Welfare state in the United Kingdom: Difference between revisions

→Expenditure: Replaced misleading Pie-Chart graphic with Pie-Chart template (see talk) |

mNo edit summary |

||

| Line 76: | Line 76: | ||

| [[Council Tax Benefit]] || £4.8 |

| [[Council Tax Benefit]] || £4.8 |

||

|- |

|- |

||

| Other |

| Other uncategorized expenditure || £4.7 |

||

|- |

|- |

||

| [[Employment and Support Allowance]] || £3.6 |

| [[Employment and Support Allowance]] || £3.6 |

||

Revision as of 11:01, 15 July 2013

This article possibly contains original research. (July 2008) |

The Welfare State comprises expenditures by the government of the United Kingdom intended to improve health, education, employment and social security.

History

The United Kingdom, as a welfare state in the modern sense, was anticipated by the Royal Commission into the Operation of the Poor Laws 1832 which found that the old poor law (a part of the English Poor laws) was subject to widespread abuse and promoted squalor, idleness and criminality in its recipients, compared to those who received private charity. Accordingly, the qualifications for receiving aid were tightened up, forcing many recipients to either turn to private charity or accept employment.

Opinions began to be changed late in the century by the reports drawn up by men such as Seebohm Rowntree and Charles Booth into the levels of poverty in Britain. These reports indicated that in the massive industrial cities, between one-quarter and one-third of the population were living below the poverty line.

After the United Kingdom general election, 1906, the Labour Party became a serious competitor to the Liberal Party. The resulting Liberal welfare reforms laid the foundations of the modern welfare state. The reforms were greatly extended over the next forty years. Certainly, governments which had seen the wave of communist revolts after the First World War were keen to ensure that deeper reforms reduced the risk of mass social unrest. In addition, modern, complex industry had more need for a healthy and educated workforce than older industries had. Crucially, the experience of almost total state control during the Second World War had inured the population to the idea that the state might be able to solve problems in wide areas of national life. Finally, it seems likely that the social mixing involved in mass evacuation of children, and of service in the armed forces, had increased support for welfare among the middle classes.

The Beveridge Report of 1942, (which identified five "Giant Evils" in society: squalor, ignorance, want, idleness and disease) essentially recommended a national, compulsory, flat rate insurance scheme which would combine health care, unemployment and retirement benefits. Beveridge himself was careful to emphasize that unemployment benefits should be held to a subsistence level, and after six months would be conditional on work or training, so as not to encourage abuse of the system.[1] After its victory in the United Kingdom general election, 1945 the Labour Party pledged to eradicate the Giant Evils, and undertook policy measures to provide for the people of the United Kingdom "from the cradle to the grave."

Included among the laws passed were the National Assistance Act 1948, National Insurance Act 1946, and National Insurance (Industrial Injuries) Act 1946.

Results

This policy resulted in massive expenditure and a great widening of what was considered to be the state's responsibility. In addition to the central services of education, health, unemployment and sickness allowances, the welfare state also included the idea of increasing redistributive taxation, increasing regulation of industry, food, and housing (better safety regulations, weights and measures controls, etc.)

However the initial foundation of the National Health Service (NHS) did not involve building new hospitals but merely the nationalisation of existing municipal and charitable foundations. The aim was not to substantially increase provision but to standardise care across the country; indeed Beveridge believed that the overall cost of medical care would decrease, as people became healthier and so needed less treatment. Instead the cost rose dramatically, from £9 billion in 1948 (accounting for inflation) to £106 billion in 2011,[2] and charges (for dentures, spectacles and prescriptions) were introduced in 1951 (by the same Labour government that had founded the NHS three years earlier). Despite this, the principle of health care "free at the point of use" became a central idea of the welfare state, which later governments, critical of the Welfare State, were unable to reverse. The classic Welfare State period lasted from approximately 1945 to the late-1970s, when policies under Thatcherism began to privatise public institutions, although many features remain today, including compulsory National Insurance contributions, and the provision of old age pensions.

The Labour Party, standing in 1945 on a programme of establishing a Welfare State, won a clear victory. However, since the 1980s the British government has begun to reduce some provisions in England: for example, free eye tests for all have now been stopped and prescription charges for drugs have constantly risen since they were first introduced in 1951. Policies differ in different countries of the United Kingdom, but the provision of a welfare state is still a basic principle of government policy in the United Kingdom today.

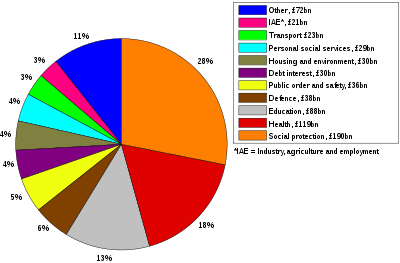

Expenditure

The level of public spending on the welfare state by the British Government accounted for £62 billion, or 16% of government spending in the fiscal year 2011, with a further 17% (£119.4 bn) being spent on the state pension and 18% (£121 bn) on health.[3] A report published in 2010 by the Government of David Cameron entitled State of the Nation compared the cost of the most expensive benefits and indicated that state pensions were overwhelmingly the largest governmental welfare expense, costing in excess of £50 billion, followed by housing benefit and council tax benefit, which combined accounted for over £20 billion.[4] Expenditure in 2011-12 on benefits included £5.1 billion paid to unemployed people and £41 billion to people on low incomes:[5][6]

UK Government welfare expenditure 2011–12 (percent)

| Benefit | Expenditure (£bn) |

|---|---|

| State pension | £74.2 |

| Housing Benefit | £16.9 |

| Disability Living Allowance | £12.6 |

| Pension Credit | £8.1 |

| Income Support | £6.9 |

| Rent rebates | £5.5 |

| Attendance allowance | £5.3 |

| Jobseeker's allowance | £4.9 |

| Incapacity Benefit | £4.9 |

| Council Tax Benefit | £4.8 |

| Other uncategorized expenditure | £4.7 |

| Employment and Support Allowance | £3.6 |

| Statutory Sick/Maternity pay | £2.5 |

| Social Fund | £2.4 |

| Carer's Allowance | £1.7 |

| Financial Assistance Scheme | £1.2 |

| TOTAL | £160.2 |

Criticism and failings

Critics of the welfare state claim that, in addition to the vast expense, by relieving citizens of personal responsibility for their own welfare the government has inadvertently promoted irresponsible and immature attitudes, with the result that squalor, ignorance, and idleness are common.[8][9] In 1980, T. E. Utley, wrote that the welfare state was "an arrangement under which we all largely cease to be responsible for our own behaviour and in return become responsible for everyone else's. The temptations which this way of doing things offers to synthetic anger, fraudulent penitence, all other forms of hypocrisy and the sheer evasion of duty are infinitely too strong for fallen man".[10]

In the early 21st Century, the Government of David Cameron has argued for a reduction of welfare spending in the United Kingdom as part of their programme of austerity.[11] Government ministers have argued that a growing culture of welfare dependency is perpetuating welfare spending, and claim that a cultural change is required to reduce the welfare bill.[12] Public opinion in the UK appears to support a reduction in welfare spending, however commentators have suggested that negative public perceptions are founded on exaggerated assumptions about the proportion of spending on unemployment benefit and the level of benefit fraud.[13][14]

See also

Housing:

References

- ^ "The Beveridge Report and the postwar reforms" (PDF). Policy Studies Institute. Retrieved 9 June 2012.

- ^ "About the NHS". Department of Health. Retrieved 9 June 2012.

- ^ "Public Spending Details for 2011". UK Public Spending. Retrieved 5 January 2013.

- ^ "The cost of the most expensive benefits and tax credits relative to selected other departmental expenditure" (PDF). State of the nation report: poverty, worklessness and welfare dependency in the UK. HM Government. May 2010. p. 36. Retrieved 5 January 2013.

- ^ "Benefits for unemployed people" (PDF). A Survey of the UK Benefit System. Institute for Fiscal Studies. November 2012. p. 16.

- ^ "Benefits for people on low incomes" (PDF). A Survey of the UK Benefit System. Institute for Fiscal Studies. November 2012. p. 25.

- ^ Rogers,Simon; Blight, Garry (4 December 2012). "Public spending by UK government department 2011-12: an interactive guide". The Guardian. Retrieved 2 April 2013.

- ^ Bartholomew, James (2013). The Welfare State We're In (3 ed.). Biteback. p. 320. ISBN 978-1849544504.

- ^ Dalrymple, Theodore (2007). Our Culture, What's Left of It: The Mandarins and the Masses. Ivan R. Dee. p. 360. ISBN 978-1-56663-721-3.

- ^ Peter Oborne (June 30, 2011). "Britain would be a better place if families looked after their own". The Daily Telegraph. Retrieved July 1, 2011.

- ^ "David Cameron: 'Don't complain about welfare cuts, go and find work'". 23 Jan 2012. Retrieved 5 January 2013.

- ^ "Conservative conference: Welfare needs 'cultural shift'". 8 October 2012. Retrieved 5 January 2013.

- ^ Grice, Andrew (4 January 2013). "Voters 'brainwashed by Tory welfare myths', shows new poll". The Independent. Retrieved 5 January 2013.

- ^ "Support for benefit cuts dependent on ignorance, TUC-commissioned poll finds". TUC. Retrieved 5 January 2013.

External links

- Text of the Beveridge Report

- The Welfare State – Never Ending Reform Brief history of the Welfare State by Frank Field (BBC website)