Medicaid

Medicaid in the United States is a social health care program for families and individuals with low income and limited resources. The Health Insurance Association of America describes Medicaid as a "government insurance program for persons of all ages whose income and resources are insufficient to pay for health care".[1] Medicaid is the largest source of funding for medical and health-related services for people with low income in the United States. It is a means-tested program that is jointly funded by the state and federal governments and managed by the states,[2] with each state currently having broad leeway to determine who is eligible for its implementation of the program. States are not required to participate in the program, although all currently do.[when?] Medicaid recipients must be U.S. citizens or legal permanent residents, and may include low-income adults, their children, and people with certain disabilities. Poverty alone does not necessarily qualify someone for Medicaid.

The Patient Protection and Affordable Care Act significantly expanded both eligibility for and federal funding of Medicaid. Under the law as written, all U.S. citizens and legal residents with income up to 133% of the poverty line, including adults without dependent children, would qualify for coverage in any state that participated in the Medicaid program. However, the United States Supreme Court ruled in National Federation of Independent Business v. Sebelius that states do not have to agree to this expansion in order to continue to receive previously established levels of Medicaid funding, and many states have chosen to continue with pre-ACA funding levels and eligibility standards.

Features

Beginning in the 1980s, many states received waivers from the federal government to create Medicaid managed care programs. Under managed care, Medicaid recipients are enrolled in a private health plan, which receives a fixed monthly premium from the state. The health plan is then responsible for providing for all or most of the recipient's healthcare needs. Today, all but a few states use managed care to provide coverage to a significant proportion of Medicaid enrollees. As of 2014, 26 states have contracts with MCOs to deliver long-term care for the elderly and individuals with disabilities. The states pay a monthly capitulated rate per member to the MCOs that provide comprehensive care and accept the risk of managing total costs.[3] Nationwide, roughly 80% of enrollees are enrolled in managed care plans.[4] Core eligibility groups of poor children and parents are most likely to be enrolled in managed care, while the aged and disabled eligibility groups more often remain in traditional "fee for service" Medicaid.

Because the service level costs vary depending on the care and needs of the enrolled, a cost per person average is only a rough measure of actual cost of care. The annual cost of care will vary state to state depending on state approved Medicaid benefits, as well as the state specific care costs. 2008 average cost per senior was reported as $14,780 (in addition to Medicare), and a state by state listing was provided.[citation needed] In a 2010 national report for all age groups, the per enrolled average cost was calculated to $5,563 and a listing by state and by coverage age is provided.[5]

Eligibility and benefits

As of 2013, Medicaid is a program intended for those with low income, but a low income is not the only requirement to enroll in the program. Eligibility is categorical—that is, to enroll one must be a member of a category defined by statute; some of these categories include low-income children below a certain age, pregnant women, parents of Medicaid-eligible children who meet certain income requirements, and low-income seniors. The details of how each category is defined vary from state to state.

People with disabilities who do not have a work history and who receive Supplemental Security Income, or SSI, are enrolled in Medicaid as a mechanism to provide them with health insurance. Persons with a disability, including blindness or physical disability, deafness, or mental illness can apply for SSI. However, in order to be enrolled, applicants must prove that they are disabled to the point of being unable to work. In recent years, a substantial liberalization occurred in the field of individual disability income insurance, which provides benefits when an insured person is unable to work because of illness or injury (HIAA, pg.13).

Some states operate a program known as the Health Insurance Premium Payment Program (HIPP). This program allows a Medicaid recipient to have private health insurance paid for by Medicaid. As of 2008 relatively few states had premium assistance programs and enrollment was relatively low. Interest in this approach remained high, however.[6]

Included in the Social Security program under Medicaid are dental services. These dental services are optional for adults above the age of 21; however, this service is a requirement for those eligible for Medicaid and below the age of 21.[7][clarification needed] Minimum services include pain relief, restoration of teeth, and maintenance for dental health. Early and Periodic Screening, Diagnostic and Treatment (EPSDT) is a mandatory Medicaid program for children that aims to focus on prevention, early diagnosis and treatment of medical conditions.[7] Oral screenings are not required for EPSDT recipients, and they do not suffice as a direct dental referral. If a condition requiring treatment is discovered during an oral screening, the state is responsible for taking care of this service, regardless of whether or not it is covered on that particular Medicaid plan.[8]

History

| Healthcare in the United States |

|---|

The Social Security Amendments of 1965 created Medicaid by adding Title XIX to the Social Security Act, 42 U.S.C. §§ 1396 et seq. Under the program, the federal government provides matching funds to states to enable them to provide medical assistance to residents who meet certain eligibility requirements. The objective is to help states provide medical assistance to residents whose incomes and resources are insufficient to meet the costs of necessary medical services. Medicaid serves as the nation’s primary source of health insurance coverage for low-income populations.

States are not required to participate. Those that do must comply with federal Medicaid laws under which each participating state administers its own Medicaid program, establishes eligibility standards, determines the scope and types of services it will cover, and sets the rate of payment. Benefits vary from state to state, and because someone qualifies for Medicaid in one state, it does not mean they will qualify in another.[9] The federal Centers for Medicare and Medicaid Services (CMS) monitors the state-run programs and establishes requirements for service delivery, quality, funding, and eligibility standards.

The Medicaid Drug Rebate Program and the Health Insurance Premium Payment Program (HIPP) were created by the Omnibus Budget Reconciliation Act of 1990 (OBRA-90). This act helped to add Section 1927 to the Social Security Act of 1935 which became effective on January 1, 1991. This program was formed due to the costs that Medicaid programs were paying for outpatient drugs at their discounted prices.[10]

The Omnibus Budget Reconciliation Act of 1993 (OBRA-93) amended Section 1927 of the Act as it brought changes to the Medicaid Drug Rebate Program,[10] as well as requiring states to implement a Medicaid estate recovery program to sue the estate of decedents for medical care costs paid by Medicaid.[11]

Medicaid also offers a Fee for Service (Direct Service) Program to schools throughout the United States for the reimbursement of costs associated with the services delivered to special education students.[12] Federal law mandates that every disabled child in America receive a “free appropriate public education.” Decisions by the United States Supreme Court and subsequent changes in federal law make it clear that Medicaid must pay for services provided for all Medicaid eligible disabled children.

Medicaid expansion under the Affordable Care Act

The Patient Protection and Affordable Care Act, passed in 2010, would have revised and expanded Medicaid eligibility starting in 2014. Under the law as written, states that wished to participate in the Medicaid program would be required to allow people with income up to 133% of the poverty line to qualify for coverage, including adults without dependent children. The federal government would pay 100% of the cost of Medicaid eligibility expansion in 2014, 2015, and 2016; 95% in 2017, 94% in 2018, 93% in 2019, and 90% in 2020 and all subsequent years.[13]

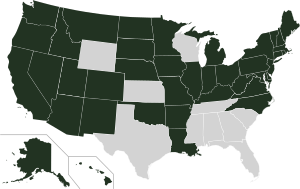

However, the Supreme Court ruled in NFIB v. Sebelius that this provision of the ACA was coercive, and that the Federal government must allow states to continue at pre-ACA levels of funding and eligibility if they chose. Several states have opted to reject the expanded Medicaid coverage provided for by the act; over half of the nation's uninsured live in those states. They include Texas, Florida, Kansas, Georgia, Louisiana, Alabama, and Mississippi.[14] As of May 24, 2013 a number of states had not made final decisions, and lists of states which have opted out or were considering opting out varied,[15][16] but Alaska,[16] Idaho,[17] South Dakota,[17] Nebraska,[15] Wisconsin,[17] Maine,[17] North Carolina,[17] South Carolina,[17] and Oklahoma[17] seemed to have decided to reject expanded coverage.[17]

Several factors are associated with states' decisions to accept or reject Medicaid expansion in accordance with the Patient Protection and Affordable Care Act. Partisan composition of state governments is the most significant factor, with states led primarily by Democrats tending to expand Medicaid and states led primarily by Republicans tending to reject expansion.Cite error: The <ref> tag has too many names (see the help page). Other important factors include the generosity of the Medicaid program in a given state prior to 2010, spending on elections by health care providers, and the attitudes people in a given state tend to have about the role of government and the perceived beneficiaries of expansion.Cite error: The <ref> tag has too many names (see the help page).Cite error: The <ref> tag has too many names (see the help page).

The federal government will pay 100 percent of defined costs for certain newly eligible adult Medicaid beneficiaries in "Medicaid Expansion" states.[18][19] The NFIB v. Sebelius ruling, effective January 1, 2014, allows Non-Expansion states to retain the program as it was before January 2014.

As of January 2014, confirmed opting out states include Alabama, Alaska, Florida, Georgia, Idaho, Kansas, Louisiana, Maine, Mississippi, Missouri, Montana, Nebraska, North Carolina, Oklahoma, South Carolina, South Dakota, Tennessee, Texas, Virginia & Wisconsin. States opting in after 2014 are Indiana & Pennsylvania.[20] On July 17, 2015, Governor Bill Walker sent a letter to the Alaskan state legislature, providing the required 45-day notice of his intention to accept the expansion of Medicaid in Alaska.[21]

Clawback controversy

The so-called "clawback" provision, the asset-recovery provision of Medicaid, was enacted in 1993 by Congress in response to rising Medicaid administrative costs. States were compelled to try to recover costs from the estates of the deceased who used the program for long-term care, either via liens placed on an individual's home or claims on their assets. There was also an option for states to recover other routine medical care expenses. The expansion of Medicaid under the Affordable Care Act made more residents eligible for Medicaid. The state and federal government as of February 2014 have not clarified clawback guidelines, triggering complaints from consumers and advocacy groups from the uncertainty.[22][23][24][25][26]

State implementations

States may bundle together the administration of Medicaid with other programs such as the Children's Health Insurance Program (CHIP), so the same organization that handles Medicaid in a state may also manage the additional programs. Separate programs may also exist in some localities that are funded by the states or their political subdivisions to provide health coverage for indigents and minors.

State participation in Medicaid is voluntary; however, all states have participated since 1982 when Arizona formed its Arizona Health Care Cost Containment System (AHCCCS) program. In some states Medicaid is subcontracted to private health insurance companies, while other states pay providers (i.e., doctors, clinics and hospitals) directly. There are many services that can fall under Medicaid and some states support more services than other states. The most provided services are intermediate care for mentally handicapped, prescription drugs and nursing facility care for under 21-year-olds. The least provided services include institutional religious (non-medical) health care, respiratory care for ventilator dependent and PACE (inclusive elderly care).[27]

Most states administer Medicaid through their own programs. A few of those programs are listed below:

- Arizona: AHCCCS

- California: Medi-Cal

- Connecticut: HUSKY D

- Maine: MaineCare

- Massachusetts: MassHealth

- New Jersey: NJ FamilyCare

- Oregon: Oregon Health Plan

- Oklahoma: Soonercare

- Tennessee: TennCare

- Washington Apple Health

- Wisconsin: BadgerCare

As of January 2012, Medicaid and/or CHIP funds could be obtained to help pay employer health care premiums in Alabama, Alaska, Arizona, Colorado, Florida, and Georgia.[28]

Enrollment

According to CMS, the Medicaid program provided health care services to more than 46.0 million people in 2001.[29][30] In 2002, Medicaid enrollees numbered 39.9 million Americans, the largest group being children [31] (18.4 million or 46 percent). From 2000 to 2012, the proportion of hospital stays for children paid by Medicaid increased by 33 percent, and the proportion paid by private insurance decreased by 21 percent.[32] Some 43 million Americans were enrolled in 2004 (19.7 million of them children) at a total cost of $295 billion. In 2008, Medicaid provided health coverage and services to approximately 49 million low-income children, pregnant women, elderly people, and disabled people. In 2009, 62.9 million Americans were enrolled in Medicaid for at least one month, with an average enrollment of 50.1 million.[33] In California, about 23% of the population was enrolled in Medi-Cal for at least 1 month in 2009-10.[34]

Medicaid payments currently assist nearly 60 percent of all nursing home residents and about 37 percent of all childbirths in the United States. The federal government pays on average 57 percent of Medicaid expenses.

Loss of income and medical insurance coverage during the 2008-2009 recession resulted in a substantial increase in Medicaid enrollment in 2009. Nine U.S. states showed an increase in enrollment of 15% or more, resulting in heavy pressure on state budgets.[35]

Comparisons with Medicare

Unlike Medicaid, Medicare is a social insurance program funded at the federal level[36] and focuses primarily on the older population. As stated in the CMS website,[37] Medicare is a health insurance program for people age 65 or older, people under age 65 with certain disabilities, and (through the End Stage Renal Disease Program) people of all ages with end-stage renal disease. The Medicare Program provides a Medicare part A which covers hospital bills, Medicare Part B which covers medical insurance coverage, and Medicare Part D which covers prescription drugs.

Medicaid is a program that is not solely funded at the federal level. States provide up to half of the funding for the Medicaid program. In some states, counties also contribute funds. Unlike the Medicare entitlement program, Medicaid is a means-tested, needs-based social welfare or social protection program rather than a social insurance program. Eligibility is determined largely by income. The main criterion for Medicaid eligibility is limited income and financial resources, a criterion which plays no role in determining Medicare coverage. Medicaid covers a wider range of health care services than Medicare. Some people are eligible for both Medicaid and Medicare and are known as Medicare dual eligibles.[38] In 2001, about 6.5 million Americans were enrolled in both Medicare and Medicaid. In 2013, approximately 9 million people qualified for Medicare and Medicaid.[39]

Eligibility

Medicaid is a joint federal-state program that provides health coverage or nursing home coverage to certain categories of low-asset people, including children, pregnant women, parents of eligible children, people with disabilities and elderly needing nursing home care. Medicaid was created to help low-asset people who fall into one of these eligibility categories "pay for some or all of their medical bills."[40]

There are two general types of Medicaid coverage. "Community Medicaid" helps people who have little or no medical insurance. Medicaid nursing home coverage pays all of the costs of nursing homes for those who are eligible except that the recipient pays most of his/her income toward the nursing home costs, usually keeping only $66.00 a month for expenses other than the nursing home.

While Congress and the Centers for Medicare and Medicaid Services (CMS) set out the general rules under which Medicaid operates, each state runs its own program. Under certain circumstances, an applicant may be denied coverage. As a result, the eligibility rules differ significantly from state to state, although all states must follow the same basic framework.

Poverty

Having limited assets is one of the primary requirements for Medicaid eligibility, but poverty alone does not qualify people to receive Medicaid benefits unless they also fall into one of the defined eligibility categories.[41] According to the CMS website, "Medicaid does not provide medical assistance for all poor persons. Even under the broadest provisions of the Federal statute (except for emergency services for certain persons), the Medicaid program does not provide health care services, even for very poor persons, unless they are in one of the designated eligibility groups."[41] In 2010, the Patient Protection and Affordable Care Act expanded Medicaid eligibility starting in 2014; people with income up to 133% of the poverty line qualify for coverage, including adults without dependent children.[42][43] However, the United States Supreme Court ruled that the Federal government must make participation in the expanded Medicaid program voluntary, and several state governments have declared that they will not participate.

More recently, many states have authorized financial requirements that will make it more difficult for working-poor adults to access coverage. In Wisconsin, nearly a quarter of Medicaid patients were dropped after the state government imposed premiums of 3% of household income.[44] A survey in Minnesota found that more than half of those covered by Medicaid were unable to obtain prescription medications because of co-payments.[45]

Categories

There are a number of Medicaid eligibility categories; within each category there are requirements other than income that must be met. These other requirements include, but are not limited to, assets, age, pregnancy, disability,[46] blindness, income and resources, and one's status as a U.S. citizen or a lawfully admitted immigrant.[47]

The Deficit Reduction Act of 2005 requires anyone seeking Medicaid to produce documents to prove that he is a United States citizen or resident alien. An exception is made for Emergency Medicaid where payments are allowed for the pregnant and disabled regardless of immigration status.[48][49] Special rules exist for those living in a nursing home and disabled children living at home. A child may be covered under Medicaid if he or she is a U.S. citizen or a permanent resident.

A child may be eligible for Medicaid regardless of the eligibility status of his parents. Thus, a child may be covered by Medicaid based on his individual status even if his parents are not eligible. Similarly, if a child lives with someone other than a parent, he may still be eligible based on its individual status.[50]

Coverage and use

One-third of children and over half (59%) of low-income children are insured through Medicaid or SCHIP. The insurance provides them with access to preventive and primary services which are used at a much higher rate than for the uninsured, but still below the utilization of privately insured patients. As of February 2011, a record 90% of children have coverage. However, 8 million children remain uninsured, including 5 million who are eligible for Medicaid and SCHIP but not enrolled.[51]

Dental

Children enrolled in Medicaid are individually entitled under the law to comprehensive preventive and restorative dental services, but dental care utilization for this population is low. The reasons for low use are many, but a lack of dental providers who participate in Medicaid is a key factor.[52][53] Few dentists participate in Medicaid – less than half of all active private dentists in some areas.[54] Low reimbursement rates, complex forms and burdensome administrative requirements are commonly cited by dentists as reasons for not participating in Medicaid.[55][56] In Washington state, a program known as Access to Baby and Child Dentistry (ABCD) has helped increase access to dental services by providing dentists higher reimbursements for oral health education and preventive and restorative services for children.[57][58]After the passing of the passing of the Affordable Care Act, many dental practices began using Dental Service Organizations to provide business management and support, allowing practices to minimize costs and pass the saving on to patients currently without adequate dental care.[59][60]

HIV

Medicaid provided the largest portion of federal money spent on health care for people living with HIV/AIDS until the implementation of Medicare Part D when the prescription drug costs for those eligible for both Medicare and Medicaid shifted to Medicare. Unless low income people who are HIV positive meet some other eligibility category, they are not eligible for Medicaid assistance unless they can qualify under the "disabled" category to receive Medicaid assistance — as, for example, if they progress to AIDS (T-cell count drops below 200).[61] The Medicaid eligibility policy contrasts with the Journal of the American Medical Association (JAMA) guidelines which recommend therapy for all patients with T-cell counts of 350 or less, or in certain patients commencing at an even higher T-cell count. Due to the high costs associated with HIV medications, many patients are not able to begin antiretroviral treatment without Medicaid help. More than half of people living with AIDS in the US are estimated to receive Medicaid payments. Two other programs that provide financial assistance to people living with HIV/AIDS are the Social Security Disability Insurance (SSDI) and the Supplemental Security Income.

Supplemental Security Income beneficiaries

Once someone is approved as a beneficiary in the Supplemental Security Income program, they may automatically be eligible for Medicaid coverage (depending on the laws of the state they reside in).

Assets

Both the federal government and state governments have made changes to the eligibility requirements and restrictions over the years. The Deficit Reduction Act of 2005 (DRA) significantly changed the rules governing the treatment of asset transfers and homes of nursing home residents.[62] The implementation of these changes proceeded state-by-state over the next few years and has now been substantially completed.

Five year "look-back"

The DRA created a five-year "look-back period." That means that any transfers without fair market value (gifts of any kind) made by the Medicaid applicant during the preceding five years are penalizable.

The penalty is determined by dividing the average monthly cost of nursing home care in the area or State into the amount of assets gifted. Therefore, if a person gifted $60,000 and the average monthly cost of a nursing home was $6,000, one would divide $6000 into $60,000 and come up with 10. 10 represents the number of months the applicant would not be eligible for medicaid.

All transfers made during the five-year look-back period are totaled, and the applicant is penalized based on that amount after having already dropped below the Medicaid asset limit. This means that after dropping below the asset level ($2,000 limit in most states), the Medicaid applicant will be ineligible for a period of time. The penalty period does not begin until the person is eligible for medicaid but for the gift.[63]

Elders who gift or transfer assets can be caught in the situation of having no money but still not being eligible for Medicaid.

Utilization

During 2003-2012, the share of hospital stays billed to Medicaid increased by 2.5 percent, or 0.8 million stays.[64]

Medicaid super utilizers (defined as Medicaid patients with four or more admissions in one year) account for more hospital stays (5.9 vs.1.3 stays), longer length of stay (6.1 vs. 4.5 days), and higher hospital costs per stay ($11,766 vs. $9,032).[65] Medicaid super-utilizers were more likely than other Medicaid patients to be male and to be aged 45-64 years.[66] Common conditions among super-utilizers include mood disorders and psychiatric disorders, as well as diabetes; cancer treatment; sickle cell anemia; septicemia; congestive heart failure; chronic obstructive pulmonary disease; and complications of devices, implants and grafts.[67]

Budget

Unlike Medicare, which is solely a federal program, Medicaid is a joint federal-state program. Each state operates its own Medicaid system, but this system must conform to federal guidelines in order for the state to receive matching funds and grants.[69] The matching rate provided to states is determined using a federal matching formula (called Federal Medical Assistance Percentages), which generates payment rates that vary from state to state, depending on each state's respective per capita income.[70] The wealthiest states only receive a federal match of 50% while poorer states receive a larger match.

Medicaid funding has become a major budgetary issue for many states over the last few years, with states, on average, spending 16.8% of state general funds on the program. If the federal match expenditure is also counted, the program, on average, takes up 22% of each state's budget.[71][72] Some 43 million Americans were enrolled in 2004 (19.7 million of them children) at a total cost of $295 billion.[73] In 2008, Medicaid provided health coverage and services to approximately 49 million low-income children, pregnant women, elderly people, and disabled people.[citation needed] Federal Medicaid outlays were estimated to be $204 billion in 2008.[74] In 2011, there were 7.6 million hospital stays billed to Medicaid, representing 15.6 percent (approximately $60.2 billion) of total aggregate inpatient hospital costs in the United States.[75] At $8,000, the mean cost per stay billed to Medicaid was $2,000 less than the average cost for all stays.[76]

Medicaid does not pay benefits to individuals directly; Medicaid sends benefit payments to health care providers. In some states Medicaid beneficiaries are required to pay a small fee (co-payment) for medical services.[47] Medicaid is limited by federal law to the coverage of "medically necessary services".[77]

Medicaid payments currently assist nearly 60 percent of all nursing home residents and about 37 percent of all childbirths in the United States. The federal government pays on average 57 percent of Medicaid expenses.

On November 25, 2008, a new federal rule was passed that allows states to charge premiums and higher co-payments to Medicaid participants.[78] This rule will enable states to take in greater revenues, limiting financial losses associated with the program. Estimates figure that states will save $1.1 billion while the federal government will save nearly $1.4 billion. However, this means that the burden of financial responsibility will be placed on 13 million Medicaid recipients who will face a $1.3 billion increase in co-payments over 5 years.[79] The major concern is that this rule will create a disincentive for low-income people to seek healthcare. It is possible that this will force only the sickest participants to pay the increased premiums and it is unclear what long-term effect this will have on the program.

Public health benefits

“The Oregon Health Insurance Experiment: Evidence from the First Year,” a 2011 paper by the Massachusetts Institute of Technology and the Harvard School of Public Health, used Oregon’s 2008 decision to hold a randomized lottery for the provision of Medicaid insurance in order to measure the impact of health insurance on an individual’s health and well-being. The study examined the outcomes of the 10,000 lower-income people eligible for Medicaid who were chosen by this randomized system, which helped eliminate potential bias in the data produced. The study's authors caution that the survey sample is relatively small and "estimates are therefore difficult to extrapolate to the likely effects of much larger health insurance expansions, in which there may well be supply side responses from the health care sector." Nevertheless, the study finds evidence that:[80]

- Hospital use increased by 30% for those with insurance, with the length of hospital stays increasing by 30% and the number of procedures increasing by 45% for the population with insurance;

- Medicaid recipients proved more likely to seek preventive care. Women were 60% more likely to have mammograms, and recipients overall were 20% more likely to have their cholesterol checked;

- In terms of self-reported health outcomes, having insurance was associated with an increased probability of reporting one’s health as “good,” “very good,” or “excellent” — overall, about 25% higher than the average;

- Those with insurance were about 10% less likely to report a diagnosis of depression.

See also

- Center for Medicare and Medicaid Innovation

- Medicaid managed care

- State Children's Health Insurance Program (SCHIP/CHIP)

- Home and Community-Based Services Waivers

- United States National Health Care Act

- Health insurance in the United States

- Oregon Medicaid health experiment

- Enhanced Primary Care Case Management Program

| State | Medicaid Program |

|---|---|

| California | Medi-Cal |

| Maine | mainecare |

| Minnesota | MinnesotaCare |

| Wisconsin | BadgerCare |

| Massachusetts | MassHealth |

| Washington | Apple Health |

References

- ^ America's Health Insurance Plans (HIAA), pg. 232

- ^ "Medicaid General Information". Centers for Medicare and Medicaid Services (CMS).

- ^ "States Turn to Managed Care To Constrain Medicaid Long-Term Care Costs". Agency for Healthcare Research and Quality. April 9, 2014. Retrieved April 14, 2014.

- ^ "Managed Care". www.medicaid.gov. Retrieved December 10, 2015.

- ^ "Medicaid pyments per enrollee". KFF.org.

- ^ Alker, Joan (2008). "Choosing Premium AssistanceH: What does State experience tell us?" (PDF). The Kaiser Family Foundation.

- ^ a b "Dental Coverage Overview". Medicaid.

- ^ "Dental Guide" (PDF). CMS.hhs.gov.

- ^ "Annual Statistical Supplement". U.S. Social Security Administration, Office of Retirement and Disability Policy. 2011. Retrieved October 19, 2012.

- ^ a b Overview "Medicaid Drug Rebate Program Overview". cms.hhs.gov.

{{cite web}}: Check|url=value (help) - ^ "Medicaid Estate Recovery". U.S. Department of Health and Human Services. April 2005.

- ^ "Fee for Service (Direct Service) Program". Medicaid.gov.

- ^ HHS Press Office (March 29, 2013). "HHS finalizes rule guaranteeing 100 percent funding for new Medicaid beneficiaries". Washington, D.C.: U.S. Department of Health & Human Services. Retrieved April 23, 2013.

effective January 1, 2014, the federal government will pay 100 percent of defined cost of certain newly eligible adult Medicaid beneficiaries. These payments will be in effect through 2016, phasing down to a permanent 90 percent matching rate by 2020.

Centers for Medicare & Medicaid Services (April 2, 2013). "Medicaid program: Increased federal medical assistance percentage changes under the Affordable Care Act of 2010: Final rule". Federal Register. 78 (63): 19917–19947.(A) 100 percent, for calendar quarters in calendar years (CYs) 2014 through 2016; (B) 95 percent, for calendar quarters in CY 2017; (C) 94 percent, for calendar quarters in CY 2018; (D) 93 percent, for calendar quarters in CY 2019;(E) 90 percent, for calendar quarters in CY 2020 and all subsequent calendar years.

- ^ Robert Pear (May 24, 2013). "States' Policies on Health Care Exclude Some of the Poorest". The New York Times. Retrieved May 25, 2013.

In most cases, [Sandy Praeger, Insurance Commissioner of Kansas] said, adults with incomes from 32 percent to 100 percent of the poverty level ($6,250 to $19,530 for a family of three) "will have no assistance."

- ^ a b Sarah Kliff (May 5, 2013). "Florida rejects Medicaid expansion, leaves 1 million uninsured". The Washington Post. Retrieved May 24, 2013.

- ^ a b "© Avalere Health LLC To Date, 20 States & DC Plan to Expand Medicaid Eligibility, 14 Will Not Expand, and the Remainder Are Undecided" (PDF). AvalereHealth.Net. May 2, 2013. Retrieved May 24, 2013.

© Avalere Health LLC To Date, 20 States & DC Plan to Expand Medicaid Eligibility, 14 Will Not Expand, and the Remainder Are Undecided

- ^ a b c d e f g h "Where each state stands on ACA's Medicaid expansion: A roundup of what each state's leadership has said about their Medicaid plans". The Advisory Board Company. May 24, 2013. Retrieved May 24, 2013.

- ^ http://www.hhs.gov/news/press/2013pres/03/20130329a.html

- ^ http://www.cbpp.org/cms/?fa=view&id=3801

- ^ http://kff.org/health-reform/state-indicator/state-activity-around-expanding-medicaid-under-the-affordable-care-act/

- ^ "NEXT STEPS ON MEDICAID EXPANSION ANNOUNCED" (Press release). Anchorage, AK: State of Alaska. July 16, 2015. Retrieved August 29, 2015.

- ^ "Some Illinois Medicaid patients' assets at risk". chicagotribune.com. February 5, 2014. Retrieved August 4, 2014.

- ^ Pollock, R (February 8, 2015). "Tax Day Shocker: Obamacare 'Clawback' To Hit Some Subsidy Recipients With Huge Tax Bill".

- ^ Shedlock, Mike (August 31, 2014). "Obamacare Fine Print: Beware the Medicaid and Medi-Cal Clawbacks and Liens". TownHall.com Finance.

- ^ Ross, Chuck (February 24, 2015). "Obamacare 'Clawback' Lowers Tax Refunds By $530 On Average". The Daily Caller.

- ^ Strether, Lambert (February 17, 2014). "Consumer Reports Shills for ObamaCare, Pooh-Poohs Medicaid Clawbacks on Bizarre Assumption They'll be Waived". naked capitalism.

- ^ Dáil, Paula vW. (2012). Women and Poverty in 21st Century America. NC, USA: McFarland. p. 137. ISBN 978-0-7864-4903-3.

- ^ "Medicaid and the Children's Health Insurance Program (CHIP) Offer Free Or Low-Cost Health Coverage To Children And Families" (PDF). United States Department of Labor/Employee Benefits Security Administration.

- ^ CMS, Medicaid and Medicare Summaries

- ^ CMS, Medicaid General Information

- ^ CMS. "A Profile of Medicaid: Chartbook 2000" (PDF). Retrieved March 31, 2012.

- ^ Witt WP, Wiess AJ, Elixhauser A (December 2014). "Overview of Hospital Stays for Children in the United States, 2012". HCUP Statistical Brief #186. Rockville, MD: Agency for Healthcare Research and Quality.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ http://www.cms.gov/Research-Statistics-Data-and-Systems/Research/ActuarialStudies/downloads/MedicaidReport2010.pdf

- ^ Medi-Cal Program Enrollment Totals for Fiscal Year 2009-10, California Department of Health Care Services Research and Analytic Studies Section, June 2011

- ^ "Recession Drove Many to Medicaid Last Year" article by Kevin Sack in The New York Times September 30, 2010, accessed October 1, 2010

- ^ Medicare.gov - Long-Term Care

- ^ Overview

- ^ Overview

- ^ "State–Federal Program Provides Capitated Payments to Plans Serving Those Eligible for Medicare and Medicaid, Leading to Better Access to Care and Less Hospital and Nursing Home Use". Agency for Healthcare Research and Quality. July 3, 2013. Retrieved July 5, 2013.

- ^ "Medicaid Eligibility: Overview," from the Centers for Medicare and Medicaid Services (CMS) website

- ^ a b Overview - What is Not Covered, U.S. Department of Health & Human Services

- ^ Galewitz, Phil (March 26, 2010). "Consumers Guide To Health Reform". Kaiser Health News.

- ^ "5 key things to remember about health care reform". CNN. March 25, 2010. Retrieved May 21, 2010.

- ^ "Making Medicaid Work" Policy Matters Ohio, http://www.policymattersohio.org/wp-content/uploads/2015/02/Making-Medicaid-work-1.pdf

- ^ "Making Medicaid Work" Policy Matters Ohio, http://www.policymattersohio.org/wp-content/uploads/2015/02/Making-Medicaid-work-1.pdf

- ^ "Medicare/Medicaid". ID-DD Resources. Retrieved November 15, 2014.

- ^ a b Overview

- ^ "Pregnant Illegal Aliens Overwhelming Emergency Medicaid". Newsmax.com. Retrieved October 5, 2011.

- ^ "Healthcare for Wisconsin Residents" (PDF). Wisconsin Department of Health and Family Services. Retrieved October 5, 2011.

- ^ CMS.hhs.gov

- ^ KFF.org

- ^ CDHP.org

- ^ U.S. General Accounting Office. Factors Contributing to Low Use of Dental Services by Low-Income Populations. Washington, DC: U.S. General Accounting Office. 2000.

- ^ Gehshan S, Hauck P, and Scales J. Increasing dentists’ participation in Medicaid and SCHIP. Washington, DC: National Conference of State Legislatures. 2001. Ecom.ncsl.org

- ^ Edelstein B. Barriers to Medicaid Dental Care. Washington, DC: Children’s Dental Health Project. 2000. CDHP.org

- ^ Krol D and Wolf JC. Physicians and dentists attitudes toward Medicaid and Medicaid patients: review of the literature. Columbia University. 2009.

- ^ "Comprehensive Statewide Program Combines Training and Higher Reimbursement for Providers With Outreach and Education for Families, Enhancing Access to Dental Care for Low-Income Children". Agency for Healthcare Research and Quality. February 27, 2013. Retrieved May 13, 2013.

- ^ "Medicaid Reimbursement and Training Enable Primary Care Providers to Deliver Preventive Dental Care at Well-Child Visits, Enhancing Access for Low-Income Children". Agency for Healthcare Research and Quality. July 17, 2013. Retrieved August 1, 2013.

- ^ "About DSOs". Association of Dental Support Organizations.

- ^ Winegarden, Wayne. "Benefits Created by Dental Service Organizations" (PDF). Pacific Research Institute.

- ^ "Medicaid and HIV/AIDS," Kaiser Family Foundation, fact sheet, kff.org

- ^ CMS.hhs.gov

- ^ 42 U.S.C. 1396p

- ^ Wiess, AJ and Elixhauser A (October 2014). "Overview of Hospital Utilization, 2012". HCUP Statistical Brief #180. Rockville, MD: Agency for Healthcare Research and Quality.

- ^ Jiang HJ, Barrett ML, Sheng M (November 2014). "Characteristics of Hospital Stays for Nonelderly Medicaid Super-Utilizers, 2012". HCUP Statistical Brief #184. Rockville, MD: Agency for Healthcare Research and Quality.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ Jiang HJ, Barrett ML, Sheng M (November 2014). "Characteristics of Hospital Stays for Nonelderly Medicaid Super-Utilizers, 2012". HCUP Statistical Brief #184. Rockville, MD: Agency for Healthcare Research and Quality.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ Jiang HJ, Barrett ML, Sheng M (November 2014). "Characteristics of Hospital Stays for Nonelderly Medicaid Super-Utilizers, 2012". HCUP Statistical Brief #184. Rockville, MD: Agency for Healthcare Research and Quality.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ The Long-Term Outlook for Health Care Spending. Figure 2. Congressional Budget Office.

- ^ Puerto Rico is considered a “state” for Medicaid purposes. Id. § 1301(a)(1).

- ^ SSA.gov, Social Security Act. Title IX, Sec. 1101(a)(8)(B)

- ^ Microsoft Word - Final Text.doc

- ^ "Medicaid and State Budgets: Looking at the Facts", Georgetown University Center for Children and Families, May 2008.

- ^ "Policy Basics: Introduction to Medicaid".

- ^ "Budget of the United States Government, FY 2008", Department of Health and Human Services, 2008.

- ^ Torio CM, Andrews RM. National Inpatient Hospital Costs: The Most Expensive Conditions by Payer, 2011. HCUP Statistical Brief #160. Agency for Healthcare Research and Quality, Rockville, MD. August 2013. [1]

- ^ Pfuntner A, Wier LM, Steiner C. (December 2013). "Costs for Hospital Stays in the United States, 2011". HCUP Statistical Brief #168. Rockville, MD: Agency for Healthcare Research and Quality.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ Peter W. Adler. Is it lawful to use Medicaid to pay for circumcision? 19 J Law Med 335-353 (2011). PMID 22320007.

- ^ search: 42 CFR Parts 447 and 457

- ^ Pear, Robert (November 27, 2008). "New Medicaid Rules Allow States to Set Premiums and Higher Co-Payments". The New York Times.

- ^ "Oregon Health Insurance Experiment: Evidence from the First Year". Journalist's Resource.org.

Further reading

- House Ways and Means Committee, "2004 Green Book - Overview of the Medicaid Program", United States House of Representatives, 2004.

External links

- CMS official web site.

- Health Assistance Partnership

- Trends in Medicaid, October 2006. Staff Paper of the Office of the Assistant Secretary for Planning and Evaluation (ASPE), U.S. Department of Health and Human Services

- Read Congressional Research Service (CRS) Reports regarding Medicaid

- "Medicaid Research" and "Medicaid Primer" from Georgetown University Center for Children and Families.

- Kaiser Family Foundation - Substantial resources on Medicaid including federal eligibility requirements, benefits, financing and administration.

- "The Role of Medicaid in State Economies: A Look at the Research," Kaiser Family Foundation, November 2013

- State-level data on health care spending, utilization, and insurance coverage, including details extensive Medicaid information.

- History of Medicaid in an interactive timeline of key developments.

- Coverage By State - Information on state health coverage, including Medicaid, by the Robert Wood Johnson Foundation & AcademyHealth.

- Medicaid information from Families USA

- Medicaid Reform - The Basics from The Century Foundation

- National Association of State Medicaid Directors Organization representing the chief executives of state Medicaid programs.

- Ranking of state Medicaid programs by eligibility, scope of services, quality of service and reimbursement from Public Citizen. 2007.

- Center for Health Care Strategies, CHCS Extensive library of tools, briefs, and reports developed to help state agencies, health plans and policymakers improve the quality and cost-effectiveness of Medicaid.