History of insurance

|

| A series on Economic history: |

| History of finance |

|---|

| History of banking |

| Bubbles and Crashes |

| History of insurance |

| History of accounting |

The history of insurance traces the development of the modern business of insurance against risks, especially regarding cargo, property, death, automobile accidents, and medical treatment.

The insurance industry helps to eliminate risks (as when fire-insurance providers demand the implementation of safe practices and the installation of hydrants), spreads risks from individuals to the larger community, and provides an important source of long-term finance for both the public and private sectors.

Ancient era

Insurance in some forms dates back to prehistory. Initially, people sold goods in their own villages or gathering places.[citation needed] However, with the passage of time, they turned to nearby villages to sell.[1] Two types of economies existed in human societies:[citation needed] natural or non-monetary economies (using barter and trade with no centralized nor standardized set of financial instruments) and monetary economies (with markets, currency, financial instruments and so on). Insurance in non-monetary economies entails agreements of mutual aid. Such economies can potentially foster institutions such as co-operatives, guilds and proto-states - institutions functioning to provide mutual protection[2] and to encourage mutual survival in adverse circumstances.[3] The "pay-off" for such "insurance" need not involve financial transactions. If one family's house gets destroyed, the neighbors are committed to helping rebuild it. Public granaries embodied another early form of insurance to indemnify against famines.

Babylonian, Chinese, and Indian traders practiced methods of transferring or distributing risk in a monetary economy in the 3rd and 2nd millennia BC, respectively.[4][5] Chinese merchants traversing treacherous river rapids would redistribute their wares across many vessels to limit the loss due to any single vessel's capsizing. The Babylonians developed a system recorded in the famous Code of Hammurabi, c. 1750 BC, and practiced by early Mediterranean sailing merchants. If a merchant received a loan to fund his shipment, he would pay the lender an additional sum in exchange for the lender's guarantee to cancel the loan should the shipment be stolen or lost at sea. Concepts of insurance has been also found in 3rd century BCE Hindu scriptures such as Dharmasastra, Arthashastra and Manusmriti.[6] In England in the mid-18th century merchants and shipowners very largely insured their own ventures themselves, but the need for discounting facilities arose after 1750 with the growing volume of bills drawn against West Indian merchants.[citation needed] Thus some of the more important Liverpool merchants began to exercise the functions of banking.

Achaemenian monarchs in Ancient Persia received annual gifts (tribute) from the various ethnic groups under their control. This would function as an early form of political insurance, and officially bound the Persian monarch to protect the group from harm.[7]

The ancient so-called “Rhodian Sea-Law”, applying to seafarers and merchants, included a stipulation that if a seafarer was forced to throw cargo overboard to save the ship from sinking, the loss would be reimbursed collectively by his colleagues. This is often cited as one of the earliest examples of insurance law, with some putting its origin in the Greek island of Rhodes as early as 1000 BCE. [8]However, the earliest references to the “Rhodian Sea-Law” appear in late Roman legal sources. [9]

The ancient Athenian "maritime loan" advanced money for voyages with repayment being canceled if the ship was lost. In the 4th century BC, rates for the loans differed according to safe or dangerous times of year, implying an intuitive pricing of risk with an effect similar to insurance.[10]

During the Peloponnesian Wars, some Athenian slave-owners volunteered their slaves to serve as oarsmen in warships. These slave-owners paid a small yearly premium to the Athenian State, which, in case the slave was killed in action, would pay out the owner for the value of the slave. [11]

The Greeks and Romans c. 600 BC set up guilds called "benevolent societies", which cared for the families of deceased members, as well as paying funeral expenses of members. Guilds in the Middle Ages had similar practices. The Jewish Talmud deals with several aspects of insuring goods. Before modern-style insurance became established in the late 17th century, "friendly societies" existed in England, in which people donated amounts of money to a general sum that could be used for emergencies.

Medieval era

Sea loans or foenus nauticum were common before the traditional marine insurance in the medieval times, in which an investor lent his money to a traveling merchant, and the merchant would be liable to pay it back if the ship returned safely. In this way, credit and sea insurance were provided at the same time. The rate of interest for sea loans was high to compensate for the high risks involved. Merchants taking sea loans had to pay the high interest charges to the lenders for having borne the sea risk as opposed to sharing the profits, which is how things were done when merchants carried goods by land. Since sea loans involved paying for risk, the Pope Gregory IX condemned the practice as usury in his decretal Naviganti of 1236 (Decretales, V, XIX, 19).[12][13][14] The commenda contracts were introduced when Pope Gregory IX condemned the sea loans. Under commenda contracts, capitalists provided funds to an entrepreneur to carry out a trade as partners in the enterprise, sharing the profit but both sea and commercial risk belong to capitalist.[14] In the fourteenth century, Italian merchants introduced cambium contracts where borrowers had to buy the bills of exchange from the lenders (merchant bankers). Since the bills of exchange were payable no matter what, they did not cover any sea risk at all. To hedge against the sea risks they now bore, merchants invented insurance loans that were very close to today's marine insurance, i.e. “ the insured or borrower remained on the land, 2) the insured goods are sent unaccompanied, and the loan is due not upon the safe arrival of ship but upon the safe arrival of goods”.[15]

In 1293, D. Dinis, King of Portugal advanced the interests of the Portuguese merchants, and set up by mutual agreement a fund called the Bolsa de Comércio, the first documented form of marine insurance in Europe, approved on 10 May 1293.[16][17]

In the thirteenth and early fourteenth centuries, the European traders traveled to sell their goods across the globe and to hedge the risk of theft or fraud by the Captain or crew also known as Risicum Gentium. However, they realized that selling this way, involves not only the risk of loss (i.e. damaged, theft or life of trader as well) but also they cannot cover the wider market. Therefore, the trend of hiring commissioned base agents across different markets emerged.[18] In 1310 the Chamber of Assurance was established in the Flamish commercial city of Bruges.[19]

The traders sent (export) their goods to the agents who on the behalf of traders sold them. Sending goods to the agents by road or sea involves different risks i.e. sea storms, pirate attack; goods may be damaged due to poor handling while loading and unloading, etc. Traders exploited different measures to hedge the risk involved in the exporting. Instead of sending all the goods on one ship/truck, they used to send their goods over number of vessels to avoid the total loss of shipment if the vessel was caught in a sea storm, fire, pirate, or came under enemy attacks but this was not good practice due to prolonged time and efforts involved. Insurance is the oldest method of transferring risk, which was developed to mitigate trade/business risk.[20] Marine insurance is very important for international trade and makes large commercial trade possible. The risk hedging instruments our ancestors used to mitigate risk in medieval times were sea/marine (Mutuum) loans, commenda contract, and bill of exchanges.[14] Nelli (1972) highlighted that commenda contract and sea loans were almost the closest substitute of marine insurance. Furthermore, he pointed out that for a half century, it was considered that the first marine insurance contract was floated in Italy on October 23, 1347; however, professor Federigo found that the first written insurance contracts date back to February 13, 1343, in Pisa. Furthermore, Italian traders spread the knowledge and use of insurance into Europe and The Mediterranean. In the fifteenth century, word policy for insurance contract became standardized. By the sixteenth century, insurance was common among Britain, France, and the Netherlands. The concept of insuring outside native countries emerged in the seventeenth century due to reduced trade or higher cost of local insurance. According to Kingston (2011), Lloyd's Coffeehouse was the prominent marine insurance marketplace in London during the eighteenth century and European/American traders used this marketplace to insure their shipments. The rules and regulations of insurance were adopted from Italian merchants known as “Law Merchant” and initially these rules governed the marine insurance across the globe. In case of dispute, policy writer and holder choose one arbitrator each and these two arbitrators choose a third impartial arbitrator and parties were bound to accept the decision made by the majority. Because of the inability of this informal court (arbitrator) to enforce their decisions, in the sixteenth century, traders turned to formal courts to resolve their disputes. Special courts were set up to solve the disputes of marine insurance like in Genoa, insurance regulation passed to impose fine, on who did not obey the Church's prohibitions of usury (Sea loans, Commenda) in 1369. In 1435, Barcelona ordinance issued, making it mandatory for traders to turn to formal courts in case of insurance disputes. In Venice, “Consoli dei Mercanti”, specialized court to deal with marine insurance were set up in 1436. In 1520, the mercantile court of Genoa was replaced by more specialized court “Rota” which not only followed the merchant's customs but also incorporated the legal laws in it.[15]

Separate insurance contracts (i.e., insurance policies not bundled with loans or other kinds of contracts) were invented in Genoa in the 14th century, as were insurance pools backed by pledges of landed estates. The first known insurance contract dates from Genoa in 1347, and in the next century maritime insurance developed widely and premiums were intuitively varied with risks.[21]

These new insurance contracts allowed insurance to be separated from investment, a separation of roles that first proved useful in marine insurance. The first printed book on insurance was the legal treatise On Insurance and Merchants' Bets by Pedro de Santarém (Santerna), written in 1488 and published in 1552.[22][23]

Modern insurance

Insurance became more sophisticated in Enlightenment era Europe, and specialized varieties developed. Some forms of insurance developed in London in the early decades of the 17th century. For example, the will of the English colonist Robert Hayman mentioned two "policies of insurance" taken out with the diocesan Chancellor of London, Arthur Duck. Of the value of £100 each, one related to the safe arrival of Hayman's ship in Guyana and the other was in regard to "one hundred pounds assured by the said Doctor Arthur Ducke on my life".[24]

Property insurance

Hamburger Feuerkasse (Template:Lang-en) is the first officially established fire insurance company in the world,[25] and the oldest existing insurance enterprise available to the public, having started in 1676.[26]

Property insurance as we know it today can be traced to the Great Fire of London, which in 1666 devoured more than 13,000 houses. The devastating effects of the fire converted the development of insurance "from a matter of convenience into one of urgency, a change of opinion reflected in Sir Christopher Wren's inclusion of a site for 'the Insurance Office' in his new plan for London in 1667".[27] A number of attempted fire insurance schemes came to nothing, but in 1681, economist Nicholas Barbon and eleven associates established the first fire insurance company, the "Insurance Office for Houses", at the back of the Royal Exchange to insure brick and frame homes. Initially, 5,000 homes were insured by his Insurance Office.[28]

In the wake of this first successful venture, many similar companies were founded in the following decades. Initially, each company employed its own fire department to prevent and minimize the damage from conflagrations on properties insured by them. They also began to issue 'Fire insurance marks' to their customers. These would be displayed prominently above the main door of the property and allowed the insurance company to positively identify properties that had taken out insurance with them. One such notable company was the Hand in Hand Fire & Life Insurance Society, founded in 1696 at Tom's Coffee House in St Martin's Lane in London.[29] It was structured as a mutual society, and for 135 years it operated its own fire brigade and played an important part in shaping fire fighting and prevention.[29] The Sun Fire Office is the earliest still existing property insurance company, dating from 1710.[30]

This system was soon exposed as terribly flawed, as rival brigades often ignored burning buildings once they discovered that it had no insurance policy with their company. Eventually, a solution was agreed upon in which all the insurance companies would supply money and equipment to a municipal authority charged with stationing fire prevention assets and firefighters equally around the city to respond to all fires. This did not solve the problem entirely, as the brigades still tended to favor saving insured buildings to those without any insurance at all.[31]

In Colonial America, the first insurance company that underwrote fire insurance was formed in Charles Town (modern-day Charleston), South Carolina in 1732. Benjamin Franklin helped to popularize and make standard the practice of insurance, particularly Property insurance to spread the risk of loss from fire, in the form of perpetual insurance. In 1752, he founded the Philadelphia Contributionship for the Insurance of Houses from Loss by Fire. Franklin's company made contributions toward fire prevention. Not only did his company warn against certain fire hazards, but it also refused to insure certain buildings where the risk of fire was too great, such as all wooden houses.

Business insurance

At the same time, the first insurance schemes for the underwriting of business ventures became available. By the end of the seventeenth century, London's growing importance as a centre for trade was increasing demand for marine insurance. In the late 1680s, Edward Lloyd opened a coffee house on Tower Street in London. It soon became a popular haunt for ship owners, merchants, and ships' captains, and thereby a reliable source of the latest shipping news.[32]

It became the meeting place for parties in the shipping industry wishing to insure cargoes and ships, and those willing to underwrite such ventures. These informal beginnings led to the establishment of the insurance market Lloyd's of London and several related shipping and insurance businesses. In 1774, long after Lloyd's death in 1713, the participating members of the insurance arrangement formed a committee and moved to the Royal Exchange on Cornhill as the Society of Lloyd's.

Life insurance

The first life insurance policies were taken out in the early 18th century. The first company to offer life insurance was the Amicable Society for a Perpetual Assurance Office, founded in London in 1706 by William Talbot and Sir Thomas Allen.[33][34] The first plan of life insurance was that each member paid a fixed annual payment per share on from one to three shares with consideration to age of the members being twelve to fifty-five. At the end of the year a portion of the "amicable contribution" was divided among the wives and children of deceased members and it was in proportion to the amount of shares the heirs owned. Amicable Society started with 2000 members.[35][36]

The first life table was written by Edmund Halley in 1693, but it was only in the 1750s that the necessary mathematical and statistical tools were in place for the development of modern life insurance. James Dodson, a mathematician and actuary, tried to establish a new company that issued premiums aimed at correctly offsetting the risks of long term life assurance policies, after being refused admission to the Amicable Life Assurance Society because of his advanced age. He was unsuccessful in his attempts at procuring a charter from the government before his death in 1757.

His disciple, Edward Rowe Mores was finally able to establish the Society for Equitable Assurances on Lives and Survivorship in 1762. It was the world's first mutual insurer and it pioneered age based premiums based on mortality rate laying "the framework for scientific insurance practice and development"[37] and "the basis of modern life assurance upon which all life assurance schemes were subsequently based".[38]

Mores also specified that the chief official should be called an actuary—the earliest known reference to the position as a business concern. The first modern actuary was William Morgan, who was appointed in 1775 and served until 1830. In 1776 the Society carried out the first actuarial valuation of liabilities and subsequently distributed the first reversionary bonus (1781) and interim bonus (1809) among its members.[37] It also used regular valuations to balance competing interests.[37] The Society sought to treat its members equitably and the Directors tried to ensure that the policyholders received a fair return on their respective investments. Premiums were regulated according to age, and anybody could be admitted regardless of their state of health and other circumstances.[39]

The sale of life insurance in the U.S. began in the late 1760s. The Presbyterian Synods in Philadelphia and New York founded the Corporation for Relief of Poor and Distressed Widows and Children of Presbyterian Ministers in 1759;[40] Episcopalian priests created a comparable relief fund in 1769. Between 1787 and 1837 more than two dozen life insurance companies were started, but fewer than half a dozen survived.

Accident insurance

In the late 19th century, "accident insurance" began to become available. This operated much like modern disability insurance.[41][42] The first company to offer accident insurance was the Railway Passengers Assurance Company, formed in 1848 in England to insure against the rising number of fatalities on the nascent railway system. It was registered as the Universal Casualty Compensation Company to:

- ...grant assurances on the lives of persons traveling by railway and to grant, in cases, of an accident not having a fatal termination, compensation to the assured for injuries received under certain conditions.

The company was able to reach an agreement with the railway companies, whereby basic accident insurance would be sold as a package deal along with travel tickets to customers. The company charged higher premiums for second and third class travel due to the higher risk of injury in the roofless carriages.[43][44]

National insurance

By the late 19th century, governments began to initiate national insurance programs against sickness and old age. Germany built on a tradition of welfare programs in Prussia and Saxony that began as early as in the 1840s. In the 1880s Chancellor Otto von Bismarck introduced old age pensions, accident insurance and medical care that formed the basis for Germany's welfare state. His paternalistic programs won the support of German industry because its goals were to win the support of the working classes for the Empire and reduce the outflow of immigrants to America, where wages were higher but welfare did not exist.[45][page needed][46][page needed]

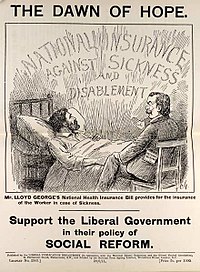

In Britain more extensive legislation was introduced by the Liberal government, led by H. H. Asquith and David Lloyd George. The 1911 National Insurance Act gave the British working classes the first contributory system of insurance against illness and unemployment.[47]

All workers who earned under £160 a year had to pay 4 pence a week to the scheme; the employer paid 3 pence, and general taxation paid 2 pence. As a result, workers could take sick leave and be paid 10 shillings a week for the first 13 weeks and 5 shillings a week for the next 13 weeks. Workers also gained access to free treatment for tuberculosis, and the sick were eligible for treatment by a panel doctor. The National Insurance Act also provided maternity benefits. Time-limited unemployment benefit was based on actuarial principles and it was planned that it would be funded by a fixed amount each from workers, employers, and taxpayers. It was restricted to particular industries, cyclical/seasonal industries like construction of ships, and neither made any provision for dependants. By 1913, 2.3 million were insured under the scheme for unemployment benefit and almost 15 million insured for sickness benefit.

This system was greatly expanded after the Second World War under the influence of the Beveridge Report, to form the first modern welfare state.[45][48][page needed]

In the United States, until the passage of the Social Security Act in 1935, the federal government did not mandate any form of insurance upon the nation as a whole. With the passage of the Act, the new program expanded the concept and acceptance of insurance as a means to achieve the individual financial security that might not otherwise be available. That expansion experienced its first boom market immediately after the Second World War with the original VA Home Loan programs that greatly expanded the idea that affordable housing for veterans was a benefit of having served. The mortgages that were underwritten by the federal government during this time included an insurance clause as a means of protecting the banks and lending institutions involved against avoidable losses. During the 1940s there was also the GI life insurance policy program that was designed to ease the burden of military losses on the civilian population and survivors.

Notes

- ^ North (1991). "The Journal of Economic Perspectives".

{{cite journal}}: Cite journal requires|journal=(help) - ^

Fukuyama, Francis (2011). The Origins of Political Order: From Prehuman Times to the French Revolution (reprint ed.). Profile Books. ISBN 9781847652812. Retrieved 7 December 2020.

Thomas Hobbes lays out the basic 'deal' underlying the state: in return for giving up the right to do whatever one pleases, the state (or Leviathan) through its monopoly of force guarantees each citizen basic security.

- ^

Szarmach, Paul E.; Tavormina, M. Teresa; Rosenthal, Joel T., eds. (1998). "Guilds and Fraternities". Medieval England: An Encyclopedia. Volume 3 of Routledge encyclopedias of the Middle Ages (reprint ed.). Abingdon: Taylor & Francis (published 2017). p. 329. ISBN 9781351666374. Retrieved 7 December 2020.

[...] by the later Middle Ages [...] Guilds and fraternities for all purposes proliferated in towns, in whose populous and changing environment the need for association and mutual support was perhaps more keenly felt, though they were not confined to urban societies.

- ^ Novi Dewan. Indian Life and Health Insurance Industry: A Marketing Approach. Springer Science & Business Media. p. 2.

- ^ See, e.g., Vaughan, E. J. (1996). Risk Management. New York: Wiley. ISBN 978-0471107590.

- ^ Tapas Kumar Parida, Debashis Acharya (2016). The Life Insurance Industry in India: Current State and Efficiency. Springer. p. 2. ISBN 9789811022333.

- ^ "Insurance in Ancient Iran". Archived from the original on 2008-04-04. [dead link]

- ^ Memorial Publications of the Prudential Insurance Company of America (1915). The Documentary History of Insurance, 1000 B.C. - 1875 A.D. (PDF). Newark, New Jersey: Prudential Press. Retrieved January 18, 2021 – via Internet Archive.

- ^ Aubert, Jean-Jacques (2008). "Dealing with the Abyss: The Nature and Purpose of the Rhodian Sea-Law on Jettison ( Lex Rhodia De Iactu , D 14.2) and the Making of Justinian's Digest". Beyond Dogmatics: Law and Society in the Roman World. 8: 157–172. doi:10.3366/edinburgh/9780748627936.003.0033. Retrieved January 18, 2021.

- ^ Franklin, James (2002). The Science of Conjecture: Evidence and Probability Before Pascal. Baltimore: Johns Hopkins University Press. p. 259. ISBN 9780801871092.

- ^ Graham, A.J. (1992). "Thucydides 7.13.2 and the Crews of Athenian Triremes". Transactions of the American Philological Association (1974-2014). 122: 257–270. doi:10.2307/284373. JSTOR 284373.

- ^ de Roover, Florence Edler (November 1945). "Early Examples of Marine Insurance". The Journal of Economic History. 5 (2): 175. doi:10.1017/s0022050700112975. ISSN 0022-0507.

{{cite journal}}: More than one of|pages=and|page=specified (help) - ^ "Gregory IX: Decretals IV". thelatinlibrary.com. Retrieved 2021-01-13.

- ^ a b c Kingston, Christopher (March 2011). "Marine Insurance in Philadelphia During the Quasi-War with France, 1795–1801". The Journal of Economic History. 71 (1): 162–184. doi:10.1017/s0022050711000064. ISSN 0022-0507.

- ^ a b Din, Sajid Mohy Ul (2013). "Impact of cost of marine and general insurance on international trade and economic growth of Pakistan". World Applied Sciences Journal. 28 (5): 659–671.

- ^ Bailey Wallys Diffie (1977). Foundations of the Portuguese Empire, 1415-1580. U of Minnesota Press. p. 21. ISBN 978-0-8166-0782-2.

- ^ John Brande Trend (1958). Portugal. Praeger. p. 103.

- ^ Roover (1945). "Early Examples of Marine Insurance".

{{cite journal}}: Cite journal requires|journal=(help) - ^ Miteski, Stefan (12 July 2019). "History of insurance – what do you know?". Reinsurance Weekly. Archived from the original on 12 July 2019.

- ^ Mundy (2001). "Enterprise risk: who knows my business better than me?".

{{cite journal}}: Cite journal requires|journal=(help) - ^ Franklin, James (2001). The Science of Conjecture: Evidence and Probability Before Pascal. Baltimore: Johns Hopkins University Press. pp. 274–277.

- ^ Santerna, Petrus (1522). Tractatus de assecurationibus et sponsionibus mercatorum. Prudential Press. Retrieved August 11, 2017 – via Google Books.

- ^ Franklin, James (2001). The Science of Conjecture: Evidence and Probability Before Pascal. Baltimore: Johns Hopkins University Press. p. 277.

- ^ "And whereas I have left in the hands of Doctor Ducke Channcellor of London two pollicies of insurance the one of one hundred pounds for the safe arivall of our Shipp in Guiana which is in mine owne name, if we miscarry by the waie (which God forbid) I bequeath the advantage thereof to my said Cosin Thomas Muchell...whereas there is an other insurance of one hundred pounds assured by the said Doctor Arthur Ducke on my life for one yeare if I chance to die within that tyme I entreat the said doctor Ducke to make it over to the said Thomas Muchell his kinsman..." Will of Robert Hayman, 1628: Records of the Prerogative Court of Canterbury, Catalogue Reference PROB 11/163

- ^ Anzovin, p. 121 The first fire insurance company was the Hamburger Feuerkasse (a.k.a. Hamburger General-Feur-Cassa), established in December 1676 by the Ratsherren (city council) of Hamburg (now in Germany).

- ^ Evenden, p. 4

- ^ Dickson (1960): 4

- ^ Dickson (1960): 7

- ^ a b "Hand in Hand Fire & Life Insurance Society". Aviva. Archived from the original on 2010-12-04. Retrieved 2014-01-04.

- ^ RSA Insurance Group History Archived September 2, 2011, at the Wayback Machine

- ^ "The World's First Insurance Company". Retrieved 2012-12-17.

- ^ Palmer, Sarah (October 2007). "Lloyd, Edward (c.1648–1713)". Oxford Dictionary of National Biography. Vol. 1 (online ed.). Oxford University Press. doi:10.1093/ref:odnb/16829. Archived from the original on 15 July 2011. Retrieved 16 February 2011. (Subscription or UK public library membership required.)

- ^ Anzovin, Stephen (2000). Famous First Facts. H. W. Wilson Company. p. 121. ISBN 978-0-8242-0958-2.

The first life insurance company known of record was founded in 1706 by the Bishop of Oxford and the financier Thomas Allen in London, England. The company called the Amicable Society for a Perpetual Assurance Office, collected annual premiums from policyholders and paid the nominees of deceased members from a common fund.

- ^ Amicable Society, The charters, acts of Parliament, and by-laws of the corporation of the Amicable Society for a perpetual assurance office, Gilbert and Rivington, 1854, p. 4

- ^ Amicable Society, The charters, acts of Parliament, and by-laws of the corporation of the Amicable Society for a perpetual assurance office, Gilbert and Rivington, 1854 Amicable Society, article V p. 5

- ^ Price, pp. 158–171

- ^ a b c "Importance of the archive". The Actuarian Profession. 2009-06-25. Archived from the original on 2014-02-01. Retrieved 2014-01-24.

- ^ "Today and History:The History of Equitable Life". 2009-06-26. Archived from the original on 2009-06-29. Retrieved 2009-08-16.

- ^ Lord Penrose (2004-03-08). "Chapter 1 The Equitable Life Inquiry" (PDF). HM Treasury. Archived from the original (PDF) on 2008-09-10. Retrieved 2009-08-20.

- ^ Newman, Frank G. (January 1965). "Acquisition of a Life Insurance Company, The". The Business Lawyer. 20 (2): 411–416. Retrieved April 4, 2016.

The first life insurance company in America was organized in 1759 under the corporate title 'The Corporation for Relief of Poor and Distressed Presbyterian Ministers, and of the Poor and Distressed Widows and Children of Presbyterian Ministers'.

- ^ "How Health Insurance Works". Howstuffworks. 2006-02-04.

- ^ "Encarta: Health Insurance". Archived from the original on 2009-11-01.

- ^ "Railway Passengers Assurance Company Ltd". Archived from the original on 2014-01-04. Retrieved 2012-12-17.

- ^ A. P. Woodward (March 1917). "The Disability Insurance Policy". The Annals of the American Academy of Political and Social Science. 70 (1): 227–237. doi:10.1177/000271621707000116. S2CID 144345819. Retrieved January 4, 2014.

- ^ a b E. P. Hennock (2007). The Origin of the Welfare State in England and Germany, 1850–1914: Social Policies Compared. Cambridge University Press.

- ^ Hermann Beck (1995). The Origins of the Authoritarian Welfare State in Prussia: Conservatives, Bureaucracy, and the Social Question, 1815-70. University of Michigan Press. ISBN 978-0472105465.

- ^ The Cabinet Papers 1915–1982: National Health Insurance Act 1911. The National Archives, 2013. Retrieved 30 June 2013.

- ^ Bentley B. Gilbert (1973). British Social Policy, 1914–1939. BATSFORD. ISBN 978-0713411287.

References

- Primary sources

- Memorial Publications of the Prudential Insurance Company of America (1915). The Documentary History of Insurance, 1000 B.C. - 1875 A.D. Newark, New Jersey: Prudential Press. Retrieved August 11, 2017 – via Internet Archive.

- Secondary sources

- Alborn, Timothy (2009). Regulated Lives: Life Insurance and British Society, 1800–1914. Toronto: University of Toronto Press. doi:10.3138/9781442697348. ISBN 9781442697348.

- Buley, R. Carlyle (1953). The American Life Convention, 1906–1952: A Study in the History of Life Insurance. Appleton-Century-Crofts.

- Chapin, Christy Ford (2015). Ensuring America' s Health: The Public Creation of the Corporate Health Care System. Cambridge University Press. ISBN 9781107622876.

- Dickson, P. G. M. (1960). The Sun Insurance Office, 1710–1960: The History of Two and a Half Centuries of British Insurance. Oxford University Press.

- Evenden, William L. (1989). German Fire Marks. VVW Karlsruhe. ISBN 9783884871904.

- Feldman, Gerald D. (2006). Allianz and the German Insurance Business, 1933–1945. Cambridge University Press. ISBN 9780521809290.

- Keller, Morton (1999). The Life Insurance Enterprise, 1855–1910: A Study in the Limits of Corporate Power. ISBN 9781583484456.

- Kingston, Christopher (June 2007). "Marine Insurance in Britain and America, 1720–1844: A Comparative Institutional Analysis". The Journal of Economic History. 67 (2). Cambridge University Press: 379–409. doi:10.1017/S0022050707000149. JSTOR 4501157.

- Levy, Jonathan (2012). Freaks of Fortune: The Emerging World of Capitalism and Risk in America. Harvard University Press. ISBN 9780674047488.

- Murphy, Sharon Ann (2010). Investing in Life: Insurance in Antebellum America. Johns Hopkins University Press. ISBN 9781421411941.

- Murray, John E. (2007). Origins of American Health Insurance: A History of Industrial Sickness Funds. Yale University Press. ISBN 9780300120912.

- Pearson, Robin, ed. (2010). The Development of International Insurance. Pickering & Chatto Publishers. ISBN 9781848930766.

- Pearson, Robin (2004). Insuring the Industrial Revolution: Fire Insurance in Great Britain, 1700–1850. Routledge. ISBN 9780754633631.

- Raynes, Harold E. (1948). A History of British Insurance. Pitman Publishing. ISBN 9780273416418.

- Stalson, J. Owen (1942). Marketing Life Insurance: Its History in America. Harvard University Press.

- Zelizer, Viviana (1979). Morals and Markets: The Development of Life Insurance in the United States. Columbia University Press. ISBN 9780878559299.