Economy of Sri Lanka

This article needs additional citations for verification. (February 2016) |

| |

| Currency | Sri Lankan rupee (LKR) |

|---|---|

| Calendar year | |

Trade organisations | SAFTA, WTO |

| Statistics | |

| GDP | US$ 110.591 Billion (World bank.) / US$ 320.415 Billion PPP[1] |

GDP growth | 4.79% (2015)[2] |

GDP per capita | US$ 13,818.161 (2015) / US$ 21,068.996 USD PPP[1] |

GDP by sector | agriculture: 12.8%; industry: 29.2%; services: 58% (2009 est.) |

| 2.8% (2016 est.)[3] | |

Population below poverty line | 1.31% (2016 est.)[3] |

| 36.4 (2013) | |

Labour force | 12,319,680([4]) |

Labour force by occupation | agriculture: 7.4%; industry: 31.6%; services: 61% (September 2016 est.) |

| Unemployment | 1.5% (2016)[3] |

Main industries | processing of rubber, tea, coconuts, tobacco and other agricultural commodities; telecommunications, insurance, banking; tourism, shipping; clothing, textiles; cement, petroleum refining, information technology services, construction |

| External | |

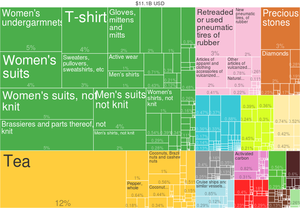

| Exports | $60.00 billion (2016 est.) |

Export goods | textiles and apparel, pharmaceuticals, tea,diamonds,gold, emeralds, coconut products,iron,cotton, automobiles,rubber,manufactures, fish,technologies,machinery,wood manufacture; |

Main export partners | |

| Imports | $35.00 billion (2016 est.) |

Import goods | textile fabrics, mineral products, petroleum, foodstuffs, and transportation equipment |

Main import partners | |

FDI stock | US$1 Billion (2011) |

Gross external debt | ~$35 billion (2016 est.) or 26% of GDP (2015 est.) |

| Public finances | |

| Revenues | $8.495 billion (2011 est.) |

| Expenses | $12.63 billion (2011 est.) |

| Standard & Poor's:[7] BB- (Domestic) B+ (Foreign) B+ (T&C Assessment) Outlook: Stable[8] Moody's:[8] B1 Outlook: Stable Fitch:[8] B+ Outlook: Positive | |

| $7.2 billion (17 April 2011 est.)[9] | |

With an economy worth $80.591 billion (2015) ($278.415 billion (2017)PPP estimate),[1] and a per capita GDP of about $11,068.996 (PPP), Sri Lanka has mostly had strong growth rates in recent years.The Sri Lankan economy has seen robust annual growth at 6.4 percent over the course of 2003 to 2012, well above its regional peers. In GDP per capita terms, it is ahead of other countries in the South Asian region. Since the end of the three-decade terrorism, Sri Lanka is now focusing on long-term strategic and structural development challenges as it strives to transition to an upper middle income country.

The main economic sectors of the country are tourism, tea export, apparel, textile, rice production and other agricultural products. In addition to these economic sectors, overseas employment contributes highly in foreign exchange, 90% of expatriate Sri Lankans reside in the Middle East.

Sri Lanka has met the Millennium Development Goal (MDG) target of halving extreme poverty and is on track to meet most of the other MDGs, outperforming other South Asian countries. Sri Lanka experienced a major decline in poverty between 2002 and 2009 – from 23 percent to 9 percent of the population. Despite this pockets of poverty continue to exist. An estimated 9 percent of Sri Lankans who are no longer classified as poor live within 20 percent of the poverty line and are, thus, vulnerable to shocks which could cause them to fall back into poverty.[10]

Sri Lanka has one of the lowest tax-to-GDP ratios in the world and creating jobs for the bottom 40% has become a challenge. Sri Lanka also faces a challenges in Social inclusion, Governance and sustainability.[11]

According to Government policies and economic reforms stated by Prime Minister and Minister of National Policy and economic affairs Ranil Wickremesinghe, Sri Lanka plans to create a knowledge based social market economy and an export-oriented economy as well as the Western Region Megapolis a Megapolis in the western province to promote economic growth. Creation of several business and technology development areas specialised in various sectors island wide as well as tourism zones in a planned manner is also being planned.[12][13][14][15]

Economic history

Since becoming independent from Britain in February 1948, the economy of the country has been affected by natural disasters such as the 2004 Indian Ocean earthquake and a number of insurrections, such as the 1971, the 1987-89 and the 1983-2009 civil war. Between 1977 and 1994 the country came under UNP rule in which under President J.R Jayawardana Sri Lanka began to shift away from a socialist orientation in 1977. Since then, the government has been deregulating, privatizing, and opening the economy to international competition. In 2001, Sri Lanka faced bankruptcy, with debt reaching 101% of GDP. The impending currency crisis was averted after the country reached a hasty ceasefire agreement with the LTTE and brokered substantial foreign loans. After 2004 the UPFA government has concentrated on mass production of goods for domestic consumption such as rice, grain and other agricultural products.[16] however twenty five years of civil war slowed economic growth,[citation needed] diversification and liberalisation, and the political group Janatha Vimukthi Peramuna (JVP) uprisings, especially the second in the early 1980s, also caused extensive upheavals.[17]

Following the quelling of the JVP insurrection, increased privatization, economic reform, and a stress on export-oriented growth helped improve the economic performance, increasing GDP growth to 7% in 1993.

Economic growth has been uneven in the ensuing years as the economy faced a multitude of global and domestic economic and political challenges. Overall, average annual GDP growth was 5.2% over 1991-2000.

In 2001, however, GDP growth was negative 1.4%--the first contraction since independence. The economy was hit by a series of global and domestic economic problems and affected by terrorist attacks in Sri Lanka and the United States. The crises also exposed the fundamental policy failures and structural imbalances in the economy and the need for reforms. The year ended in parliamentary elections in December, which saw the election of United National Party to Parliament, while Sri Lanka Freedom Party retained the Presidency.

During the short lived peace process from 2002 to 2004, the economy benefited from lower interest rates, a recovery in domestic demand, increased tourist arrivals, a revival of the stock exchange, and increased foreign direct investment (FDI). In 2002, the economy experienced a gradual recovery. During this period Sri Lanka has been able to reduce defense expenditures and begin to focus on getting its large, public sector debt under control. In 2002, economic growth reached 4%, aided by strong service sector growth. The agricultural sector of the economy staged a partial recovery. Total FDI inflows during 2002 were about $246 million[18]

The Mahinda Rajapakse government halted the privatization process and launched several new companies as well as re-nationalising previous state owned enterprises, one of which the courts declared that privatizationis null and void.[19] Some state-owned corporations became overstaffed and less efficient, making huge losses with series of frauds being uncovered in them and neopotism rising.[20] During this time EU revoked GSP plus preferential tariffs from Sri Lanka due to alleged human rights violations, which cost about USD 500 million a year.[21][22]

The resumption of the civil-war in 2005 led to a steep increase defense expenditures. The increased violence and lawlessness also prompted some donor countries to cut back on aid to the country.[2][3].

A sharp rise in world petroleum prices combined with economic fallout from the civil war led to inflation that peaked 20%. However, as the civil war ended in May 2009 the economy started to grow at a higher rate of 8.0% in the year 2010 and reached 9.1% in 2012 mostly due to the boom in non-tradable sectors. However the boom didn't last and the GDP growth for 2013 fell to 3.4% in 2013 and only slightly recovered to 4.5% in 2014.[23][24][25][26]

In 2016 the unity government succeeded in lifting an EU ban on Sri Lankan fish products which resulted in fish exports to EU rising by 200% and in 2017 improving human rights conditions resulted in the European Commission proposing to restore GSP plus facility to Sri Lanka.[13][14][27][28]

Macro-economic trend

This is a chart of trend of gross domestic product of Sri Lanka at market prices[29] by the International Monetary Fund with figures in millions of Sri Lankan Rupees.

| Year | Gross Domestic Product | US Dollar Exchange |

|---|---|---|

| 1980 | 66,167 | 16.53 Sri Lankan Rupees |

| 1985 | 162,375 | 27.20 Sri Lankan Rupees |

| 1990 | 321,784 | 40.06 Sri Lankan Rupees |

| 1995 | 667,772 | 51.25 Sri Lankan Rupees |

| 2000 | 1,257,637 | 77.00 Sri Lankan Rupees |

| 2005 | 2,363,669 | 100.52 Sri Lankan Rupees |

| 2016 | 6,718,000 | 145.00 Sri Lankan Rupees |

For purchasing power parity comparisons, the US Dollar is exchanged at 113.4 Sri Lankan Rupees only.

In 1977, Colombo abandoned statist economic policies and its import substitution trade policy for market-oriented policies and export-oriented trade.

Sri Lanka's most dynamic industries now are food processing, textiles and apparel, food and beverages, telecommunications, and insurance and banking.

By 1996 plantation crops made up only 20% of exports (compared with 93% in 1970), while textiles and garments accounted for 63%. GDP grew at an annual average rate of 5.5% throughout the 1990s until a drought and a deteriorating security situation lowered growth to 3.8% in 1996.

The economy rebounded in 1997-98 with growth of 6.4% and 4.7% - but slowed to 3.7% in 1999. For the next round of reforms, the central bank of Sri Lanka recommends that Colombo expand market mechanisms in nonplantation agriculture, dismantle the government's monopoly on wheat imports, and promote more competition in the financial sector.

Pre 2009 there was a continuing cloud over the economy the civil war and fighting between the Government of Sri Lanka and LTTE. However the war ended with a resounding victory for the Sri Lankan Government on 19 May 2009 with the total elimination of LTTE.

External sector

Trade account issues

In the recent past, the Sri Lankan Government has identified some key focal areas to address the external imbalances of the economy, especially with regard to reducing its high trade deficit (~15% of GDP for 2012) in order to make the economy comply with the Marshall–Lerner condition. Sri Lanka's oil import bill accounts for an estimated 27% of total imports while its pro-growth policies have resulted in an investment goods import component of 24% of total imports. These inelastic import components have led to Sri Lanka's Export goods price elasticity + Import goods price elasticity totalling less than 1, resulting in the country not complying with the Marshall–Lerner condition.

Some of the suggested proposals include:

- Import substitution of investment goods and consumer goods

- Tax concessions towards value added exports

- Negotiating longer credit periods for oil imports

- Allowing the external value of the currency to be determined by market forces (with minimal central bank intervention).

Capital account

- Within the capital account, borrowings still account for a significant proportion as opposed to Foreign direct investments.

- FDIs were estimated at ~US$800mn for FY2012

Overall balance (BOP)

- The economy ended with an overall positive balance of US$151mn for 2012 (vs. a US$1,061mn deficit in FY2011)

Financial institutions

The Central Bank of Sri Lanka is the monetary authority of Sri Lanka and was established in 1950. The Central Bank is responsible for the conduct of monetary policy in the country and also has supervisory powers over the financial system.[30]

The Colombo Stock Exchange (CSE) is the main stock exchange in Sri Lanka. It is one of the most modern exchanges in South Asia, providing a fully automated trading platform. The vision of the CSE is to contribute to the wealth of the nation by creating value through securities. The headquarters of the CSE have been located at the World Trade Center Towers [5] in Colombo since 1995 and it also has branches across the country in Kandy, Matara, Kurunegala, Negombo and Jaffna.[31] In 2009, after the 30 years long civil war came to an end, the CSE was the best performing stock exchange in the world.

Economic infrastructure and resources

Transportation and roads

Most Sri Lankan cities and towns are connected by the Sri Lanka Railways, the state-run railway operator. The Sri Lanka Transport Board is the state-run agency responsible for operating public bus services across the island.

The government has launched several highway projects to bolster the economy and national transport system, including the Colombo-Katunayake Expressway, the Colombo-Kandy (Kadugannawa) Expressway, the Colombo-Padeniya Expressway and the Outer Circular Highway to ease Colombo's traffic congestion. The government sponsored Road Development Authority (RDA) has been involved in several large-scale projects all over the island in an attempt to improve the road network in Sri Lanka. Sri Lanka's commercial and economic centres, primarily the capitals of the nine provinces are connected by the "A-Grade" roads which are categorically organised and marked. Furthermore, "B-Grade" roads, also paved and marked, connect district capitals within provinces. The grand total of A, B and E grade roads are estimated at 12,379.49 km.[32]

Energy

The energy policy is governed by the Ministry of Power and Energy, while the production and retailing of electricity is carried out by the Ceylon Electricity Board. Energy in Sri Lanka is mostly generated by hydroelectric power stations in the Central Province.[33][34]

Economic sectors

Tourism

Tourism is one of the main industries in Sri Lanka. Major tourist attractions are focused around the islands famous beaches located in the southern and the eastern parts of the country and ancient heritage sites located in the interior of the country and resorts located in the mountainous regions of the country.[35][36] Also, due to precious stones such as rubies and sapphires being frequently found and mined in Ratnapura and its surrounding areas, they are a major tourist attraction.[37]

The 2004 Indian Ocean Tsunami[38] and the past civil war have reduced the tourist arrivals, however the number of tourists visiting have been recently increasing, beginning in early 2008.[39] March 2008 by 8.6% and Sri Lanka attracted 1,003,000 tourists in 2012 according to the Central Bank of Sri Lanka's 2013 roadmap.[40]

Tea industry

The tea industry, operating under the Ministry of Public Estate Management and Development, is one of the main industries in Sri Lanka. It became the world's leading exporter in 1995 with a 23% share of global tea export, higher than Kenya's 22% share. The central highlands of the country have a low temperature climate throughout the year and annual rainfall and the humidity levels that are suitable for growing tea. The industry was introduced to the country in 1867 by James Taylor, a British planter who arrived in 1852.[41]

Recently, Sri Lanka has become one of the countries exporting fair trade tea to the UK and other countries. It is believed that such projects could reduce rural poverty.[42][43]

Apparel and textile industry

The apparel industry of the Sri Lanka mainly exports to the United States and Europe. Europe increasingly relies on Sri Lankan textiles due to the high cost of labour in Europe.[citation needed] There are about 900 factories throughout country serving companies such as Victoria's Secret, Liz Claiborne and Tommy Hilfiger.[44]

Agriculture

The agricultural sector of the country produces mainly rice, coconut and grain, largely for domestic consumption and occasionally for export. The tea industry which has existed since 1867 is not usually regarded as part of the agricultural sector, which is mainly focused on export rather than domestic use in the country.[45]

IT industry

Export revenue of Sri Lankan IT sector is estimated to be USD 720 million in 2013.[46][47]

Global economic relations

Exports to the United States, Sri Lanka's most important market, were valued at $1.8 billion in 2002, or 38% of total exports. For many years, the United States has been Sri Lanka's largest market for garments, receiving more than 63% of the country's total garment exports. India is Sri Lanka's largest supplier, with imports worth $835 million in 2002. Japan, traditionally Sri Lanka's largest supplier, was its fourth-largest in 2002 with exports of $355 million. Other important suppliers include Hong Kong, Singapore, Taiwan, and South Korea. The United States is the 10th-largest supplier to Sri Lanka; US imports amounted to $218 million in 2002, according to Central Bank trade data.

A new port is being built in Hambantota in Southern Sri Lanka, funded by the Chinese government as a part of the Chinese aid to Sri Lanka. This will ease the congestion in Sri Lankan ports, particularly in Colombo. In 2009, 4456 ships visited Sri Lankan ports.

Credit rating and commercial borrowing

Sri Lanka had applied for credit ratings from international agencies in its efforts to apply for loans from international markets in 2005 after the election of Mahinda Rajapakse as president. Standard and Poor's has rated Sri Lanka a "B+" speculative rating, four grades below investment grade. Fitch has rated Sri Lanka with "BB-" which is three grades below investment grade. Standard and Poor's maintains Sri Lanka is constrained by providing widespread subsidies, a bloated public sector, transfers to loss-making state enterprises, and high interest local and international burdens [6]. Standard and Poor's estimates public sector debt has reached 95% of GDP [7], in comparison to CIA estimates of 89% of GDP [8]. Sri Lanka in mid-2007 sought to borrow $500 million from international markets to shore up the deteriorating exchange rate and reduce pressure on repayment of the domestic debt market [9]. The head of the opposition UNP, Ranil Wickremasinghe has warned that such intense borrowing is unsustainable and will not repay these loans if elected to power [10].

Foreign assistance

Sri Lanka is highly dependent on foreign assistance, and several high-profile assistance projects were launched in 2003. The most significant of these resulted from an aid conference in Tokyo in June 2003; pledges at the summit, which included representatives from the International Monetary Fund, World Bank, Asian Development Bank, Japan, the European Union and the United States, totalled $4.5 billion.

Debt and IMF assistance

During the past few years, the country's debt has soared as it was developing its infrastructure to the point of near bankruptcy which required a bailout from the International Monetary Fund (IMF). "Without an IMF loan, Sri Lanka would have been in a precarious position," in May 2016 according to Krystal Tan, an Asia economist at Capital Economics who added that "foreign exchange reserves only covered around 80 percent of short-term external debt".[48] The IMF had agreed to provide a $1.5 billion bailout loan in April 2016 after Sri Lanka provided a set of criteria intended to improve its economy.

By the fourth quarter of 2016 the debt was estimated to be $64.9 billion. Additional debt had been incurred in the past by state-owned organizations and this was said to be at least $9.5 billion. Since early 2015, domestic debt increased by 12 percent and external debt by 25 percent.[49]

In late 2016 the World Bank provided US$100 million in financing and the Japan International Cooperation Agency provided a US$100M loan, both intended to "provide budget financing and to support reforms in competitiveness, transparency, public sector and fiscal management", according to the World Bank. The bank also reported that the country's government had agreed that there was a need for reforms "in the areas of fiscal operations, competitiveness and governance" and if fully implemented, "these could help the country reach Upper Middle Income status in the medium term" according to the bank.[50]

In November 2016, the International Monetary Fund reported that it would disburse a higher amount than the US$150 million originally planned, a full US$162.6 million (SDR 119.894 million), to Sri Lanka. The agency's evaluation was cautiously optimistic about the future: "While inflation has abated, credit growth remains strong. The central bank indicates its readiness to tighten the monetary policy stance further if inflationary pressures resurge or credit growth persists. The authorities intend to continue building up reserves through outright purchases while allowing for greater exchange rate flexibility. The banking sector is currently well capitalized. Steps are being taken to find a resolution mechanism for the distressed financial institutions. Going forward, there is a need to strengthen the supervisory and regulatory framework, and identify and mitigate vulnerabilities in the financial sector, particularly with regard to non-banks and state-owned banks."[51]

See also

References

- ^ a b c http://www.imf.org/external/pubs/ft/weo/2017/01/weodata/weorept.aspx?pr.x=48&pr.y=18&sy=2017&ey=2017&scsm=1&ssd=1&sort=country&ds=.&br=1&c=524&s=NGDPD%2CNGDPDPC%2CPPPGDP%2CPPPPC&grp=0&a=

- ^ "GDP growth (annual %)". data.worldbank.org.

- ^ a b c http://www.cbsl.gov.lk/pics_n_docs/latest_news/roadmap_2012.pdf

- ^ http://www.statistics.gov.lk/page.asp?page=Labour+Force

- ^ "Export Partners of Sri Lanka". CIA World Factbook. 2015. Retrieved 26 July 2016.

- ^ "Import Partners of Sri Lanka". CIA World Factbook. 2015. Retrieved 26 July 2016.

- ^ "Sovereigns rating list". Standard & Poor's. Retrieved 26 May 2011.

- ^ a b c Rogers, Simon; Sedghi, Ami (15 April 2011). "How Fitch, Moody's and S&P rate each country's credit rating". The Guardian. Retrieved 28 May 2011.

- ^ Ondaatjie, Anusha; Sirimanne, Asantha (11 April 2011). "Bloomberg financials". Bloomberg.

- ^ "The Spatial Distribution of Poverty in Sri Lanka" (PDF).

- ^ www.worldbank.org http://www.worldbank.org/en/news/feature/2016/02/15/sri-lanka-a-systematic-country-diagnostic. Retrieved 25 April 2016.

{{cite web}}: Missing or empty|title=(help) - ^ "Economic Policy Statement made by Prime Minister, Ranil Wickremesinghe in Parliament". www.news.lk. Retrieved 17 November 2015.

- ^ a b "Govt pushing for GSP+, TPP membership - Dr. Harsha | Daily News". www.dailynews.lk. Retrieved 17 November 2015.

- ^ a b "EU delegation to meet Ranil before taking decision on ban on Sri Lankan fish products | The Sunday Times Sri Lanka". www.sundaytimes.lk. Retrieved 17 November 2015.

- ^ "Sri Lanka to join Trans-Pacific Partnership?". www.sundayobserver.lk. Retrieved 22 April 2016.

- ^ "Asian Development Outlook 2008" (PDF). Asian Development Bank.

- ^ "The Economy of Sri Lanka". The Postcolonial Web-National University of Singapore.

- ^ "Sri Lanka Economy - GDP, Budget, Industry and Agriculture". www.factrover.com. Retrieved 22 April 2016.

- ^ "SLI privatization null and void, reverts back to the state".

{{cite web}}: Cite has empty unknown parameter:|1=(help) - ^ "Sri Lanka aiming to reduce burden of SOEs on the_people".

{{cite web}}: Cite has empty unknown parameter:|1=(help) - ^ Bajaj, Vikas (6 July 2010). "Sri Lanka Loses E.U. Trade Benefit". The New York Times. ISSN 0362-4331. Retrieved 17 November 2015.

- ^ "GSP Plus suspension will cost Lanka Rs. 570 billion a year". www.sundaytimes.lk. Retrieved 17 November 2015.

- ^ "Background Note: Sri Lanka->section "Economy"". US State Department.

- ^ "GDP growth (annual %) | Data | Graph". data.worldbank.org. Retrieved 26 June 2016.

- ^ "Sri Lanka's post-war economic miracle turns sour!". www.ft.lk. Retrieved 26 June 2016.

- ^ thecurionomist (4 May 2014). "Construction Bias in Sri Lanka's Recent Growth". The Curionomist. Retrieved 26 June 2016.

- ^ "European Commission proposes GSP Plus to SL". Retrieved 12 January 2017.

- ^ "EU lifts fish ban on Sri Lanka". Retrieved 12 January 2017.

- ^ "Edit/Review Countries". Archived from the original on 11 June 2010. Retrieved 3 March 2015.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Official Web site of Central Bank, Sri Lanka".

- ^ "Official Web site of Colombo Stock Exchange".

- ^ "Class A, B & E Roads". www.rda.gov.lk. Archived from the original on 28 April 2016. Retrieved 27 April 2016.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "SRI LANKA: RENEWABLE ENERGY AND CAPACITY BUILDING". Global Environment Facility.

- ^ "Power Sector Assistance Evaluation" (PDF). Asian Development Bank.

- ^ Sri Lanka tourism revives slowly, International Herald Tribune

- ^ "Sri Lanka tour guide". BBC Sport. 21 November 2003. Retrieved 3 June 2008.

- ^ "Gem Mining". National Geographic Society. 16 January 2008.

- ^ "Tsunami region seeks tourism boost". CNN. 6 January 2005.

- ^ Aneez, Shihar (15 February 2008). "Sri Lanka Jan tourist arrivals up 0.6 pct vs yr ago". Reuters.

- ^ Sirilal, Ranga (16 April 2008). "Sri Lanka March tourist arrivals up 8.6 pct yr/yr". Reuters.

- ^ "TED Case Studies - Ceylon Tea". American University, Washington, D.C.

- ^ Steenbergs Organic Fairtrade Pepper and Spice

- ^ [1]

- ^ "Sri Lanka seeks US free trade". BBC News. 8 April 2002. Retrieved 3 January 2010.

- ^ "Sri Lanka - Agriculture". CountryStudies.com.

- ^ "Sri Lankan IT/BPM Industry - 2014 Review" (PDF). Retrieved 28 December 2015.

- ^ "ICT/BPO Industry In Sri Lanka" (PDF). Sri Lanka Business. Retrieved 30 December 2015.

- ^ Shaffer, Leslie (2 May 2016). "Why Sri Lanka's economic outlook is looking less rosy". CNBC. CNBC LLC. Retrieved 14 January 2017.

While the government is aiming to raise its low revenue collection, partly through an increase in the value-added tax rate ... the country has a spotty record on tax collection.

- ^ Shepard, Wade (30 September 2016). "Sri Lanka's Debt Crisis Is So Bad The Government Doesn't Even Know How Much Money It Owes". Forbes. Forbes. Retrieved 14 January 2017.

"We still don't know the exact total debt number," Sri Lanka's prime minister admitted to parliament earlier this month.

- ^ "Sri Lanka Development Update". The World Bank News. The World Bank Group. 27 October 2016. Retrieved 14 January 2017.

The report emphasizes the importance of adhering to the revenue-led fiscal consolidation path to create fiscal space for increased investment in human and physical capital and the provision of other public goods to sustain growth in the medium term. It also highlights the need for structural reforms to improve competitiveness and governance.

- ^ "IMF Completes First Review of the Extended Arrangement Under the EFF with Sri Lanka and Approves US$162.6 Million Disbursement". IMF. IMF. 18 November 2016. Retrieved 14 January 2017.

[IMF] completed the first review of Sri Lanka's economic performance under the program supported by a three-year extended arrangement under theExtended Fund Facility (EFF) arrangement.

External links

- Global Economic Prospects: Growth Prospects for South Asia The World Bank, 13 December 2006

- World Bank Trade Summary Statistics Sri Lanka 2012

- CSE ALL-SHARE

- CIA Factbook

- Economy of Sri Lanka at Curlie

- Information and News

- Sri Lanka's Most Trusted Investment Community

- Community-driven Market and Stock Predictions for the Colombo Stock Exchange (cse.lk)