Price ceiling

A price ceiling is a government-imposed price control or limit on how high a price is charged for a product. Governments intend price ceilings to protect consumers from conditions that could make necessary commodities unattainable[citation needed]. However, a price ceiling can cause problems if imposed for a long period without controlled rationing. Price ceilings can produce negative results when the correct solution would have been to increase supply[citation needed]. Misuse occurs when a government misdiagnoses a price as too high when the real problem is that the supply is too low[citation needed]. In an unregulated market economy price ceilings do not exist.

Real world examples

Rent control in New York City

Rent control is a price ceiling on rent. When soldiers returned from World War II and started families (which increased demand for apartments), but stopped receiving military pay, many could not deal with the jumping rent. The government put in price controls, so soldiers and their families could pay the rent and keep their homes. However, this increased the quantity demanded for apartments and lowered the quantity supplied, meaning that available apartments were rapidly taken until none were left for late-comers. Price ceilings create shortages when producers are allowed to abdicate market share or go unsubsidized.

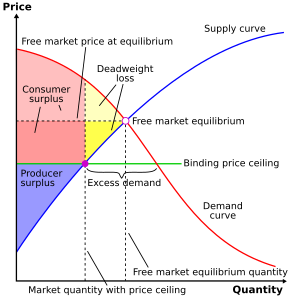

Definition: Price ceiling is a situation when the price charged is more than or less than the equilibrium price determined by market forces of demand and supply. It has been found that higher price ceilings are ineffective. Price ceiling has been found to be of great importance in the house rent market.

Description: Government imposes a price ceiling to control the maximum prices that can be charged by suppliers for the commodity. This is done to make commodities affordable to the general public. However, prolonged application of a price ceiling can lead to black marketing and unrest in the supply side.

For example: Let's consider the house-rent market. Here in the given graph, a price of $9000 has been determined as the equilibrium price with the quantity at 30 homes. Now, the government determines a price ceiling of $6000. At this rate there is a shortage (demand for 40 houses, but supply is for only 20 houses). In the long run, the extra 20 people will try to get a house on rent, which will eventually give rise to black market and higher rents.

Apartment price control in Finland

According to professors Niko Määttänen and Ari Hyytinen, price ceilings on Helsinki City Hitas apartments are economically highly inefficient. They cause queuing, and discriminate against the handicapped, single parents, elderly, and others not able to queue for days. They cause inefficient allocation, as apartments are not bought by those willing to pay the most for them — and those who get an apartment are unwilling to leave it, even when their family or work situation changes, since they can't sell it at what they feel the market price should be. These inefficiencies increase apartment shortage and raise the market price of other apartments.[1]

Coulter law in the Australian Football League

As a result of declining competitive balance following the admission of Footscray, Hawthorn & North Melbourne in 1925,[2][3] the VFL introduced a ceiling wage of £3 (around 160 Australian dollars at 2008 prices) in 1930. Known as the Coulter Law after George Coulter, it was varied several times before finally being abolished in 1968, being cut in half during World War II and increased in line with inflation after the war.

In its early years, poorer clubs did not have the money to pay their players even the legal wage, and Melbourne preferred to give its players jobs rather than payments, but some clubs such as Richmond did pay above the legal wage.

The Coulter Law was a strictly binding price ceiling through its history, mainly for top players such as Ron Todd, John Coleman and Brian Gleeson. In the case of Todd, it led to him moving to the VFA because he was dissatisfied with the pay he could legally get with Collingwood,[4] whilst Coleman and Gleeson could not afford surgery to continue their careers, that they would have been able to have on higher wages.

State Farm Insurance

A February 4, 2009 Wall Street Journal article stated, "Last month State Farm pulled the plug on its 1.2 million homeowner policies in Florida, citing the state's punishing price controls... State Farm's local subsidiary recently requested an increase of 47%, but state regulators refused. State Farm says that since 2000 it has paid $1.21 in claims and expenses for every $1 of premium income received."[5]

Venezuela

A January 10, 2006, BBC article reported that since 2003, Venezuela President Hugo Chávez had been setting price ceilings on food, and that these price ceilings had caused shortages and hoarding.[6] A January 22, 2008 article from Associated Press stated, "Venezuelan troops are cracking down on the smuggling of food... the National Guard has seized about 750 tons of food... Hugo Chavez ordered the military to keep people from smuggling scarce items like milk... He's also threatened to seize farms and milk plants..."[7] On February 28, 2009 Chávez ordered the military to temporarily seize control of all the rice processing plants in the country and force them to produce at full capacity, which he alleged they had been avoiding in response to the price caps.[8]

A January 3, 2007 article in the International Herald Tribune reported that Chávez's price ceilings were causing shortages of materials used in the construction industry.[9] According to an April 4, 2008 article from CBS News, Chávez ordered the nationalization of the cement industry in response to the industry exporting its products to receive higher prices outside the country.[10]

Price ceilings that lead to higher prices

There is a substantial body of research showing that under some circumstances price ceilings can, paradoxically, lead to higher prices. The leading explanation is that price ceilings serve to coordinate collusion among suppliers who would otherwise compete on price.

More precisely: Forming a cartel is profitable, because it enables nominally competing firms to act like a monopoly, limiting quantities and raising prices. But forming a cartel is difficult, because it is necessary to agree on quantities and prices, and because each firm will have an incentive to "cheat", that is, to sell more than agreed at by lowering prices. (Antitrust laws make collusion even more difficult because of legal sanctions.) Having a third party such as a regulator announce and enforce a maximum price level can make it easier for the firms to agree on a price and to monitor pricing. We can view the regulatory price as a focal point which is natural for both parties to charge.

One research paper documenting this phenomenon is Knittel and Stangel.[11] The authors discovered that in the 1980s in the United States, in states that fixed an interest rate ceiling of 18% firms charged a rate only slightly below the ceiling. But in states without an interest rate ceiling, interest rates were significantly lower. (The authors did not find any difference in costs which could explain the result.) Another example is Sen et al. [12] who found that gasoline prices were higher in states that instituted price ceilings. We can give here the example of a supreme court of Pakistan decision regarding fixing of a ceiling price for sugar at PKR45/kg. The result was sugar disappeared from the market due to a cartel of sugar producers and the failure of the Pakistani government to maintain supply even in the stores owned by the Government against the large demand of the sugar. The imported sugar require time to reach the country, and it was not feasible to sell at the rate fixed by the Supreme Court of Pakistan. Eventually the government went for a review petition in the Supreme Court and sought the withdrawal of the earlier decision of the apex court. Eventually fixation of ceiling price was withdrawn and the market equilibrium was achieved between PKR55-60/kg (Supreme Court of Pakistan decision2006-2007.

See also

References

- ^ Onko Hitas-järjestelmässä mitään järkeä?, professor Niku Määttänen 16.4.2010 & professor Ari Hyytinen 17.4.2010, Akateeminen talousblogi (in Finnish)

- ^ Daly Anne and Akira Kawaguchi; Competitive Balance in Australian and Japanese Sport

- ^ Booth, Ross; Comparing Competitive Balance in Australian Sports Leagues, The AFL, NBL and NRL: Does The AFL's Team Salary Cap and Player Draft Measure Up?; p. 30

- ^ Main, Jim and Holmesby, Russell (editors); The Encyclopedia of League Footballers (1st edition); p. 438. ISBN 1-86337-085-4

- ^ Florida's Unnatural Disaster, Wall St. Journal, February 4, 2009

- ^ Venezuelan shoppers face food shortages, BBC, January 10, 2006

- ^ Venezuelan troops crack down on border smuggling, Associated Press, January 22, 2008

- ^ Chavez Seizes Venezuelan Rice Plants, Associated Press, February 28, 2009

- ^ Venezuelan businesses say Chávez's price controls create shortages International Heralrd Tribune, January 3, 2007

- ^ Hugo Chavez Nationalizes Cement Industry, CBS News, April 4, 2008.

- ^ RK Knittel and V Stango ‘Price Ceilings as Focal points for Tacit Collusion: Evidence from Credit Cards’ (2003) 93 American Economic Review 1703-1729.

- ^ A Sen, A Clemente, and L Jonker ‘Retail Gasoline Price Ceilings and Regulatory Capture: Evidence from Canada’ (2011) 13(2) American Law and Economics Review 532-564.

Further reading

- Rockoff, Hugh (2008). "Price Controls". In David R. Henderson (ed.) (ed.). Concise Encyclopedia of Economics (2nd ed.). Indianapolis: Library of Economics and Liberty. ISBN 978-0865976658. OCLC 237794267.

{{cite encyclopedia}}:|editor=has generic name (help)