Talk:Laffer curve: Difference between revisions

| Line 93: | Line 93: | ||

:Lawrence, please refer to the discussion I initiated above. It's difficult to have a discussion while you are ignoring what I wrote. |

:Lawrence, please refer to the discussion I initiated above. It's difficult to have a discussion while you are ignoring what I wrote. |

||

:To repeat, I'm neutral about which sources you would prefer for simple revenue data. There is a difference between an historical occurrence and a theory. Hsing offered a theory (which must be an academic RS), while the White House provided history (and the White House should indeed be a reliable source). As I wrote above, the statement "Babe Ruth happened to have a lot of strike outs while he was achieving his home run record" is NOT something that requires an academic paper, while the quite different statement of "linear-log analysis demonstrates that a home run record has a specific correlation with strike outs" |

:To repeat, I'm neutral about which sources you would prefer for simple revenue data. There is a difference between an historical occurrence and a theory. Hsing offered a theory (which must be an academic RS), while the White House provided history (and the White House should indeed be a reliable source). As I wrote above, the statement "Babe Ruth happened to have a lot of strike outs while he was achieving his home run record" is NOT something that requires an academic paper, while the quite different statement of "linear-log analysis demonstrates that a home run record has a specific correlation with strike outs" would indeed require an academic paper. |

||

:However, at this time the data does NOT support the Hsing paper, which I read in detail today, because the Hsing data itself is flawed. It arrived at the correct number for the maximum tax rate (per actual receipts), but then mistook a maximum tax rate for an average tax rate. An average tax rate of 35% in a progressive tax would give a maximum tax rate of 65%. Conversely, a maximum tax rate of 35% in a progressive tax would give an average tax rate of 19%. Hsing does not distinguish between the two, and he actually says "average", which cannot be supported by the historical receipts. Maximum rates of 65% are not even addressed by Hsing's paper, though they would be required for a 35% average rate. |

:However, at this time the data does NOT support the Hsing paper, which I read in detail today, because the Hsing data itself is flawed. It arrived at the correct number for the maximum tax rate (per actual receipts), but then mistook a maximum tax rate for an average tax rate. An average tax rate of 35% in a progressive tax would give a maximum tax rate of 65%. Conversely, a maximum tax rate of 35% in a progressive tax would give an average tax rate of 19%. Hsing does not distinguish between the two, and he actually says "average", which cannot be supported by the historical receipts. Maximum rates of 65% are not even addressed by Hsing's paper, though they would be required for a 35% average rate. |

||

| Line 101: | Line 101: | ||

:At this time there is no need for me to restore the White House source, since Hsing's paper is so poorly done that there is no way to match it with real history. |

:At this time there is no need for me to restore the White House source, since Hsing's paper is so poorly done that there is no way to match it with real history. |

||

:I do plan to continue to look for sources, though, because |

:I do plan to continue to look for sources, though, because this one isn't well represented by the excerpt.[[User:SkyWriter|SkyWriter (Tim)]] ([[User talk:SkyWriter|talk]]) |

||

Revision as of 23:00, 15 January 2013

| This is the talk page for discussing improvements to the Laffer curve article. This is not a forum for general discussion of the article's subject. |

Article policies

|

| Find sources: Google (books · news · scholar · free images · WP refs) · FENS · JSTOR · TWL |

| Archives: 1, 2, 3Auto-archiving period: 90 days |

| This article is of interest to the following WikiProjects: | |||||||||||||||||||||||||||||||||||||

Please add the quality rating to the {{WikiProject banner shell}} template instead of this project banner. See WP:PIQA for details.

Please add the quality rating to the {{WikiProject banner shell}} template instead of this project banner. See WP:PIQA for details.

| |||||||||||||||||||||||||||||||||||||

|

|||

|

This page has archives. Sections older than 90 days may be automatically archived by Lowercase sigmabot III when more than 5 sections are present. |

| This is the talk page for discussing improvements to the Laffer curve article. This is not a forum for general discussion of the article's subject. |

Article policies

|

| Find sources: Google (books · news · scholar · free images · WP refs) · FENS · JSTOR · TWL |

| Archives: 1, 2, 3Auto-archiving period: 90 days |

Terminology

What is a "stylized graph?" I have degrees in math and engineering, and have never heard of such a thing; neither does a Google search turn up any significant hits. Perhaps this should just read "graph?"

vague

"There is serious doubt about the relevance considering a single marginal tax rate."

The relevance of what? Of considering a marginal tax rate? Of the curve? Vague. Surely the curve. But needs clarity.

Graphs removed

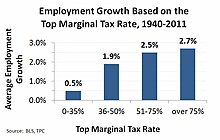

These graphs were removed because they "have little relevance and provide no context for the section's content". Why aren't they relevant to the Laffer curve? Do we need a source saying that the government gets more revenue when there are more jobs? For those of you who think they provide no context for the article, please say why. I think they explain a great deal. —Cupco 20:44, 3 October 2012 (UTC)

- While I agree that economic growth increases government revenue, I don't see that either one of these graphs makes that point. In addition, it would seem to have to have some direct connection to how this applies to the Laffer curve. The first graph is the average annual growth, which seems to suggest an optimal tax rate above 75% for economic growth. Obviously, this is WP:SYN and WP:POV - and at what point does it make use of the Laffer curve? And at what point does economic growth overtake the an increase in the tax? It's SYN on top of SYN, on top of SYN. Then we have the "The U.S. federal effective corporate tax rate, 1947-2011". How does this apply to the Relationship with supply-side economics? Am I looking for the Reagan years here to prove something? Laffer curve? I understand this stuff... imagine a user unfamiliar with this content. The graph has no relation to the content. It doesn't tell the user anything about the topic. Morphh (talk) 21:31, 3 October 2012 (UTC)

- As we discussed above, there is considerable disagreement as to whether the Laffer curve peaks above 70%, which the majority of the economists and almost all of the peer reviewed secondary literature says it does. The people with an opposing view say it peaks below 30%. The graphs are accurate representations of historical facts, and one of them agrees with the former of the two of the differing opposing views. Do you believe that because historical facts agree with one of the two differing opinions, that means the facts themselves are biased and synthesis? —Cupco 01:19, 4 October 2012 (UTC)

Laffer placed in "Other" Category

I find it curious that Laffer, the guy who came up with the Laffer curver, is slotted into the "other"category near the bottom of the Empiricle Data section, while the "The New Palgrave Dictionary of Economics", which is frankly so large I doubt the co-authors could have studied Laffer curves sufficiently to come up with a great result. Shouldn't the guy who came up with this be at the top of the Empiricle Data section? JettaMann (talk) 17:20, 5 December 2012 (UTC)

government revenue vs. tax revenue

Under "In political discourse", "Reaganomics":

According to the CBO historical tables, government revenue as a percentage of GDP increased from 31.8% in 1980 to 33.2% in 1989. [25]

The article Hauser's law, under "History:

From fiscal year 1946 to fiscal year 2007, federal tax receipts as a percentage of gross domestic product averaged 17.9%, with a range from 14.4% to 20.9%.[5] 2009 tax collections, at 15% of GDP...

If "31.8% in 1980" is the same kind of number that Hauser claimed was never far from 19.5%, the article on Hauser's law should note that Hauser's law failed from 1980 to 1989.

If there is a meaningful difference between "government revenue" and "federal tax receipts", either this mention of government revenue should be removed from the article on Laffer's curve, or there should be an explanation that this is a different type of measure, and there should be an explanation of what the citation is believed to illustrate.

Jmichael ll (talk) 03:12, 2 January 2013 (UTC)

Records and Analysis

Lawrence, there is a difference between simple records and analysis.

An academic study says, "things must be this way."

Simple record says, "this happened."

A record doesn't say, "what happened could not have been otherwise" but rather "this happened to occur." It's like saying "Babe Ruth happened to have a lot of strike outs during his period of home run hits." Almost anything can serve as a source for the latter, and since this is a simple matter of record, I really don't care WHAT source you want to use. It's just boring news about 2000s tax revenues that HAPPENED to agree with the theory predicted by Hsing in the 1990s. Let's not war about the news, but work together until you're okay with it.SkyWriter (Tim) (talk)

Just to be clear -- I'm not interested in an edit war, but rather looking for how to collaborate on something non-controversial. The controversy is in the theory of what must and should optimize tax revenue (which involves academic sources). The non-controversial material is the simple history of what levels have experienced maximum revenues so far. That's no more controversial than Babe Ruth's batting average. It says nothing about what must or should occur, but rather reports on what has so far. Since the record happens to fall within the range of one academic source already listed in the article, and the Romer paper I added, it is certainly of interest in the article. There's no reason not to list it, and if maximum revenues change to correspond to a different academic theory, then it's a simple matter of updating it.SkyWriter (Tim) (talk)

Recent claim based on blog post

I have removed[1] this recent addition by Skywriter to the section "Tax rate at which revenue is maximized":

and per capita Federal revenues have historically peaked during policy periods within that range.Cite error: The

<ref>tag has too many names (see the help page).[1] More recently Christina Romer, an economic adviser for President Obama, has also calculated the peak of the Laffer Curve with a maximum tax bracket at 33%.[2][3]

If one examines the sources, one can see that they don't back the claim, except for a single post from a right-wing blog, which is not RS for this academic issue. The sources are:

- White House, page 411 [2] which is a table of raw data with no discussion.

- Tax Policy Center, Historical Federal Receipt and Outlay Summary [3] which is a table of raw data with no discussion.

- An an economist, I can say that these tables do not back the argument being made. More relevantly for Wikipedia, tables without discussion are Primary sources, and cannot be used to justify a position. Doing so violates WP:OR, especially WP:SYN.

- Christina Romer,"The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks" [4]

- This paper is about the short-run macroeconomic stimulus effects of tax cuts, and is irrelevant to the Laffer curve, which is about the tax rate that maximises long run tax collection. The paper is irrelevant to this topic, and does not address the Laffer curve at all. A search for 'Laffer' in the article, finds no results. This paper does not back the claim being made. More relevantly for Wikipedia, in order not to violate WP:OR, sources used should be "directly related to the topic of the article, and directly support the material being presented." This paper is neither.

- From the right wing group blog, Ricochet: Right people, Right tone Right place, "The Laffer Curve and New Evidence that Taxes Stifle Economic Output", blog post by Tim Grose [5]

- This is a blog post from a partisan blog, and is not a reliable source for an academic issue. As an economist, I can also state that it is wrong and misleading, but that's irrelevant for Wikipedia.

LK (talk) 03:33, 15 January 2013 (UTC)

- Lawrence, please refer to the discussion I initiated above. It's difficult to have a discussion while you are ignoring what I wrote.

- To repeat, I'm neutral about which sources you would prefer for simple revenue data. There is a difference between an historical occurrence and a theory. Hsing offered a theory (which must be an academic RS), while the White House provided history (and the White House should indeed be a reliable source). As I wrote above, the statement "Babe Ruth happened to have a lot of strike outs while he was achieving his home run record" is NOT something that requires an academic paper, while the quite different statement of "linear-log analysis demonstrates that a home run record has a specific correlation with strike outs" would indeed require an academic paper.

- However, at this time the data does NOT support the Hsing paper, which I read in detail today, because the Hsing data itself is flawed. It arrived at the correct number for the maximum tax rate (per actual receipts), but then mistook a maximum tax rate for an average tax rate. An average tax rate of 35% in a progressive tax would give a maximum tax rate of 65%. Conversely, a maximum tax rate of 35% in a progressive tax would give an average tax rate of 19%. Hsing does not distinguish between the two, and he actually says "average", which cannot be supported by the historical receipts. Maximum rates of 65% are not even addressed by Hsing's paper, though they would be required for a 35% average rate.

- Hsing's paper, then, cannot be correlated with any of the sources I gave, because they would have supported a 35% max / 19% average, rather than a 65% max / 35% average.

- At this time there is no need for me to restore the White House source, since Hsing's paper is so poorly done that there is no way to match it with real history.

- I do plan to continue to look for sources, though, because this one isn't well represented by the excerpt.SkyWriter (Tim) (talk)