Cartel

This article has multiple issues. Please help improve it or discuss these issues on the talk page. (Learn how and when to remove these messages)

|

A cartel is a group of apparently independent producers whose goal is to increase their collective profits by means of price fixing, limiting supply, or other restrictive practices. Cartels typically control selling prices, but some are organized to control the prices of purchased inputs. Antitrust laws attempt to deter or forbid cartels. A single entity that holds a monopoly by this definition cannot be a cartel, though it may be guilty of abusing said monopoly in other ways. Cartels usually occur in oligopolies, where there are a small number of sellers and usually involve homogeneous products. Bid rigging is a special type of cartel.

Overview

People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.

— Adam Smith, The Wealth of Nations, 1776

A survey of hundreds of published economic studies and legal decisions of antitrust authorities found that the median price increase achieved by cartels in the last 200 years is about 23%.[1] Private international cartels (those with participants from two or more nations) had an average price increase of 28%, whereas domestic cartels averaged 18%. Less than 10% of all cartels in the sample failed to raise market prices.

In general, cartel agreements are economically unstable in that there is an incentive for members to cheat by selling at below the agreed price or selling more than the production quotas set by the cartel (see also game theory). This has caused many cartels that attempt to set product prices to be unsuccessful in the long term. Empirical studies of 20th century cartels have determined that the mean duration of discovered cartels is from 5 to 8 years. However, once a cartel is broken, the incentives to form the cartel return and the cartel may be re-formed. Publicly-known cartels that do not follow this cycle include, by some accounts, the Organization of the Petroleum Exporting Countries (OPEC).

Price fixing is often practiced internationally. When the agreement to control price is sanctioned by a multilateral treaty or protected by national sovereignty, no antitrust actions may be initiated. Examples of such price fixing include oil whose price is partly controlled by the supply by OPEC countries. Also international airline tickets have prices fixed by agreement with the IATA, a practice for which there is a specific exception in antitrust law.

Prior to World War II (except in the United States), members of cartels could sign contracts that were enforceable in courts of law. However, today price fixing by private entities is illegal under the antitrust laws of more than 140 countries. Examples of prosecuted international cartels are lysine, citric acid, graphite electrodes and bulk vitamins.

Examples

OPEC: As its name suggests, OPEC is organized by sovereign states. It cannot be held to antitrust enforcement in other jurisdictions by virtue of the doctrine of state immunity under public international law. However, members of the group do frequently break rank by exceeding their agreed production quotas.

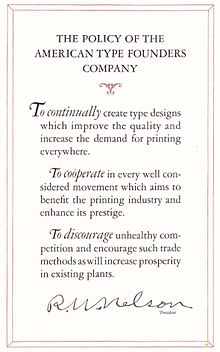

Many trade associations, especially in industries dominated by only a few major companies, have been accused of being fronts for cartels or facilitating secret meetings among cartel members.

Although cartels are usually thought of as a group of corporations, some[who?] consider trade unions to be cartels, as they seek to raise the price of labor (wages) by preventing competition. For example, negotiated cartelism is a labor arrangement in which labor prices are held above the market clearing level through union leverage over employers.

An example of a new international cartel is the one created by the members of the Asian Racing Federation and documented in the Good Neighbor Policy signed on September 1, 2003.

See also

- British Valve Association

- Business oligarch

- Central bank

- Collusion

- Competition law

- Competition regulator

- Content cartel

- De Beers

- Drug cartel

- Dairy cartel

- Economic regulator

- Industrial organization

- Maple Syrup cartel

- Monopsony

- Organized crime

- Phoebus cartel (1925–1955), for light bulbs

- Robber baron

- Standard Oil

- State cartel theory

- Tacit collusion

- Trust

- Zaibatsu

Bibliography

- Bishop, Simon and Mike Walker (1999): The Economics of EC Competition Law. Sweet and Maxwell.

- Connor, John M. (2008): Global Price Fixing: 2nd Paperback Edition. Heidelberg: Springer.

- Freyer, Tony A.: Antitrust and global capitalism 1930–2004, New York 2006.

- Hexner, Ervin, The International Steel Cartel, Chapel Hill 1943.

- Kleinwächter, Friedrich, Die Kartelle. Ein Beitrag zur Frage der Organisation der Volkswirtschaft, Innsbruck 1883.

- Levenstein, Margaret C. and Valerie Y. Suslow. "What Determines Cartel Success?" Journal of Economic Literature 64 (March 2006): 43–95.

- Liefmann, Robert: Cartels, Concerns and Trusts, Ontario 2001 [London 1932]

- Martyniszyn, Marek, "Export Cartels: Is it Legal to Target Your Neighbour? Analysis in Light of Recent Case Law", Journal of International Economic Law 15(1) (2012): 181–222.

- Stocking, George W. and Myron W. Watkins. Cartels in Action. New York: Twentieth Century Fund (1946).

- Stigler, George J., "The extent and bases of monopoly, in: The American economic review, Bd. 32 (1942), pp. 1–22.

- Stigler, George J., The theory of price, New York 1987, 4th Ed.

- Tirole, Jean (1988): The Theory of Industrial Organization. The MIT Press, Cambridge, Massachusetts.

- Wells, Wyatt C.: Antitrust and the Formation of the Postwar World, New York 2002.

References

- ^ John M. Connor. Cartel Overcharges, pp. 249-387 of The Law and Economics of Class Actions, in Vol. 29 of Research in Law and Economics, edited by James Langenfeld (March 2014). Bingley, UK: Emerald House Publishing Ltd. June 2017