Pyramid scheme: Difference between revisions

m Reverted edits by 152.8.187.26 (talk) to last version by Alexfusco5 |

|||

| Line 76: | Line 76: | ||

==References== |

==References== |

||

{{reflist}} |

{{reflist}} |

||

djksjakdsvgjaslkjkadhgadjfhasdjhjdhsajhasfhadfhadjhasdjhasdjncmbskjjchjnahaf |

|||

==See also== |

==See also== |

||

Revision as of 00:55, 11 April 2008

A pyramid scheme is a non-sustainable business model that involves the exchange of money primarily for enrolling other people into the scheme, usually without any product or service being delivered. It has been known to come under many guises. Some famous examples including the massive Albanian Pyramid Schemes of 1996[1] were technically not Pyramid schemes but Ponzi schemes.

Pyramid schemes are illegal in many countries, including the United States,[2] the United Kingdom, France, Canada, Malaysia, Norway, Australia,[3] New Zealand,[4] Nepal,[citation needed] Sri Lanka,[citation needed] and Iran.[citation needed] These types of schemes have existed for at least a century.

Models

There are other commercial models using cross-selling such as multi-level marketing (MLM) or party planning which are legal and sustainable, although there is a significant grey area in many cases. Most pyramid schemes take advantage of confusion between genuine businesses and complicated but convincing moneymaking scams.

The essential idea behind each scam is that the individual makes only one payment, but is promised to somehow receive exponential benefits from other people as a reward. A common example might be an offer that, for a fee, allows the victim to sell the same offer to other people, or receive bonuses through other people they refer. Each sale includes a fee to the original seller.

Clearly, the flaw is that there is no end benefit; the money simply travels up the chain, and only the originator (or at best a very few) wins in swindling his followers. Of course, the people in the worst situation are the ones at the bottom of the pyramid: those who subscribed to the plan, but were not able to recruit any followers themselves. To embellish the act, most such scams will have fake referrals, testimonials, and information.

Internet

In 2003, an internet-based "pyramid scam"[5] was uncovered by the United States Federal Trade Commission (FTC), where customers would pay a registration fee to join a program and purchase a package which included Internet mail and related goods and services. The FTC's complaint states that the company assured consumers who purchased the package would allow them to earn significant commissions for every website sold.

The FTC alleged that the company deceptively represented that consumers who participated in their scheme would earn substantial income, when in fact most consumers lost money in the operation, and that the defendants provided deceptive marketing material to affiliates - providing them with the means to deceive others; and finally, the company failed to disclose that a substantial percentage of participants would lose money, and that the scheme was actually an illegal pyramid.

Identifying features

The distinguishing feature of these schemes is the fact that the product being sold has little to no intrinsic value of its own or is sold at a price out of line with its fair market value. Examples include "products" such as brochures, cassette tapes or systems which merely explain to the purchaser how to enroll new members, or the purchasing of name and address lists of future prospects. The costs for these "products" can range up into the hundreds or thousands of dollars. A common Internet version involves the sale of documents entitled "How to make $1 million on the Internet" and the like. The result is that only a person enrolled in the scheme would buy it and the only way to make money is to recruit more and more people below that person also paying more than they should. This extra amount paid for the product is then used to fund the pyramid scheme. In effect, the scheme ends up paying for new recruits through their overpriced purchases rather than an initial "signup" fee.

The key identifiers of a pyramid scheme include the following:

- A highly excited sales pitch.

- A reassurance that it is not, in fact, a pyramid scheme, possibly with a false account of what a pyramid scheme is.

- Little to no information offered about the company unless an investor purchases the products and becomes a participant.

- Vaguely phrased promises of limitless income potential.

- No product, or a product being sold at a price ridiculously in excess of its real market value, or a product with minimal or unrealistic market potential. As with the company, the product is vaguely described.

- An income stream that chiefly depends on the commissions earned by enrolling new members or the purchase by members of products for their own use rather than sales to customers who are not participants in the scheme.

- A tendency for only the early investors/joiners to make any real income.

- Assurances that it is perfectly legal to participate.

- The insistence they are not here to pressure you but merely to guide you.

- The idea that there are no bosses, only coaches and mentors.

The key distinction between these schemes and legitimate MLM businesses is that in the latter cases a meaningful income can be earned solely from the sales of the associated product or service to customers who are not themselves enrolled in the scheme. The FTC also warns that the practice of getting commissions from recruiting new members is outlawed in most states as "pyramiding".[6] However, the absence of payment for recruiting does not mean that an MLM is not a cover for a pyramid scheme. The distinguishing characteristic is whether the money in the scheme comes primarily from the participants themselves (pyramid scheme) or from sales of products or services to customers who are not participants in the scheme (legitimate MLM).

Market saturation

Over 90% of the people who get involved in pyramid schemes never recoup their initial investment.

The people on the bottom level of the pyramid, no matter how shallow or deep it goes, will always lose their money. It is easy to see that the number in the bottom level of the pyramid always exceeds the total of all those in the levels above no matter how many levels there are. If each level must recruit six more below them, the ratio of losers to winners is close to 5 to 1 - ~84% of all investors will lose their money. The pyramid in reality would not be perfectly balanced and some members might be able to partially fill their number of recruits, but the same principles apply.

"8-ball" model

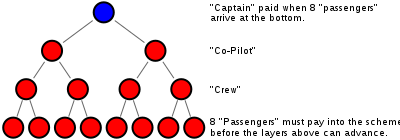

Many pyramids are more sophisticated than the simple model. These recognize that recruiting a large number of others into a scheme can be difficult so a seemingly simpler model is used. In this model each person must recruit two others, but the ease of achieving this is offset because the depth required to recoup any money also increases. The scheme requires a person to recruit two others, who must each recruit two others, who must each recruit two others.

Prior instances of this scam have been called the "Plane Game" and the four tiers labelled as "captain", "co-pilot", "crew", and "passenger" to denote a person's level. Another instance was called the "Original Dinner Party" which labelled the tiers as "dessert", "main course", "side salad", and "entree". A person on the "dessert" course is the one at the top of the tree. Another variant "Treasure Traders" variously used gemology terms such as "polishers", "stone cutters" etc. or gems "rubies", "sapphires" etc.

Such schemes may try to downplay their pyramid nature by referring to themselves as "binary systems", or "gifting circles" with money being "gifted". Popular scams such as the "Women Empowering Women" do exactly this. Joiners may even be told that "gifting" is a way to skirt around tax laws.

Whichever euphemism is used, there are 15 total people in four tiers (1 + 2 + 4 + 8) in the scheme - the person at the top of this tree is the "captain", the two below are "co-pilots", the four below are "crew" and the bottom eight joiners are the "passengers".

The eight passengers must each pay (or "gift") a sum (e.g. $1000) to join the scheme. This sum (e.g. $8000) goes to the captain who leaves, with everyone remaining moving up one tier. There are now two new captains so the group splits in two with each group requiring eight new passengers. A person who joins the scheme as a passenger will not see a return until they exit the scheme as a captain. This requires that 14 others have been persuaded to join underneath them.

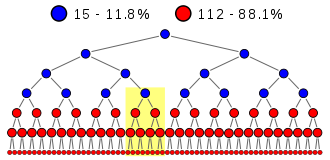

As such, the bottom 3 tiers of the pyramid always lose their money when the scheme finally collapses. Consider a pyramid consisting of tiers with 1, 2, 4, 8, 16, 32 and 64 members. The highlighted section corresponds to the previous diagram.

If the scheme collapses at this point, only those in the 1, 2, 4 and 8 got out with a return. The remainder in the 16, 32, and 64 tier lose everything. 112 out of the total 127 members or 88% lost all of their money.

During a wave of pyramid activity, a surge frequently develops once a significant fraction of people know someone personally who exited with a $8000 payout for example. This spurs others to seek to get in on one of the many pyramids before the wave collapses.

The figures also hide the fact that the confidence trickster would make the lion's share of the money. They would do this by filling in the first 3 tiers (with 1, 2, and 4 people) with phoney names, ensuring they get the first 7 payouts, at 8 times the buy-in sum, without paying a single penny themselves. So if the buy-in were $1000, they would receive $56,000, paid for by the first 56 investors. They would continue to buy in underneath the real investors, and promote and prolong the scheme for as long as possible in order to allow them to skim even more from it before the collapse.

Other cons may also be effective. For example, rather than using fake names, a group of seven people may agree to form the top three layers of a pyramid without investing any money. They then work to recruit eight paying passengers, and pretend to follow the pyramid payout rules, but in reality split any money received. Ironically, though they are being conned, the eight paying passengers are not really getting anything less for their money than if they were buying into a 'legitimate' pyramid which had split off from a parent pyramid. They truly are now in a valid pyramid, and have the same opportunity to earn a windfall if they can successfully recruit enough new members and reach captain. This highlights the fact that by 'buying' in to a pyramid, passengers are not really obtaining anything of value they couldn't create themselves other than a vague sense of "legitimacy" or history of the pyramid, which may make it marginally easier to sell passenger seats below them.

In early 2006 Ireland was hit by a wave of schemes with major activity in Cork and Galway. Participants were asked to contribute €20,000 each to a "Liberty" scheme which followed the classic 8-ball model. Payments were made in Munich, Germany to skirt Irish tax laws concerning gifts. Spin-off schemes called "Speedball" and "People in Profit" prompted a number of violent incidents and calls were made by politicians to tighten existing legislation.[7] Ireland has launched a website to better educate consumers to pyramid schemes and other scams.[8]

Matrix schemes

Matrix schemes use the same fraudulent non-sustainable system as a pyramid; here, the victims pay to join a waiting list for a desirable product which only a fraction of them can ever receive. Since matrix schemes follow the same laws of geometric progression as pyramids, they are subsequently as doomed to collapse. Such schemes operate as a queue, where the person at head of the queue receives an item such as a television, games console, digital camcorder, etc. when a certain number of new people join the end of the queue. For example ten joiners may be required for the person at the front to receive their item and leave the queue. Each joiner is required to buy an expensive but worthless item, such as an e-book, for their position in the queue. The scheme organizer profits because the income from joiners far exceeds the cost of sending out the item to the person at the front. Organizers can further profit by starting a scheme with a queue with shill names that must be cleared out before genuine people get to the front. The scheme collapses when no more people are willing to join the queue. Schemes may not reveal, or may attempt to exaggerate, a prospective joiner's queue position which essentially means the scheme is a lottery. Some countries have ruled that matrix schemes are illegal on that basis.

References

- ^ The Rise and Fall of Albania's Pyramid Schemes Christopher Jarvis, imf.org

- ^ Pyramid Schemes Debra A. Valentine, General Counsel, Federal Trade Commission

- ^ Trade Practices Amandment Act (No. 1) 2002 Trade Practices Act 1974 (Cth) ss 65AAA - 65AAE, 75AZO

- ^ Laws and Regulations Covering Multi-Level Marketing Programs and Pyramid Schemes Consumer Fraud Reporting.com

- ^ FTC Charges Internet Mall Is a Pyramid Scam Federal Trade Commission

- ^ Multilevel Marketing Plans Federal Trade Commission

- ^ Gardaí hold firearm after pyramid scheme incident Irish Examiner

- ^ National Consumer Agency Ireland

See also

- Autosurfing

- Burnlounge

- Large Group Awareness Training (LGAT)

- High Yield Investment Program

- Holiday Magic

- Ponzi scheme

- Sali Berisha

- Make money fast

External links

- FTC consumer complaint form

- Article by Financial Crimes Investigator, Bill E. Branscum

- Spoof article

- Difference between Pyramid Schemes and Network Marketing

- The Math Behind Pyramid Schemes, Chain Letters, and 2-Up Schemes - Investigates the mathematics of the geometric series involved.

- IMF feature on "The Rise and Fall of Albania's Pyramid Schemes"

- Cockeyed.com presents: Pyramid Schemes - A thorough description of the 8-ball model and matrix schemes which is a close cousin to pyramid schemes.

- National Consumer Agency on Pyramid Schemes - Irish consumer site describes two local pyramid schemes and offers advice to would-be participants.

- London Kural Coverage of Gold Quest owner's recent arrest in Indonesia

- National Consumer Agency Ireland

- Australian Trade Practices Amendment Act (No. 1) 2002 Australian Law Online