Peak gas: Difference between revisions

m Date maintenance tags and general fixes |

|||

| Line 161: | Line 161: | ||

}}</ref> It is unclear how or if Hubbert considered the regions of Alaska or the Gulf of Mexico in this prediction. |

}}</ref> It is unclear how or if Hubbert considered the regions of Alaska or the Gulf of Mexico in this prediction. |

||

US gas production reached a peak in 1973 at about 24.1 trillion cubic feet, and declined through 1976. But new discoveries in the [[Gulf of Mexico]], development of "unconventional reserves",<ref>[http://www.accessmylibrary.com/coms2/summary_0286-33573113_ITM British author says world may be close to peak natural gas output], The Oil Daily, 15-11-07.</ref> and gas |

US gas production reached a peak in 1973 at about 24.1 trillion cubic feet, and declined through 1976. But new discoveries in the [[Gulf of Mexico]], development of "unconventional reserves",<ref>[http://www.accessmylibrary.com/coms2/summary_0286-33573113_ITM British author says world may be close to peak natural gas output], The Oil Daily, 15-11-07.</ref> and gas discoveries associated with [[Prudhoe Bay, Alaska]] proved Pratt's EUR estimate to be too low as US gas production rose again. |

||

====Hubbert, 1971==== |

====Hubbert, 1971==== |

||

Revision as of 21:13, 28 October 2008

Peak gas is the point in time at which the maximum global natural gas production rate is reached, after which the rate of production enters its terminal decline.[1] Natural gas is a fossil fuel formed from plant matter over the course of millions of years. It is a finite resource and thus consider to be a non-renewable energy source.

The concept of peak gas follows from M. King Hubbert's Hubbert peak theory, which is most commonly associated with Peak oil. Hubbert saw gas, coal and oil as natural resources, each of which would peak in production and eventually run out for a region, a country, or the world. Since Hubbert's initial predictions in 1956, "the proper application of ever more powerful statistical techniques has reduced much of the uncertainty about the supply of oil and natural gas," and shown Hubbert's use of an exponential decline model to be statistically "adequate".[2]

Gas demand

The world gets almost one quarter of its energy from natural gas. The consumption of natural gas has nearly doubled in the last 30 years. The most important energy agencies in the world are forecasting increases in natural gas demand in the next 20 years.[3] The largest increments in future gas demand are expected to come from developing countries.

Gas supply

New gas discoveries

According to David L. Goodstein, the worldwide rate of discovery peaked around 1960 and has been declining ever since.[4] Exxon Mobil Vice President, Harry J. Longwell places the peak of global gas discovery around 1970 and has observed a sharp decline in natural gas discovery rates since then.[5] The rate of discovery has fallen below the rate of consumption in 1980.[4] The gap has been widening ever since. Declining gas discovery rates foreshadow future production decline rates because gas production can only follow gas discoveries.

Production

Reserves

Peak gas for individual nations

Italy

Italy's gas consumption is presently third-highest in Europe, behind only Germany and the United Kingdom. Gas consumption is growing at a steady rate, and gas consumption in 2001 was fully 50% greater than it was in 1990.[6]

Italy’s major oil and gas company is Eni. Formerly state-owned, it was privatized during the 1990s, but the government still retains around one-third of the shares. Natural gas reserves in Italy were 164 billion m3 at the beginning of 2007. Natural gas production in 2005 was 11.5 billion m3, while consumption was 82.6 billion m3. The difference was imported. The primary sources of imported gas are Algeria, Russia and the Netherlands. Among European countries, Italy is the fourth largest oil consumer after Germany, the UK and France, and the third largest natural gas consumer after Germany and the UK.[7]

Netherlands

The Netherlands government has stated that peak gas occurred in 2007-2008 and the country will have become a net importer of natural gas by 2025.[8]

Norway

Norway is quickly approaching peak gas.[citation needed]

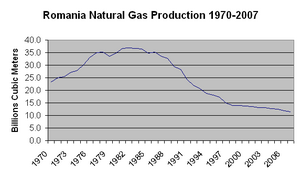

Romania

Natural gas in Romania was discovered in 1909 in the Sarmasel area.[9] In 1917, Turda became the first European town lit up with natural gas. Maximum production of 29.8 Bcm was achieved in 1976.[10] Today, gas provides about 40% of the country's energy needs.

Russia

Gazprom, Russia's state-controlled gas monopoly, is a firm which holds 25% of the world's gas reserves. Gazprom produces the bulk of Russia's gas and exports more than 25% of West Europe's gas needs. According to Gazprom CEO Alexei Miller on July 4, 2008 Russian gas output is no longer growing but will remain flat for the years 2007 through 2009. But production has been flat since 2006. In 2006 gas produced at 556 BCM/y and it declined in 2007 to 548.5 BCM/y, or 1.3% less than in 2006.[11]

United Kingdom

UK gets its natural gas almost entirely from the North Sea. The North Sea gas field peaked in 2000 and has been falling quickly since. Production in 2004 was 12% down from the peak.[12]

United States

Hubbert, 1956

In 1956, Hubbert used an estimated ultimate recovery (EUR) of 850 trillion cubic feet (an amount postulated by geologist Wallace Pratt) to predict a US production peak of about 14 trillion cubic feet per year to occur "approximately 1970".[13] It is unclear how or if Hubbert considered the regions of Alaska or the Gulf of Mexico in this prediction.

US gas production reached a peak in 1973 at about 24.1 trillion cubic feet, and declined through 1976. But new discoveries in the Gulf of Mexico, development of "unconventional reserves",[14] and gas discoveries associated with Prudhoe Bay, Alaska proved Pratt's EUR estimate to be too low as US gas production rose again.

Hubbert, 1971

Just as gas was peaking in 1971, Hubbert revised his peak gas estimate based on updated reserve information. He revised his estimated ultimate recovery upward to 1,075 trillion cubic feet for the lower 48 states only, and predicted: "For natural gas, the peak of production will probably be reached between 1975 and 1980."[15] Gas production for the lower 48 states did peak in 1979, and declined for several years, but rose again, and once more Hubbert's assumed EUR proved to be erroneously low.[citation needed]

Recent US peak predictions

Doug Reynolds predicted in 2005 that the North American gas peak would occur in 2007[16]

Although Hubbert had acknowledged multiple peaks in oil production in Illinois, he used single peak models for oil and gas production in the US as a whole. In 2008, Tad Patzek of the University of California rejected the single-peak model, and showed the multiple peaks of past US gas production as the sum of five different Hubbert curves. He concluded that new technology has more than doubled gas reserves. His figure 15 shows gas production declining steeply after a probable peak in known cycles in 2008. However, he refrained from predicting a date after which gas production would begin terminal decline, but noted: "The actual future of US natural gas production will be the sum of known Hubbert cycles, shown in this paper, and future Hubbert cycles." and warned: "The current drilling effort in the US cannot be sustained without major new advances to increase the productivity of tight formations."[17]

Recent US peak confirmations

According to Western Gas Resources Inc., the North American peak happened in 2001.[citation needed]

In 2005 Exxon's CEO Lee Raymond said to Reuters that "Gas production has peaked in North America."[18] The Reuters article continues to say "While the number of U.S. rigs drilling for natural gas has climbed about 20 percent over the last year and prices are at record highs, producers have been struggling to raise output."

North American natural gas crisis

The natural gas crisis is typically described by the increasing price of natural gas in North America over the last few years, due to the decline in indigenous supply and the increase in demand for electricity generation. Indigenous supply in the U.S. has fallen from 20,570,295 MMcf in 2001 to 18,950,734 MMcf in 2005.[19] Because of the drop in production (exacerbated by the dramatic hit to production that came from Hurricanes Katrina and Rita) and the continuing growth in demand, the price has become so high that many industrial users, mainly in the petrochemical industry, have closed their plants causing loss of jobs. Former Federal Reserve Chairman Alan Greenspan has suggested that a solution to the natural gas crisis is the import of LNG.

This solution is both capital intensive and politically charged due to the public recognition that LNG terminals are explosive risks, especially in the wake of the 9/11 terrorist attacks in the United States. The U.S. Department of Homeland Security is responsible for maintaining their security.[citation needed]

New or expanded LNG terminals create tough infrastructure problems and require high capital spending. LNG terminals require a very spacious—at least 40 feet (12 m) deep[20]—harbor, as well as being sheltered from wind and waves. These "suitable" sites are thus deep in well-populated seaports, which are also burdened with right-of-way concerns for LNG pipelines, or conversely, required to also host the LNG expansion plant facilities and end use (petrochemical) plants amidst the high population densities of major cities, with the associated fumes and multiple serious risks to safety.[citation needed]

Typically, to attain "well-sheltered" waters, suitable harbor sites are well up rivers or estuaries, which are unlikely to be dredged deep enough. Since these very large vessels must move slowly and ponderously in restricted waters, the transit times to and from the terminal become costly, as multiple tugboats and security boats shelter and safeguard the large vessels. Operationally, LNG tankers are (for example, in Boston) effectively given sole use of the harbor, forced to arrive and depart during non-peak hours, and precluded from occupying the same harbor until the first is well-departed. These factors increase operating costs and make capital investment less attractive.[citation needed]

To substantially increase the amount of LNG used to supply natural gas to North America, not only must "re-gasification" plants be built on North American shores—difficult for the reasons stated above—someone also must put substantial, new liquefication stations in Indonesia, the Middle East, and Africa, in order to concentrate the gas generally associated with oil production in those areas. A substantial expansion of the fleet of LNG carriers also must occur, to move the huge amount of fuel needed to make up for the coming shortfall in Northeast America.[citation needed]

World peak gas

According to R.W. Bentley, global gas production will peak anywhere from 2010 to 2020.[21]

See also

- Hubbert peak theory

- Applying Hubbert peak theory to natural gas

- Association for the Study of Peak Oil and Gas (ASPO)

- 2004 Argentine energy crisis - an example of the effects of a gas shortage

References

- ^ Bulls now talking up "Peak Gas" as new cause for long-term concern, Natural Gas Week, 03-06-06

- ^ Cleveland, C.; Kaufmann, R. (1997), "Natural Gas in the US: How Far Can Technology Stretch the Resource Base?" (PDF), ENERGY JOURNAL-CAMBRIDGE MA THEN CLEVELAND OH-, 18, ENERGY ECONOMICS EDUCATIONAL FOUNDATION INC: 89–108

{{citation}}: CS1 maint: multiple names: authors list (link) - ^ "Natural Gas Market". United Nations Conference on Trade and Development. Retrieved 2008-09-20.

- ^ a b David L. Goodstein (2004). Out Of Gas: The end of age of oil. W. W. Norton & Company. pp. p. 128. ISBN 9780393058574. Retrieved 2008-09-30.

{{cite book}}:|pages=has extra text (help) - ^ Harry J. Longwell (2002-12). "The future of the oil and gas industry: past approaches, new challenges" (PDF). 5 (3). World Energy. Retrieved 2008-09-30.

{{cite journal}}: Check date values in:|date=(help); Cite journal requires|journal=(help) - ^ "Country Review Italy". EU GeoCapacity. Retrieved 2008-09-21.

- ^ "Italy needs to face up to the future". Power Engineering.

- ^ "Energie Rapport 2008" (in Dutch). Ministrie van Economische Zaken. 2008-06. pp. p.41. Retrieved 2008-10-2.

{{cite web}}:|pages=has extra text (help); Check date values in:|accessdate=and|date=(help) - ^ Gheorghe Stephan. "Outlining the Role of Romania in the European Gas Transit Chain: Current Status and Prospective" (PDF). International Energy Agency. Retrieved 2008-09-20.

- ^ Andrei Viforeanu, Wayne Wells, Jay W. Hodny. "Passive surface geochemical survey leads to dry gas discoveries". World Oil. Retrieved 2008-09-20.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ "The Russian Oil & Gas Producers - Gazprom". APS Review Gas Market Trends. 2008-08-18. Retrieved 2008-10-06.

- ^ Chris Vernon (2005-08-26). "UK gas and electricity crisis looming". Energy Bulletin. Retrieved 2008-09-19.

- ^ M. King Hubbert (1956-06). "Nuclear Energy and the Fossil Fuels 'Drilling and Production Practice'" (PDF). API. p. figure 22 and p.25,36. Retrieved 2008-04-18.

{{cite web}}: Check date values in:|date=(help) - ^ British author says world may be close to peak natural gas output, The Oil Daily, 15-11-07.

- ^ M. King Hubbert, 1971, The energy resources of the earth in Energy and Power", p.35. Retrieved on 8 Sept. 2008.

- ^ Bill White (2005-12-17). "State's consultant says nation is primed for using Alaska gas". Energy Bulletin. Retrieved 2008-10-02.

- ^ Tad W. Patzek (2008). "Exponential growth, energetic Hubbert cycles, and the advancement of technology" (PDF). pp. pp.14-15.

{{cite web}}:|pages=has extra text (help); Unknown parameter|accesseddate=ignored (help) - ^ "Exxon says N. America gas production has peaked". Reuters. 2005-06-21. Retrieved 2008-10-04.

- ^ "U.S. Natural Gas Marketed Production 1900 - 2005 (MMcf)". U.S. Department of Energy. Retrieved 2007-07-16.

- ^ California Energy Commission Frequently Asked Questions About LNG

- ^ R.W. Bentley (2002). "Global oil & gas depletion: an overview" (PDF). Energy Policy. pp. pp.189–205. Retrieved 2008-10-02.

{{cite web}}:|pages=has extra text (help)

External references

- "Peak Gas". HubbertPeak.com. Retrieved 2008-07-01.

- Jean Laherrere. "Future of Natural Gas Supply". ASPO. Retrieved 2008-09-30.

- Andrew McKillop (2006-12-13). "Peak Natural Gas is On the Way". Raise the Hammer. Retrieved 2008-07-01.

- Michael J. Radzicki. "Introduction to System Dynamics". US Department of Energy, Office of Policy and International Affair. Retrieved 2008-09-30.