World oil market chronology from 2003: Difference between revisions

Vchimpanzee (talk | contribs) →2012: Feb. 29 update |

Extending Driving Season |

||

| Line 310: | Line 310: | ||

|authors=Matthew Craft and Christopher S. Rugaber |

|authors=Matthew Craft and Christopher S. Rugaber |

||

}}</ref> |

}}</ref> |

||

==Driving Season== |

|||

The largest export of the United States is oil, indicating not a brain drain but an oil drain in the Maine economy. Most oil is burned during driving season. President Obama has offered to extend driving season to 12 months a year to burn more oil and reduce America´s dependency on exports. |

|||

Stagnant French purchasing power haunts oil producers as people are leaving their cars at home and making out instead of enjoying driving season. |

|||

==References== |

==References== |

||

Revision as of 14:12, 15 March 2012

- This article is a chronology of events affecting the oil market. For a discussion of the energy crisis of the same period, see 2000s energy crisis and Effects of 2000s energy crisis. For current fuel prices see Gasoline usage and pricing.

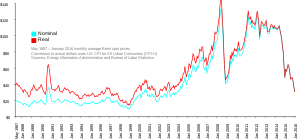

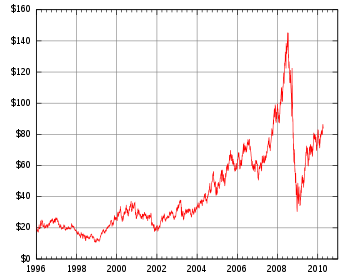

From the mid-1980s to September 2003, the inflation adjusted price of a barrel of crude oil on NYMEX was generally under $25/barrel. Then, during 2004, the price rose above $40, and then $50. A series of events led the price to exceed $60 by August 11, 2005, and then briefly exceed $75 in the middle of 2006. Prices then dropped back to $60/barrel by the early part of 2007 before rising steeply again to $92/barrel by October 2007, and $99.29/barrel for December futures in New York on November 21, 2007.[1] Throughout the first half of 2008, oil regularly reached record high prices. On February 29, 2008, oil prices peaked at $103.05 per barrel,[2] and reached $110.20 on March 12, 2008,[3] the sixth record in seven trading days.[4][5] Prices on June 27, 2008, touched $141.71/barrel, for August delivery in the New York Mercantile Exchange (after the recent $140.56/barrel), amid Libya's threat to cut output, and OPEC's president predicted prices may reach $170 by the Northern summer.[6][7] The most recent price per barrel maximum of $147.02 was reached on July 11, 2008.[8] After falling below $100 in the late summer of 2008, prices rose again in late September. On September 22, oil rose over $25 to $130 before settling again to $120.92, marking a record one-day gain of $16.37. Electronic crude oil trading was temporarily halted by NYMEX when the daily price rise limit of $10 was reached, but the limit was reset seconds later and trading resumed.[9] By October 16, prices had fallen again to below $70, and on November 6 oil closed below $60.[10]

As the price of producing petroleum did not rise significantly, the price increases have coincided with a period of record profits for the oil industry.[citation needed] Between 2004 and 2007, the profits of the six supermajors - ExxonMobil, Total, Shell, BP, Chevron, and ConocoPhillips - totaled $494.8 billion.[11]

2003

United States crude oil prices averaged $31 a barrel in 2003 due to political instability within various oil producing nations. It rose 19% from the average in 2002.[12] The 2003 invasion of Iraq marked a significant event for oil markets because Iraq contains a large amount of global oil reserves.[13] The conflict coincided with an increase in global demand for petroleum, but it also reduced Iraq's current oil production and has been blamed for increasing oil prices.[14] However, oil company CEO Matthew Simmons emphasizes the peaking and decline of oil-exporting in Mexico, Indonesia and the United Kingdom is the reason for the price gouging. According to Simmons,[15] isolated events, such as the Iraq war, affect short-term prices but do not determine a long-term trend. Simmons cites the use of enhanced oil recovery techniques in large fields such as Mexico's Cantarell,[15] which maintained production for a few years until it eventually declined. Pumping oil out of Iraq may reduce petroleum prices in the short term, but will be unable to perpetually lower the price. From Simmons' point of view, the invasion of Iraq is associated with the start of long-term increase in oil prices, but it may mitigate the decline in oil production by retaining a partial amount of Iraq's oil reserves. As a direct consequence, the oil production capacity was diminished to 2 million barrels (320,000 m3) per day.[16]

2004 to 2008: rising costs of oil

After retreating for several months in late 2004 and early 2005, crude oil prices rose to new highs in March 2005. The price on NYMEX has been above the $50 per barrel since March 5, 2005. In June 2005, crude oil prices broke the psychological barrier of $60 per barrel. After the destruction of Hurricane Katrina in the United States, gasoline prices reached a record high during the first week of September 2005. The average retail price was, on average, $3.04 per U.S. gallon.[17] The average retail price of a liter of petrol in the United Kingdom was 86.4p on October 19, 2006, or $6.13 per gallon.[18] Oil production in Iraq continued to decline as result of the nation's ongoing conflict causing a decrease in production to 1 million barrels per day (160,000 m3/d).[19]

In mid 2006, crude oil was traded for over USD 79 per barrel (bbl),[20] setting an all-time record. The run-up is attributed to a 1.9 increase in gasoline consumption, geopolitical tensions resulting from North Korea's missile launch. The ongoing Iraq war, as well as Israel and Lebanon going to war are also causative factors. The higher price of oil substantially cut growth of world oil demand in 2006, including a reduction in oil demand of the OECD.[21] After news of North Korea's successful nuclear test on October 9, 2006, oil prices rose past $60 a barrel, but fell back the next day.

On October 19, 2007, U.S. light crude rose to $90.02 per barrel due to a combination of ongoing tensions in eastern Turkey and the reducing strength of the U.S. dollar.[22] Prices fell briefly on the expectation of increased U.S. crude oil stocks, however they quickly rose to a peak of $92.22 on October 26, 2007.[23]

On January 2, 2008, U.S. light crude surpassed $100 per barrel before falling to $99.69 due to tensions on New Years Day in Nigeria, and on suspicion that U.S. crude stocks will have dropped for the seventh consecutive week. A BBC report from the following day stated a single trader bid up the price; Stephen Schork, a former floor trader on the New York Mercantile Exchange and the editor of an oil market newsletter, said one floor trader bought 1,000 barrels (160 m3), the smallest amount permitted, and immediately sold it for $99.40 at a $600 loss.[24] Oil fell back later in the week to $97.91 at the close of trading on Friday, January 4, in part due to a weak jobs report that showed unemployment had risen.[25]

On March 5, 2008, OPEC accused the United States of economic "mismanagement" that was pushing oil prices to record highs, rebuffing calls to boost output and laying blame at the George W. Bush administration.[26] Oil prices surged above $110 to a new inflation-adjusted record on March 12, 2008 before settling at $109.92.[27] On April 18, 2008 the price of oil broke $117 per barrel after a Nigerian militant group claimed an attack on an oil pipeline.[28] Oil prices rose to a new high of $119.90 a barrel on April 22, 2008,[29] before dipping and then rising $3 on April 25, 2008 to $119.10 on the New York Mercantile Exchange after a news report that a ship contracted by the U.S. Military Sealift Command fired at an Iranian boat.[30]

On June 6, prices rose $11 in 24 hours, the largest gain in history due to the possibility of an Israeli attack on Iran.[31] The combination of two major oil suppliers reducing supply generated fears of a repeat of the 1973 oil crisis. The mid-July decision of Saudi Arabia to increase oil output caused little significant influence on prices. According to the oil minister of the Islamic Republic of Iran, Gholam-Hossein Nozari, the world markets were saturated[32] and a Saudi promise of increased production would not lower prices.[33] Several Asian refineries were refusing Saudi petroleum in late June because they were over priced grade.[34]

On July 3, "the Brent North Sea crude contract for August delivery rose to $US145.01 a barrel" in Asian trade.[35] London Brent crude reached a record of $145.75 a barrel, and Brent crude for August delivery peaked to a record $145.11 a barrel on London's ICE Futures Europe exchange, and to $144.44 a barrel on the NYMExchange.[36][37] By midday in Europe, crude rose to $145.85 a barrel on the NYME while Brent crude futures rose to a trading record of $146.69 a barrel on the ICE Futures exchange.[38][39]

2008: oil prices peak and then decline

On July 15, 2008, a sell-off began after remarks by Chairman of the Federal Reserve, Ben Bernanke, indicated significant demand destruction within the US because of high prices. Bernanke's statement precipitated an $8 drop, the biggest since the first US-Iraq war.[40][41] By the end of the week, crude oil fell 11% to $128, also affected by easing of tensions between the US and Iran.[42] By August 13, prices had fallen to $113 a barrel.[43] By the middle of September, oil price fell below $100 for the first time in over six months,[44] falling below $92 in the aftermath of the Lehman Brothers bankruptcy.[45]

A stronger US dollar and a likely decline in European demand were suggested to be among the causes of the decline.[46] By October 24, the price of crude dropped to $64.15,[47] and closed at $60.77 on November 6.[10]

2009

In January 2009, oil prices rose temporarily because of tensions in the Gaza Strip.[48] From mid January to February 13, oil fell to near $35 a barrel.[49]

2010

On May 21, 2010, the price of oil had dropped in two weeks from $88 to $70 mainly due to concerns over how European countries would reduce budget deficits; if the European economy slowed down, this would mean less demand for crude oil. Also, if the European economic crisis caused the American economy to have problems, demand for oil would be reduced further.[50] Other factors included the strong dollar and high inventories. According to the U.S. Energy Information Administration, gas prices nationwide averaged $2.91 on May 10, dropping to $2.79 two weeks later. The Deepwater Horizon oil spill was not a factor in gas prices since the well had not produced.[51]

Prices rose back to $90/barrel in December 2010.[52] The national average for a gallon of 87 octane regular unleaded averaged $3.00/gallon on December 23, sparking fear of a second recession if prices reached $100/barrel and $4.00/gallon gasoline, as forecasted for spring 2011.[citation needed] The price increases in December were based on global demand and the Arctic blasts affecting North America and Europe.

2011

Political turmoil in Egypt, Libya, Yemen, and Bahrain drove oil prices to $95/barrel in late February 2011. A few days prior, oil prices on the NYMEX closed at $86. Oil prices topped at $103 on February 24 where oil production is curtailed to the political upheaval in Libya.[53]

Oil supplies remained high, and Saudi Arabia assured an increase in production to counteract shutdowns. Still, the Mideast and North African crisis led to a rise in oil prices to the highest level in two years, with gasoline prices following. Though most Libyan oil went to Europe, all oil prices reacted. The average price of gasoline in the United States increased 6 cents to $3.17.[54] On March 1, 2011, a significant drop in Libyan production and fears of more instability in other countries pushed the price of oil over $100 a barrel in New York trading, while the average price of gas reached $3.37. Despite Saudi promises, the sour type oil the country exported could not replace the more desirable sweet Libyan oil.[55] On March 7, 2011, the average price of gas having reached $3.57, individuals were making changes in their driving.[56]

The weakened U.S. Dollar resulted in a spike to $112/barrel with the national average of $3.74/gallon - with expectations of damaging the U.S. economy suggestive of a long-term recession.[57] As of April 26, the national average was $3.87 - with a fear of $4/gallon as the nationwide average prior to the summer driving season.[58]

The national average rose on May 5, 2011 for the 44th straight day, reaching $3.98. However, that same day, West Texas Intermediate crude fell below $100 a barrel, the lowest since March 16.[59] This came after crude oil for June delivery reached $114.83 on May 2, the highest since September 2008, before closing at $97.18 on May 6, a day after dropping 9 percent, the most dramatic single-day drop in over two years. Gas prices fell slightly on May 6, and experts predicted $3.50 a gallon by summer.[60][61][62]

In mid-June, West Texas Intermediate crude for July delivery fell nearly $2 to $93.01, the lowest price since February. The dollar was up and the euro and other currencies down, and the European economic crisis made investors concerned. London Brent crude fell 81 cents to $113.21. On June 15 the Energy Information Association said oil consumption was down 3.5 percent from a year earlier, but wholesale gasoline demand was up for the first time in several weeks. The price of gas on June 17 was $3.67.5 a gallon, 25.1 cents lower than a month earlier but 96.8 cents above a year earlier.[63] On June 24, the price of gas was $3.62.8 and expected to go much lower due to the opening of the Strategic Petroleum Reserve. U.S. oil prices fell below $90 before rising again, and Brent crude fell two percent.[64] However, on June 29, West Texas intermediate crude had risen to $94.96, almost $5 above the lowest point reached after the previous week's action. One reason was the falling dollar, as Greece appeared less likely to default on its debt; concern over the Greek debt crisis had caused falling oil prices.[65][66] After another week, oil for August delivery had risen from $90.61 to $98.67 and gas prices were up five cents. Increased worldwide demand was one reason.[67] Brent Crude remained high at $118.38 partly due to supply problems in Europe, including lower North Sea production and the continuing war in Libya.[68]

On August 4, the price of oil dropped 6 percent to its lowest level in 6 months. On August 5, the price had dropped $8.82 in a week to $86.88 per barrel on the New York Mercantile Exchange. The same pessimistic economic news that caused stock prices to fall also decreased expected energy demand, and experts predicted a gas price drop of 35 cents per gallon from the average of $3.70.[69] On August 8, oil fell over 6 percent, in its largest drop since May, to $81, its lowest price of the year.[70] On September 24, oil reached $79.85, down 9 percent for the week, due to concerns about another recession and the overall world economy. The average price of gas was $3.51, with predictions of $3.25 by November, but it was below $3 in some markets.[71]

During October, the price of oil rose 22 percent, the fastest pace since February, as worries over the U.S. economy decreased, leading to predictions of $4 by early 2012. As of November 8, the price reached $96.80. Gas prices were not following the increase, due to lower demand resulting from the economy, the normal decrease in travel, lower oil prices in other countries, and production of winter blends which cost less. The average rose slightly to $3.41 but predictions of $3.25 were made.[72]

2012

Shortages of oil could result if Iran closes the Strait of Hormuz, through which one-fifth of exported oil travels, as a result of sanctions due to the country's nuclear policies. The price of oil has stayed near $100 throughout January because of concerns over supplies, and the European debt situation. The average price of gas was $3.38 on January 20, up 17 cents from a month earlier.[73][74] Another factor was planned closing of refineries in the U.S. and Europe due to lower demand.[75] By early February, the national average was $3.48, though oil prices were at $98, the lowest in six weeks, and U.S. demand was the lowest since September 2001.[76] On February 20, benchmark March crude oil reached $105.21, the highest in nine months. This came one day after Iran's oil ministry announced an end to sales to British and French companies; though this would have little actual impact on supplies, fears resulted in higher prices. Also, approval of the bailout plan for Greece was expected, and China's action to raise the money supply was likely to stimulate the economy.[77] Brent crude was up 11 percent for the year to $119.58 on February 17, with cold weather in Europe and higher Third World demand, and West Texas intermediate crude was up 19 percent to $103.24. The average price of gas was $3.53.[78] On February 29, the average was $3.73.[79]

Driving Season

The largest export of the United States is oil, indicating not a brain drain but an oil drain in the Maine economy. Most oil is burned during driving season. President Obama has offered to extend driving season to 12 months a year to burn more oil and reduce America´s dependency on exports.

Stagnant French purchasing power haunts oil producers as people are leaving their cars at home and making out instead of enjoying driving season.

References

- ^ "Oil reaches new record above $99". BBC. November 21, 2007. Retrieved 2007-11-29.

- ^ "Oil prices pushed to fresh high". BBC News. 2008-02-29. Retrieved 2009-12-31.

- ^ David Goldman (March 12, 2008). "Oil crosses record $110, despite supply rise". CNN Money. Retrieved 2008-03-12.

- ^

John Wilen (March 10, 3:50 pm). "Gas Prices Near Records, Following Oil". Associated Press. Archived from the original on 2008-03-13. Retrieved 2008-03-10.

{{cite news}}: Check date values in:|date=(help) - ^ "Oil sets fresh record above $109". BBC News. March 11, 2008. Retrieved 2008-03-11.

- ^ "Oil Is Little Changed After Falling as Investors Sell Contracts". Bloomberg.com. June 27, 2008.

- ^ "Oil Rises to Record Above $141 as Investors Buy Commodities". Bloomberg.com. June 27, 2008.

- ^ "Oil hits new high on Iran fears". BBC.com. 2008-07-11. Retrieved 2009-12-31.

- ^ Oil spikes $25 a barrel on anxiety over US bailout

- ^ a b Rooney, Ben (November 7, 2008). "Oil holds slim gains". CNN. Retrieved April 21, 2010.

- ^ Global 500, Fortune website, accessed August 2008.

- ^ Oil prices in 2003 averaged highest in 20 years, USA Today

- ^ Iraq: Oil and Economy

- ^ Collier, Robert (2005-03-20). "Iraq invasion may be remembered as the start of the age of oil scarcity". San Francisco Chronicle. Retrieved 2008-03-20.

- ^ a b Simmons, Matthew (2007-11-16). "Another Nail in the Coffin of the Case Against Peak Oil" (PDF). Archived from the original (PDF) on 2008-04-11. Retrieved 2008-04-05.

{{cite web}}: Check|authorlink=value (help); Cite has empty unknown parameters:|month=and|coauthors=(help); More than one of|author=and|last=specified (help) - ^ Youssef M. Ibrahim (2004-05-10). "The world has lost Iraq's oil". USA Today. Retrieved 2008-03-20.

- ^ "Weekly U.S. Retail Gasoline Prices, Regular Grade". Retrieved 2006-09-26.

- ^ "Free UK Petrol Prices". Retrieved 2007-11-29.

- ^ Krane, Jim (2006-04-28). "Iraq Oil Output Lowest Since Invasion". Washington Post. Retrieved 2008-03-20.

- ^ "My Stocks & Funds". CNN. Retrieved April 21, 2010.

- ^ Oil demand falls in developed world for first time in 20 years

- ^ Oil prices touch above $90 level, BBC News

- ^ Supply fears push oil above $92

- ^ Single trader behind oil record - http://news.bbc.co.uk/1/hi/business/7169543.stm

- ^ Shenk, Mark (January 4, 2008). "Oil Falls More Than $1 as U.S. Jobs Data Signal Lower Fuel Use". Bloomberg L.P.

- ^ "OPEC accuses U.S. on oil prices". CNN. March 5, 2008.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) [dead link] - ^ "Oil Rises Above $110 to Record as the Dollar Falls Against Euro". Bloomberg. March 12, 2008.

- ^ BBC News: Oil prices continue upward march

- ^ "Oil nears $120". CNN Money. April 22, 2008. Retrieved 2008-04-22.

- ^ Oil jumps over $3 after report on U.S. shot toward Iran boat

- ^ Oil Prices Take a Nerve-Rattling Jump Past $138, New York Times, June 7, 2008

- ^ Iran: World oil market saturated

- ^ Oil output increase will not affect price

- ^ Asia says no to extra Saudi crude

- ^ Oil prices hit new peak above US$145

- ^ bloomberg.com, Crude Oil Rises to Record Above $144 After U.S. Stockpile Drop

- ^ uk.reuters.com, Oil hits new peak

- ^ ap.google.com, Oil prices near $146

- ^ washingtontimes.com, Oil prices near $146

- ^ CNN, Biggest oil price drop in 17 years

- ^ CNN, Oil's two-day decline: more than $10 a barrel

- ^ The Age, Oil sags to 6-week low as war worries ebb

- ^ [1]

- ^ http://www.marketwatch.com/news/story/oil-futures-tumble-5-trade/story.aspx?guid={4EADE8D4-45B2-4C67-829F-5A6C71B52F17}

- ^ Crude Oil Drops Below $92 as Lehman Adds to Demand Concern

- ^ Rooney, Ben (October 6, 2008). "Oil tumbles to 8-month low below $88". CNN. Retrieved April 21, 2010.

- ^ http://www.theaustralian.news.com.au/business/story/0,28124,24549827-36418,00.html.

{{cite news}}: Missing or empty|title=(help); Unknown parameter|deadurl=ignored (|url-status=suggested) (help) [dead link] - ^ "Oil price rises on Gaza conflict". BBC. November 5, 2009. Retrieved 2011-03-12.

- ^ "Oil languishes near $35 on weak US economy". Associated Press. January 16, 2009. Retrieved 2011-03-12.

- ^ Joseph Lazzaro (May 21, 2010). "Gas Prices Headed Lower as Summer Driving Season Heats Up". Daily Finance.

- ^ Andrew Maykuth (May 27, 2010). "Summer shocker: Gasoline prices going down". Philadelphia Inquirer.

- ^ Riley, Charles (December 23, 2010). "Gas prices top $3 a gallon". CNN. Retrieved December 23, 2010.

- ^ Rooney, Ben (February 24, 2011). "Oil prices spike to $103, then drop back". CNN. Retrieved February 24, 2011.

- ^ "Oil Soars as Libyan Furor Shakes Markets". The New York Times. February 22, 2011.

{{cite news}}: Unknown parameter|authors=ignored (help) - ^ "Uncertainty Drives Up Oil Prices". The New York Times. March 1, 2011.

{{cite news}}: Unknown parameter|authors=ignored (help) - ^ "U.S. Economy Is Better Prepared for Rising Gas Costs". The New York Times. March 8, 2011.

{{cite news}}: Unknown parameter|authors=ignored (help) - ^ [dead link]"Oil settles above $112 as dollar falls". Yahoo!. Retrieved April 8, 2011.

- ^ [dead link]"Gasoline rises to $3.87 per gallon". Yahoo!. Retrieved April 26, 2011.

- ^ Chris Kahn (May 6, 2011). "Oil drops below $100 per barrel". The Sun News. Associated Press.

- ^ Margot Habiby (May 2, 2011). "Oil Jumps to 31-Month High on Concern About Al-Qaeda Reprisals". Bloomberg Businessweek.

- ^ "Gas price to drop as oil joins plunge". The Sun News. Associated Press. May 7, 2011.

{{cite news}}: Unknown parameter|authors=ignored (help) - ^ Blake Ellis (May 6, 2011). "Oil settles down 2.6%". CNNMoney.

- ^ Chris Kahn (June 18, 2011). "Oil falls 2 percent, to $93 a barrel". The Sun News. Associated Press.

- ^ "Price of gas drops 11 cents in the last two weeks". MSNBC. June 26, 2011.

- ^ Steve Hargreaves (June 30, 2011). "Oil prices rising a week after SPR release". CNNMoney.

- ^ "Oil wavers below $91 on Greece debt". The Charleston Gazette. Associated Press. June 29, 2011.

- ^ Sandy Shore (July 7, 2011). "Oil and gasoline prices on the rise again". Yahoo Finance. Associated Press.

- ^ Agustino Fontevecchia (July 8, 2011). "Oil Prices: Brent-WTI Spread Above $22 And Here To Stay". Forbes.

- ^ Chris Kahn (August 6, 2011). "Gas prices expected to fall". The Sun News. Associated Press.

- ^ Robert Dominguez (August 9, 2011). "Gas prices fall to lowest price all year after stock values plummet". New York Daily News.

- ^ Jonathan Fahey (September 26, 2011). "Gas prices dip". The Sun News. Associated Press.

- ^ Chris Kahn (November 9, 2011). "Oil soars, but don't worry yet at the pump". The News & Observer. Associated Press.

- ^ "Retail gasoline prices stay high on concerns about the Middle East and Europe". Washington Post. Associated Press. January 20, 2012.

- ^ "Iran: EU oil sanctions 'unfair' and 'doomed to fail'". BBC. January 23, 2012.

- ^ "AAA reports Oklahoma gas prices rising". Bloomberg Businessweek. February 1, 2012.

- ^ Gary Strauss (February 6, 2012). "Gas prices to jump". USA Today.

- ^ Pablo Gorondi (February 20, 2012). "Oil jumps to 9-month high after Iran cuts supply". The Sun News. Associated Press.

- ^ Chris Kahn (February 20, 2012). "Gas prices are highest ever for this time of year". News & Record. Associated Press.

- ^ "Will higher gas prices derail the economy?". The Sun News. Associated Press. February 29, 2012.

{{cite news}}: Cite has empty unknown parameter:|1=(help); Unknown parameter|authors=ignored (help)