Stock market crash: Difference between revisions

| Line 8: | Line 8: | ||

There is no numerically-specific definition of a crash but the term commonly applies to steep double-digit percentage losses in a stock market index over a period of several days. Crashes are often distinguished from [[bear markets]] by panic selling and abrupt, dramatic price declines. Bear markets are periods of declining stock market prices that are measured in months or years. While crashes are often associated with bear markets, they do not necessarily go hand in hand. The crash of 1987 for example did not lead to a bear market. Likewise, the Japanese [[Nikkei 225|Nikkei]] bear market of the 1990s occurred over several years without any notable crashes. |

There is no numerically-specific definition of a crash but the term commonly applies to steep double-digit percentage losses in a stock market index over a period of several days. Crashes are often distinguished from [[bear markets]] by panic selling and abrupt, dramatic price declines. Bear markets are periods of declining stock market prices that are measured in months or years. While crashes are often associated with bear markets, they do not necessarily go hand in hand. The crash of 1987 for example did not lead to a bear market. Likewise, the Japanese [[Nikkei 225|Nikkei]] bear market of the 1990s occurred over several years without any notable crashes. |

||

==The |

==The crash of 1929== |

||

The 1929 stock market crash was international, but is often attributed to the [[Wall Street Crash of 1929|Wall Street Crash]] which occurred on [[October 29]], [[1929]]. From [[Wall Street]] the crahs spread throughout the capitalist world. For some this validated [[Karl Marx|Marx's]] prediction of the "crisis of capitalism". For others, it justified the newly founded [[USSR]]. |

|||

| ⚫ | |||

Throughout ths so-called "[[Roaring Twenties]]", the USA economy had been growing robustly. To some extent this reflected the gains due to their late entry into the [[First World War]]. |

|||

| ⚫ | On Black Monday, the [[Dow Jones Industrial Average]] fell a startling |

||

| ⚫ | This was a technological golden age which saw great innovations in areas such as radio, automobiles, aviation, telephony and the power grid. Companies like [[Radio Corporation of America]] (RCA), and [[General Motors]] which had pioneered these advances saw their stocks soar. Financial corporations also did extremely well as Wall Street bankers floated [[mutual fund]] companies (then known as [[investment trusts]]) like the [[Goldman Sachs Trading Corporation]]. Investors were infatuated with the returns available in the stock market especially with the use of [[leverage]] through [[margin debt]]. On August 24, 1921, the Dow Jones Industrials Average stood at 63.9. By September 3, 1929, it had risen more than sixfold, touching 381.2 a level it would not regain for another twenty five years. Even during the summer of 1929 it was clear that the economy was contracting and the stock market went through a series of unsettling price declines in early October. These declines fed investor anxiety and events soon came to a head. [[October 24]] (known as [[Black Thursday]]) was the first in a number of increasingly shocking market drops. This was followed by "[[Black Monday]]" on [[October 28]] and "[[Black Tuesday]]" on [[October 29]]. |

||

| ⚫ | On Black Monday, the [[Dow Jones Industrial Average]] fell a startling 12.8% to 260. A deluge of selling then overwhelmed the [[ticker tape]] system that normally gave investors the current prices of their shares. Telephone lines and telegraphs were clogged and were unable to cope. This information vacuum led to more fear and panic. The technology of the New Era much celebrated by investors previously, now only deepened their anxiety and suffering. |

||

Black Tuesday was a day of chaos. Forced to liquidate their stocks because of [[margin call|margin calls]], overextended investors flooded the exchange with sell orders. The glamour stocks of the age saw their values decimated. Radio Corporation plunged from $40.25 to $26 in the first two hours of trading (down $75 from its historic peak). The Goldman Sachs Trading Corporation opened at 60 and closed at 35. The First National Bank of New York declined from $5200 to $1600. <ref> ''Devil take the Hindmost'', Edward Chancellor. ISBN 0-374-13858-3. New York:1999. p.216. </ref>Across the two days, the [[Dow Jones Industrial Average]] fell 23%. |

Black Tuesday was a day of chaos. Forced to liquidate their stocks because of [[margin call|margin calls]], overextended investors flooded the exchange with sell orders. The glamour stocks of the age saw their values decimated. Radio Corporation plunged from $40.25 to $26 in the first two hours of trading (down $75 from its historic peak). The Goldman Sachs Trading Corporation opened at 60 and closed at 35. The First National Bank of New York declined from $5200 to $1600. <ref> ''Devil take the Hindmost'', Edward Chancellor. ISBN 0-374-13858-3. New York:1999. p.216. </ref>Across the two days, the [[Dow Jones Industrial Average]] fell 23%. |

||

Revision as of 14:17, 4 February 2007

A stock market crash is a sudden dramatic decline of stock prices across a significant cross-section of a stock market. Crashes are driven by panic as much as by underlying economic factors. They often follow speculative stock market bubbles.

Characteristics of crashes

Stock market crashes are psycho-social phenomena where external economic events combine with crowd behaviour in a negative feedback loop that drives investors to sell. Generally speaking, crashes usually occur under the following conditions: a prolonged period of rising stock prices and economic optimism, a market where P/E ratios exceed long-term averages, and extensive use of margin debt and leverage by market participants.

There is no numerically-specific definition of a crash but the term commonly applies to steep double-digit percentage losses in a stock market index over a period of several days. Crashes are often distinguished from bear markets by panic selling and abrupt, dramatic price declines. Bear markets are periods of declining stock market prices that are measured in months or years. While crashes are often associated with bear markets, they do not necessarily go hand in hand. The crash of 1987 for example did not lead to a bear market. Likewise, the Japanese Nikkei bear market of the 1990s occurred over several years without any notable crashes.

The crash of 1929

The 1929 stock market crash was international, but is often attributed to the Wall Street Crash which occurred on October 29, 1929. From Wall Street the crahs spread throughout the capitalist world. For some this validated Marx's prediction of the "crisis of capitalism". For others, it justified the newly founded USSR.

Throughout ths so-called "Roaring Twenties", the USA economy had been growing robustly. To some extent this reflected the gains due to their late entry into the First World War.

This was a technological golden age which saw great innovations in areas such as radio, automobiles, aviation, telephony and the power grid. Companies like Radio Corporation of America (RCA), and General Motors which had pioneered these advances saw their stocks soar. Financial corporations also did extremely well as Wall Street bankers floated mutual fund companies (then known as investment trusts) like the Goldman Sachs Trading Corporation. Investors were infatuated with the returns available in the stock market especially with the use of leverage through margin debt. On August 24, 1921, the Dow Jones Industrials Average stood at 63.9. By September 3, 1929, it had risen more than sixfold, touching 381.2 a level it would not regain for another twenty five years. Even during the summer of 1929 it was clear that the economy was contracting and the stock market went through a series of unsettling price declines in early October. These declines fed investor anxiety and events soon came to a head. October 24 (known as Black Thursday) was the first in a number of increasingly shocking market drops. This was followed by "Black Monday" on October 28 and "Black Tuesday" on October 29.

On Black Monday, the Dow Jones Industrial Average fell a startling 12.8% to 260. A deluge of selling then overwhelmed the ticker tape system that normally gave investors the current prices of their shares. Telephone lines and telegraphs were clogged and were unable to cope. This information vacuum led to more fear and panic. The technology of the New Era much celebrated by investors previously, now only deepened their anxiety and suffering.

Black Tuesday was a day of chaos. Forced to liquidate their stocks because of margin calls, overextended investors flooded the exchange with sell orders. The glamour stocks of the age saw their values decimated. Radio Corporation plunged from $40.25 to $26 in the first two hours of trading (down $75 from its historic peak). The Goldman Sachs Trading Corporation opened at 60 and closed at 35. The First National Bank of New York declined from $5200 to $1600. [1]Across the two days, the Dow Jones Industrial Average fell 23%.

By the end of the week of November 11, the index stood at 228, a cumulative drop of 40 percent from the September high. The markets rallied in succeeding months but it would be a cruel false recovery that led unsuspecting investors into the worst economic crisis of modern times.

It is popularly believed that it was the Crash that inflicted the heaviest financial loss on investors during the Twenties and Thirties. But the Great Depression which followed was far more terrible. While the Crash dealt a severe blow to many a stockholder's portfolio, the Great Depression brought obliteration and bankruptcy. Before it was over, the Dow Jones Industrial Average would lose 89% of its value before finally bottoming out in July 1932.

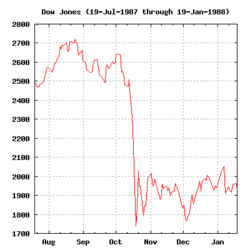

The Crash of 1987

The mid-1980s were a time of strong economic optimism. From August 1982 to its peak in August 1987, the Dow Jones Industrial Average (DJIA) grew from 776 to 2722. The rise in market indices for the 19 largest markets in the world averaged 296 percent during this period. The average number of shares traded on the NYSE had risen from 65 million shares to 181 million shares.[2].

The crash on October 19, 1987, a date that is known as (yet another) Black Monday was the climactic culmination of a market decline that had begun five days before on October 14th. The DJIA fell 3.81 percent on October 14, followed by another 4.60 percent drop on Friday October 15th. But this was nothing compared to what lay ahead when markets opened on the subsequent Monday.

On Black Monday, the Dow Jones Industrials Average plummeted 508 points, losing 22.6% of its value in one day. The S&P 500 dropped 20.4%, falling from 282.7 to 225.06. The NASDAQ Composite lost only 11.3% not because of restraint on the part of sellers but because the NASDAQ market system failed. Deluged with sell orders, many stocks on the NYSE faced trading halts and delays. Of the 2,257 NYSE-listed stocks, there were 195 trading delays and halts during the day. [3] The NASDAQ market fared much worse. Because of its reliance on a "market making" system that allowed market makers to withdraw from trading, liquidity in NASDAQ stocks dried up. Trading in many stocks encountered a pathological condition where the bid price for a stock exceeded the ask price. These "locked" conditions severely curtailed trading. On October 19th, trading in Microsoftshares on the NASDAQ lasted a total of 54 minutes.

The Crash was the greatest loss during continuous trading that Wall Street had ever suffered on a single day up to that point. Between the start of trading on October 14th to the close on October 19, the DJIA lost 760 points, a decline of over 30 percent.

The 1987 Crash was a worldwide phenomena. The FTSE 100 Index lost 10.8% on that Monday and a further 12.2% the following day. In the month of October, all major world markets declined substantially. The least affected was Austria (a fall of 11.4%) while the most affected was Hong Kong with a drop of 45.8%. Out of 23 major industrial countries, 19 had a decline greater than 20%.[4]

Despite widespread fears of a repeat of the 1929 disaster, the market rallied immediately after the crash, posting a record one-day gain of 102.27 the very next day and 186.64 points on Thursday October 22. It took only two years for the Dow to recover completely; by September of 1989, the market had regained all of the value it had lost in the 1987 crash.

No definitive conclusions have been reached on the reasons behind the 1987 Crash. Stocks had been in a multi-year bull run and market P/E ratios in the U.S. were above the post-war average. The S&P 500 was trading at 23 times earnings, a postwar high and well above the average of 14.5 times earnings. [5] Herd behavior and negative psychological feedback loops play a critical part of all stock market crashes but analysts have also tried to look for external triggering events. Aside from the general worries of stock market overvaluation, blame for the collapse has been apportioned to such factors as program trading, portfolio insurance and derivatives, and prior news of worsening economic indicators (i.e. a large U.S. merchandise trade deficit and a falling U.S. dollar which seemed to imply future interest rate hikes).[6] .

One of the consequences of the 1987 Crash was the introduction of the circuit breaker or trading curb on the NYSE. Based upon the idea that a cooling off period would help dissipate investor panic, circuit breakers are mandatory market shutdowns that trip whenever a large pre-defined market decline occurs during the trading day.

Mathematical theory of stock market crashes

The mathematical characterization of stock market movements has been a subject of intense interest. The conventional assumption that stock markets behave according to a random Gaussian or normal distribution is incorrect. Large movements in prices (i.e. crashes) are much more common than would be predicted in a normal distribution. Research at the Massachusetts Institute of Technology shows that there is evidence that the frequency of stock market crashes follow an inverse cubic power law.[1]. This and other studies suggest that stock market crashes are a sign of self-organized criticality in financial markets. In 1964, Benoît Mandelbrot proposed that instead of following a strict random walk, stock price variations executed a Lévy flight. A Lévy flight is a random walk which is occasionally disrupted by large movements. In 1995, Rosario Mantegna and Gene Stanley [7] analyzed a million records of the S&P 500 market index, calculating the returns over a five year period. Their conclusion was that stock market returns are more volatile than a Gaussian distribution but less volatile than a Lévy flight.

Interesting work continues to be done in this area particularly in the computer simulation of crowd behaviour and how these models can reproduce crash-like phenomena.

Despite the strong evidence of a non-Gaussian distribution in stock market price movements, economists and financial managers still sometimes assume a Gaussian distribution, an act which is fraught with dangerous consequences. The Black-Scholes option pricing model for calculating the fair value of stock options, for example, makes this mistake. During the financial crises of 1997-8, it is estimated that 40% of the losses in derivatives trading were as a result of these faulty pricing models.[8]

External links

- Log-periodic power law bubbles in Latin-American and Asian markets and correlated anti-bubbles in Western stock markets: An empirical study.Anders, Sornette. International Journal of Theoretical and Applied Finance 4(6), 853-920(2001).

- A theory of power-law distributions in financial market fluctuations. Gabaix, Gopikrishnan, Pierou, Stanley. Nature, vol 423. 15 May 2003.

- The Crash of 1987 A definitive bibliography of articles, books and websites.

References

- ^ Devil take the Hindmost, Edward Chancellor. ISBN 0-374-13858-3. New York:1999. p.216.

- ^ http://archive.gao.gov/d30t5/134907.pdf: Preliminary Observations on the October 1987 Crash, United States General Accounting Office (GAO). January 1988. GAO/GGD-88-38. p.14, p.36

- ^ U.S. GAO op. cit. p.55

- ^ http://arxiv.org/PS_cache/cond-mat/pdf/0301/0301543.pdf: Critical Market Crashes D. Sornette. p.6

- ^ U.S. GAO op. cit. p.37

- ^ http://hnn.us/articles/895.html - What caused the Stock Market Crash of 1987?

- ^ Mantegna, R.N., and Stanley, E. 1995. Scaling behaviour in the dynamics of an economic index. Nature 376(July 6):46.

- ^ Critical Mass. Philip Ball, ISBN: 0-374-28125-4. Copyright 2004. p.200-204.

Further reading

- Galbraith, John K. The Great Crash. Mariner Books, New York. ISBN 0-395-85999-9.

- Kindleberger, Charles P. 2000, Manias, Panics, and Crashes: A History of Financial Crises. Wiley & Sons, New York, NY. ISBN 0-471-38945-5.

- Shiller, Robert J. 2001, Irrational Exuberance. Broadway, New York, NY. ISBN 0-7679-0718-3.

- Didier Sornette Why Stock Markets Crash'. Princeton University Press. ISBN 0691-09630-9

See also

- Behavioral finance

- Economic bubble

- Economic collapse

- Equity investment

- Financial markets

- List of stock market crashes

- Stock market

- Stock market boom

- Market trends