2012–2013 Cypriot financial crisis: Difference between revisions

GoingBatty (talk | contribs) →Eurozone/IMF deal: manual clean up using AWB (10617) |

|||

| Line 18: | Line 18: | ||

Since January 2012, Cyprus has been relying on a €2.5bn (US$3.236 billion) emergency loan from Russia to cover its budget deficit and re-finance maturing debt. The loan has an interest rate of 4.5%, with no amortization/repayment until its maturity ends after 4.5 years, and no penalty if repayment at that point of time will be delayed, in the event of a persisting lack of access for Cyprus to cover its financial needs through the normal funding markets.<ref>{{Cite news |title=Russia loans Cyprus 2.5 billion |newspaper=The Guardian |url=http://www.athensnews.gr/issue/13464/48840|date=10 October 2011 |accessdate=13 March 2012}}</ref><ref name="ft.com">{{Cite news |title=Cyprus nears €2.5bn Russian loan deal |newspaper=Financial Times |url=http://www.ft.com/intl/cms/s/0/655a3fd2-de31-11e0-9fb7-00144feabdc0.html |first1=Andreas |last1=Hadjipapas |first2=Kerin |last2=Hope |date=14 September 2011 |accessdate=13 March 2012 |deadurl=no}}</ref> The received loan was expected to cover all refinancing of maturing government debt and the amount needed for the governments continued budget deficits, until the first quarter of 2013. But the received loan did not include any funds for recapitalization of the Cypriot financial sector. Looking further ahead, it was generally expected Cyprus would need to apply for an additional bailout loan.<ref name="ft.com"/> |

Since January 2012, Cyprus has been relying on a €2.5bn (US$3.236 billion) emergency loan from Russia to cover its budget deficit and re-finance maturing debt. The loan has an interest rate of 4.5%, with no amortization/repayment until its maturity ends after 4.5 years, and no penalty if repayment at that point of time will be delayed, in the event of a persisting lack of access for Cyprus to cover its financial needs through the normal funding markets.<ref>{{Cite news |title=Russia loans Cyprus 2.5 billion |newspaper=The Guardian |url=http://www.athensnews.gr/issue/13464/48840|date=10 October 2011 |accessdate=13 March 2012}}</ref><ref name="ft.com">{{Cite news |title=Cyprus nears €2.5bn Russian loan deal |newspaper=Financial Times |url=http://www.ft.com/intl/cms/s/0/655a3fd2-de31-11e0-9fb7-00144feabdc0.html |first1=Andreas |last1=Hadjipapas |first2=Kerin |last2=Hope |date=14 September 2011 |accessdate=13 March 2012 |deadurl=no}}</ref> The received loan was expected to cover all refinancing of maturing government debt and the amount needed for the governments continued budget deficits, until the first quarter of 2013. But the received loan did not include any funds for recapitalization of the Cypriot financial sector. Looking further ahead, it was generally expected Cyprus would need to apply for an additional bailout loan.<ref name="ft.com"/> |

||

==Economic Adjustment Programme for Cyprus== |

|||

===Credit rating downgrade to speculative=== |

|||

{{main|Economic Adjustment Programme for Cyprus}} |

|||

On 13 March 2012, [[Moody's Investors Service|Moody's]] slashed Cyprus's [[credit rating]] to speculative status, warning that the Cyprus government would have to inject more fresh capital into its banks to cover losses incurred through Greece's debt swap. On 25 June 2012, the day when [[Fitch Group|Fitch]] downgraded bonds issued by Cyprus to BB+, which disqualified them from being accepted as collateral by the [[European Central Bank]], the Cypriot government requested a [[bailout]] from the [[European Financial Stability Facility]] or the [[European Stability Mechanism]].<ref name=FT625>{{cite news|title=Cyprus requests eurozone bailout|url=http://www.ft.com/intl/cms/s/0/80320e0e-bed0-11e1-b24b-00144feabdc0.html|accessdate=25 June 2012|newspaper=Financial Times|date=25 June 2012|author=James Wilson |deadurl=no}}</ref> |

|||

{{Move portions from|Economic Adjustment Programme for Cyprus|section=y|date=January 2015}} |

|||

===Request for EU intervention and agreement=== |

|||

The Cypriot Government was reported requesting a bailout from the [[European Financial Stability Facility]] or the [[European Stability Mechanism]] on 25 June 2012, citing difficulties in supporting its banking sector from the exposure to the Greek debt.<ref>{{cite web|url=http://www.aljazeera.com/news/europe/2012/06/201262517189248721.html |title=Cyprus asks EU for financial bailout – Europe |publisher=Al Jazeera |deadurl=no}}</ref> Representatives of the Troika (the [[European Commission]], the [[International Monetary Fund]], and the European Central Bank) arrived on the island in July to investigate the country's financial problems, and submitted the terms of the bailout to the Cypriot government on 25 July.<ref>{{cite web|url=https://web.archive.org/web/20121102084708/http://www.cyprus-mail.com/cyprus/shiarly-troika-will-be-here-very-soon/20121102 |title=Shiarly: troika will be here very soon |work=Cyprus Mail |date=2 November 2012 |deadurl=no}}</ref> The Cypriot government expressed disagreement over the terms, and continued negotiation with Troika representatives concerning possible alterations to them throughout the following months.<ref>[http://www.cyprus-mail.com/inbusinessnews/trying-defend-basic-conquests/20120913 ]{{dead link|date=March 2013 |url=http://www.cyprus-mail.com/inbusinessnews/trying-defend-basic-conquests/20120913}}</ref><ref>{{cite web|url=https://web.archive.org/web/20120914093932/http://www.cyprus-mail.com/ecofin/troika-leaves-no-stone-unturned/20120914 |title=Troika leaves no stone unturned |work=Cyprus Mail |date=14 September 2012}}</ref> |

|||

On 20 November, the government handed its counter-proposals to the Troika on the terms of the bailout,<ref>{{cite web|url=https://web.archive.org/web/20121121215341/http://www.cyprus-mail.com/cyprus/troika-handed-compromise-proposals/20121121 |title=Troika handed compromise proposals |work=Cyprus Mail |date=21 November 2012 |deadurl=no}}</ref> with negotiations continuing. On 30 November it was reported that Troika and the Cypriot Government had agreed on the bailout terms with only the amount of money required for the bailout remaining to be agreed upon.<ref>{{cite news|last=Tugwell |first=Paul |url=http://www.bloomberg.com/news/2012-11-30/cyprus-troika-agree-bailout-terms-ecb-demetriades-says.html |title=Cyprus, Troika Agree Bailout Terms, ECB Demetriades Says |publisher=Bloomberg |date=30 November 2012 |deadurl=no}}</ref> By contrast, the IMF referred only to "good progress towards an agreement".<ref>{{cite web|last=IMF |url=http://www.imf.org/external/np/sec/pr/2012/pr12457.htm |title=Statement by the EC, ECB, and IMF on the Mission to Cyprus |date=23 November 2012 |deadurl=no}}</ref> The preliminary agreement terms were made public on 30 November.<ref>{{cite web|url=https://web.archive.org/web/20121201155220/http://www.cyprus-mail.com/bailout/bailout-deal-made-public/20121201 |title=Bailout deal made public |work=Cyprus Mail |date=1 December 2012 |deadurl=no}}</ref> The [[austerity]] measures included cuts in civil service salaries, social benefits, allowances and pensions and increases in VAT, tobacco, alcohol and fuel taxes, taxes on lottery winnings, property, and higher public health care charges.<ref>{{cite web|url=http://www.politis-news.com/upload/20121130/1354292326-07337.pdf |title=Microsoft Word - Cyprus MoU 29 Nov to EWG.doc |format=PDF }}</ref> |

|||

===Eurozone/IMF deal=== |

|||

On 16 March 2013, the [[Eurogroup]], [[European Commission]] (EC), [[European Central Bank]] (ECB) and [[International Monetary Fund]] (IMF) agreed on a €10 billion deal with Cyprus,<ref>{{cite news |url=http://www.rte.ie/news/2013/0316/376965-cyprus-bailout/ |title=Eurozone agrees to €10bn bailout package for Cyprus while Cypriots voice anger over deposits levy |publisher=Raidió Teilifís Éireann |date=16 March 2013 |accessdate=16 March 2013 |deadurl=no}}</ref> making it the fifth country—after Greece, Ireland, Portugal and Spain—to receive money from the EU-IMF. As part of the deal, a one-off [[bank deposit levy]] of 6.7% for deposits up to €100,000 and 9.9% for higher deposits, was announced on all domestic bank accounts. Savers were due to be compensated with shares in their banks.<ref name=BBCcb>{{cite news |title=Cyprus bailout: Parliament postpones debate |url=http://www.bbc.co.uk/news/world-europe-21819990 |publisher=BBC News |date=17 March 2013 |deadurl=no}}</ref> Measures were put in place to prevent withdrawal or transfer of moneys representing the prescribed levy.<ref>{{cite news |url=http://www.guardian.co.uk/world/2013/mar/16/cyprus-eurozone-bailout-anger |title=Cyprus eurozone bailout prompts anger as savers hand over possible 10% levy: Angry Cypriots try in vain to withdraw savings as eurozone bailout terms break taboo of hitting bank depositors |newspaper=The Guardian |agency=Reuters |date=16 March 2013 |accessdate=16 March 2013 |deadurl=no |location=London}}</ref> |

|||

The deal required the approval of the [[Cypriot parliament]], which was due to debate it on 18 March. According to President [[Nicos Anastasiades]], failure to ratify the measures would lead to a "disorderly bankruptcy" of the country.<ref name=BBCcb/> The Russian government "blasted Cyprus's bank levy, piling more pressure on the country's capital, Nicosia" ahead of the parliament's vote on the bailout. Russia had not decided at the time whether to extend its existing loan to Cyprus.<ref>{{cite news |author=Graeme Wearden |title=Cyprus races to rework savings tax after closing banks till Thursday – as it happened |publisher=Guardian |date=15 March 2013 |url=http://www.guardian.co.uk/business/2013/mar/18/eurozone-crisis-cyprus-bailout-savers-markets |accessdate=2 April 2013 |deadurl=no |location=London}}</ref> |

|||

With the background of large demonstrations outside the House of Representatives in Nicosia by Cypriot people protesting the bank deposit levy,<ref>http://www.theaustralian.com.au/news/world/cypriots-take-to-streets-over-bank-deposits-tax/story-fnb64oi6-1226600994875</ref> the deal was rejected by the Cypriot parliament on 19 March 2013 with 36 votes against, 19 abstentions and one not present for the vote.<ref>{{cite news |url=http://www.reuters.com/article/2013/03/19/us-cyprus-parliament-idUSBRE92G03I20130319 |title=Cyprus lawmakers reject bank tax; bailout in disarray Reuters<!-- Bot generated title --> |deadurl=no |date=19 March 2013}}</ref> |

|||

On 22 March, the Cyprus legislature approved a plan to restructure the [[Cyprus Popular Bank]] (also known as Laiki Bank), its second largest bank, creating in the process a so-called "[[bad bank]]".<ref>{{cite news|last=Alderman|first=Liz|title=Cyprus Passes Parts of Bailout Bill, but Delays Vote on Tax|url=http://www.nytimes.com/2013/03/23/business/global/cyprus-bailout-vote.html?_r=1&|newspaper=New York Times|date=22 March 2013 |deadurl=no}}</ref> On 25 March, Cyprus President Anastasiades, [[Eurozone]] finance ministers, and IMF officials announced a new plan to preserve all [[Deposit insurance|insured deposits]] of 100,000 Euros or less without a levy, but shut down Laiki Bank, levying all uninsured deposits there, and levying 40% of uninsured deposits in [[Bank of Cyprus]], held mostly by wealthy Russians and Russian [[multinational corporations]] who use Cyprus as an [[offshore bank]] and safe [[tax haven]]. The revised agreement, expected to raise 4.2 billion Euros in return for a €10 billion bailout, does not require any further approval of the Cypriot parliament, as the legal framework for the implied solutions for Laiki Bank and Bank of Cyprus has already been accounted for in the bill passed by the parliament last week.<ref name=ReutersNewdeal>{{cite news |author=Jan Strupczewski |author2=Annika Breidthardt |title=Last-minute Cyprus deal to close bank, force losses |publisher=Reuters |date=25 March 2013 |url=http://www.reuters.com/article/2013/03/25/us-cyprus-parliament-idUSBRE92G03I20130325 |accessdate=25 March 2013 |deadurl=no}}</ref><ref name=Ekathimerini>{{cite news |title=Eurogroup signs off on bailout agreement reached by Cyprus and troika |newspaper=Ekathimerini |location=Greece |date=25 March 2013 |url=http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_25/03/2013_489702 |accessdate=25 March 2013 |deadurl=no}}</ref> |

|||

When the final agreement was settled on 25 March, the idea of imposing any sort of deposit levy was dropped, as it was instead now possible to reach a mutual agreement with the Cypriot authorities accepting a direct closure of the most troubled [[Laiki Bank]]. Remaining good assets and deposits below €100,000 with Laiki Bank would be saved and transferred to Bank of Cyprus (BoC), while shareholder capital would be written off, and the uninsured deposits above €100,000 – along with other creditor claims – would be lost to the degree being decided by how much the receivership subsequently can recover from liquidation of the remaining bad assets. As an extra safety measure, uninsured deposits above €100,000 in BoC will also remain frozen until a recapitalisation has been implemented ''(with a possible imposed haircut if this is later deemed needed to reach the requirement for a 9% [[tier 1 capital]] ratio)''. The targeted closure of Laiki and recapitalisation plan for BoC helped significantly to reduce the needed loan amount for the overall bailout package, so that €10bn was still sufficient without need for imposing a general levy on bank deposits. The final conditions for activation of the bailout package were outlined by the Troika's [[Memorandum of Understanding|MoU]] agreement, which was endorsed in full by the [[House of Representatives (Cyprus)|Cypriot House of Representatives]] on 30 April 2013, and included:<ref name="Eurogroup bailout package agreement on 25 March">{{cite web|url=http://www.consilium.europa.eu/uedocs/cms_Data/docs/pressdata/en/ecofin/136487.pdf|title=Eurogroup Statement on Cyprus |format=PDF|publisher=Eurogroup|date=25 March 2013|accessdate=25 March 2013}}</ref><ref name="Economic Adjustment Programme for Cyprus">{{cite web|url=http://ec.europa.eu/economy_finance/publications/occasional_paper/2013/pdf/ocp149_en.pdf|title=The Economic Adjustment Programme for Cyprus|format=PDF|work=Occasional Papers 149 (yield spreads displayed by graph 19)|publisher=European Commission|date=17 May 2013|accessdate=19 May 2013}}</ref> |

|||

{{cquote| |

|||

#Recapitalisation of the entire financial sector while accepting a closure of the Laiki bank, |

|||

#Implementation of the [[anti-money laundering]] framework in Cypriot financial institutions, |

|||

#Fiscal consolidation to help bring down the Cypriot governmental budget deficit, |

|||

#Structural reforms to restore competitiveness and macroeconomic imbalances, |

|||

#Privatization programme.''}} |

|||

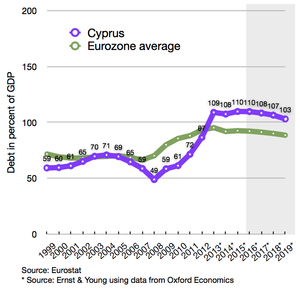

The Cypriot [[debt-to-GDP ratio]] is on this background now forecasted only to peak at 126% in 2015 and subsequently decline to 105% in 2020, and thus considered to remain within sustainable territory. The €10bn bailout comprise €4.1bn spend on debt liabilities (refinancing and amortization), 3.4bn to cover fiscal deficits, and €2.5bn for the bank recapitalization. These amounts will be paid to Cyprus through regular tranches from 13 May 2013 until 31 March 2016. According to the programme this will be sufficient, as Cyprus during the programme period in addition will:<ref name="Economic Adjustment Programme for Cyprus"/> |

|||

# Receive €1.0bn extraordinary revenue from privatization of government assets. |

|||

# Ensure an automatic roll-over of €1.0bn maturing Treasury Bills and €1.0bn of maturing bonds held by domestic creditors. |

|||

# Bring down the funding need for bank recapitalization with €8.7bn, of which 0.4bn is a reinjection of future profits earned by the Cyprus Central Bank (injected in advance at the short term by selling its gold reserve), and €8.3bn origin from the bail-in of creditors in Laiki Bank and Bank of Cyprus. |

|||

Given the proposed and actual element of taking deposits as part of the agreement, it was sometimes referred to as a "bail-in" rather than a bailout.<ref>Bjork, Christopher, {{cite web |url=http://www.marketwatch.com/story/ecbs-mersch-cyprus-bail-in-not-a-template-2013-03-27 |title=ECB's Mersch: Cyprus ‘bail in’ not a template |deadurl=no}}, ''[[MarketWatch]]'', 27 March 2013. Headline reference is to ECB governing council member [[Yves Mersch]]. Retrieved 27 March 2013.</ref> |

|||

===Exit of the bailout support programme=== |

|||

Although the bailout support programme feature sufficient financial transfers until March 2016, Cyprus began slowly to regain its access to the private lending markets already in June 2014. At this point of time, the government sold €0.75bn of bonds with a five-year maturity, to the tune of a 4.85% yield. A continued selling of bonds with a ten-year maturity, which would equal a regain of complete access to the private lending market (and mark the end of the era with need for bailout support), is expected to happen sometime in 2015.<ref>{{cite web|url=http://www.bloomberg.com/news/2014-06-18/cyprus-said-to-start-selling-bond-ending-exile.html|title=Cyprus Sells Bonds, Bailed-0ut Nations’ Market Exile|publisher=Bloomberg|date=18 June 2014}}</ref> |

|||

==Criticism== |

==Criticism== |

||

Revision as of 14:28, 5 January 2015

The 2012–2013 Cypriot financial crisis is an economic crisis in the Republic of Cyprus that involves the exposure of Cypriot banks to overleveraged local property companies, the Greek government-debt crisis, the downgrading of the Cypriot government's bond credit rating to junk status by international credit rating agencies, the consequential inability to refund its state expenses from the international markets[1][2] and the reluctance of the government to restructure the troubled Cypriot financial sector.[3]

On 25 March 2013, a €10 billion international bailout by the Eurogroup, European Commission (EC), European Central Bank (ECB) and International Monetary Fund (IMF) was announced, in return for Cyprus agreeing to close the country's second-largest bank, the Cyprus Popular Bank (also known as Laiki Bank), imposing a one-time bank deposit levy on all uninsured deposits there, and possibly around 40% of uninsured deposits in the Bank of Cyprus (the island's largest commercial bank), many held by wealthy citizens of other countries (many of them from Russia) who were using Cyprus as a tax haven.[4][5] No insured deposit of €100,000 or less would be affected.[6][7]

Context

The United States' subprime mortgage crisis in 2007–2008 led to a domino effect of negative consequences in the global economy including the European Union. The Cypriot economy went into recession in 2009, as the economy shrank by 1.67%,[8] with large falls specifically in the tourism and shipping sectors[9] which caused rising unemployment.[10] Economic growth between 2010 and 2012 was weak and failed to reach its pre-2009 levels.[8] Commercial property values declined by approximately 30%.[11] Non-performing loans rose to a reported 6.1% in 2011,[12] increasing pressure on the banking system. With a small population and modest economy, Cyprus had a large offshore banking industry. Compared to a nominal GDP of €19.5bn ($24bn)[13] the banks had amassed €22 billion of Greek private-sector debt with bank deposits $120bn, including $60bn from Russia business corporations.[14] Russian oligarch Dmitry Rybolovlev owned a 10% shareholding of Bank of Cyprus.[14][15][16]

Cyprus banks first came under severe financial pressure as bad debt ratios rose. Former Laiki CEO Efthimios Bouloutas admitted that his bank was probably insolvent as early as 2008, even before Cyprus entered the Eurozone. The banks were then exposed to a haircut of upwards of 50% in 2011[17] during the Greek government-debt crisis,[18][19] leading to fears of a collapse of the Cypriot banks. The Cypriot state, unable to raise liquidity from the markets to support its financial sector, requested a bailout from the European Union.[9]

Progress on fiscal and structural reforms was slow and following a serious, accidental explosion in July 2011 at the Evangelos Florakis Naval Base the major credit rating agencies downgraded the country's rating in September. Yields on its long-term bonds rose above 12% and there was concern that the country would be unable to stabilize its banks.

Response

Emergency loan (2012)

Since January 2012, Cyprus has been relying on a €2.5bn (US$3.236 billion) emergency loan from Russia to cover its budget deficit and re-finance maturing debt. The loan has an interest rate of 4.5%, with no amortization/repayment until its maturity ends after 4.5 years, and no penalty if repayment at that point of time will be delayed, in the event of a persisting lack of access for Cyprus to cover its financial needs through the normal funding markets.[20][21] The received loan was expected to cover all refinancing of maturing government debt and the amount needed for the governments continued budget deficits, until the first quarter of 2013. But the received loan did not include any funds for recapitalization of the Cypriot financial sector. Looking further ahead, it was generally expected Cyprus would need to apply for an additional bailout loan.[21]

Economic Adjustment Programme for Cyprus

It has been suggested that portions of Economic Adjustment Programme for Cyprus be split from it and merged into this section. (Discuss) (January 2015) |

Criticism

- Irish MEP Nessa Childers, daughter of the country's former President Erskine H. Childers, painted a bleak picture. She described the efforts of the EU-IMF as an "incompetent mess" and said the Eurozone was more destabilised as a result.[22]

- In its Schumpeter Blog The Economist called The Cyprus bail-out:Unfair, short-sighted and self-defeating.[23]

Specifically the article says

"The Cypriot deal has no coherence in the larger context. The euro crisis has been in abeyance for a few months, thanks largely to the readiness of the European Central Bank to intervene to help struggling countries. The ECB's price for helping countries is to insist they go into a bail-out programme. The political price of going into a programme has just gone up, so the ECB's safety net looks a little thinner. The bail-out appears to move Europe further away from the institutional reforms that are needed to resolve the crisis once and for all. Rather than using the European Stability Mechanism to recapitalise banks, and thereby weaken the link between banks and their governments, the euro zone continues to equate bank bail-outs with sovereign bail-outs. As for debt mutualisation, after imposing losses on local depositors, the price of support from the rest of Europe is arguably costlier now than it ever has been."

- Dr. Jeffrey Stacey wrote in Germany's Der Spiegel, under the headline "'Abject Error': How the Cyprus Deal Hurts EU Strategic Interests":[24]

In strategic terms the EU hurt not only Cyprus and itself, but also the interests of the US and other allies in the West. Europe pushed Cyprus directly into the arms of the Russian government. Not only did this hurt the prospects for its own deal, but it gave leverage to Moscow in the process.

More important still, however, by forcing Anastasiades between the rock of a forced bank levy and the hard place of seeking assistance from Moscow, the EU seriously undermined him domestically precisely when the West was about to reap the benefits at long last of a fairly pro-Western Cypriot president, crucially necessary to overcome sour relations with Turkey that continue to undermine NATO relations, EU relations, NATO-EU relations, and US relations with both.

To top it all off, a peace deal along the lines of the Annan Plan for a final resolution of the 40-year-old Cypriot divide – the prospects for which had improved with the election of Anastasiades – has seen its prospects diminished.

- Economist Richard D. Wolff commented in an interview in relation to the Cyprus bailout agreement as follows:[25]

This is blackmail. This is basically the officials of the banks and the political leaders going to the mass of people and saying to them, "This awful deal that makes you, who have nothing to do with the crisis and didn't get any bailout, pay the costs of the crisis and the bailout. You must do this, because if you don't, we will do even more damage to you and your economy. So give us your deposits, give us your money, pay more taxes, suffer fewer social programs, because if you don't, we will impose even worse on you." It's the basic idea of austerity across the board and in our country, too. And I think it's the confrontation of a system that does not work with the mass of the people, saying, "We will go down and take you with us, unless you bail us out."

Local reaction

Cyprus has seen a number of reactions and responses towards the austerity measures of the bailout plan. On 8 November 2012, the Cypriot far-left party Committee for a Radical Left Rally (ERAS) organized the first protest against austerity while the Troika negotiations that were still taking place.[26] Protesters were gathered outside the House of Representatives holding banners and shouting slogans against austerity. Leaflets with alternative proposals for the economy were distributed in the protest, with proposals including the nationalization of banking, the reduction of the army and the freezing of the army budget, and the increase of the corporate tax. Members of the New Internationalist Left (NEDA) also participated in the protest.[27]

On 14 November the New Internationalist Left organised an anti-austerity protest outside the Ministry of Finance in Nicosia together with the Alliance Against the Memorandum. In the protest NEDA gave out leaflets, which expressed the view that "the EU is trying to burden the workers with the debts from the collapse of the bankers" and that "if this happens, the Cypriot economy and the future of the new generations will then be mortgaged to local and foreign profiteers and usurious bankers".[28]

Contract teachers protested outside the House of Representatives on 29 November against austerity measures that would leave 992 of them without a job next year. The teachers stormed the building and bypassed the policemen, entering the parliament. The teachers shouted against the banks and poverty.[29] A protest by investors was staged on the morning of 11 December outside the House of Representatives, with protesters again storming parliament and bypassing the police. The storming of the parliament led to the interruption of the discussions of the parliamentary committee of customs. The protesters were asked to leave so that the committee could continue its work, and the protesters left half an hour later.[30]

A number of protests took place on 12 December. Members of large families protested outside the House of Representatives against cuts in the benefits given by the state to support large families. Protesters threw eggs and stones at the main entrance of the parliament, and a number of protesters tried to enter the building, but were blocked by the police force that arrived to handle the protest. It was reported that a woman fainted during the incidents. The protesters shouted for the MPs to come out but no response was given.[31]

The protesters were joined by members of KISOA (Cypriot Confederation of Organisations of the Disabled, Κυπριακή Συνομοσπονδία Οργανώσεων Αναπήρων), who marched from the Ministry of Finance to the House of Representatives to protest against cuts in benefits for people with disabilities.[32] Later in the day members of public school teachers' trade unions protested outside the Ministry of Finance against the cuts in education spending which could result in the firing of teachers.[33] The unions staged another protest the next day near the House of Representatives.[34]

Haravgi, a far left-wing newspaper reported that just before bank deposits were blocked a number of companies belonging to family of president Nikos Anastasiadis have transferred over $21m outside of Cyprus.[35] Anastasiadis has denied these allegations.[36] Also a number of loans issued to members of political parties or public administration officers were fully or partially written off.[37]

Non-EU bank depositors

Non-resident investors who held deposits prior to 15 March 2013 when the plan to impose losses on savers was first formulated, and who lost at least three million euros would be eligible to apply for Cypriot citizenship. Cyprus's existing "citizenship by investment" program would be revised to reduce the amount of investment required to be eligible for the program to three million euros from the previous ten million euros. "These decisions will be deployed in a fast-track manner," Anastasiades said in an address to Russian business people in the port city of Limassol in 2013. Other measures were also under consideration, he said, including offering tax incentives for existing or new companies doing business in Cyprus.[38][39]

Analysis

A team of 16 Cypriot economists, organized by the citizens group Eleutheria ("Freedom"),[40] attributed the crisis to sliding competitiveness, increasing public and private debt, exacerbated by the banking crisis.[41]

References

- ^ "Cyprus asks EU for financial bailout – Europe". Al Jazeera English.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Cypriot banks in the aftermath of the Greek haircut". The Cyprus Lawyer. 26 October 2011.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Dixon, Hugo (24 March 2013). "Cyprus Refuses to Learn From Its Mistakes". The New York Times no. Retrieved 2 April 2013.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Ehrenfreund, Max (27 March 2013). "Cypriot banks to reopen amid criticism of bailout". The Washington Post.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Cyprus disaster shines light on global tax haven industry no". MSNBC. 26 March 2013. Retrieved 2 April 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Cite error: The named reference

ReutersNewdealwas invoked but never defined (see the help page). - ^ Cite error: The named reference

Ekathimeriniwas invoked but never defined (see the help page). - ^ a b "Cyprus economic growth, Cyprus GDP growth rate TheGlobalEconomy.com".

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b "Up Front – March 19, 2013 at 7:00am KPFA 94.1 FM Berkeley: Listener Sponsored Free Speech Radio".

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Cyprus Unemployment rate – Economy".

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "RICS Cyprus Property Index Q4 2012". RICS Europe. Retrieved 14 April 2013.

- ^ "Bank nonperforming loans to total gross loans (%)". World Bank. Retrieved 14 April 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Cyprus". International Monetary Fund. Retrieved 18 April 2012.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b Stephen Castle; David Jolly (12 June 2012). "Rates on Spanish Bond Soar". The New York Times. Retrieved 12 June 2012.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Wearden, Graeme (13 March 2012). "Eurozone crisis live: Spain told to cut harder as Greek deal approved". The Guardian. London. Retrieved 13 March 2012.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Cite error: The named reference

FT625was invoked but never defined (see the help page). - ^ forbes.com: "There's Something Very Strange About The Cyprus Bank Haircut. Very Strange Indeed" (Worstall) 31 Mar 2013

- ^ "Greek bond investors take big 'haircut' in bailout deal Marketplace.org".

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Greek debt 'haircut' takes off New Europe".

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Russia loans Cyprus 2.5 billion". The Guardian. 10 October 2011. Retrieved 13 March 2012.

- ^ a b Hadjipapas, Andreas; Hope, Kerin (14 September 2011). "Cyprus nears €2.5bn Russian loan deal". Financial Times. Retrieved 13 March 2012.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "MEP Childers: Cyprus bailout an 'incompetent mess'". Irish Examiner. Thomas Crosbie Holdings. 27 March 2013. Retrieved 27 March 2013.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Wearden, Graeme (16 March 2013). "The Cyprus bail-out: Unfair, short-sighted and self-defeating". The Economist. UK. Retrieved 20 March 2013.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Wearden, Graeme (3 April 2013). "'Abject Error': How the Cyprus Deal Hurts EU Strategic Interests". Der Spiegel. Germany. Retrieved 4 April 2013.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Events in Cyprus expose EU plan to steal peoples' savings and bailout private banks". Citizen Action Monitor. 31 March 2013. Retrieved 17 February 2014.

- ^ BDigital Web Solutions. "Την Πέμπτη η πρώτη εκδήλωση διαμαρτυρίας κατά του Μνημονίου | Κύπρος | Η ΚΑΘΗΜΕΡΙΝΗ". Kathimerini.com.cy.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Συγκέντρωση διαμαρτυρίας από την ΕΡΑΣ κατά του μνημονίου και της Τρόικας μπροστά από τη Βουλή". Onlycy.com.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Εκδήλωση διαμαρτυρίας κατά της Τρόικας έξω από το ΥΠΟΙΚ".

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ BDigital Web Solutions (29 November 2012). "Σοβαρά επεισόδια σε Βουλή-ΥΠΟΙΚ με τους εποχιακούς ωρομίσθιους | Κύπρος | Η ΚΑΘΗΜΕΡΙΝΗ". Kathimerini.com.cy.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Επεισόδια έξω από τη Βουλή (φωτο+βίντεο)". Sigmalive.com.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Συμπλοκές στη Βουλή στη διαμαρτυρία των πολυτέκνων(βίντεο) | News". Sigmalive.com.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Στους δρόμους και οι ανάπηροι". Sigmalive.com.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Αντιδρούν και οι εκπαιδευτικές οργανώσεις | News". Sigmalive.com.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Υπό δρακόντεια μέτρα η διαδήλωση των εκπαιδευτικών". Sigmalive.com.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Cyprus President's Family Transferred Tens of Millions To London Days Before Deposit Haircuts". HPUB. 2013. Retrieved 1 April 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Anastasiades requests investigation into allegations against family members". EnetEnglish. 2013. Retrieved 1 April 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Cypriot banks in politician loan scandal". EnetEnglish. 2013. Retrieved 1 April 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Cyprus to ease citizenship requirements, attacks EU "hypocrisy"". Reuters.com. 14 April 2013. Retrieved 17 August 2013.

- ^ "Cyprus to ease citizenship rules for EU bailout losers". Bbc.co.uk. 14 April 2013. Retrieved 17 August 2013.

- ^ Greek ΕΛΕΥΘΕΡΙΑ

- ^ Η τριλογία της αποτυχίας μας, in the Cyprus daily newspaper Φιλελεύθερος dated 9 September 2012, economics section, page 1.