Income tax in the United States: Difference between revisions

m Date maintenance tags and general fixes: build 545: |

→Hauser's Law: Link 25 is missing important gif images. It has been replaced with a link to the same article hosted at another website with the gifs intact. |

||

| Line 546: | Line 546: | ||

===Hauser's Law=== |

===Hauser's Law=== |

||

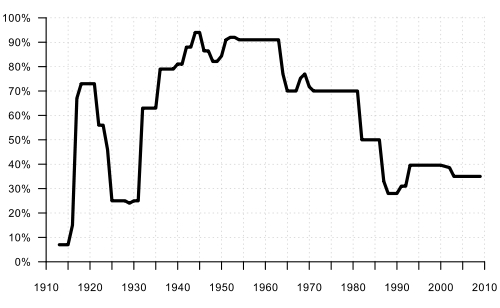

[[Hauser's Law]] is a theory by one economist that postulates that in the United States, federal tax revenues will always be equal to approximately 19.5% of [[GDP]], regardless of what the top [[Tax rate#Marginal|marginal tax rate]] is. The theory was first suggested in 1993 by Kurt Hauser, a San Francisco investment economist, who wrote at the time, "No matter what the tax rates have been, in postwar America tax revenues have remained at about 19.5% of GDP."<ref>W. Kurt Hauser, "The Tax and Revenue Equation," ''The Wall Street Journal'', March 25, 1993. Reprinted in: W. Kurt Hauser, ''Taxation and Economic Performance'' (Stanford, California: Hoover Institution Press, 1996), [http://books.google.com/books?id=X7zLmIK1HgEC&pg=PA13&lpg=PA13&source=bl&ots=Gwf7fTg5vT&sig=0KkZ3ImfLCEDnGSp70Fh50Xhoak&hl=en&ei=AYPzS8bAKoOdlgf1ocT8DA&sa=X&oi=book_result&ct=result&resnum=1&ved=0CBcQ6AEwAA#v=onepage&q&f=false pages 13-16]. In a May 20, 2008 editorial in the ''[[Wall St. Journal]]'', David Ranson published a graph showing that even though the top marginal tax rate of federal income tax had varied between a low of 28% to a high of 91% between 1950 and 2007, federal tax revenues had indeed constantly remained at about 19.5% of GDP. See [http://online.wsj.com/article/SB121124460502305693.html You Can't Soak the Rich].</ref> Critics of Hauser's Law, such as Zubin Jelveh in a ''Wall St. Journal'' editorial, point out that tax revenues have fallen as top income rates declined if you don't include Social Security revenues.<ref>[http:// |

[[Hauser's Law]] is a theory by one economist that postulates that in the United States, federal tax revenues will always be equal to approximately 19.5% of [[GDP]], regardless of what the top [[Tax rate#Marginal|marginal tax rate]] is. The theory was first suggested in 1993 by Kurt Hauser, a San Francisco investment economist, who wrote at the time, "No matter what the tax rates have been, in postwar America tax revenues have remained at about 19.5% of GDP."<ref>W. Kurt Hauser, "The Tax and Revenue Equation," ''The Wall Street Journal'', March 25, 1993. Reprinted in: W. Kurt Hauser, ''Taxation and Economic Performance'' (Stanford, California: Hoover Institution Press, 1996), [http://books.google.com/books?id=X7zLmIK1HgEC&pg=PA13&lpg=PA13&source=bl&ots=Gwf7fTg5vT&sig=0KkZ3ImfLCEDnGSp70Fh50Xhoak&hl=en&ei=AYPzS8bAKoOdlgf1ocT8DA&sa=X&oi=book_result&ct=result&resnum=1&ved=0CBcQ6AEwAA#v=onepage&q&f=false pages 13-16]. In a May 20, 2008 editorial in the ''[[Wall St. Journal]]'', David Ranson published a graph showing that even though the top marginal tax rate of federal income tax had varied between a low of 28% to a high of 91% between 1950 and 2007, federal tax revenues had indeed constantly remained at about 19.5% of GDP. See [http://online.wsj.com/article/SB121124460502305693.html You Can't Soak the Rich].</ref> Critics of Hauser's Law, such as Zubin Jelveh in a ''Wall St. Journal'' editorial, point out that tax revenues have fallen as top income rates declined if you don't include Social Security revenues.<ref>[http://seekingalpha.com/article/78256-lying-with-charts-wsj-edition Lying With Charts], Zubin Jelveh, May 21, 2008</ref> |

||

==Sources of U.S. income tax laws== |

==Sources of U.S. income tax laws== |

||

Revision as of 19:02, 26 September 2010

| This article is part of a series on |

| Taxation in the United States |

|---|

|

|

|

The federal government of the United States imposes a progressive tax on the taxable income of individuals, partnerships, companies, corporations, trusts, decedents' estates, and certain bankruptcy estates. Some state and municipal governments also impose income taxes. The first Federal income tax was imposed (under Article I, section 8, clause 1 of the U.S. Constitution) during the Civil War, then again in the 1890s, and again after the Sixteenth Amendment was ratified in 1919. Current income taxes are imposed under these constitutional provisions and various sections of Subtitle A of the Internal Revenue Code of 1986, as amended, including 26 U.S.C. § 1 (imposing income tax on the taxable income of individuals, estates and trusts) and 26 U.S.C. § 11 (imposing income tax on the taxable income of corporations).

Income tax basics

While U.S. income tax law is very complex, the underlying idea is relatively easy to understand. Simplifying greatly, gross income is all income from all sources (§ 61) less any exclusions (§ 101 et seq.). An exclusion is something that Congress has effectively said a taxpayer need not include in his or her income for tax purposes, such as employer-paid health insurance (§ 106) or interest from tax-exempt bonds (§ 103). Exclusions, often referred to as deductions, are a matter of legislative grace; that is, taxpayers may not exclude, or deduct, from gross income any item which Congress has not specifically allowed.

For individuals, Adjusted Gross Income (AGI) is gross income less any above-the-line deductions (§ 62). Above-the-line deductions are listed in § 62 and include trade or business deductions, alimony (§ 215), and moving expenses (§ 217). Taxable income is AGI less (1) itemized deductions or the applicable standard deduction, whichever is greater, and (2) a deduction for any allowable personal exemptions for the taxpayer, the taxpayer's spouse (if filing jointly), and the taxpayer's dependents. (In certain cases involving higher income taxpayers, the allowed personal exemptions may be reduced or even eliminated.)

Non-itemizers take the standard deduction. Itemized deductions include any deduction not listed in § 62 such as charitable contributions (§ 170) and certain medical expenses (§ 213). Taxable income is then multiplied by the appropriate tax rate to arrive at the tax due. Tax credits such as the Earned Income Tax Credit (§ 32) or the Child Tax Credit (§ 24) lower the tax owed on a dollar-for-dollar basis. This means tax credits are more valuable than deductions of the same amount, because deductions are applied before the tax rate, while credits are applied after. For instance, with a 35% tax rate, a deduction of $100 would save only $35 of taxes, while a $100 credit would save $100 worth of taxes.

Types of income

For tax purposes, income can be divided in a variety of ways. The first division is between ordinary income and capital gains. Ordinary income includes compensation for personal services such as wages and salaries, business profit, dividends from stock shares, and interest income from invested funds while capital gain generally comes from the sale of investment property. Congress has typically shown a preference for long-term investment by having a capital gains tax rate lower than the ordinary income rate. However, only long-term capital gains get preferential treatment; short-term capital gains (from property held for one year or less) are taxed at the same rate as ordinary income. Added complications come from various distinctions within each category. For instance, qualified dividends, which were previously taxed at ordinary income rates (as non-qualified dividends currently are), can be currently taxed at long-term capital gain rates until 2011 under the Jobs and Growth Tax Relief Reconciliation Act of 2003, and within long-term capital gains, gains on certain real estate, collectibles, and small business stock each have their own tax rates. The rules for offsetting capital losses with gains (whether capital or ordinary) add further complications. In ordinary usage, when someone speaks of their "tax rate", they typically are referring to their marginal tax rate for ordinary income.

Another important distinction in types of income is income from passive activities versus non-passive activities (§ 469), an attempt to curb tax shelters used by taxpayers not directly involved with an activity other than as an investor ("passive").

Year 2008 income brackets and tax rates

| Marginal Tax Rate | Single | Married Filing Jointly or Qualified Widow(er) | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 10% | $0 – $8,025 | $0 – $16,050 | $0 – $8,025 | $0 – $11,450 |

| 15% | $8,026 – $32,550 | $16,051 – $65,100 | $8,026 – $32,550 | $11,451 – $43,650 |

| 25% | $32,551 – $78,850 | $65,101 – $131,450 | $32,551 – $65,725 | $43,651 – $112,650 |

| 28% | $78,851 – $164,550 | $131,451 – $200,300 | $65,726 – $100,150 | $112,651 – $182,400 |

| 33% | $164,551 – $357,700 | $200,301 – $357,700 | $100,151 – $178,850 | $182,401 – $357,700 |

| 35% | $357,701+ | $357,701+ | $178,851+ | $357,701+ |

Year 2009 income brackets and tax rates

| Marginal Tax Rate[1] | Single | Married Filing Jointly or Qualified Widow(er) | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 10% | $0 – $8,350 | $0 – $16,700 | $0 – $8,350 | $0 – $11,950 |

| 15% | $8,351 – $33,950 | $16,701 – $67,900 | $8,351 – $33,950 | $11,951 – $45,500 |

| 25% | $33,951 – $82,250 | $67,901 – $137,050 | $33,951 – $68,525 | $45,501 – $117,450 |

| 28% | $82,251 – $171,550 | $137,051 – $208,850 | $68,526 – $104,425 | $117,451 – $190,200 |

| 33% | $171,551 – $372,950 | $208,851 – $372,950 | $104,426 – $186,475 | $190,201 - $372,950 |

| 35% | $372,951+ | $372,951+ | $186,476+ | $372,951+ |

Year 2010 income brackets and tax rates

| Marginal Tax Rate[2] | Single | Married Filing Jointly or Qualified Widow(er) | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 10% | $0 – $8,375 | $0 – $16,750 | $0 – $8,375 | $0 – $11,950 |

| 15% | $8,376 – $34,000 | $16,751 – $68,000 | $8,376 – $34,000 | $11,951 – $45,550 |

| 25% | $34,001 – $82,400 | $68,001 – $137,300 | $34,001 – $68,650 | $45,551 – $117,650 |

| 28% | $82,401 – $171,850 | $137,301 – $209,250 | $68,651 – $104,625 | $117,651 – $190,550 |

| 33% | $171,851 – $373,650 | $209,251 – $373,650 | $104,626 – $186,825 | $190,551 - $373,650 |

| 35% | $373,651+ | $373,651+ | $186,826+ | $373,651+ |

An individual's marginal income tax bracket depends upon his income and his tax-filing classification. As of 2008, there are six tax brackets for ordinary income (ranging from 10% to 35%) and four classifications: single, married filing jointly (or qualified widow or widower), married filing separately, and head of household.

An individual pays tax at a given bracket only for each dollar within that bracket's range. For example, a single taxpayer who earned $10,000 in 2009 would be taxed 10% of each dollar earned from the 1st dollar to the 8,350th dollar (10% × $8,350 = $835.00), then 15% of each dollar earned from the 8,351st dollar to the 10,000th dollar (15% × $1,650 = $247.50), for a total of $1,082.50. Notice this amount ($1,082.50) is lower than if the individual had been taxed at 15% on the full $10,000 (for a tax of $1,500). This is because the individual's marginal rate (the percentage tax on the last dollar earned, here 15%) has no effect on the income taxed at a lower bracket (here the first $8,350 of income taxed at 10%). This ensures that every rise in a person's pre-tax salary results in an increase of his after-tax salary.

However, taxpayers are not taxed on every dollar they make. For 2009, single and married filing separate taxpayers are allowed a standard deduction of $5,700. Married filing jointly and surviving widow(er)s are allowed $11,340 and head of household taxpayers are allowed $8,350. Taxpayers over 65 or blind are given an additional $1,100 standard deduction ($2,200 if over 65 and blind). A taxpayer may choose to take the standard deduction or they may itemize their deductions if the amount of itemized deductions is greater than the standard deduction.

Taxpayers are also allowed a personal exemption depending on their filing status. The personal exemption amount in 2009 is $3,650 per person.

Claiming deductions may reduce an individual's tax liability by a rate equal to the marginal tax rate of their particular tax bracket, with a corresponding reduction in returns as the individual crosses in to a lower tax bracket. For example, if an individual is able to increase the amount of their deduction by $1000 with a last-minute donation to a charitable organization, and the individual's adjusted gross income is $500 into the 25% marginal tax bracket, the donation will reduce the tax liability of the individual by ($500 × 25%) + ($500 × 15%) = $200.

The effective tax rates corresponding to the definitions above are shown in the accompanying graph.

Short-term capital gains are taxed as ordinary income rates as listed above. Long-term capital gains have lower rates corresponding to an individual’s marginal ordinary income tax rate, with special rates for a variety of capital goods.

| Ordinary Income Rate | Long-term Capital Gain Rate | Short-term Capital Gain Rate | Long-term Gain on Real Estate* | Long-term Gain on Collectibles | Long-term Gain on Certain Small Business Stock |

|---|---|---|---|---|---|

| 10% | 0% | 10% | 10% | 10% | 10% |

| 15% | 0% | 15% | 15% | 15% | 15% |

| 25% | 15% | 25% | 25% | 25% | 25% |

| 28% | 15% | 28% | 25% | 28% | 28% |

| 33% | 15% | 33% | 25% | 28% | 28% |

| 35% | 15% | 35% | 25% | 28% | 28% |

- * Capital gains up to $250,000 ($500,000 if filed jointly) on real estate used as primary residence are exempt.

Example of a tax computation

Income tax for year 2009:

Single taxpayer, no children, under 65 and not blind taking standard deduction;

- $40,000 gross income - $5,700 standard deduction - $3,650 personal exemption = $30,650 taxable income

- $8,350 × 10% = $835.00

- ($30,650 - $8,350) = $22,300.00 x 15% = $3,345.00

- Total income tax is $835.00 + $3,345.00 = $4180.00 (10.45% effective tax)

Note that in addition to income tax, a wage earner would also have to pay FICA (payroll) tax (and an equal amount of FICA tax must be paid by the employer):

- $40,000 (adjusted gross income)

- $40,000 × 6.2% = $2,480 (Social Security portion)

- $40,000 × 1.45% = $580 (Medicare portion)

- Total FICA tax = $3,060 (7.65% of income)

- Total federal tax of individual = $7,190.00 (17.98% of income)

Taxable income

Income tax is imposed as a tax rate times taxable income, less applicable tax credits. Taxable income is gross income less allowable tax deductions. Taxable income as determined for Federal tax purposes may be modified for state tax purposes.

Gross income

The Internal Revenue Code states that "gross income means all income from whatever source derived," and gives specific examples.[3] Gross income is not limited to cash received. "It includes income realized in any form, whether money, property, or services."[4] Gross income includes wages and tips, fees for performing services, gain from sale of inventory or other property, interest, dividends, rents, royalties, pensions, alimony, and many other types of income.[3] Items must be included in income when received or accrued. The amount included is the amount the taxpayer is entitled to receive. Gains on property are the gross proceeds less amounts returned, cost of goods sold, or tax basis of property sold.

Certain types of income are subject to tax exemption. Among the more common types of exempt income are interest on municipal bonds, a portion of Social Security benefits, life insurance proceeds, gifts or inheritances, and the value of many employee benefits.

Gross income is reduced by adjustments and tax deductions. Among the more common adjustments are reductions for alimony paid and IRA and certain other retirement plan contributions. Adjusted gross income is used in calculations relating to various deductions, credits, phase outs, and penalties.

Business deductions

Deductions are permitted for most business expenses of entities and individuals. There are limits on some types of these deductions. The deduction for depreciation expense must be computed under MACRS rules. Deductions for meals and entertainment are limited to 50% of the amount incurred.

Certain deductions must be capitalized or deferred. These include:

- Cost of goods sold, including costs required to be capitalized under tax rules that differ from financial accounting rules,

- Personal, living, and family expenses,

- Items producing future benefits,

- Political contributions,

- Expenses not properly documented under tax rules, and

- Other items.

Business losses may reduce nonbusiness income for individuals and corporations. However, losses from passive activities may reduce only income from other passive activities. Passive activities include most rental activities (except for real estate professionals) and business activities in which the taxpayer does not materially participate. In addition, losses may not, in most cases, be deducted in excess of the taxpayer's amount at risk (generally tax basis in the entity plus share of debt).

Overall net operating losses (business deductions in excess of gross income) may be deducted in other years by carryover or carryback of the loss.

Personal deductions

Individuals are allowed a special deduction called a personal exemption for dependents. This is a fixed amount allowed each taxpayer, plus an additional fixed amount for each child or other dependent the taxpayer supports. The amount of this deduction for 2009 and 2010 is $3,650. The amount is indexed annually for inflation. The amount of exemption is phased out at higher incomes.

Citizens and individuals who have U.S. tax residence may deduct a flat amount as a standard deduction. Alternatively, they may claim an itemized deduction for actual amounts incurred for specific categories of nonbusiness expenses. Home owners may deduct the amount of interest and property taxes#United States paid on their principal and second homes. Local and state income taxes are deductible, or the individual may elect to deduct state and local sales tax. Contributions to charitable organizations are deductible by individuals and corporations, but the deduction is limited to 50% and 10% of gross income respectively. Medical expenses in excess of 7.5% of adjusted gross income are deductible, as are uninsured casualty losses. Other income producing expenses in excess of 2% of adjusted gross income are also deductible.

Capital gains

Taxable income includes capital gains. These are the excess of the sales price over tax basis (cost) of capital assets, such as corporate stock, land, buildings, etc. Capital losses (where basis is more than sales price) are deductible, but deduction for long term capital losses is limited to capital gains. An individual may exclude $250,000 ($500,000 for a married couple filing jointly) of capital gains on the sale of the individual's primary residence, subject to certain conditions and limitations.

In determining gain, it is necessary to determine which property is sold and the basis of that property. This may require identification conventions, such as first-in-first-out, for identical properties like shares of stock. Further, tax basis must be allocated among properties purchased together unless they are sold together. Original basis, usually cost paid for the asset, is reduced by deductions for depreciation or loss.

Certain capital gains are deferred, that is, taxed at a time later than disposition. Gains on property sold for installment payments may be recognized as those payments are received. Gains on property exchanged for like kind property are not recognized, and the tax basis of the new property is based on the tax basis of the old property.

Before 1986 and from 2004 onward, individuals have been subject to a reduced rate of Federal tax on long term capital gains. This reduced rate (limited to 15%) applies for regular tax and the Alternative Minimum Tax.

Partnerships and LLCs

Business entities treated as partnerships are not subject to income tax at the entity level. Instead, their members include their shares of income, deductions, and credits in computing their own tax. The character of the partner's share of income (such as capital gains) is determined at the partnership level. Many types of business entities, including limited liability companies (LLCs), may elect to be treated as a corporation or as a partnership. Distributions from partnerships are not taxed as dividends.

Corporate tax

Corporate tax is imposed in the United States at the Federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. Shareholders of a corporation wholly owned by U.S. citizens and resident individuals may elect for the corporation to be taxed similarly to partnerships (see S Corporation). Corporate income tax is based on taxable income, which is defined similarly to individual taxable income.

Shareholders (including other corporations) of corporations (other than S Corporations) are taxed on dividend distributions from the corporation. They are also subject to tax on capital gains upon sale or exchange of their shares for money or property. However, certain exchanges, such as in reorganizations, are not taxable.

Multiple corporations may file a consolidated return at the Federal and some state levels with their common parent.

Corporate tax rates

Federal corporate income tax is imposed at graduated rates from 15% to 35%. The lower rate brackets are phased out at higher rates of income, with all income subject to tax at 34% to 35% where taxable income exceeds $335,000. All income is taxed at the same rate. Additional tax rates imposed below the federal level vary widely by jurisdiction, from under 1% to over 16%. State and local income taxes are allowed as tax deductions in computing Federal taxable income.

Deductions for corporations

Corporations are not allowed the personal deductions allowed to individuals, such as deductions for exemptions and the standard deduction. However, most other deductions are allowed. In addition, corporations are allowed certain deductions unique to corporate status. These include a partial deduction for dividends received from other corporations, deductions related to organization costs, and certain other items.

Some deductions of corporations are limited at Federal or state levels. Limitations apply to items due to related parties, including interest and royalty expenses.

Estates and trusts

Estates and trusts may be subject to income tax at the estate or trust level, or the beneficiaries may be subject to income tax on their share of income. Where the all income must be distributed, the beneficiaries are taxed similarly to partners in a partnership. Where income may be retained, the estate or trust is taxed. It may get a deduction for later distributions of income. Estates and trusts are allowed only those deductions related to producing income, plus $1,000. They are taxed at graduated rates that increase rapidly to the maximum rate for individuals. The tax rate for trust and estate income in excess of $11,500 was 35% for 2009. Estates and trusts are eligible for the reduced rate of tax on dividends and capital gains through 2010.

Retirement savings and fringe benefit plans

Employers get a deduction for amounts contributed to a qualified employee retirement plan or benefit plan. The employee does not recognize income with respect to the plan until he or she receives a distribution from the plan. The plan itself is organized as a trust and is considered a separate entity. For the plan to qualify for tax exemption, and for the employer to get a deduction, the plan must meet minimum participation, vesting, funding, and operational standards.

Examples of qualified plans include:

- pension plans (Defined benefit pension plan),

- profit sharing plans (defined contribution plan),

- Employee Stock Ownership Plan (ESOPs),

- stock purchase plans,

- health insurance plans,

- employee benefit plans,

- Cafeteria plans.

Employees or former employees are generally taxed on distributions from retirement or stock plans. Employees are not taxed on distributions from health insurance plans to pay for medical expenses. Cafeteria plans allow employees to choose among benefits (like choosing food in a cafeteria), and distributions to pay those expenses are not taxable.

In addition, individuals may make contributions to Individual Retirement Accounts (IRAs). Those not currently covered by other retirement plans may claim a deduction for contributions to certain types of IRAs. Income earned within an IRA is not taxed until the individual withdraws it.

Credits

The Federal and state systems offer numerous tax credits for individuals and businesses. Among the key Federal credits for individuals are:

- child credit: a credit up to $1,000 per qualifying child.

- Child and dependent care credit: a credit up to $6,000, phased out at incomes above $15,000.

- Earned income credit: this refundable credit is granted for a percentage of income earned by a low income individual. The credit is calculated and capped based on the number of qualifying children, if any. This credit is indexed for inflation and phased out for incomes above a certain amount. For 2009, the maximum credit was $5,657.

- Credit for the elderly and disabled: A nonrefundable credit up to $1,125

- Two mutually exclusive credits for college expenses.

Businesses are also eligible for several credits. These credits are available to individuals and corporations, and can be taken by partners in business partnerships. Among the Federal credits included in a "general business credit" are:

- Credit for increasing research expenses.

- Work Incentive Credit or credit for hiring people in certain enterprise zones or on welfare.

- A variety of industry specific credits.

In addition, a Federal foreign tax credit is allowed for foreign income taxes paid. This credit is limited to the portion of Federal income tax arising due to foreign source income. The credit is available to all taxpayers.

Business credits and the foreign tax credit may be offset taxes in other years.

States and some localities offer a variety of credits that vary by jurisdiction. States typically grant a credit to resident individuals for income taxes paid to other states, generally limited in proportion to income taxed in the other state(s).

Alternative Minimum Tax

Taxpayers must pay the higher of the regular income tax or the Alternative Minimum Tax (AMT). Taxpayers who have paid AMT in prior years may claim a credit against regular tax for the prior AMT. The credit is limited so that regular tax is not reduced below current year AMT.

AMT is imposed at a nearly flat rate (20% for corporations, 26% or 28% for individuals, estates, and trusts) on taxable income as modified for AMT. Key differences between regular taxable income and AMT taxable income include:

- The standard deduction and personal exemptions are replaced by a single deduction, which is phased out at higher income levels,

- No deduction is allowed individuals for state taxes,

- Most miscellaneous itemized deductions are not allowed for individuals,

- Depreciation deductions are computed differently, and

- Corporations must make a complex adjustment to more closely reflect economic income.

Accounting periods and methods

The United States tax system allows individuals and entities to choose their tax year. Most individuals choose the calendar year. There are restrictions on choice of tax year for some closely held entities. Taxpayers may change their tax year in certain circumstances, and such change may require IRS approval.

Taxpayers must determine their taxable income based on their method of accounting for the particular activity. Most individuals use the cash method for all activities. Under this method, income is recognized when received and deductions taken when paid. Taxpayers may choose or be required to use the accrual method for some activities. Under this method, income is recognized when the right to receive it arises, and deductions are taken when the liability to pay arises and the amount can be reasonably determined. Taxpayers recognizing cost of goods sold on inventory must use the accrual method with respect to sales and costs of the inventory.

Methods of accounting may differ for financial reporting and tax purposes. Specific methods are specified for certain types of income or expenses. Gain on sale of property other than inventory may be recognized at the time of sale or over the period in which installment salepayments are received. Income from long term contracts must be recognized ratably over the term of the contract, not just at completion. Other special rules also apply.

Tax exempt entities

U.S. tax law exempts certain types of entities from income and some other taxes. These provisions arose during the late 1800s. Charitable organizations and cooperatives may apply to the IRS for tax exemption. Exempt organizations are still taxed on any business income. An organization which participates in lobbying, political campaigning, or certain other activities may lose its exempt status. Special taxes apply to prohibited transactions and activities of tax exempt entities.

Special taxes

There are many Federal tax rules designed to prevent people from abusing the tax system. Provisions related to these taxes are often complex. Such rules include:

- Accumulated earnings tax on corporation accumulations in excess of business needs,

- Personal holding company taxes,

- Passive foreign investment company rules, and

- Controlled Foreign Corporation provisions.

Special industries

Tax rules recognize that some types of businesses do not earn income in the traditional manner and thus require special provisions. For example, Insurance companies must ultimately pay claims to some policy holders from the amounts received as premiums. These claims may happen years after the premium payment. Computing the future amount of claims requires actuarial estimates until claims are actually paid. Thus, recognizing premium income as received and claims expenses as paid would seriously distort an insurance company's income.

Special rules apply to some or all items in the following industries:

- Insurance companies (rules related to recognition of income and expense; different rules apply to life insurance and to property and casualty insurance)

- Shipping (rules related to the revenue recognition cycle)

- Extractive industries (rules related to expenses for exploration and development and for recovery of capitalized costs)

In addition, mutual funds (regulated investment companies) are subject to special rules allowing them to be taxed only at the owner level. The company must report to each owner his/her share of ordinary income, capital gains, and creditable foreign taxes. The owners then include these items in their own tax calculation. The fund itself is not taxed, and distributions are treated as a return of capital to the owners. Similar rules apply to real estate investment trusts and real estate mortgage investment conduits.

International aspects

Federal income tax is imposed on citizens, residents, and U.S. corporations based on their worldwide income. To mitigate double taxation, a credit is allowed for foreign income taxes. This foreign tax credit is limited to that part of current year tax caused by foreign source income. Determining such part involves determining the source of income and allocating and apportioning deductions to that income. States tax resident individuals and corporations on their worldwide income, but few allow a credit for foreign taxes.

Federal and state income taxes are imposed on foreign persons on their income within the jurisdiction. Federal rules tax interest, dividends, royalties, and certain other income of foreign persons at a flat rate of 30%. This rate is often reduced under tax treaties. Foreign persons are taxed on income from a U.S. business similarly to U.S. persons. Foreign persons are not subject to U.S. tax on capital gains and certain other income. The states tax non-resident individuals only on income earned within the state (wages, etc.) and tax individuals and corporations on business income apportioned to the state. Most of the states otherwise do not impose income tax on persons not resident in the state.

The United States has income tax treaties with over 65 countries. These treaties reduce the chance of double taxation by allowing each country to fully tax its citizens and residents and reducing the amount the other country can tax them. Generally the treaties provide for reduced rates of tax on investment income and limits as to which business income can be taxed. The treaties each define which taxpayers can benefit from the treaty.

Social Security tax

The United States social insurance system is funded by a tax similar to an income tax. Social Security tax of 6.2% is imposed on wages paid to employees. The tax is imposed on both the employer and the employee. The maximum amount of wages subject to the tax for 2009 and 2010 was/is $106,800. This amount is indexed for inflation. A companion Medicare Tax of 1.45% of wages is imposed on employers and employees, with no limitation. A self employment tax in like amounts (totaling 15.3%) is imposed on self employed persons.

Withholding of tax

Persons paying wages or making certain payments to foreign persons are required to withhold income tax from such payments. The Social Security tax is one type of withholding tax. Withholding of income tax is also required. Income tax withholding on wages is based on declarations by employees and tables provided by the IRS. Persons paying interest, dividends, royalties, and certain other amounts to foreign persons must also withhold income tax at a flat rate of 30%. This rate may be reduced by a tax treaty. Additional backup withholding provisions apply to some payments of interest or dividends to U.S. persons. The amount of income tax withheld is treated as a payment of tax by the person receiving the payment on which tax was withheld.

Tax returns

Individuals, corporations, partnerships, estates, and trusts must file annual reports, called tax returns, with Federal and appropriate state tax authorities. These returns vary greatly in complexity level depending on the type of filer and complexity of their affairs. On the return, the taxpayer reports income and deductions, calculates the amount of tax owed, reports payments and credits, and calculates the balance due.

Federal individual, estate, and trust income tax returns are due by April 15 for most taxpayers. Corporate returns are due two and one half months following the corporation's year end. Partnership returns are due three and one half months following the partnership's year end. Tax exempt entity returns are due four and one half months following the entity's year end. All Federal returns may be extended, with most extensions available upon merely filing a single page form. Due dates and extension provisions for state and local income tax returns vary.

Income tax returns generally consist of the basic form with attached forms and schedules. Several forms are available for individuals and corporations, depending on complexity and nature of the taxpayer's affairs. Many individuals are able to use the one page Form 1040-EZ, which requires no attachments except wage statements from employers (Forms W-2). Individuals claiming itemized deductions must complete Schedule A. Similar schedules apply for interest (B), dividends (B), business income (C), capital gains (D), farm income (F), and self employment tax (SE). All taxpayers must file those forms for credits, depreciation, AMT, and other items that apply to them.

Electronic filing of tax returns may be done for taxpayers by registered tax preparers.

If a taxpayer discovers an error on a return, or determines that tax for a year should be different, the taxpayer should file an amended return. These returns constitute claims for refund if taxes are determined to have been overpaid.

Tax examinations

The IRS and state, and local tax authorities may examine a tax return and propose changes. Changes to tax returns may be made with minimal advance involvement by taxpayers, such as changes to wage or dividend income to correct errors. Other examination of returns may require extensive taxpayer involvement, the dreaded "IRS audit". These audits often require that taxpayers provide the IRS or other tax authority access to records of income and deductions. Audits of businesses are usually conducted by IRS personnel at the business location.

Changes to returns are subject to appeal by the taxpayer, including going to court. IRS changes are often first issued as proposed adjustments. The taxpayer may agree to the proposal, or may advise the IRS why it disagrees. Proposed adjustments are often resolved by the IRS and taxpayer agreeing to what the adjustment should be. For those adjustments to which agreement is not reached, the IRS issues a 30-day letter advising of the adjustment. The taxpayer may appeal this preliminary assessment within 30 days within the IRS. The Appeals Division reviews the IRS field team determination and taxpayer arguments, and often proposes a solution that the IRS team and the taxpayer find acceptable. Where agreement is still not reached, the IRS issues an assessment as a notice of deficiency or 90-day letter. The taxpayer then has three choices: file suit in United States Tax Court without paying the tax, pay the tax and sue for refund in regular court, or pay the tax and be done. Recourse to court can be costly and time consuming, but is often successful.

IRS computers routinely make adjustments to correct mechanical errors in returns. In addition, the IRS conducts an extensive document matching computer program that compares taxpayer amounts of wages, interest, dividends, and other items to amounts reported by payors. These programs automatically issue 30-day letters advising of proposed changes. Only a very small percentage of tax returns are actually examined. These are selected by a combination of computer analysis of return information and random sampling. The IRS has long maintained a program to identify patterns on returns most likely to require adjustment.

Procedures for examination by state and local authorities vary by jurisdiction.

Tax collection

Taxpayers are required to voluntarily pay all taxes owed based on the self-assessed tax returns, as adjusted. The IRS allows taxpayers to extent payment in certain circumstances, and provides time payment plans that include interest and a "penalty" that is merely added interest. Where taxpayers do not pay tax owed, the IRS has strong means to enforce collection. These include the ability to levy bank accounts and seize property. Generally, significant advance notice is given before levy or seizure. However, in certain rarely used jeopardy assessments the IRS may immediately seize money and property. The IRS Collection Divisions are responsible for most collection activities.

Statute of limitations

Taxpayers and the IRS are both precluded from changing tax after a certain period of time. Generally, this period is three years from the later of the due date of the original tax return or the date the original return was filed. The IRS has an additional three more years to make changes if the taxpayer has substantially understated gross income. The period under which the IRS may make changes is unlimited in the case of fraud by the taxpayer.

Penalties

Taxpayers who fail to file returns, file late, or file returns that are wrong, may be subject to penalties. These penalties vary based on the type of failure. Some penalties are computed like interest, some are fixed amounts, and some are based on other measures. Penalties for filing or paying late are generally based on the amount of tax that should have been paid and the degree of lateness. Penalties for failures related to certain forms are fixed amounts, and vary by form from very small to huge.

Intentional failures, including tax fraud, may result in criminal penalties. These penalties may include jail time or forfeiture of property. Criminal penalties are assessed in coordination with the United States Department of Justice.

Legal history

Article I, Section 8, Clause 1 of the United States Constitution (the "Taxing and Spending Clause"), specifies Congress's power to impose "Taxes, Duties, Imposts and Excises," but Article I, Section 8 requires that, "Duties, Imposts and Excises shall be uniform throughout the United States."[5]

The Constitution specifically limited Congress' ability to impose direct taxes, by requiring Congress to distribute direct taxes in proportion to each state's census population. It was thought that head taxes and property taxes (slaves could be taxed as either or both) were likely to be abused, and that they bore no relation to the activities in which the federal government had a legitimate interest. The fourth clause of section 9 therefore specifies that, "No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or enumeration herein before directed to be taken."

Taxation was also the subject of Federalist No. 33 penned secretly by the Federalist Alexander Hamilton under the pseudonym Publius. In it, he explains that the wording of the "Necessary and Proper" clause should serve as guidelines for the legislation of laws regarding taxation. The legislative branch is to be the judge, but any abuse of those powers of judging can be overturned by the people, whether as states or as a larger group.

The courts have generally held that direct taxes are limited to taxes on people (variously called "capitation", "poll tax" or "head tax") and property.[6] All other taxes are commonly referred to as "indirect taxes," because they tax an event, rather than a person or property per se.[7] What seemed to be a straightforward limitation on the power of the legislature based on the subject of the tax proved inexact and unclear when applied to an income tax, which can be arguably viewed either as a direct or an indirect tax.

Early Federal income taxes

In order to help pay for its war effort in the American Civil War, the United States government imposed its first personal income tax, on August 5, 1861, as part of the Revenue Act of 1861 (3% of all incomes over US $800).[8] This tax was repealed and replaced by another income tax in 1862.[9]

In 1894, Democrats in Congress passed the Wilson-Gorman tariff, which imposed the first peacetime income tax. The rate was 2% on income over $4000, which meant fewer than 10% of households would pay any. The purpose of the income tax was to make up for revenue that would be lost by tariff reductions.[10] Also, the Panic of 1893 is said to have something to do with the passage of Wilson-Gorman.

In 1895 the United States Supreme Court, in its ruling in Pollock v. Farmers' Loan & Trust Co., held a tax based on receipts from the use of property to be unconstitutional. The Court held that taxes on rents from real estate, on interest income from personal property and other income from personal property (which includes dividend income) were treated as direct taxes on property, and therefore had to be apportioned. Since apportionment of income taxes is impractical, this had the effect of prohibiting a federal tax on income from property. However, the Court affirmed that the Constitution did not deny Congress the power to impose a tax on real and personal property, and it affirmed that such would be a direct tax.[11] Due to the political difficulties of taxing individual wages without taxing income from property, a federal income tax was impractical from the time of the Pollock decision until the time of ratification of the Sixteenth Amendment (below).

Ratification of the Sixteenth Amendment

In response, Congress proposed the Sixteenth Amendment (ratified by the requisite number of states in 1913),[12] which states:

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

The Supreme Court in Brushaber v. Union Pacific Railroad, 240 U.S. 1 (1916), indicated that the amendment did not expand the federal government's existing power to tax income (meaning profit or gain from any source) but rather removed the possibility of classifying an income tax as a direct tax on the basis of the source of the income. The Amendment removed the need for the income tax to be apportioned among the states on the basis of population. Income taxes are required, however, to abide by the law of geographical uniformity.

Some tax protesters and others opposed to income taxes cite what they contend is evidence that the Sixteenth Amendment was never properly ratified, based in large part on materials sold by William J. Benson. In December 2007, Benson's "Defense Reliance Package" containing his non-ratification argument which he offered for sale on the Internet, was ruled by a federal court to be a "fraud perpetrated by Benson" that had "caused needless confusion and a waste of the customers' and the IRS' time and resources."[13] The court stated: "Benson has failed to point to evidence that would create a genuinely disputed fact regarding whether the Sixteenth Amendment was properly ratified or whether United States Citizens are legally obligated to pay federal taxes."[14] See also Tax protester Sixteenth Amendment arguments.

Modern interpretation of the power to tax incomes

The modern interpretation of the Sixteenth Amendment taxation power can be found in Commissioner v. Glenshaw Glass Co. 348 U.S. 426 (1955). In that case, a taxpayer had received an award of punitive damages from a competitor for antitrust violations and sought to avoid paying taxes on that award. The Court observed that Congress, in imposing the income tax, had defined gross income, under the Internal Revenue Code of 1939, to include:

gains, profits, and income derived from salaries, wages or compensation for personal service . . . of whatever kind and in whatever form paid, or from professions, vocations, trades, businesses, commerce, or sales, or dealings in property, whether real or personal, growing out of the ownership or use of or interest in such property; also from interest, rent, dividends, securities, or the transaction of any business carried on for gain or profit, or gains or profits and income derived from any source whatever.[15]

(Note: The Glenshaw Glass case was an interpretation of the definition of "gross income" in section 22 of the Internal Revenue Code of 1939. The successor to section 22 of the 1939 Code is section 61 of the current Internal Revenue Code of 1986, as amended.)

The Court held that "this language was used by Congress to exert in this field the full measure of its taxing power", id., and that "the Court has given a liberal construction to this broad phraseology in recognition of the intention of Congress to tax all gains except those specifically exempted."[16]

The Court then enunciated what is now understood by Congress and the Courts to be the definition of taxable income, "instances of undeniable accessions to wealth, clearly realized, and over which the taxpayers have complete dominion." Id. at 431. The defendant in that case suggested that a 1954 rewording of the tax code had limited the income that could be taxed, a position which the Court rejected, stating:

The definition of gross income has been simplified, but no effect upon its present broad scope was intended. Certainly punitive damages cannot reasonably be classified as gifts, nor do they come under any other exemption provision in the Code. We would do violence to the plain meaning of the statute and restrict a clear legislative attempt to bring the taxing power to bear upon all receipts constitutionally taxable were we to say that the payments in question here are not gross income.[17]

Tax statutes passed after the ratification of the Sixteenth Amendment in 1913 are sometimes referred to as the "modern" tax statutes. Hundreds of Congressional acts have been passed since 1913, as well as several codifications (i.e., topical reorganizations) of the statutes (see Codification).

In Central Illinois Public Service Co. v. United States, 435 U.S. 21 (1978), the U.S. Supreme Court confirmed that wages and income are not identical as far as taxes on income are concerned, because income not only includes wages, but any other gains as well. The Court in that case noted that in enacting taxation legislation, Congress "chose not to return to the inclusive language of the Tariff Act of 1913, but, specifically, 'in the interest of simplicity and ease of administration,' confined the obligation to withhold [income taxes] to 'salaries, wages, and other forms of compensation for personal services'" and that "committee reports ... stated consistently that 'wages' meant remuneration 'if paid for services performed by an employee for his employer'".[18]

Other courts have noted this distinction in upholding the taxation not only of wages, but also of personal gain derived from other sources, recognizing some limitation to the reach of income taxation. For example, in Conner v. United States, 303 F. Supp. 1187 (S.D. Tex. 1969), aff’d in part and rev’d in part, 439 F.2d 974 (5th Cir. 1971), a couple had lost their home to a fire, and had received compensation for their loss from the insurance company, partly in the form of hotel costs reimbursed. The court acknowledged the authority of the IRS to assess taxes on all forms of payment, but did not permit taxation on the compensation provided by the insurance company, because unlike a wage or a sale of goods at a profit, this was not a gain. As the Court noted, "Congress has taxed income, not compensation".

By contrast, other courts have interpreted the Constitution as providing even broader taxation powers for Congress. In Murphy v. IRS, the United States Court of Appeals for the District of Columbia Circuit upheld the Federal income tax imposed on a monetary settlement recovery that the same court had previously indicated was not income, stating: "[a]lthough the 'Congress cannot make a thing income which is not so in fact,' [ . . . ] it can label a thing income and tax it, so long as it acts within its constitutional authority, which includes not only the Sixteenth Amendment but also Article I, Sections 8 and 9."[19]

Similarly, in Penn Mutual Indemnity Co. v. Commissioner, the United States Court of Appeals for the Third Circuit indicated that Congress could properly impose the Federal income tax on a receipt of money, regardless of what that receipt of money is called:

It could well be argued that the tax involved here [an income tax] is an "excise tax" based upon the receipt of money by the taxpayer. It certainly is not a tax on property and it certainly is not a capitation tax; therefore, it need not be apportioned. [ . . . ] Congress has the power to impose taxes generally, and if the particular imposition does not run afoul of any constitutional restrictions then the tax is lawful, call it what you will.[20]

Tax rates in history

History of top rates[21]

- In 1913, the top tax rate was 7% on incomes above $500,000 ($10 million 2007 dollars).

- During World War I, the top rate rose to 77% and the income threshold to be in this top bracket increased to $1,000,000 ($16 million 2007 dollars); after the war, the top rate was scaled down to a low of 24% and the income threshold for paying this rate fell to a low of $100,000 ($1 million 2007 dollars).

- During the Great Depression and World War II, the top income tax rate rose from pre-war levels. In 1939, the top rate was 75% applied to incomes above $5,000,000 ($75 million 2007 dollars). During 1944 and 1945, the top rate was its all-time high at 94% applied to income above $200,000.

- Since 1964, the threshold for paying top income tax rate has generally been between $200,000 and $400,000. The one exception is the period from 1982-1992 when the top income tax brackets were removed and incomes above around $100,000 (varies by year) paid the top rate. From 1988-1990, the threshold for paying the top rate was even lower, with incomes above $29,750 to $32,450 ($51,000 in 2007 dollars) paying the top rate of 28% in those years.

History of federal income tax

The federal income tax rates in the United States have varied widely since 1913. For example, in 1954 the Congress imposed a federal income tax on individuals, with the tax imposed in layers of 24 income brackets at tax rates ranging from 20% to 91% (for a chart, see Internal Revenue Code of 1954). Here is a partial history of changes in the U.S. federal income tax rates for individuals (and the income brackets) since 1913:[22][23]

| Partial History of U.S. Federal Marginal Income Tax Rates Since 1913 | ||||

|---|---|---|---|---|

| Applicable Year |

Income brackets |

First bracket |

Top bracket |

Source |

| 1913-1915 | - | 1% | 7% | IRS |

| 1916 | - | 2% | 15% | IRS |

| 1917 | - | 2% | 67% | IRS |

| 1918 | - | 6% | 77% | IRS |

| 1919-1920 | - | 4% | 73% | IRS |

| 1921 | - | 4% | 73% | IRS |

| 1922 | - | 4% | 56% | IRS |

| 1923 | - | 3% | 56% | IRS |

| 1924 | - | 1.5% | 46% | IRS |

| 1925-1928 | - | 1.5% | 25% | IRS |

| 1929 | - | 0.375% | 24% | IRS |

| 1930-1931 | - | 1.125% | 25% | IRS |

| 1932-1933 | - | 4% | 63% | IRS |

| 1934-1935 | - | 4% | 63% | IRS |

| 1936-1939 | - | 4% | 79% | IRS |

| 1940 | - | 4.4% | 81.1% | IRS |

| 1941 | - | 10% | 81% | IRS |

| 1942-1943 | - | 19% | 88% | IRS |

| 1944-1945 | - | 23% | 94% | IRS |

| 1946-1947 | - | 19% | 86.45% | IRS |

| 1948-1949 | - | 16.6% | 82.13% | IRS |

| 1950 | - | 17.4% | 84.36% | IRS |

| 1951 | - | 20.4% | 91% | IRS |

| 1952-1953 | - | 22.2% | 92% | IRS |

| 1954-1963 | - | 20% | 91% | IRS |

| 1964 | - | 16% | 77% | IRS |

| 1965-1967 | - | 14% | 70% | IRS |

| 1968 | - | 14% | 75.25% | IRS |

| 1969 | - | 14% | 77% | IRS |

| 1970 | - | 14% | 71.75% | IRS |

| 1971-1981 | 15 brackets | 14% | 70% | IRS |

| 1982-1986 | 12 brackets | 12% | 50% | IRS |

| 1987 | 5 brackets | 11% | 38.5% | IRS |

| 1988-1990 | 3 brackets | 15% | 28% | IRS |

| 1991-1992 | 3 brackets | 15% | 31% | IRS |

| 1993-2000 | 5 brackets | 15% | 39.6% | IRS |

| 2001 | 5 brackets | 15% | 39.1% | IRS |

| 2002 | 6 brackets | 10% | 38.6% | IRS |

| 2003-2009 | 6 brackets | 10% | 35% | Tax Foundation |

Hauser's Law

Hauser's Law is a theory by one economist that postulates that in the United States, federal tax revenues will always be equal to approximately 19.5% of GDP, regardless of what the top marginal tax rate is. The theory was first suggested in 1993 by Kurt Hauser, a San Francisco investment economist, who wrote at the time, "No matter what the tax rates have been, in postwar America tax revenues have remained at about 19.5% of GDP."[24] Critics of Hauser's Law, such as Zubin Jelveh in a Wall St. Journal editorial, point out that tax revenues have fallen as top income rates declined if you don't include Social Security revenues.[25]

Sources of U.S. income tax laws

United States income tax law comes from a number of sources. These sources have been divided into three tiers as follows:[26]

- Tier 1

- United States Constitution

- Internal Revenue Code (IRC) (legislative authority, written by the United States Congress through legislation)

- Treasury regulations

- Federal court opinions (judicial authority, written by courts as interpretation of legislation)

- Treaties (executive authority, written in conjunction with other countries)

- Tier 2

- Agency interpretative regulations (executive authority, written by the Internal Revenue Service (IRS) and Department of the Treasury), including:

- Final, Temporary and Proposed Regulations promulgated under IRC § 7805;

- Treasury Notices and Announcements;

- Public Administrative Rulings (IRS Revenue Rulings, which provide informal guidance on specific questions and are binding on all taxpayers)

- Agency interpretative regulations (executive authority, written by the Internal Revenue Service (IRS) and Department of the Treasury), including:

- Tier 3

- Legislative History

- Private Administrative Rulings (private parties may approach the IRS directly and ask for a Private Letter Ruling on a specific issue - these rulings are binding only on the requesting taxpayer).

Where conflicts exist between various sources of tax authority, an authority in Tier 1 outweighs an authority in Tier 2 or 3. Similarly, an authority in Tier 2 outweighs an authority in Tier 3.[27] Where conflicts exist between two authorities in the same tier, the "last-in-time rule" is applied. As the name implies, the "last-in-time rule" states that the authority that was issued later in time is controlling.[28]

Regulations and case law serve to interpret the statutes. Additionally, various sources of law attempt to do the same thing. Revenue Rulings, for example, serves as an interpretation of how the statutes apply to a very specific set of facts. Treaties serve in an international realm.

The complexity of the U.S. income tax laws

United States tax law attempts to define a comprehensive system of measuring income in a complex economy. Many provisions granting or removing benefits require significant definition of terms. Further, many state income tax laws do not conform with Federal tax law in material respects. These factors and others have resulted in substantial complexity. Even venerable legal scholars like Judge Learned Hand have expressed amazement and frustration with the complexity of the U.S. income tax laws. In the article, Thomas Walter Swan, 57 Yale Law Journal No. 2, 167, 169 (December 1947), Judge Hand wrote:

In my own case the words of such an act as the Income Tax… merely dance before my eyes in a meaningless procession: cross-reference to cross-reference, exception upon exception — couched in abstract terms that offer [me] no handle to seize hold of [and that] leave in my mind only a confused sense of some vitally important, but successfully concealed, purport, which it is my duty to extract, but which is within my power, if at all, only after the most inordinate expenditure of time. I know that these monsters are the result of fabulous industry and ingenuity, plugging up this hole and casting out that net, against all possible evasion; yet at times I cannot help recalling a saying of William James about certain passages of Hegel: that they were no doubt written with a passion of rationality; but that one cannot help wondering whether to the reader they have any significance save that the words are strung together with syntactical correctness.

Complexity is a separate issue from flatness of rate structures. In the United States, income tax codes are often legislatures' favored policy instrument for encouraging numerous undertakings deemed socially useful — including the buying of life insurance, the funding of employee health care and pensions, the raising of children, home ownership, development of alternative energy sources and increased investment in conventional energy. Special tax rebates granted for any purpose increase complexity, irrespective of the system's flatness or lack thereof.

State, local and territorial income taxes

Income tax is also be levied by most U.S. states and many localities on individuals, corporations, estates, and trusts. These taxes are in addition to Federal income tax and are deductible for federal tax purposes. State and local income tax rates vary from 1% to 16% of taxable income.[29] Some state and local income tax rates are flat (single rate) and some are graduated. State and local definitions of what income is taxable vary highly. Some states incorporate the Federal definitions by reference. Taxable income is defined separately and differently for individuals and corporations in some jurisdictions. Some states impose alternative or additional taxes based a second measure of income or capital.

States and localities tend to tax all income of residents. States and localities only tax nonresidents on income allocated or apportioned to the jurisdiction. Generally, nonresident individuals are taxed on wages earned in the state based on the portion of days worked in the state. Many states require partnerships to pay tax for nonresident partners.

Tax returns are filed separately for states and localities imposing income tax, and may be due on dates that differ from Federal due dates. Some states permit related corporations to file combined or consolidated returns. Most states and localities imposing income tax require estimated payments where tax exceeds certain thresholds, and require withholding tax on payment of wages.

Puerto Rico imposes a separate income tax in lieu of Federal income tax.[30] The unincorporated territories Guam, American Samoa, and the Virgin Islands also impose income tax separately, under a "mirror" tax law based on Federal income tax law.

Arguments against the U.S. income tax

This section may lend undue weight to certain ideas, incidents, or controversies. (September 2010) |

Libertarians believe in a natural right to property (money being a representation of a person's property), and that no individual, including institutions composed of individuals, can take another individual's property without their permission. Some holders of this view say that the only way government can enforce its power is through coercion; thus, such individuals may view taxation as equivalent to theft. Some believe income taxation offers the federal government a technique to diminish the power of the states, because the federal government is then able to distribute funding to states with conditions attached, often giving the states no choice but to submit to federal demands. Although many libertarians view all taxes as undesirable, the question of whether or not taxation is nevertheless necessary is up for debate among libertarians. However, in general the libertarian philosophy prefers local government over less-local government; thus a federal tax is by some viewed as the worst kind of tax.

Proponents of a consumption tax argue that the income tax system creates perverse incentives by encouraging taxpayers to spend rather than save: a taxpayer is only taxed once on income spent immediately, while any interest earned on saved income is itself taxed.[31] To the extent that this is considered unjust, it may be remedied in a variety of ways, e.g. excluding investment income from taxable income, making investments deductible and therefore only taxing them when gains are realized, or replacing the income tax by other forms of tax, such as a sales tax.[32] The proposed Fair Tax Act, a bill before the U.S. Congress, aims to repeal the income tax in favor of a national sales tax with a rebate, and calls for a repeal of the Sixteenth Amendment.

Finally, numerous tax protester arguments have been raised asserting that the federal income tax is unconstitutional, including discredited claims that the Sixteenth Amendment was not properly ratified. All such claims have been repeatedly rejected by the Judicial branch as frivolous.[33]

Distribution

This section's factual accuracy is disputed. (September 2010) |

Some[who?] argue that the current income tax system, which is the government's largest revenue source, is too progressive and redistributive.[34] In 2007, the top 5% of income earners paid over half of the federal income tax revenue.[35] However, as of 2004, the top 5% hold 59.2% of wealth. The top 1% of income earners paid 25% of the total income tax revenue.[36] Again however, the top 1% hold 23.5% of wealth. According to a conservative media group, it was "predicted" by an unnamed source that forty seven percent of Americans would pay no federal income tax in 2009 (though they still pay federal payroll taxes),[35][37] which raises moral concerns regarding wealth redistribution and the economics for controlling the size and spending of government. Note, though, that this percentage does include some people without job income (e.g. children, retirees) along with the low-income workers to whom this moral hazard applies.[34]

See also

- FairTax: Proposal to replace the federal income tax with a national sales tax.

- Federal tax revenue by state

- Flat Tax: Proposals to alter the federal income tax with a single rate.

- Internal Revenue Code § 212 - tax deductibility of investment expenses.

- Payroll taxes in the United States

- Capital gains tax in the United States

- Sales taxes in the United States

- State income tax

- State tax levels

- Tax Day

- Tax preparation

- Tax protester

- Taxation in the United States

- Taxation of illegal income in the United States

- Tax resister

- US State NonResident Withholding Tax

References

- ^ IRS.gov

- ^ IRS.gov

- ^ a b 26 USC 61.

- ^ 26 CFR 1.61-1(a).

- ^ US Constitution.net

- ^ Penn Mutual Indemnity Co. v. Commissioner, 227 F.2d 16, 19-20 (3rd Cir. 1960)

- ^ Steward Machine Co. v. Davis, 301 U.S. 548 (1937), 581-582

- ^ Revenue Act of 1861, sec. 49, ch. 45, 12 Stat. 292, 309 (Aug. 5, 1861).

- ^ Sections 49, 51, and part of 50 repealed by Revenue Act of 1862, sec. 89, ch. 119, 12 Stat. 432, 473 (July 1, 1862); income taxes imposed under Revenue Act of 1862, section 86 (pertaining to salaries of officers, or payments to "persons in the civil, military, naval, or other employment or service of the United States ...") and section 90 (pertaining to "the annual gains, profits, or income of every person residing in the United States, whether derived from any kind of property, rents, interest, dividends, salaries, or from any profession, trade, employment or vocation carried on in the United States or elsewhere, or from any other source whatever....").

- ^ Charles F. Dunbar, "The New Income Tax," Quarterly Journal of Economics, Vol. 9, No. 1 (Oct., 1894), pp. 26-46 in JSTOR.

- ^ Chief Justice Fuller's opinion, 158 U.S. 601, 634.

- ^ United States Government Printing Office, at Amendments to the Constitution of the United States of America; see generally United States v. Thomas, 788 F.2d 1250 (7th Cir. 1986), cert. denied, 107 S.Ct. 187 (1986); Ficalora v. Commissioner, 751 F.2d 85, 85-1 U.S. Tax Cas. (CCH) paragr. 9103 (2d Cir. 1984); Sisk v. Commissioner, 791 F.2d 58, 86-1 U.S. Tax Cas. (CCH) paragr. 9433 (6th Cir. 1986); United States v. Sitka, 845 F.2d 43, 88-1 U.S. Tax Cas. (CCH) paragr. 9308 (2d Cir.), cert. denied, 488 U.S. 827 (1988); United States v. Stahl, 792 F.2d 1438, 86-2 U.S. Tax Cas. (CCH) paragr. 9518 (9th Cir. 1986), cert. denied, 107 S. Ct. 888 (1987); Brown v. Commissioner, 53 T.C.M. (CCH) 94, T.C. Memo 1987-78, CCH Dec. 43,696(M) (1987); Lysiak v. Commissioner, 816 F.2d 311, 87-1 U.S. Tax Cas. (CCH) paragr. 9296 (7th Cir. 1987); Miller v. United States, 868 F.2d 236, 89-1 U.S. Tax Cas. (CCH) paragr. 9184 (7th Cir. 1989); also, see generally Boris I. Bittker, Constitutional Limits on the Taxing Power of the Federal Government, The Tax Lawyer, Fall 1987, Vol. 41, No. 1, p. 3 (American Bar Ass'n).

- ^ Memorandum Opinion, p. 14, Dec. 17, 2007, docket entry 106, United States v. Benson, case no. 1:04-cv-07403, United States District Court for the Northern District of Illinois, Eastern Division.

- ^ Memorandum Opinion, p. 9, Dec. 17, 2007, docket entry 106, United States v. Benson, case no. 1:04-cv-07403, United States District Court for the Northern District of Illinois, Eastern Division.

- ^ 348 U.S. at 429

- ^ Id. at 430.

- ^ Id. at 432-33.

- ^ Id. at 27.

- ^ Opinion on rehearing, July 3, 2007, p. 16, Murphy v. Internal Revenue Service and United States, case no. 05-5139, United States Court of Appeals for the District of Columbia Circuit, 2007-2 U.S. Tax Cas. (CCH) paragr. 50,531 (D.C. Cir. 2007).

- ^ Penn Mutual Indemnity Co. v. Commissioner, 277 F.2d 16, 60-1 U.S. Tax Cas. (CCH) paragr. 9389 (3d Cir. 1960) (footnotes omitted).

- ^ History of Federal Individual Income Bottom and Top Bracket Rates. Retrieved 2010-02-04.

- ^ Personal Exemptions and Individual Income Tax Rates: 1913-2002, Internal Revenue Service

- ^ U.S. Federal Individual Marginal Income Tax Rates History, 1913-2009, The Tax Foundation.

- ^ W. Kurt Hauser, "The Tax and Revenue Equation," The Wall Street Journal, March 25, 1993. Reprinted in: W. Kurt Hauser, Taxation and Economic Performance (Stanford, California: Hoover Institution Press, 1996), pages 13-16. In a May 20, 2008 editorial in the Wall St. Journal, David Ranson published a graph showing that even though the top marginal tax rate of federal income tax had varied between a low of 28% to a high of 91% between 1950 and 2007, federal tax revenues had indeed constantly remained at about 19.5% of GDP. See You Can't Soak the Rich.

- ^ Lying With Charts, Zubin Jelveh, May 21, 2008

- ^ Samuel A. Donaldson, Federal Income Taxation of Individuals: Cases, Problems and Materials, 4 (2nd Ed. 2007).

- ^ Id.

- ^ Id.

- ^ See, e.g., CCH 2009 State Tax Handbook, ISBN 978-0-8080-1921-3.

- ^ Residents of Puerto Rico pay federal taxes other than federal income taxes. Also see [http://www.doi.gov/oia/Islandpages/prpage.htm Dept of the Interior, Office of Insular Affairs. DOI.gov), regarding import/export taxes (See Stanford.wellsphere.com), federal commodity taxes (See Stanford.wellsphere.com), social security taxes (See IRS.gov), etc. Residents pay federal payroll taxes, such as Social Security (See IRS.gov) and Medicare (See Reuters.com), as well as Commonwealth of Puerto Rico income taxes (See Puertorico-herald.org and HTRCPA.com). All federal employees (See Heritage.org), those who do business with the federal government (See MCVPR.com), Puerto Rico-based corporations that intend to send funds to the U.S. (See p. 9, line 1.), and some others (For example, Puerto Rican residents that are members of the U.S. military, See Heritage.org; and Puerto Rico residents who earned income from sources outside Puerto Rico, See pp 14-15.) also pay federal income taxes. In addition, because the cutoff point for income taxation is lower than that of the U.S. IRS code, and because the per-capita income in Puerto Rico is much lower than the average per-capita income on the mainland, more Puerto Rico residents pay income taxes to the local taxation authority than if the IRS code were applied to the island. This occurs because "the Commonwealth of Puerto Rico government has a wider set of responsibilities than do U.S. State and local governments" (See GAO.gov). As residents of Puerto Rico pay into Social Security, Puerto Ricans are eligible for Social Security benefits upon retirement, but are excluded from the Supplemental Security Income (SSI) (Commonwealth of Puerto Rico residents, unlike residents of the Commonwealth of the Northern Mariana Islands and residents of the 50 States, do not receive the SSI. See Socialsecurity.gov), and the island actually receives less than 15% of the Medicaid funding it would normally receive if it were a U.S. state (See Magiccarpetautotransport.com). However, Medicare providers receive less-than-full state-like reimbursements for services rendered to beneficiaries in Puerto Rico, even though the latter paid fully into the system (See p 252). In general, "many federal social welfare programs have been extended to Puerto Rican (sic) residents, although usually with caps inferior to those allocated to the states." (The Louisiana Purchase and American Expansion: 1803-1898. By Sanford Levinson and Bartholomew H. Sparrow. New York: Rowman and Littlefield Publishers. 2005. Page 167. For a comprehensive coverage of federal programs made extensive to Puerto Rico see Richard Cappalli's Federal Aid to Puerto Rico (1970)). It has also been estimated (See Egleforum.org) that, because the population of the Island is greater than that of 50% of the States, if it were a state, Puerto Rico would have six to eight seats in the House, in addition to the two seats in the Senate.(See Eagleforum.org, CRF-USA.org and Thomas.gov [Note that for the later, the official US Congress database website, you will need to resubmit a query. The document in question is called "House Report 110-597 - Puerto Rico Democracy Act of 2007." These are the steps to follow: THOMAS.gov > Committee Reports > 110 > drop down "Word/Phrase" and pick "Report Number" > type "597" next to Report Number. This will provide the document "House Report 110-597 - 2007", then from the Table of Contents choose "Background and need for legislation".). Another misconception is that the import/export taxes collected by the U.S. on products manufactured in Puerto Rico are all returned to the Puerto Rico Treasury. This is not the case. Such import/export taxes are returned only for rum products, and even then the US Treasury keeps a portion of those taxes (See the "House Report 110-597 - Puerto Rico Democracy Act of 2007" mentioned above.)

- ^ John Stuart Mill's argument, reported by Marvin A. Chirelstein, Federal Income Taxation, p. 433 (Foundation Press, 10th Ed., 2005)

- ^ Chirelstein, loc.cit.

- ^ "The Truth About Frivolous Tax Arguments". 2010-01-01. Retrieved 2010-02-10.

- ^ a b Fleischer, Ari (2009-04-13). "Everyone Should Pay Income Taxes". Wall Street Journal. Retrieved 2009-04-14.

{{cite web}}: Italic or bold markup not allowed in:|publisher=(help) This article is an editorial by a former press secretary to a former President. - ^ a b Babington, Charles (Associated Press) (October 22, 2008). Spreading the wealth? U.S. already does it. Burlington Free Press.

- ^ Shinkle, Kirk (December 15–22, 2008). Shutting Down the Spin Cycle. US News and World Report.

- ^ Representation without taxation, Madia Research, April 10, 2010

Additional reading

Government sources:

- IRS Publication 17, Your Federal Income Tax

- IRS Publication 334, Tax Guide for Small Business

- IRS Publication 509, Tax Calendar

- IRS Publication 541, Partnerships

- IRS Publication 542, Corporations

- IRS Publicatoin 544, Sales and Other Dispositions of Assets

- IRS Publication 556 Examination of Returns, Appeal Rights, and Claims for Refund

- IRS Publications by topic

Law & regulations:

Standard texts (updated annually):

- Pratt, James W., Kulsrud, William N., et al, Federal Taxation", updated periodically. 2010 edition ISBN 978-1424069866 (cited above as Pratt & Kulsrud 2005).

- Whittenberg, Gerald, and Altus-Buller, Martha, Income Tax Fundamentals 2010, ISBN 9781439044094

- Willis, Eugene, Hoffman, William H. Jr., et al, South-Western Federal Taxation, published annually. 2009 edition included ISBN 973-0-324-66060-0 (student) and ISBN 978-0-324-66208-5 (instructor).

Reference works (annual): CCH U.S. Master Tax Guide, 2010 ISBN 978-0808021698 RIA Federal Tax Handbook 2010 ISBN 978-0781104173

Popular publications (annual): J.K. Lasser's Your Income Tax for 2010 ISBN 978-0470447116