Diversification (finance): Difference between revisions

m r2.7.1) (Robot: Adding eu:Dibertsifikazio |

→External links: Example of a synthetic portfolio based on mean-variance optimization |

||

| Line 213: | Line 213: | ||

* [http://viking.som.yale.edu/will/finman540/classnotes/notes.html An Introduction to Investment Theory], Prof. William N. Goetzmann, [[Yale School of Management]] |

* [http://viking.som.yale.edu/will/finman540/classnotes/notes.html An Introduction to Investment Theory], Prof. William N. Goetzmann, [[Yale School of Management]] |

||

* [http://www.barclayhedge.com/research/educational-articles/managed-futures-articles/managed-futures-overview.html Overview of Managed Futures] |

* [http://www.barclayhedge.com/research/educational-articles/managed-futures-articles/managed-futures-overview.html Overview of Managed Futures] |

||

* [http://www.macroaxis.com/invest/marketRiskAndReturn Synthetically diversified portfolio based on mean-variance optimization],Risk-adjusted returns analysis for public companies |

|||

{{Financial risk}} |

{{Financial risk}} |

||

Revision as of 17:30, 16 February 2012

| Part of a series on |

| Finance |

|---|

|

In finance, diversification means reducing risk by investing in a variety of assets. If the asset values do not move up and down in perfect synchrony, a diversified portfolio will have less risk than the weighted average risk of its constituent assets, and often less risk than the least risky of its constituents.[1] Therefore, any risk-averse investor will diversify to at least some extent, with more risk-averse investors diversifying more completely than less risk-averse investors.

Diversification is one of two general techniques for reducing investment risk. The other is hedging. Diversification relies on the lack of a tight positive relationship among the assets' returns, and works even when correlations are near zero or somewhat positive. Hedging relies on negative correlation among assets, or shorting assets with positive correlation.

It is important to remember that diversification only works because investment in each individual asset is reduced. If someone starts with $10,000 in one stock and then puts $10,000 in another stock, they would have more risk, not less. Diversification would require the sale of $5,000 of the first stock to be put into the second. There would then be less risk. Hedging, by contrast, reduces risk without selling any of the original position.[2]

The risk reduction from diversification does not mean anyone else has to take more risk. If person A owns $10,000 of one stock and person B owns $10,000 of another, both A and B will reduce their risk if they exchange $5,000 of the two stocks, so each now has a more diversified portfolio.[3]

Examples

The simplest example of diversification is provided by the proverb "don't put all your eggs in one basket". Dropping the basket will break all the eggs. Placing each egg in a different basket is more diversified. There is more risk of losing one egg, but less risk of losing all of them. In finance, an example of an undiversified portfolio is to hold only one stock. This is risky; it is not unusual for a single stock to go down 50% in one year. It is much less common for a portfolio of 20 stocks to go down that much, even if they are selected at random. If the stocks are selected from a variety of industries, company sizes and types (such as some growth stocks and some value stocks) it is still less likely.

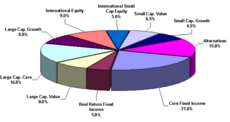

Further diversification can be obtained by investing in stocks from different countries, and in different asset classes such as bonds, real estate, private equity, infrastructure and commodities such as heating oil or gold.[4]

Since the mid-1970s, it has also been argued that geographic diversification would generate superior risk-adjusted returns for large institutional investors by reducing overall portfolio risk while capturing some of the higher rates of return offered by the emerging markets of Asia and Latin America.[5][6]

Return expectations while diversifying

If the prior expectations of the returns on all assets in the portfolio are identical, the expected return on a diversified portfolio will be identical to that on an undiversified portfolio. Ex post, some assets will do better than others; but since one does not know in advance which assets will perform better, this fact cannot be exploited in advance. The ex post return on a diversified portfolio can never exceed that of the top-performing investment, and indeed will always be lower than the highest return (unless all returns are ex post identical). Conversely, the diversified portfolio's return will always be higher than that of the worst-performing investment. So by diversifying, one loses the chance of having invested solely in the single asset that comes out best, but one also avoids having invested solely in the asset that comes out worst. That is the role of diversification: it narrows the range of possible outcomes. Diversification need not either help or hurt expected returns, unless the alternative non-diversified portfolio has a higher expected return.[7] But risk averse investors may find it beneficial to diversify into assets with lower expected returns, thereby lowering the expected return on the portfolio, when the risk-reduction benefit of doing so exceeds the cost in terms of diminished expected return.

Maximum diversification

Given the advantages of diversification, many experts recommend maximum diversification, also known as “buying the market portfolio.” Unfortunately, identifying that portfolio is not straightforward. The earliest definition comes from the capital asset pricing model which argues the maximum diversification comes from buying a pro rata share of all available assets. This is the idea underlying index funds.

One objection to that is it means avoiding investments like futures that exist in zero net supply. Another is that the portfolio is determined by what securities come to market, rather than underlying economic value. Finally, buying pro rata shares means that the portfolio overweights any assets that are overvalued, and underweights any assets that are undervalued. This line of argument leads to portfolios that are weighted according to some definition of “economic footprint,” such as total underlying assets or annual cash flow.[8]

“Risk parity” is an alternative idea. This weights assets in inverse proportion to risk, so the portfolio has equal risk in all asset classes. This is justified both on theoretical grounds, and with the pragmatic argument that future risk is much easier to forecast than either future market value or future economic footprint.[9]

Effect of diversification on variance

One simple measure of financial risk is variance. Diversification can lower the variance of a portfolio's return below what it would be if the entire portfolio were invested in the asset with the lowest variance of return, even if the assets' returns are uncorrelated. For example, let asset X have stochastic return and asset Y have stochastic return , with respective return variances and . If the fraction of a one-unit (e.g. one-million-dollar) portfolio is placed in asset X and the fraction is placed in Y, the stochastic portfolio return is . If and are uncorrelated, the variance of portfolio return is . The variance-minimizing value of is , which is strictly between and . Using this value of in the expression for the variance of portfolio return gives the latter as , which is less than what it would be at either of the undiversified values and (which respectively give portfolio return variance of and ). Note that the favorable effect of diversification on portfolio variance would be enhanced if and were negatively correlated but diminished (though not necessarily eliminated) if they were positively correlated.

In general, the presence of more assets in a portfolio leads to greater diversification benefits, as can be seen by considering portfolio variance as a function of , the number of assets. For example, if all assets' returns are mutually uncorrelated and have identical variances , portfolio variance is minimized by holding all assets in the equal proportions .[10] Then the portfolio return's variance equals = = , which is monotonically decreasing in .

The latter analysis can be adapted to show why adding uncorrelated risky assets to a portfolio,[11][12] thereby increasing the portfolio's size, is not diversification, which involves subdividing the portfolio among many smaller investments. In the case of adding investments, the portfolio's return is instead of and the variance of the portfolio return if the assets are uncorrelated is which is increasing in n rather than decreasing. Thus, for example, when an insurance company adds more and more uncorrelated policies to its portfolio, this expansion does not itself represent diversification—the diversification occurs in the spreading of the insurance company's risks over a large number of part-owners of the company.

Diversifiable and non-diversifiable risk

The Capital Asset Pricing Model introduced the concepts of diversifiable and non-diversifiable risk. Synonyms for diversifiable risk are idiosyncratic risk and security-specific risk. Synonyms for non-diversifiable risk are systematic risk, beta risk and market risk.

If one buys all the stocks in the S&P 500 one is obviously exposed only to movements in that index. If one buys a single stock in the S&P 500, one is exposed both to index movements and movements in the stock relative to the index. The first risk is called “non-diversifiable,” because it exists however many S&P 500 stocks are bought. The second risk is called “diversifiable,” because it can be reduced it by diversifying among stocks, and it can be eliminated completely by buying all the stocks in the index.

Of course, there's nothing special about the S&P 500; the same argument can apply to any index, up to and including the market portfolio of all assets.

The Capital Asset Pricing Model argues that investors should only be compensated for non-diversifiable risk. Other financial models allow for multiple sources of non-diversifiable risk, but also insist that diversifiable risk should not carry any extra expected return. Still other models do not accept this contention[13]

An empirical example relating diversification to risk reduction

In 1977 Elton and Gruber[14] worked out an empirical example of the gains from diversification. Their approach was to consider a population of 3290 securities available for possible inclusion in a portfolio, and to consider the average risk over all possible randomly chosen n-asset portfolios with equal amounts held in each included asset, for various values of n. Their results are summarized in the following table. It can be seen that most of the gains from diversification come for n≤30.

| Number of Stocks in Portfolio | Average Standard Deviation of Annual Portfolio Returns | Ratio of Portfolio Standard Deviation to Standard Deviation of a Single Stock |

|---|---|---|

| 1 | 49.24% | 1.00 |

| 2 | 37.36 | 0.76 |

| 4 | 29.69 | 0.60 |

| 6 | 26.64 | 0.54 |

| 8 | 24.98 | 0.51 |

| 10 | 23.93 | 0.49 |

| 20 | 21.68 | 0.44 |

| 30 | 20.87 | 0.42 |

| 40 | 20.46 | 0.42 |

| 50 | 20.20 | 0.41 |

| 400 | 19.29 | 0.39 |

| 500 | 19.27 | 0.39 |

| 1000 | 19.21 | 0.39 |

Corporate diversification strategies

In corporate portfolio models, diversification is thought of as being vertical or horizontal. Horizontal diversification is thought of as expanding a product line or acquiring related companies. Vertical diversification is synonymous with integrating the supply chain or amalgamating distributions channels.

Non-incremental diversification is a strategy followed by conglomerates, where the individual business lines have little to do with one another, yet the company is attaining diversification from exogenous risk factors to stabilize and provide opportunity for active management of diverse resources.

History

Diversification is mentioned in the Bible, in the book of Ecclesiastes which was written in approximately 935 B.C.[15]:

- But divide your investments among many places,

- for you do not know what risks might lie ahead.[16]

Diversification is also mentioned in the Talmud. The formula given there is to split one's assets into thirds: one third in business (buying and selling things), one third kept liquid (e.g. gold coins), and one third in land (real estate).

Diversification is mentioned in Shakespeare[17] (Merchant of Venice):

- My ventures are not in one bottom trusted,

- Nor to one place; nor is my whole estate

- Upon the fortune of this present year:

- Therefore, my merchandise makes me not sad.

The modern understanding of diversification dates back to the work of Harry Markowitz[18] in the 1950s.

Diversification with an equally-weighted portfolio

The expected return on a portfolio is a weighted average of the expected returns on each individual asset:

where is the proportion of the investor's total invested wealth in asset .

The variance of the portfolio return is given by:

Inserting in the expression for :

Rearranging:

where is the variance on asset and is the covariance between assets and . In an equally-weighted portfolio, .

The portfolio variance then becomes:

And simplifying:

Now, taking the number of assets, , to the limit gives:

Thus, in an equally-weighted portfolio, the portfolio variance tends to the average of covariances between securities as the number of securities becomes arbitrarily large.

See also

- Modern portfolio theory

- Central limit theorem

- Dollar cost averaging

- Systematic risk

- List of finance topics

References

- ^ Sullivan, arthur (2003). Economics: Principles in action. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. p. 273. ISBN 0-13-063085-3.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help)CS1 maint: location (link) - ^ Fama, Eugene F. (June 1972). The Theory of Finance. Holt Rinehart & Winston. ISBN 978-0155042667.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ Sharpe, William (October 30, 1998). Investments. Prentice Hall. ISBN 978-0130101303.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ Campbell, John Y. Campbell (December 9, 1996). The Econometrics of Financial Markets. Princeton University Press. ISBN 978-0691043012.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ Template:Fr icon "see M. Nicolas J. Firzli, "Asia-Pacific Funds as Diversification Tools for Institutional Investors", Revue Analyse Financière/The French Society of Financial Analysts (SFAF)" (PDF). Retrieved 2009-04-02Template:Inconsistent citations

{{cite web}}: CS1 maint: postscript (link) - ^ Template:En icon "see Michael Prahl, "Asian Private Equity – Will it Deliver on its Promise?", INSEAD Global Private Equity Initiative (GPEI)" (PDF). Retrieved 2011-06-15Template:Inconsistent citations

{{cite web}}: CS1 maint: postscript (link) - ^ Goetzmann, William N. An Introduction to Investment Theory. II. Portfolios of Assets. Retrieved on November 20, 2008.

- ^ Wagner, Hans Fundamentally Weighted Index Investing. Retrieved on June 20, 2010.

- ^ Asness, Cliff; David Kabiller and Michael Mendelson Using Derivatives and Leverage To Improve Portfolio Performance, Institutional Investor, May 13, 2010. Retrieved on June 21, 2010.

- ^ Samuelson, Paul, "General Proof that Diversification Pays,"Journal of Financial and Quantitative Analysis 2, March 1967, 1-13.

- ^ Samuelson, Paul, "Risk and uncertainty: A fallacy of large numbers," Scientia 98, 1963, 108-113.

- ^ Ross, Stephen, "Adding risks: Samuelson's fallacy of large numbers revisited," Journal of Financial and Quantitative Analysis 34, September 1999, 323-339.

- ^ .Fama, Eugene F. (June 1972). The Theory of Finance. Holt Rinehart & Winston. ISBN 978-0155042667.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ E. J. Elton and M. J. Gruber, "Risk Reduction and Portfolio Size: An Analytic Solution," Journal of Business 50 (October 1977), pp. 415-37

- ^ Life Application Study Bible: New Living Translation. Wheaton, Illinois: Tyndale House Publishers, Inc. 1996. p. 1024. ISBN 0-8423-3267-7.

- ^ Ecclesiastes 11:2 NLT

- ^ The Only Guide to a Winning Investment Strategy You'll Ever Need

- ^ Markowitz, Harry M. (1952). "Portfolio Selection". Journal of Finance. 7 (1): 77–91. doi:10.2307/2975974. JSTOR 2975974.

External links

- Macro-Investment Analysis, Prof. William F. Sharpe, Stanford University

- Portfolio Diversifier, Dynamically-generated diversified portfolios

- Asset Correlations, Dynamically-generated correlation matrices for the major asset classes

- An Introduction to Investment Theory, Prof. William N. Goetzmann, Yale School of Management

- Overview of Managed Futures

- Synthetically diversified portfolio based on mean-variance optimization,Risk-adjusted returns analysis for public companies

![{\displaystyle q=\sigma _{y}^{2}/[\sigma _{x}^{2}+\sigma _{y}^{2}]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/167455d2a2b370630091fb1522c633b3ce158d29)

![{\displaystyle \sigma _{x}^{2}\sigma _{y}^{2}/[\sigma _{x}^{2}+\sigma _{y}^{2}]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/b21332ce10f785024bf50efeb295fa11d4a4863c)

![{\displaystyle var[(1/n)x_{1}+(1/n)x_{2}+...+(1/n)x_{n}]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/2291febb63f51686452a9957e05eca33da87333e)

![{\displaystyle var[x_{1}+x_{2}+\dots +x_{n}]=\sigma _{x}^{2}+\sigma _{x}^{2}+\dots +\sigma _{x}^{2}=n\sigma _{x}^{2},}](https://wikimedia.org/api/rest_v1/media/math/render/svg/f1f90d53d0e631da4c656a783a55af8cf382c7c3)

![{\displaystyle \mathbb {E} [R_{P}]=\sum _{i=1}^{n}x_{i}\mathbb {E} [R_{i}]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/9f892f670bf130a4a19c1a0cdb28f929af85e3ab)

![{\displaystyle \underbrace {{\text{Var}}(R_{P})} _{\equiv \sigma _{P}^{2}}=\mathbb {E} [R_{P}-\mathbb {E} [R_{P}]]^{2}}](https://wikimedia.org/api/rest_v1/media/math/render/svg/9cf2d5f455db9505a3a6202a9f499d3ae47fd6b7)

![{\displaystyle \mathbb {E} [R_{P}]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/9d914f1024fb3a51f8f3e145e075dd198894df76)

![{\displaystyle \sigma _{P}^{2}=\mathbb {E} \left[\sum _{i=1}^{n}x_{i}R_{i}-\mathbb {E} \left[\sum _{i=1}^{n}x_{i}\mathbb {E} [R_{i}]\right]\right]^{2}}](https://wikimedia.org/api/rest_v1/media/math/render/svg/b72503e93d33b272e9f932fee96be66f746ddbed)

![{\displaystyle \sigma _{P}^{2}=\mathbb {E} \left[\sum _{i=1}^{n}x_{i}(R_{i}-\mathbb {E} [R_{i}])\right]^{2}}](https://wikimedia.org/api/rest_v1/media/math/render/svg/f5821da5b5e1c3cad0565e10bc6ab5ab158e04b5)

![{\displaystyle \sigma _{P}^{2}=\mathbb {E} \left[\sum _{i=1}^{n}\sum _{j=1}^{n}x_{i}x_{j}(R_{i}-\mathbb {E} [R_{i}])(R_{j}-\mathbb {E} [R_{j}])\right]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/a600910fc58ea5d8f8f92dd7e442f46329e50e40)

![{\displaystyle \sigma _{P}^{2}=\mathbb {E} \left[\sum _{i=1}^{n}x_{i}^{2}\underbrace {(R_{i}-\mathbb {E} [R_{i}])^{2}} _{\equiv \sigma _{i}^{2}}+\sum _{i=1}^{n}\sum _{j=1,i\neq j}^{n}x_{i}x_{j}\underbrace {(R_{i}-\mathbb {E} [R_{i}])(R_{j}-\mathbb {E} [R_{j}])} _{\equiv \sigma _{ij}}\right]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/8e352b69b9e6806cef7de6e042078770113311b7)