve Bank of Australia by the big four banks, despite the ongoing Royal Commission.

- 7 December - "Uncharted territory", despite "the unemployment rate's been coming down, the economy's growing at a reasonable pace", RBA deputy Guy Debelle promotes further interest rate cuts and QE (quantitative easing) as methods to support housing prices.[75]

2019[edit]

- January 2019 - RBA releases a research discussion paper 'A Model of the Australian Housing Market', which concludes that the lower interest rates explain much of the rapid growth in housing prices and construction over the past few years.[76]

- 7 February - Home prices across Sydney and Melbourne continue to fall as the RBA keeps rates on hold at 1.5 per cent for a record 29th month.

- 3 March - Mathias Cormann described (downward) flexibility in the rate of wage growth as “a deliberate design feature of our economic architecture”, ensuring wage growth is subdued, requiring the RBA to maintain low interest rates.[77]

- 12 May - The Federal government seeks to increase first home owners entering the market, through introduction of the First Home Loan Deposit Scheme

- 4 June - The RBA drops interest rates to a record low of 1.25 per cent, suggesting further cuts were to come later in the year[78]

- 2 July - RBA drops rates to another low of 1 per cent.[79]

- 5 July - APRA reduces interest rate buffer requirements for ADIs from 7% to 2.5% above the loan rate[80]

- 1 October - The RBA announces interest rate cut to 0.75%

2020s[edit]

2020[edit]

- 3 March - The RBA reduced the cash rate to 0.5% (from 0.75%)

- 19 March - The RBA introduces 4 core changes to support the economy as the COVID-19 pandemic shuts borders and businesses

- Reduction in the cash rate to 0.25% (down from 0.5%)

- Targeting the yield of the 3 year bond at 0.25%, through the commencement of bond buying

- Establishment of the Term Funding Facility (TFF) to facilitate cheap credit to small business at rate of 0.25%

- Increase in Exchange Settlement balances to 0.1% to decrease costs to the banking system for reserves held at the RBA

- 2 June - The Federal government announces the HomeBuilder grant of $25,000 to support the construction industry to 31 December 2020, with a budgeted cost of $680m

- April - Economists within the RBA propose pausing the real estate market to avoid a crash[81]

- 26 August - RBA discussion paper shows that the banking sector could withstand an extreme but plausible 40% fall in Australian house prices.[82]

- 25 September - The Federal government announces plans to remove Responsible Lending Obligations from the National Consumer Credit Protection Act 2009

- 3 November - The RBA introduces 3 core changes to support the economic recovery

- Reduction in the cash rate to 0.1% (down from 0.25% set in April 2020)

- Reduction of target of 3 year bond yield to 0.1%, with commencement of Quantitative Easing, by announcing the quantity of bond buying - $100 billion of government bonds over a six-month period.

- Reduction in the interest rate on Exchange Settlement balances to 0.0%

- 30 November - The Federal government extends the HomeBuilder grants scheme until 31 March 2021 at a reduced rate of $15,000.

2021[edit]

- 1 February - The housing market started the year strongly with a national price increase of 0.9%.

- 1 March - The housing market saw euphoria through February with national prices rising 2.1% in the calendar month, fear of missing out (FOMO) leading to first home owners and owner occupiers making up the majority of buyers.

- 12 March - In a sign the interest rate cycle may have turned, rising global bond yields through 2021 caused the 30 year US mortgage rate to increase 0.4% (2.65% -> 3.05%) through January and February, despite central banks doubling down on low interest commitments to assure markets they will let inflation run rather than raise rates prematurely.

- 15 March - Term Funding Facility creates debt binge for banking sector [83]

- 16 March - APRA release quarterly ADI statistics for December quarter 2020, showing "higher loan-to-valuation ratios and debt-to-income ratio" [84]

- Debt-to-income ≥ 6x increase by 26.3%

- LVR ≥ 95 increase by 27.4%

- 19 March - Parents become 9th biggest lender in Australia, creating a financial system feedback loop ensuring that a downturn in housing affects not only first home owners and young families but also retirees, with large implications to pension and superannuation systems.[85]

- 29 March - APRA chairman Wayne Byres states house prices not within remit of financial stability mandate.[86]

- 29 March - The Term Funding Facility (TFF) is alleged to fuel a 2023 housing debt time bomb [87]

- 30 March - Banks plan to avoid 2023 debt cliff by repaying TTF early and increasing saving rates [88]

- 9 April - RBA flags booming property market as risk to the financial system [89]

- 22 April - Mortgage rates in Australia begin the long path northwards [90]

- 30 April - As the housing affordability crises worsens, the blame game ramps up, with Federal tax concessions, State planning laws, loose monetary policy and lax lending standards all contributing factors [91]

- 30 Dec - Major Australian banks start predicting price drops for 2023.[92]

See also[edit]

- Australian Dream

- Australian property market

- Canadian property bubble

- Home ownership in Australia

- House price index

References[edit]

- ^ "Treasury Warning on Home Price Bubble". The Australian. Retrieved 20 January 2016.

- ^ Matthewson, Paula (21 June 2012). "House prices must be allowed to fall - The Drum (Australian Broadcasting Corporation)". ABC News. Retrieved 20 January 2016.

- ^ https://grattan.edu.au/wp-content/uploads/2018/03/901-Housing-affordability.pdf

- ^ ABC News, 12 June 2014: Australia has third highest house price-to-income ratio in the world: IMF

- ^ ABC News, 3 June 2016: Housing boom could end in a 'dramatic and destabilising' real estate hard landing: OECD

- ^ Stapledon, Nigel (18 November 2010). A History of Housing Prices in Australia 1880-2010. School of Economics Discussion Paper: 2010/18. Sydney, Australia: The University of New South Wales Australian School of Business. ISBN 978-0-7334-2956-9. SSRN 1711224.

- ^ "Executive Summary - Parliament of Australia". aph.gov.au. Retrieved 7 June 2020.

- ^ "Housing industry accuses state government of dragging its feet over releasing land". Seek Estate. 2 June 2014. Archived from the original on 2 June 2014. Retrieved 1 June 2014.

- ^ "1301.0 - Year Book Australia, 2005". Abs.gov.au. Retrieved 20 January 2016.

- ^ "Australia Population (2020) - Worldometer". worldometers.info. Retrieved 5 June 2020.

- ^ Roser, Max; Ritchie, Hannah; Ortiz-Ospina, Esteban (9 May 2013). "World Population Growth - Our World In Data". Our World in Data. Retrieved 5 June 2020.

- ^ "Parliament of Australia: Senate Committees Affordability in Australia: A good house is hard to find: Housing affordability in Australia - Chapter 4 - Factors influencing the demand for housing". Archived from the original on 15 March 2011. Retrieved 19 March 2011.

- ^ Kelly, Andrew H (27 August 2012). "The Development of Local Government in Australia, Focusing on NSW: From Road Builder to Planning Agency to Servant of the State Government and Developmentalism". Research Online. Retrieved 21 December 2023.

- ^ "Archived copy" (PDF). Archived from the original (PDF) on 11 October 2016. Retrieved 4 March 2016.

{{cite web}}: CS1 maint: archived copy as title (link) - ^ a b "Archived copy" (PDF). Archived from the original (PDF) on 12 October 2016. Retrieved 4 March 2016.

{{cite web}}: CS1 maint: archived copy as title (link) - ^ "Archived copy". Archived from the original on 8 March 2016. Retrieved 4 March 2016.

{{cite web}}: CS1 maint: archived copy as title (link) - ^ "Productivity Commission Inquiry on First Home Ownership". Rba.gov.au. 14 November 2003. Archived from the original on 5 August 2012. Retrieved 20 January 2016.

- ^ Inflation data 'very poor' cost of living measure due to house price exclusion Michael Janda "ABC News", 20 April 2017

- ^ Klan, A. (17 March 2007) Locked out Archived 22 October 2008 at the Wayback Machine

- ^ Wade, M. (9 September 2006) PM told he's wrong on house prices

- ^ a b c d "Microsoft Word - prelims.doc" (PDF). Archived from the original (PDF) on 3 June 2011. Retrieved 14 July 2011.

- ^ "A good house is hard to find: Housing affordability in Australia". aph.gov.au. June 2008.

- ^ "Foreign buyers blow out the housing bubble". Crikey.com.au. 21 September 2009. Retrieved 20 January 2016.

- ^ Colebatch, Tim (24 April 2010). "Foreign home buyers backflip The Age 23 April 2010". Melbourne.

- ^ "Government Tightens Foreign Investment Rules for Residential Housing". Ministers.treasury.gov.au. 24 April 2010.

- ^ "Prime Minister Kevin Rudd Slams Door in Asian Raiders". Heraldsun.com.au. Retrieved 20 January 2016.

- ^ a b First Home Ownership - Productivity Commission Inquiry Report (PDF). Productivity Commission. 31 March 2004. ISBN 1740371437. Archived from the original (PDF) on 3 June 2011. Retrieved 14 July 2011.

- ^ Peter Costello, Treasurer of Australia. "Government response to the productivity commission inquiry report on first home ownership". Archived from the original on 26 October 2009. Retrieved 7 February 2010.

- ^ "Parliament of Australia: Senate Select Committee on Housing Affordability in Australia". Archived from the original on 13 March 2011. Retrieved 10 April 2011.

- ^ "Australia's future tax system - Final Report - Part 1 (consolidated version)" (PDF). treasury.gov.au. December 2009.

- ^ a b "Former Australian Government Department of Education, Employment and Workplace Relations | Australian Government Shared Services Centre" (PDF). Deewr.gov.au. 18 September 2013. Archived from the original (PDF) on 8 April 2012. Retrieved 20 January 2016.

- ^ "Housing Affordability: No Recommendations". ABC News. Henry Belot, ABC News. 16 December 2016.

- ^ "Residential lending may hurt us in the long run". Crikey. 12 February 2010.

- ^ "Do Asset Price Bubbles have Negative Real Effects?" (PDF). University of Pennsylvania. November 2013. Archived from the original (PDF) on 28 December 2013. Retrieved 29 December 2013.

- ^ "Mortgage holders showing stress". News.com.au. 5 April 2011. Retrieved 20 January 2016.

- ^ a b O’Donnell, Jim (July 2005). "Quarantining Interest Deductions for Negatively Geared Rental Property Investments". eJournal of Tax Research. 3 (1). Sydney: Atax, University of New South Wales. Retrieved 2 May 2011.

- ^ "The Implications of Recent Changes to the Consumer Price Index for Monetary Policy and the Inflation Target, Bulletin, October 1998". Bulletin (October). 1998. Retrieved 15 March 2021.

- ^ "1383.0.55.001 - Measures of Australia's Progress: Summary Indicators, 2009". Abs.gov.au. 30 April 2009. Retrieved 20 January 2016.

- ^ "First Home Owners Scheme". Firsthome.gov.au. Retrieved 20 January 2016.

- ^ "Melbourne's Green wedge history - Peninsula Speaks Inc". Peninsulaspeaks.org. Retrieved 20 January 2016.

- ^ Borio, Claudio; Lowe, Philip (2 July 2002). "Asset prices, financial and monetary stability: exploring the nexus". Bank for International Settlements. Retrieved 14 March 2021.

- ^ "Integrated Planning and Other Legislation Amendment Bill 2003 Explanatory Notes". Austlii.edu.au. Retrieved 20 January 2016.

- ^ "House Affordability : Australia : Markets : 1981-2010" (JPG). Macrobusiness.com.au. Retrieved 20 January 2016.

- ^ "Parliament of Australia: Affordability in Australia: A god house is hard to find: Housing affordability in Australia". Archived from the original on 19 February 2009. Retrieved 2 June 2009.

- ^ "FIRB: Foreign Investment Review Board - General Policy". www.firb.gov.au. Archived from the original on 6 March 2010.

- ^ "Home grant boost rolled back - ABC News (Australian Broadcasting Corporation)". ABC News. 1 October 2009. Retrieved 20 January 2016.

- ^ "Prices rise as new home sales fall - ABC News (Australian Broadcasting Corporation)". ABC News. 30 November 2009. Retrieved 20 January 2016.

- ^ "Victorian home prices overstated". Heraldsun.com.au. Retrieved 20 January 2016.

- ^ Uren, David (6 January 2010). "Housing sector hit by rate rises, end of grant". The Australian.

- ^ Frangos, Alex (4 May 2010). "Asia Inflation Fears Point to Likely Rate Rises". Wall Street Journal.

- ^ Colebatch, Tim (24 April 2010). "Foreign home buyers backflip". Melbourne: The Age.

- ^ "Executive summary" (PDF). Taxreview.treasury.gov.au. Retrieved 20 January 2016.

- ^ Uren, David (7 April 2011). "Buyer retreat spells slump in home prices". The Australian.

- ^ "Quarterly Authorised Deposit-taking Institution Property Exposures" (PDF). 26 November 2013. Archived from the original (PDF) on 4 February 2014. Retrieved 26 January 2014.

- ^ "News & Research | CoreLogic". RPData. Archived from the original on 19 February 2014.

- ^ "Main Features - Summary of Findings". Australian Bureau of Statistics. 12 March 2014.

- ^ "Worries over property boom, dollar - RN Breakfast - ABC Radio National (Australian Broadcasting Corporation)". Abc.net.au. 31 March 2014. Retrieved 20 January 2016.

- ^ Kehoe, John (2 May 2015). "IMF to probe Australia's record property and debt levels". Australian Financial Review.

- ^ Daniel Hurst. "Josh Frydenberg disputes top Treasury adviser's advice on housing bubble risk | Australia news". The Guardian. Retrieved 20 January 2016.

- ^ "Property prices: House prices to fall in March 2016: Macquarie". News.com.au. 12 October 2015. Retrieved 20 January 2016.

- ^ Elizabeth Knight (14 October 2015). "Westpac rate rise ushers in end of the property boom". The Sydney Morning Herald. Retrieved 20 January 2016.

- ^ "Westpac's raising will hit economy but ward off hedge fund attack". Afr.com. 14 October 2015. Retrieved 20 January 2016.

- ^ "Appointment of the Governor of the Reserve Bank and a member of the Reserve Bank Board | Treasury Ministers". Treasury (Website). Retrieved 20 March 2021.

- ^ Kirsty Needham (15 May 2016). "Foreign buyer crackdown as new identity rules applied to Sydney property market". SMH. Retrieved 6 July 2016.

- ^ Larry Schlesinger (15 June 2016). "New foreign buyer taxes cast their net far and wide: Frasers Property boss". The Sydney Morning Herald. Retrieved 6 July 2016.

- ^ Sydney, Build. "When will the Australian Housing Bubble Burst?". Retrieved 16 January 2017.

- ^ "CBA, ANZ hike mortgage rates". Retrieved 28 January 2018.

- ^ "Negative gearing fuelling unhealthy appetite for interest-only home loans: RBA governor". ABC News. 4 April 2017.

- ^ a b "Australian Dwelling Values Continue To Trend Lower In June Amidst Tight Credit Conditions And Less Investment Activity". Corelogic. 19 January 2022.

- ^ "Nearly a million households 'on the edge' of mortgage default, analyst warns". ABC News. 10 July 2018.

- ^ "APRA's Wayne Byres says there is no evidence of a mortgage credit crunch". Australian Financial Review. 11 July 2018.

- ^ Yeates, Clancy (13 July 2018). "Bendigo Bank raises mortgage rates, blames funding costs". The Sydney Morning Herald.

- ^ "How long before the big banks join in the rate hike party?". Australian Financial Review. 16 July 2018.

- ^ "'No strong case' for near-term interest rate hike: RBA". Australian Financial Review. 17 July 2018.

- ^ "Reserve Bank says rate cuts and QE possible as Australian housing enters 'uncharted territory'". ABC News. 7 December 2018. Retrieved 18 March 2021.

- ^ Tulip, Peter; Saunders, Trent. "Research Discussion Paper – RDP 2019-01 A Model of the Australian Housing Market". Reserve Bank of Australia. Retrieved 28 September 2019.

- ^ "Ultra low wage growth isn't accidental. It is the intended outcome of government policies". Academic rigour, journalistic flair. Retrieved 4 June 2019.

- ^ Letts, Stephen; Janda, Michael (4 June 2019). "RBA cuts interest rates to a fresh record low". ABC News. Retrieved 4 June 2019.

- ^ Zhou, Naaman; Farrer, Martin (2 July 2019). "Reserve Bank interest rates cut to historic low of 1% – as it happened". The Guardian. ISSN 0261-3077. Retrieved 18 July 2019.

- ^ "APRA finalises amendments to guidance on residential mortgage lending". APRA Website. Retrieved 4 June 2019.

- ^ "Reserve Bank considered asking for real estate transaction 'pause' amid property crash fears". ABC News. 17 June 2020. Retrieved 23 June 2020.

- ^ "Post-coronavirus deposits are safe with the banks, and debt for property is not a huge risk, say regulators". ABC News. 25 August 2020. Retrieved 28 August 2020.

- ^ "Banks lending as fast as they can as margins and profits rise". SmallCaps (Article). 14 March 2021. Retrieved 2 May 2021.

- ^ "APRA releases quarterly authorised deposit-taking institution statistics for December 2020". APRA (Media Release). Retrieved 18 March 2021.

- ^ "Bank of Mum and Dad 9th biggest lender". AFR (Article). 18 March 2021. Retrieved 11 April 2021.

- ^ "Managing hot house prices 'not our job': APRA". AFR (Article). 29 March 2021. Retrieved 11 April 2021.

- ^ "Alan Kohler: The three-year housing bomb". The New Daily (Article). 28 March 2021. Retrieved 11 April 2021.

- ^ "Banks primed for $180b 'cliff'". Australian Financial Review (Article). 30 March 2021. Retrieved 2 May 2021.

- ^ "Booming property and share markets a risk to financial stability". ABC (Radio). 9 April 2021. Retrieved 11 April 2021.

- ^ "Fourteen lenders hike mortgage rates despite no change by the RBA". The Weekend Australian (Article). Retrieved 2 May 2021.

- ^ "High house prices a 'risk for all state governments'". The Sydney Morning Herald (Article). 30 April 2021. Retrieved 3 May 2021.

- ^ "Will the housing boom be over in 2022? We ask the experts". ABC News. 29 December 2021. Retrieved 30 December 2021.