2020s commodities boom

The 2020s commodities boom refers to the rise of many commodity prices in the early 2020s following the COVID-19 pandemic. The COVID-19 recession initially made commodity prices drop, but lockdowns, supply chain bottlenecks, and dovish monetary policy limited supply and created excess demand causing a commodity super cycle rise.[1]

The 2022 Russian invasion of Ukraine worsened the bottlenecks, creating the 2022 Russia–European Union gas dispute and the 2021–2022 United Kingdom natural gas supplier crisis, contributing to the 2021–present global energy crisis. As Russia and Belarus are major fertilizer exporters[2] and natural gas is a primary component in many fertilizers, fertilizer prices rose accordingly, starting the 2022 food crises.[3]

The previous commodity super cycle was the 2000s commodities boom, which was attributed to emerging markets, especially that of China, providing a high demand for raw materials.

Food

|

|

Global food shortages already existed due to the COVID-19 pandemic when, during the 2022 Russian invasion of Ukraine, Russia blockaded the Port of Odesa, preventing grain exports.[4] Ukraine is known as the breadbasket of Eastern Europe because of its fertile soil and exports of wheat, corn, and sunflower oil.[5]

Turkey and the United Nations brokered the Black Sea Grain Initiative between Russia and Ukraine, allowing the export of grain through the Port to the Black Sea.[6]

Natural gas is in most fertilizers, and fertilizer prices rose after the Russia–European Union gas dispute, contributing to the food crises.[7]

Lumber

Lumber prices increased with the hot housing market. Potentially new tariffs of 17.99% on Canadian lumber also sent the price higher. Those tariffs were finalized lower to 11.64% by the Biden Administration.[8] New contracts that allow semi trucks to haul contracts instead of just rail cars starting August 8, 2022, potentially the reason prices came back down to normal in the second half of 2022.[9] Mortgage interest rates rising with inflation is another reason for cooling housing demand and lumber as well.[10]

Natural gas

Natural gas prices have increased around the world. In Europe, Russia has invaded Ukraine and Europe is very dependent on Russia for natural gas via pipelines. Russia has economically weaponized natural gas and reduced flows on pipelines like the Nord Stream 1. Natural gas prices were rising before the invasion of Ukraine that basically gave Russia the finances and leverage to do so.[11]

Natural gas recently became more of a global market with liquefied natural gas and LNG ships maturing in size with Qatar leading the way and exporting a lot of LNG.[12] This has caused the prices to shadow each other more in different markets.

Crude oil and petroleum products

|

Diesel fuel (Left) Gasoline (Left) Crude oil Price (WTI) (Right) |

Crude oil prices dropped dramatically during the first months of the COVID Pandemic (WTI went negative for a day) and production was cut in anticipation of a prolonged slowdown. Demand soon exceeded supply because of loose monetary policy causing a global energy crisis and prices to rise.[13] Russia's invasion of Ukraine also made oil prices increase because many countries were going to sanction Russia and their oil in retaliation.

Jet Fuel

|

|

Kerosene jet fuel refining has to compete with Diesel fuel and gasoline at the refineries when refining petroleum products.[14] Jet Fuel topped $5 a gallon in 2022.

No. 2 heating oil

Heating oil went from around $2 before the pandemic to almost $5 a gallon in 2022. The prices have peaked and are falling in 2022.

Electricity

Electricity prices were rising through 2021 and 2022 mostly from the increase in natural gas prices which makes up the 35% of electricity generated in the United States [15]

Lithium

The Price of Lithium carbonate Started to rise in 2021 after slumping in 2020 and peaked in early 2022 close to $80,000 per ton. Demand for electric vehicles around the world is the primary cause for the price rise. In 2021 electric vehicle sales doubled to 6.6 million from 2020.[16]

Copper

The price of copper rose through 2021 and peaked close to $5 per pound in Q2 2022 before retreating. Copper demand is expected to double from 25 million metric tonnes in 2022 to over 50 MMT by they year 2035. [17]

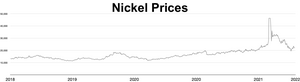

Nickel

In March 2022 Nickel prices spiked higher over fear of the 2022 Russian invasion of Ukraine because Russia produced 15.2% of nickel in 2021, and they could decide to halt exports or countries could ban imports from Russia like they did with oil. [18]

Tin

Prices of tin were up 79% in 2021 because of high demand for circuit boards which tin is often used for. [19]

Titanium

Demand for titanium is high because defense spending on the Russo-Ukrainian War, parts for aircraft makers and defense contractors, also from the automotive industry demand is high for titanium dioxide pigments.

Rolled Steel

Hot-rolled steel prices hit close to $2,000 per ton in 2021.[20]

Palladium

Palladium is used a lot in Catalytic converters to curb harmful emissions from car exhaust. Russia produces 40% of all Palladium in the world, and the 2022 Russian invasion of Ukraine has spooked the Palladium market in fear of supply issues and sanctions.[21]

Rhodium

Rhodium is used a lot in catalytic converters to reduce harmful emissions from car exhaust. Many Countries have agreed to the Paris climate accord to cut car emissions and have higher standards for exhaust.

South Africa produces 80-90% of Rhodium each year. Russia is the second largest producer of Rhodium but it is around 1%. The COVID-19 pandemic in South Africa caused the country to lockdown in March 2020 hard and again in December 2020 - March 2021. This affected to supply of Rhodium causing the price to increase.[22][23]

Gold

Gold started to increase in price at the start of the COVID-19 pandemic as stocks sunk initially, it was seen as a safe haven from inflation as well during the inflationary period of the pandemic. Gold crossed the $2,000 mark for the first time in August 2020 and again in March 2022. [24] [25]

Iron ore

|

China import/inbound iron ore spot price[26] Global iron ore price[27] |

China is the number one consumer of iron ore and they import 80% of all internationally traded iron ore. The price has been very volatile because of curbs the CCP has placed on the steel industry to meet emission standards. Australia, Brazil, and China are the top three producers of iron ore. [28]

Cotton

In the Western United States and specifically Texas there has been persistent droughts in the 2020s hurting cotton yields.[29]

See also

References

- ^ "Commodity supercycle 2022: A stellar rally, but built on sand?". Capital. Retrieved August 30, 2022.

- ^ "Global fertilizer exports: How much comes from Russia, Belarus & Ukraine?".

- ^ Lynch, David J.; Reiley, Laura (July 14, 2022). "Fertilizer crisis delivers profits and pain as Ukraine fallout broadens". The Washington Post. ISSN 0190-8286. Retrieved August 30, 2022.

- ^ Youssef, Nancy A.; Luxmoore, Matthew; MacDonald, Alistair (July 2, 2022). "Mines, Port Damage Threaten Revival of Sea Route for Ukraine Grain". The Wall Street Journal. ISSN 0099-9660. Retrieved August 30, 2022.

- ^ Reed, John; Terazono, Emiko; Heal, Alexandra; Joiner, Sam; Clark, Dan; Learner, Sam (April 27, 2022). "How Russia's war in Ukraine upended the breadbasket of Europe". Financial Times. Retrieved August 30, 2022.

- ^ "Black Sea grain exports deal 'a beacon of hope' amid Ukraine war - Guterres". United Nations. July 22, 2022. Retrieved August 30, 2022.

- ^ Weersink, Alfons; Wagner-Riddle, Claudia; von Massow, Michael (August 25, 2022). "The federal government's plan to cut fertilizer emissions will not threaten food security". The Conversation. Retrieved August 30, 2022.

- ^ "NAHB Welcomes Biden Administration Move to Lower Lumber Tariffs".

- ^ "Lumber prices are set for a shakeup with the rollout of new futures contracts - and a top broker says trading volume could soar 10 times".

- ^ "These are the 5 markets where home sales are cooling fastest: Sellers need to be 'realistic' about price, says broker". CNBC.

- ^ "3 charts show Europe's unprecedented natural gas crisis". CNBC.

- ^ "Qatar Energy Data, Statistics and Analysis - Oil, Gas, Electricity, C…".

- ^ Gaffen, David (24 February 2022). "Analysis: Oil's journey from worthless in the pandemic to $100 a barrel". Reuters.

- ^ "What You Need to Know About Aviation Fuel Prices". 4 May 2022.

- ^ "Short-Term Energy Outlook - U.S. Energy Information Administration (EIA)".

- ^ "Lithium Price Forecast | is Lithium a Good Investment?".

- ^ "New Study Finds That the Future of Copper is Coming at Us Fast". Forbes.

- ^ "Nickel market remains at risk of further short squeezes: S&P Global". 31 March 2022.

- ^ "Tin price outlook dims in 2022 – report". 4 January 2022.

- ^ "Raw Steels MMI: Steel Prices Decline Amid Record HRC / Plate Spread". 16 August 2022.

- ^ Patel, Brijesh (3 March 2022). "Palladium hits over 7-month high on supply woes, gold rises". Reuters.

- ^ "3 reasons why rhodium prices have zoomed over 70% since January 1". 8 March 2021.

- ^ "Why the Price of Rhodium is Rocketing to Record Highs in 2021". 17 February 2021.

- ^ "Gold prices are popping as Russia invades Ukraine. Why you may want to resist the rush". CNBC.

- ^ "Gold Price Surges Above $2,000 to Highest Level Since 2020".

- ^ "Iron Ore - Monthly Price - Commodity Prices - Price Charts, Data, and News - IndexMundi".

- ^ "Global price of Iron Ore".

- ^ "China's Challenge with Iron Ore".

- ^ "Cotton Prices Soar as Texas Megadrought Persists".