Black–Scholes model

The term Black–Scholes refers to three closely related concepts:

- The Black–Scholes model is a mathematical model of the market for an equity, in which the equity's price is a stochastic process.

- The Black–Scholes PDE is a partial differential equation which (in the model) must be satisfied by the price of a derivative on the equity.

- The Black–Scholes formula is the result obtained by solving the Black-Scholes PDE for a European call option.

Fischer Black and Myron Scholes first articulated the Black-Scholes formula in their 1973 paper, "The Pricing of Options and Corporate Liabilities." The foundation for their research relied on work developed by scholars such as Jack L. Treynor, Paul Samuelson, A. James Boness, Sheen T. Kassouf, and Edward O. Thorp. The fundamental insight of Black-Scholes is that the option is implicitly priced if the stock is traded.

Robert C. Merton was the first to publish a paper expanding the mathematical understanding of the options pricing model and coined the term "Black-Scholes" options pricing model.

Merton and Scholes received the 1997 The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel for this and related work. Though ineligible for the prize because of his death in 1995, Black was mentioned as a contributor by the Swedish academy [1].

Black–Scholes model

The Black-Scholes model of the market for a particular equity makes the following explicit assumptions:

- It is possible to borrow and lend cash at a known constant risk-free interest rate.

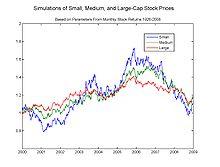

- The price follows a geometric Brownian motion with constant drift and volatility.

- There are no transaction costs.

- The stock does not pay a dividend (see below for extensions to handle dividend payments).

- All securities are perfectly divisible (i.e. it is possible to buy any fraction of a share).

- There are no restrictions on short selling.

From these ideal conditions in the market for an equity (and for an option on the equity), the authors show that "it is possible to create a hedged position, consisting of a long position in the stock and a short position in [calls on the same stock], whose value will not depend on the price of the stock."[2]

Notation

Define

- , the price of the stock (please note as below).

- , the price of a derivative as a function of time and stock price.

- the price of a European call and the price of a European put option.

- , the strike of the option.

- , the annualized risk-free interest rate, continuously compounded.

- , the drift rate of , annualized.

- , the volatility of the stock; this is the square root of the quadratic variation of the stock's log price process.

- a time in years; we generally use now = 0, expiry = T.

- , the value of a portfolio.

- , the accumulated profit or loss following a delta-hedging trading strategy.

denotes the standard normal cumulative distribution function, .

denotes the standard normal probability density function,.

Black–Scholes PDE

As per the model assumptions above, we assume that the underlying asset (typically the stock) follows a geometric Brownian motion. That is,

where Wt is Brownian -- the dW term here stands in for any and all sources of uncertainty in the price history of a stock.

The payoff of an option at maturity is known. To find its value at an earlier time we need to know how V evolves as a function of S and T. By Itō's lemma for two variables we have

Now consider a trading strategy under which one holds one option and continuously trades in the stock in order to hold shares. At time t, the value of these holdings will be

The composition of this portfolio, called the delta-hedge portfolio, will vary from time-step to time-step. Let R denote the accumulated profit or loss from following this strategy. Then over the time period [t, t + dt], the instantaneous profit or loss is

By substituting in the equations above we get

This equation contains no dW term. That is, it is entirely riskless (delta neutral). Black and Scholes reason that under their ideal conditions, the rate of return on this portfolio must be equal at all times to the rate of return on any other riskless instrument; otherwise, there would be opportunities for arbitrage. Now assuming the risk-free rate of return is r we must have over the time period [t, t + dt]

If we now substitute in for and divide through by dt we obtain the Black–Scholes PDE:

With the assumptions of the Black–Scholes model, this partial differential equation holds whenever V is twice differentiable with respect to S and once with respect to t.

Other derivations of the PDE

Above we used the method of arbitrage-free pricing ("delta-hedging") to derive some PDE governing option prices given the Black–Scholes model. It is also possible to use a risk-neutrality argument. This latter method gives the price as the expectation of the option payoff under a particular probability measure, called the risk-neutral measure, which differs from the real world measure.

Black–Scholes formula

The Black Scholes formula is used for obtaining the price of European put and call options. It is obtained by solving the Black-Scholes PDE as discussed - see derivation below.

The value of a call option in terms of the Black–Scholes parameters:

The price of a put option is:

For both, as above:

- N(•) is the standard normal cumulative distribution function

- T - t is the time to maturity

- S is the spot price of the underlying asset

- K is the strike price

- r is the risk free rate (annual rate, expressed in terms of continuous compounding)

- is the volatility in the log-returns of the underlying

Interpretation

and are the probabilities of the option expiring in-the-money under the equivalent exponential martingale probability measure (numéraire = stock) and the equivalent martingale probability measure (numéraire = risk free asset), respectively. The equivalent martingale probability measure is also called the risk-neutral probability measure. Note that both of these are probabilities in a measure theoretic sense, and neither of these is the true probability of expiring in-the-money under the real probability measure.

Derivation

We now show how to get from the general Black–Scholes PDE to a specific valuation for an option. Consider as an example the Black–Scholes price of a call option, for which the PDE above has boundary conditions

The last condition gives the value of the option at the time that the option matures. The solution of the PDE gives the value of the option at any earlier time, . In order to solve the PDE we transform the equation into a diffusion equation which may be solved using standard methods. To this end we introduce the change-of-variable transformation

Then the Black–Scholes PDE becomes a diffusion equation

The terminal condition now becomes an initial condition

Using the standard method for solving a diffusion equation we have

After some algebra we obtain

where

and

Substituting for u, x, and , we obtain the value of a call option in terms of the Black–Scholes parameters:

where

The price of a put option may be computed from this by put-call parity and simplifies to

Greeks

The Greeks under Black–Scholes are given in closed form, below:

| What | Calls | Puts | |

|---|---|---|---|

| delta | |||

| gamma | |||

| vega | |||

| theta | |||

| rho | |||

Note that the gamma and vega formulas are the same for calls and puts. This can be seen directly from put-call parity.

In practice, some sensitivities are usually quoted in scaled-down terms, to match the scale of likely changes in the parameters. For example, rho is often reported divided by 10,000 (1bp rate change), vega by 100 (1 vol point change), and theta by 365 or 252 (1 day decay based on either calendar days or trading days per year).

Extensions of the model

The above model can be extended to have non-constant (but deterministic) rates and volatilities. The model may also be used to value European options on instruments paying dividends. In this case, closed-form solutions are available if the dividend is a known proportion of the stock price. American options and options on stocks paying a known cash dividend (in the short term, more realistic than a proportional dividend) are more difficult to value, and a choice of solution techniques is available (for example lattices and grids).

Instruments paying continuous yield dividends

For options on indexes, it is reasonable to make the simplifying assumption that dividends are paid continuously, and that the dividend amount is proportional to the level of the index.

The dividend payment paid over the time period [t, t + dt] is then modelled as

for some constant q (the dividend yield).

Under this formulation the arbitrage-free price implied by the Black–Scholes model can be shown to be

where now

is the modified forward price that occurs in the terms d1 and d2:

Exactly the same formula is used to price options on foreign exchange rates, except that now q plays the role of the foreign risk-free interest rate and S is the spot exchange rate. This is the Garman–Kohlhagen model (1983).

Instruments paying discrete proportional dividends

It is also possible to extend the Black–Scholes framework to options on instruments paying discrete proportional dividends. This is useful when the option is struck on a single stock.

A typical model is to assume that a proportion of the stock price is paid out at pre-determined times t1, t2, .... The price of the stock is then modelled as

where n(t) is the number of dividends that have been paid by time t.

The price of a call option on such a stock is again

where now

is the forward price for the dividend paying stock.

Black–Scholes in practice

The Black–Scholes model disagrees with reality in a number of ways, some significant. It is widely used as a useful approximation, but proper use requires understanding its limitations – blindly following the model exposes the user to unexpected risk.

Among the most significant limitations are:

- the underestimation of extreme moves, yielding tail risk, which can be hedged with out-of-the-money options;

- the assumption of instant, cost-less trading, yielding liquidity risk, which is difficult to hedge;

- the assumption of a stationary process, yielding volatility risk, which can be hedged with volatility hedging;

- the assumption of continuous time and continuous trading, yielding gap risk, which can be hedged with Gamma hedging.

In short, while in the Black–Scholes model one can perfectly hedge options by simply Delta hedging, in practice there are many other sources of risk.

Results using the Black–Scholes model differ from real world prices due to simplifying assumptions of the model. One significant limitation is that in reality security prices do not follow a strict stationary log-normal process, nor is the risk-free interest actually known (and is not constant over time). The variance has been observed to be non-constant leading to models such as GARCH to model volatility changes. Pricing discrepancies between empirical and the Black-Scholes model have long been observed in options that are far out-of-the-money, corresponding to extreme price changes; such events would be very rare if returns were lognormally distributed, but are observed much more often in practice.

Nevertheless, Black–Scholes pricing is widely used in practice,[3] for it is easy to calculate and explicitly models the relationship of all the variables. It is a useful approximation, particularly when analyzing the directionality that prices move when crossing critical points. It is used both as a quoting convention and a basis for more refined models. Although volatility is not constant, results from the model are often useful in practice and helpful in setting up hedges in the correct proportions to minimize risk. Even when the results are not completely accurate, they serve as a first approximation to which adjustments can be made.

One reason for the popularity of the Black–Scholes model is that it is robust in that it can be adjusted to deal with some of its failures. Rather than considering some parameters (such as volatility or interest rates) as constant, one considers them as variables, and thus added sources of risk. This is reflected in the Greeks (the change in option value for a change in these parameters, or equivalently the partial derivatives with respect to these variables), and hedging these Greeks mitigates the risk caused by the non-constant nature of these parameters. Other defects cannot be mitigated by modifying the model, however, notably tail risk and liquidity risk, and these are instead managed outside the model, chiefly by minimizing these risks and by stress testing.

Additionally, rather than assuming a volatility a priori and computing prices from it, one can use the model to solve for volatility, which gives the implied volatility of an option at given prices, durations and exercise prices. Solving for volatility over a given set of durations and strike prices one can construct an implied volatility surface. In this application of the Black–Scholes model, a coordinate transformation from the price domain to the volatility domain is obtained. Rather than quoting option prices in terms of dollars per unit (which are hard to compare across strikes and tenors), option prices can thus be quoted in terms of implied volatility, which leads to trading of volatility in option markets.

The volatility smile

One of the attractive feature of the Black-Scholes model is that the parameters in the model (other than the volatility and the risk-free interest rate) — the time to maturity, the strike, and the current underlying price — are unequivocally observable. All other things being equal, an option's theoretical value is a monotonic increasing function of implied volatility. By computing the implied volatility for traded options with different strikes and maturities, the Black-Scholes model can be tested. If the Black–Scholes model held, then the implied volatility for a particular stock would be the same for all strikes and maturities. In practice, the volatility surface (the three-dimensional graph of implied volatility against strike and maturity) is not flat. The typical shape of the implied volatility curve for a given maturity depends on the underlying instrument. Equities tend to have skewed curves: compared to at-the-money, implied volatility is substantially higher for low strikes, and slightly lower for high strikes. Currencies tend to have more symmetrical curves, with implied volatility lowest at-the-money, and higher volatilities in both wings. Commodities often have the reverse behaviour to equities, with higher implied volatility for higher strikes.

Despite the existence of the volatility smile (and the violation of all the other assumptions of the Black-Scholes model), the Black-Scholes PDE and Black-Scholes formula are still used extensively in practice. A typical approach is to regard the volatility surface as a fact about the market, and use an implied volatility from it in a Black-Scholes valuation model. This has been described as using "the wrong number in the wrong formula to get the right price."[4] This approach also gives usable values for the hedge ratios (the Greeks).

Even when more advanced models are used, traders prefer to think in terms of volatility as it allows them to evaluate and compare options of different maturities, strikes, and so on.

Valuing bond options

Black–Scholes cannot be applied directly to bond securities because of the pull-to-par problem. As the bond reaches its maturity date, all of the prices involved with the bond become known, thereby decreasing its volatility, and the simple Black–Scholes model does not reflect this process. A large number of extensions to Black–Scholes, beginning with the Black model, have been used to deal with this phenomenon.

Interest rate curve

In practice, interest rates are not constant - they vary by tenor, giving an interest rate curve which may be interpolated to pick an appropriate rate to use in the Black-Scholes formula. Another consideration is that interest rates vary over time. This volatility may make a significant contribution to the price, especially of long-dated options.

Short stock rate

It is not free to take a short stock position. Similarly, it may be possible to lend out a long stock position for a small fee. In either case, this can be treated as a continuous dividend for the purposes of a Black-Scholes valuation.

Formula derivation

Elementary derivation

Let S0 be the current price of the underlying stock and S the price when the option matures at time T. Then S0 is known, but S is a random variable. Assume that

is a normal random variable with mean and variance . It follows that the mean of S is

for some constant q (independent of T). Now a simple no-arbitrage argument shows that the theoretical future value of a derivative paying one share of the stock at time T, and so with payoff S, is

where r is the risk-free interest rate. This suggests making the identification q = r for the purpose of pricing derivatives. Define the theoretical value of a derivative as the present value of the expected payoff in this sense. For a call option with exercise price K this discounted expectation (using risk-neutral probabilities) is

The derivation of the formula for C is facilitated by the following lemma: Let Z be a standard normal random variable and let b be an extended real number. Define

If a is a positive real number, then

where is the standard normal cumulative distribution function. In the special case b = −∞, we have

Now let

and use the corollary to the lemma to verify the statement above about the mean of S. Define

and observe that

for some b. Define

and observe that

The rest of the calculation is straightforward.

Although the "elementary" derivation leads to the correct result, it is incomplete as it cannot explain, why the formula refers to the risk-free interest rate while a higher rate of return is expected from risky investments. This limitation can be overcome using the risk-neutral probability measure, but the concept of risk-neutrality and the related theory is far from elementary. In elementary terms, the value of the option today is not the expectation of the value of the option at expiry, discounted with the risk-free rate. (So the basic capital asset pricing model (CAPM) results are not violated.) The value is instead computed using the expectation under another distribution of probability, of the value of the option at expiry, discounted with the risk-free rate. This other distribution of probability is called the "risk neutral" probability.

Remarks on notation

The reader is warned of the inconsistent notation that appears in this article. Thus the letter S is used as:

- (1) a constant denoting the current price of the stock

- (2) a real variable denoting the price at an arbitrary time

- (3) a random variable denoting the price at maturity

- (4) a stochastic process denoting the price at an arbitrary time

It is also used in the meaning of (4) with a subscript denoting time, but here the subscript is merely a mnemonic.

In the partial derivatives, the letters in the numerators and denominators are, of course, real variables, and the partial derivatives themselves are, initially, real functions of real variables. But after the substitution of a stochastic process for one of the arguments they become stochastic processes.

The Black–Scholes PDE is, initially, a statement about the stochastic process S, but when S is reinterpreted as a real variable, it becomes an ordinary PDE. It is only then that we can ask about its solution.

The parameter u that appears in the discrete-dividend model and the elementary derivation is not the same as the parameter that appears elsewhere in the article. For the relationship between them see Geometric Brownian motion.

See also

- Black model, a variant of the Black–Scholes option pricing model.

- Binomial options model, which is a discrete numerical method for calculating option prices.

- Monte Carlo option model, using simulation in the valuation of options with complicated features.

- Financial mathematics, which contains a list of related articles.

- Heat equation, to which the Black–Scholes PDE can be transformed.

- real options analysis

- Black Shoals, a financial art piece

Notes

- ^ Nobel prize foundation, 1997 Press release [1]

- ^ Black, Fischer; Myron Scholes (1973). "The Pricing of Options and Corporate Liabilities". Journal of Political Economy 81 (3): 637–654.

- ^ http://www.wilmott.com/blogs/paul/index.cfm/2008/4/29/Science-in-Finance-IX-In-defence-of-Black-Scholes-and-Merton

- ^ R Rebonato: Volatility and correlation in the pricing of equity, FX and interest-rate options (1999)

References

Primary references

- Black, Fischer (1973). "The Pricing of Options and Corporate Liabilities". Journal of Political Economy. 81 (3): 637–654. doi:10.1086/260062.

{{cite journal}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) [2] (Black and Scholes' original paper.) - Merton, Robert C. (1973). "Theory of Rational Option Pricing". Bell Journal of Economics and Management Science. 4 (1): 141–183. doi:10.2307/3003143. [3]

Historical and sociological aspects

- Bernstein, Peter (1992). Capital Ideas: The Improbable Origins of Modern Wall Street. The Free Press. ISBN 0-02-903012-9.

- MacKenzie, Donald (2003). "An Equation and its Worlds: Bricolage, Exemplars, Disunity and Performativity in Financial Economics". Social Studies of Science. 33 (6): 831–868. doi:10.1177/0306312703336002. [4]

- MacKenzie, Donald (2003). "Constructing a Market, Performing Theory: The Historical Sociology of a Financial Derivatives Exchange". American Journal of Sociology. 109 (1): 107–145. doi:10.1086/374404.

{{cite journal}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) [5] - MacKenzie, Donald (2006). An Engine, not a Camera: How Financial Models Shape Markets. MIT Press. ISBN 0-262-13460-8.

External links

This article's use of external links may not follow Wikipedia's policies or guidelines. |

Discussion of the model

- Black, Merton, and Scholes: Their work and its consequences, by Ajay Shah

- Inside Wall Street's Black Hole by Michael Lewis, March 2008 Issue of portfolio.com

- Whither Black-Scholes? by Pablo Triana, April 2008 Issue of Forbes.com

Derivation and solution

- Proving the Back-Scholes formula

- The risk neutrality derivation of the Black-Scholes Equation, quantnotes.com

- Arbitrage-free pricing derivation of the Black-Scholes Equation, quantnotes.com, or an alternative treatment, Prof. Thayer Watkins

- Solving the Black-Scholes Equation, quantnotes.com

- Solution of the Black–Scholes Equation Using the Green's Function, Prof. Dennis Silverman

- Solution via risk neutral pricing or via the PDE approach using Fourier transforms (includes discussion of other option types), Simon Leger

- Step-by-step solution of the Black-Scholes PDE, planetmath.org.

- Black-Scholes formula

Revisiting the model

- Triana, P, (2009): Lecturing Birds on Flying: Can Mathematical Theories Destroy the Financial Markets?, Wiley Publishing. The book takes a critical look at the Black, Scholes and Merton model.

- Haug, E. G, (2007): Derivatives Models on Models, Chapter 2, Wiley Publishing. The book gives a series of historical references supporting the theory that option traders use much more robust hedging and pricing principles than the Black, Scholes and Merton model.

- Anomalies in option pricing: the Black–Scholes model revisited, New England Economic Review, March-April, 1996

- Why We Have Never Used the Black-Scholes-Merton Option Pricing Formula, Nassim Taleb and Espen Gaarder Haug

- The illusions of dynamic replication, Emanuel Derman and Nassim Taleb

- When You Cannot Hedge Continuously: The Corrections to Black-Scholes, Emanuel Derman

- In defence of Black Scholes and Merton, Paul Wilmott

Computer implementations

- Sourcecode

- Black–Scholes in Multiple Languages, espenhaug.com

- VBA sourcecode for Black Scholes and Greeks, global-derivatives.com

- Chicago Option Pricing Calculator, C# implementation, optionpricing.org

- Excel

- Option Pricing Spreadsheet with documented VBA, OptionTradingTips.com

- Excel spreadsheet with VBA sourcecode, quantnotes.com

- Excel implementation and tutorial, researchkitchen.co.uk

- Black&Scholes European option calculator including the Greeks, www.quantonline.co.za

- Foreign exchange option pricing, www.global-derivatives.com

- Real Time

- End of day file with Implied Volatility, Options Trade Data

- Black-Scholes tutorial based on graphic simulations, Jerry Marlow

- Surface Plots of Black-Scholes Greeks, Chris Murray

- Real-time calculator of Call and Put Option prices when the underlying follows a Mean-Reverting Geometric Brownian Motion

- Black & Scholes calculator, with profitability of some operations, epx.com.br

Historical

- Trillion Dollar Bet—Companion Web site to a Nova episode originally broadcast on February 8, 2000. "The film tells the fascinating story of the invention of the Black-Scholes Formula, a mathematical Holy Grail that forever altered the world of finance and earned its creators the 1997 Nobel Prize in Economics."

- BBC Horizon A TV-programme on the so-called Midas formula and the bankruptcy of Long-Term Capital Management (LTCM)

![{\displaystyle \mathbb {E} \left[\max(S-K,0)\right]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/f547fd27265a72680c2cf47ad128fcbc101e1d26)

![{\displaystyle \mathbb {E} \left[S\right]=S_{0}e^{qT}\,}](https://wikimedia.org/api/rest_v1/media/math/render/svg/04c3fed2ea8ddc25ea93d715581a7267e2166128)

![{\displaystyle C(S_{0},T)=e^{-rT}\mathbb {E} \left[\max(S-K,0)\right].\,}](https://wikimedia.org/api/rest_v1/media/math/render/svg/c05b7a80ad4fab725a39ea366397a72a69c92dd4)

![{\displaystyle \mathbb {E} \left[e^{aZ^{+}(b)}\right]=e^{a^{2}/2}N(a-b)}](https://wikimedia.org/api/rest_v1/media/math/render/svg/5923c3f05e4c727da716d841970f67b11ed05bfb)

![{\displaystyle \mathbb {E} \left[e^{aZ}\right]=e^{a^{2}/2}.}](https://wikimedia.org/api/rest_v1/media/math/render/svg/c344193d8222c56d173514196b1d1a9922b2e35c)