Gold as an investment

- For the physical properties and applications of gold, please see gold.

This article discusses buying gold as an investment.

Types of gold investor

Gold price

The usual benchmark for the price of gold is known as the London Gold Fixing, a twice-daily (telephone) meeting of representatives from five bullion-trading firms. Furthermore, there is active gold trading based on the intra-day spot price, derived from gold-trading markets around the world as they open and close throughout the day.

The following table sets forth the gold price versus various investments and key statistics (Note: the prices on the following table and graphs are expressed in terms of nominal dollars, and thus are not adjusted for inflation):

| Year to 31st December |

Gold Price US$/oz |

Silver Price US$/oz |

S&P 500 [1] | Dow Jones Industrial Average [2] |

Money Supply M3 [3] US$ billions |

Average US Farm Wages [4] US$/hr |

US Govt Debt [5] US$ billions |

|---|---|---|---|---|---|---|---|

| 1910 | 20.67 | 0.54 | 9.05 | 59.60 | 2.6 | ||

| 1920 | 20.67 | 0.54 | 6.81 | 71.95 | 25.9 | ||

| 1930 | 20.67 | 0.33 | 15.34 | 164.58 | 16.2 | ||

| 1940 | 34.50 | 0.35 | 10.58 | 131.13 | 43.0 | ||

| 1950 | 40.25 | 0.80 | 20.41 | 235.42 | 257.4 | ||

| 1960 | 36.50 | 0.91 | 58.11 | 615.89 | 315.2 | 290.2 | |

| 1970 | 37.60 | 1.64 | 92.15 | 838.92 | 677.1 | 389.2 | |

| 1980 | 641.20 | 15.65 | 135.76 | 963.99 | 1,995.5 | 3.50 | 930.2 |

| 1990 | 423.80 | 4.17 | 330.22 | 2,633.66 | 4,154.6 | 5.52 | 3,233.3 |

| 2000 | 272.15 | 4.60 | 1,320.28 | 10,786.85 | 7,117.7 | 8.10 | 5,674.2 |

| 2005 | 513.00 | 8.83 | 1,248.29 | 10,717.50 | 10,191.4 | 9.51 | 8,170.4 |

| 2007 | 807.00 | 14.59 | 2,644.00 | 13,223.93 | No Longer Reported | 9,054.7 |

Factors influencing the gold price

Today, like all investments and commodities, the price of gold is ultimately driven by supply and demand, including hoarding and dis-hoarding. Unlike most other commodities, the hoarding and dis-hoarding plays a much bigger role in affecting the price, because almost all the gold ever mined still exists and is potentially able to come on to the market at the right price.[citation needed] Given the huge quantity of above-ground hoarded gold, compared to the annual production, the price of gold is mainly affected by changes in sentiment, rather than changes in annual production.

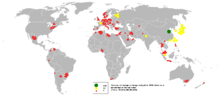

Central banks and the International Monetary Fund play an important role in the gold price. At the end of 2004 central banks and official organisations held 19 percent of all above-ground gold as official gold reserves [6]. The Washington Agreement on Gold (WAG), which dates from September 1999, limits gold sales by its members (Europe, United States, Japan, Australia, Bank for International Settlements and the International Monetary Fund) to less than 400 tonnes a year [7]. European central banks, such as the Bank of England and Swiss National Bank, have been key sellers of gold over this period [8].

In November 2005, Russia, Argentina and South Africa expressed interest in increasing their gold holdings [9]. Other than Russia, these are not viewed as significant central banks, but any move by Japan, China or South Korea to do the same would be seen as significant.[citation needed] Currently the United States Federal Reserve has 16% of its assets in gold Federal Reserve gold holdings, whereas China holds approximately 1% in gold.

Although central banks do not generally announce gold purchases in advance, some, such as Russia, have expressed interest in growing their gold reserves again as of late 2005 [10]. In early 2006, China, which only holds 1.3% of its reserves in gold [11], announced that it was looking for ways to improve the returns on its official reserves. Many bulls took this as a thinly veiled signal that gold would play a larger role in China's reserves, which they hope will push up the price of gold.

Inflation fears have also been influential in the past. The October 2005 consumer price index level of 199.2 (1982-84=100) was 4.3 percent higher than in October 2004. During the first ten months of 2005, the CPI-U rose at a 4.9 percent seasonally adjusted annual rate (SAAR). This compares with an increase of 3.3 percent for all of 2004.[citation needed]

- Bank failures

- When dollars were fully convertible into gold, both were regarded as money. However, most people preferred to carry around paper banknotes rather than the somewhat heavier and less divisible gold coins. If people feared their bank would fail, a bank run might have been the result. This is what happened in the USA during the Great Depression of the 1930s, leading President Roosevelt to impose a national emergency and to outlaw the holding of gold by US citizens.[citation needed]

- Inflation

- Paper currencies pose a risk of being inflated, possibly to the point of hyperinflation. Historically, currencies have lost their value in this way over time. In times of inflation, people seek to protect their savings by purchasing liquid, tangible assets that are valued for some other purpose. Gold is in this respect a good candidate, since producing more is far more difficult than issuing new fiat currency, and its value does not rely on any particular government's health.

- Low or negative real interest rates

- Gold has a long history of being an inflation proof investment. During times of low or negative real interest rates, when significant inflation is present and interest rates are relatively low, investors seek the safe haven of gold to protect their capital. A prime example of this is the period of Stagflation that occurred during the 1970s and which led to an economic bubble forming in precious metals.

- War, invasion, looting, crisis

- In times of national crisis, people fear that their assets may be seized and that the currency may become worthless. They see gold as a solid asset which will always buy food or transportation. Thus in times of great uncertainty, particularly when war is feared, the demand for gold rises.[citation needed]

- Production

- According to the World Gold Council, annual gold production over the last few years has been close to 2,500 tonnes. However, the effects of official gold sales (500 tonnes), scrap sales (850 tonnes), and producer hedging activities take the annual gold supply to around 3,500 tonnes.[citation needed]

- Demand

- About 3,000 tonnes goes into jewelry or industrial/dental production, and around 500 tonnes goes to retail investors and exchange traded gold funds.[citation needed]

- Supply and demand

- Some investors consider that supply and demand factors are less relevant than with other commodities since most of the gold ever mined is still above ground and available for sale at a price. However, supply and demand do play a role. According to the World Gold Council, gold demand rose 29% in the first half of 2005. The increase came mainly from the launch of a gold exchange-traded fund, but also from jewelry. Gold demand was at an all time record. Demand from the electronics industry is rising by 11% a year, jewelry by 19%, and industrial and dental by 21%.[citation needed]

Conspiracy Theories

The Gold Anti-Trust Action Committee was organized in January 1999 to advocate and undertake litigation against illegal collusion to control the price and supply of gold and related financial securities. GATA underwrote the federal anti-trust lawsuit of its consultant, Reginald H. Howe -- Howe vs. Bank for International Settlements et al. -- which was pursued in U.S. District Court in Boston from 2000 to 2002. While the Howe suit was dismissed on a jurisdictional technicality, it became the model for Blanchard Coin and Bullion's anti-trust lawsuit against Barrick Gold and J.P. Morgan Chase & Co., which was filed in U.S. District Court in New Orleans in 2002 and prompted Barrick Gold's decision to stop selling gold in advance for 10 years. [12]

Methods of investing in gold

Investment in gold can be done directly through bullion ownership, or indirectly through certificates, accounts, spread betting, derivatives or shares.

Investment strategies

Fundamental analysis

Investors may base their investment decisions on fundamental analysis. These investors analyze the macroeconomic situation, which includes international economic indicators, such as GDP growth rates, inflation, interest rates, productivity and energy prices. They would also analyze the total global gold supply versus demand. Over 2005 the World Gold Council estimated total global gold supply to be 3,859 tonnes and demand to be 3,754 tonnes, giving a surplus of 105 tonnes [9]. Others point out that total mine production is only about 2,500 tonnes each year, leaving a 1,300 tonne deficit that must be made up by central bank or private sales.[13]. While gold production is unlikely to change in the near future, supply and demand due to private ownership is highly liquid and subject to rapid changes. This makes gold very different from almost every other commodity.[citation needed] Stock analyst Jim Jubak recently chose gold as one of his "stock" picks for the next 12 months giving it a price target of $870 per Troy ounce by July 2008. [14]

Gold versus stocks

The performance of Gold bullion is often compared to stocks. They are fundamentally different asset classes: gold is a store of value whereas stocks are a return on value (i.e. growth plus dividends). Stocks and bonds perform best in a stable political climate with strong property rights and little turmoil [Source: Investments (7th Ed) by Bodie, Kane and Marcus, P.570-571]. The attached graph shows the value of Dow Jones Industrial Average divided by the price of an ounce of gold. Since 1800, stocks have consistently gained value in comparison to gold due in part to the stability of the American political system.[citation needed] This appreciation has been cyclical with long periods of stock outperformance followed by long periods of gold outperformance. The Dow Industrials bottomed out a ratio of 1:1 with gold during 1980 (the end of the 1970s bear market) and proceeded to post gains throughout the 1980s and 1990s. The ratio peaked on January 14th, 2000 a value of 41.3 and has fallen sharply since. William Anton III wrote in the 2004 issue of Jefferson Coin and Bullion "...downward movement in the Dow/gold ratio is unlikely to stop precisely at the mean trendline. The extreme distension of the the 90s will likely overshoot to the opposite extreme in the current cycle." Source: Source: [10] [11] [12] [13]

In November 2005, Rick Munarriz of Motley Fool.com posed the question of which represented a better investment: a share of Google or an ounce of gold. The specific comparison between these two very different investments seems to have captured the imagination of many in the investment commuity and is serving to crystalize the broader debate. Source: [14] [15]

Technical analysis

As with stocks, gold investors may base their investment decision partly on, or solely on, technical analysis. Typically, this involves analyzing chart patterns, moving averages, market trends and/or the economic cycle in order to speculate on the future price.

Using leverage

Bullish investors may choose to leverage their position by borrowing money against their existing gold assets and then purchasing more gold on account with the loaned funds. In order to keep the cost of debt to a minimum, these individuals would normally seek a loan in the currency with the lowest LIBOR, which, as of April 2006, was the Japanese yen. This technique is referred to as a "yen-gold carry trade". Leverage may increase investment gains but increases risk, as, if the gold price decreases, the investor may be subject to a margin call. Leverage is also an integral part of buying gold derivatives and unhedged gold mining company shares (see gold mining companies).

Gold's value versus money supply

Historically, increases in the supply of fiat currency through increased money supply have caused the demand for gold to increase. There was a time when gold was money and vice versa. If citizens felt that there may be insufficient gold to cover the paper money in circulation, they would queue up at the bank to change their paper currency back into gold.

However, since the gold standard was ended on August 15, 1971, governments have been free to print as much money as they choose, without fear that their populations will come knocking on the central bank's door demanding to change their paper money back into gold.

In January 1959 US M3 money supply was $288.8 billion [16], and the official gold reserves of the United States was then 17,335.1 tonnes, or 557,336,000 ounces [17] (there are 32,150.7 troy ounces in a tonne). That means that in 1959, there were $518 in circulation for every ounce of gold reserves held by the USA. Although the actual ration of dollars to gold was $518 per ounce, the actual price, as fixed under the gold standard, was only $35 an ounce.

By August 2005, the US M3 money supply had risen to $9,873.9 billion, whilst at the same time the Official Gold Holdings of the United States had fallen to just 8,133.5 tonnes, or 261.50 million Troy Ounces [18]. This means that today, in 2005, there are $37,831 in circulation for every troy ounce of gold held by the United States.

However, this increase of 75 times in the ratio of central bank gold holdings to debt does not allow for the fact that the gold standard was abandoned in 1971 and gold holdings have been deliberately and considerably reduced. Another far less dramatic way of looking at the same figures is this: In 1959 US government debt valued in gold was 8 billion Troy ounces, in 2005 US government debt was 20 billion ounces gold - an increase of only 2.5 times.

The above numbers show the falling influence of gold in today's monetary system.[citation needed] Gold bugs believe, or hope, that one day gold's importance will return as the printing of paper money gets out of control and before we end in a hyper-inflationary fiat money collapse.[citation needed]

The US Federal Reserve ceased publishing M3 data on 23 March, 2006, with the last published data indicating a year-on-year growth rate of 8.23%. Central banks may see this as a reason to limit further increases in their reserves of dollars, and thus alternatives such as gold or the euro might be considered.[citation needed] Jon Nadler, an analyst at Kitco Bullion Dealers, said gold was still benefiting from August 30 2006 release of the minutes to the last rate-setting meeting of the US Federal Reserve. The minutes to the August 8 2006 meeting, at which the Federal Open Market Committee kept short-term interest rates unchanged for the first time since 2004, supported the view that US borrowing costs have peaked.[19]

Supply

At the end of 2001, it was estimated that all the gold ever mined totaled 145,000 tonnes [20], which would form a cube with 19.58 meter edges. Global gold mine production is between 2,500 to 3,000 tonnes per year, which would mean that about 155,000 tonnes of gold would have been mined as of 2006, with a total value of $3.2 trillion at June 2006 prices.

Bulls versus bears

Analysts such as Chuck Saletta argue that while Gold may indeed preserve wealth against inflation, it does not present the kind of long term growth potential that stocks do. Saletta goes on to argue that, even if the United States enters a period of high inflation, the stocks of companies involved in consumer staples represent a better investment. [21] The gold price peaked at around $850/oz t ($27,300,000 per tonne) in 1980, and in real terms is still well below that. However, since April 2001 the gold price has more than doubled in value against the US dollar (as seen here), prompting speculation to circulate that this long secular bear market (or the Great Commodities Depression) has ended and a bull market has returned [22] [23].

References

- ^ S&P 500 [1]

- ^ Dow Jones Industrial Average [2]

- ^ Money Supply M3 [3]

- ^ Farm Wages [4]

- ^ US Govt Debt [5]

- ^ Official gold reserves

- ^ 400 tonnes/year

- ^ [6]

- ^ Russia, Argentina and South Africa increasing gold holdings

- ^ Russia

- ^ [7]

- ^ GATA

- ^ The Chevreaux Report [8]

- ^ http://www.thestreet.com/pf/newsanalysis/investing/10379027.html

See also

- Diamonds as an investment

- Silver as an investment

- Palladium as an investment

- Platinum as an investment

- Full-reserve banking

- Gold exchange-traded fund

- Methods of investing in gold