Agricultural subsidy: Difference between revisions

m Journal cites, using AWB (11321) |

Cyberbot II (talk | contribs) Rescuing 1 sources, flagging 0 as dead, and archiving 6 sources. (Peachy 2.0 (alpha 8)) |

||

| Line 27: | Line 27: | ||

{{See also|Agricultural policy of the United States|Food, Conservation, and Energy Act of 2008}} |

{{See also|Agricultural policy of the United States|Food, Conservation, and Energy Act of 2008}} |

||

The United States currently pays around $20 billion per year to farmers in direct subsidies as "farm income stabilization"<ref>[http://www.gpoaccess.gov/USbudget/fy10/sheets/hist03z2.xls ]{{ |

The United States currently pays around $20 billion per year to farmers in direct subsidies as "farm income stabilization"<ref>[http://www.gpoaccess.gov/USbudget/fy10/sheets/hist03z2.xls ] {{wayback|url=http://www.gpoaccess.gov/USbudget/fy10/sheets/hist03z2.xls |date=20120128135925 |df=y }}</ref><ref>{{cite web|url=http://www.washingtonpost.com/wp-dyn/content/graphic/2006/07/02/GR2006070200024.html |title=Farm Subsidies Over Time |work=The Washington Post |date=2 July 2006 |accessdate=12 April 2012}}</ref><ref>{{cite web|author=Stephen Vogel |url=http://www.ers.usda.gov/topics/farm-economy/farm-sector-income-finances.aspx |title=Farm Income and Costs: Farms Receiving Government Payments |publisher=Ers.usda.gov |accessdate=12 April 2012}}</ref> via [[U.S. farm bill]]s. These bills pre-date the economic turmoil of the [[Great Depression]] with the 1922 [[Grain Futures Act]], the 1929 [[Agricultural Marketing Act]] and the 1933 [[Agricultural Adjustment Act]] creating a tradition of government support. |

||

The beneficiaries of the subsidies have changed as [[agriculture in the United States]] has changed. In the 1930s, about 25% of the country's population resided on the nation's 6,000,000 small farms. By 1997, 157,000 large farms accounted for 72% of farm sales, with only 2% of the U.S. population residing on small farms. In 2006, the top 3 states receiving subsidies were Texas (10.4%), Iowa (9.0%), and Illinois (7.6%). The Total USDA Subsidies from farms in Iowa totaled $1,212,000,000 in 2006.<ref name="farm.ewg.org">{{cite web|url=http://farm.ewg.org |title=EWG Farm Subsidy Database |publisher=Farm.ewg.org |date=29 November 2004 |accessdate=12 April 2012}}</ref> From 2003 to 2005 the top 1% of beneficiaries received 17% of subsidy payments.<ref name="farm.ewg.org"/> In Texas, 72% of farms do not receive government subsidies. Of the close to $1.4 Billion in subsidy payments to farms in Texas, roughly 18% of the farms receive a portion of the payments.<ref>{{cite web|url=http://farm.ewg.org/farm/regionsummary.php?fips=48000 |title=Texas Farm Subsidy Payments by Category || EWG Farm Subsidy Database |publisher=Farm.ewg.org |date=29 November 2004 |accessdate=12 April 2012}}</ref> |

The beneficiaries of the subsidies have changed as [[agriculture in the United States]] has changed. In the 1930s, about 25% of the country's population resided on the nation's 6,000,000 small farms. By 1997, 157,000 large farms accounted for 72% of farm sales, with only 2% of the U.S. population residing on small farms. In 2006, the top 3 states receiving subsidies were Texas (10.4%), Iowa (9.0%), and Illinois (7.6%). The Total USDA Subsidies from farms in Iowa totaled $1,212,000,000 in 2006.<ref name="farm.ewg.org">{{cite web|url=http://farm.ewg.org |title=EWG Farm Subsidy Database |publisher=Farm.ewg.org |date=29 November 2004 |accessdate=12 April 2012}}</ref> From 2003 to 2005 the top 1% of beneficiaries received 17% of subsidy payments.<ref name="farm.ewg.org"/> In Texas, 72% of farms do not receive government subsidies. Of the close to $1.4 Billion in subsidy payments to farms in Texas, roughly 18% of the farms receive a portion of the payments.<ref>{{cite web|url=http://farm.ewg.org/farm/regionsummary.php?fips=48000 |title=Texas Farm Subsidy Payments by Category || EWG Farm Subsidy Database |publisher=Farm.ewg.org |date=29 November 2004 |accessdate=12 April 2012}}</ref> |

||

Revision as of 09:39, 30 August 2015

An agricultural subsidy is a governmental subsidy paid to farmers and agribusinesses to supplement their income, manage the supply of agricultural commodities, and influence the cost and supply of such commodities. Examples of such commodities include; wheat, feed grains (grain used as fodder, such as maize or corn, sorghum, barley, and oats), cotton, milk, rice, peanuts, sugar, tobacco, oilseeds such as soybeans, and meat products such as beef, pork, and lamb and mutton. Such subsidies are extremely controversial, both because of their complex effects and because of their political origins, which involve heavy lobbying from groups representing the interests of agribusiness.[1]

Agricultural subsidies by region

European Union

In 2010, the EU spent €57 billion on agricultural development, of which €39 billion was spent on direct subsidies.[4] Agricultural and fisheries subsidies form over 40% of the EU budget.[5] Since 1992 (and especially since 2005), the EU's Common Agricultural Policy has undergone significant change as subsidies have mostly been decoupled from production. The largest subsidy is the Single Farm Payment.

Africa

Increases in food and fertilizer prices have underlined the vulnerability of poor urban and rural households in many developing countries, especially in Africa, renewing policymakers' focus on the need to increase staple food crop productivity.

A study by the Overseas Development Institute evaluates the benefits of the Malawi Government Agricultural Inputs Subsidy Programme, which was implemented in 2006/2007 to promote access to and use of fertilizers in both maize and tobacco production to increase agricultural productivity and food security. The subsidy was implemented by means of a coupon system which could be redeemed by the recipients for fertilizer types at approximately one-third of the normal cash price.[6] According to policy conclusions of the Overseas Development Institute the voucher for coupon system can be an effective way of rationing and targeting subsidy access to maximize production and economic and social gains. Many practical and political challenges remain in the program design and implementation required to increase efficiency, control costs, and limit patronage and fraud.[6]

New Zealand

New Zealand is reputed to have the most open agricultural markets in the world[7][8][9] after radical reforms started in 1984 by the Fourth Labour Government stopped all subsidies.

"In 1984 New Zealand's Labor government took the dramatic step of ending all farm subsidies, which then consisted of 30 separate production payments and export incentives. This was a truly striking policy action, because New Zealand's economy is roughly five times more dependent on farming than is the U.S. economy, measured by either output or employment. Subsidies in New Zealand accounted for more than 30 percent of the value of production before reform, somewhat higher than U.S. subsidies today. And New Zealand farming was marred by the same problems caused by U.S. subsidies, including overproduction, environmental degradation and inflated land prices."

As the country is a large agricultural exporter, continued subsidies by other countries are a long-standing bone of contention,[10][11] with New Zealand being a founding member of the 19-member Cairns Group fighting to improve market access for exported agricultural goods.

United States

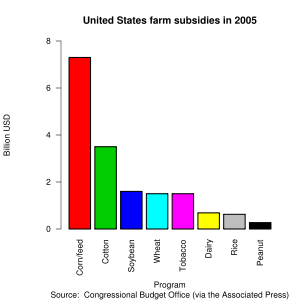

The United States currently pays around $20 billion per year to farmers in direct subsidies as "farm income stabilization"[12][13][14] via U.S. farm bills. These bills pre-date the economic turmoil of the Great Depression with the 1922 Grain Futures Act, the 1929 Agricultural Marketing Act and the 1933 Agricultural Adjustment Act creating a tradition of government support.

The beneficiaries of the subsidies have changed as agriculture in the United States has changed. In the 1930s, about 25% of the country's population resided on the nation's 6,000,000 small farms. By 1997, 157,000 large farms accounted for 72% of farm sales, with only 2% of the U.S. population residing on small farms. In 2006, the top 3 states receiving subsidies were Texas (10.4%), Iowa (9.0%), and Illinois (7.6%). The Total USDA Subsidies from farms in Iowa totaled $1,212,000,000 in 2006.[15] From 2003 to 2005 the top 1% of beneficiaries received 17% of subsidy payments.[15] In Texas, 72% of farms do not receive government subsidies. Of the close to $1.4 Billion in subsidy payments to farms in Texas, roughly 18% of the farms receive a portion of the payments.[16]

"Direct payment subsidies are provided without regard to the economic need of the recipients or the financial condition of the farm economy. Established in 1996, direct payments were originally meant to wean farmers off traditional subsidies that are triggered during periods of low prices for corn, wheat, soybeans, cotton, rice, and other crops."[17]

Top states for direct payments were Iowa ($501 million), Illinois ($454 million), and Texas ($397 million). Direct payments of subsidies are limited to $40,000 per person or $80,000 per couple.[17]

The subsidy programs give farmers extra money for their crops and guarantee a price floor. For instance in the 2002 Farm Bill, for every bushel of wheat sold, farmers were paid an extra 52 cents and guaranteed a price of 3.86 from 2002–03 and 3.92 from 2004–2007.[18] That is, if the price of wheat in 2002 was $3.80, farmers would get an extra 58¢ per bushel (52¢ plus the 6¢ price difference).

Corn is the top crop for subsidy payments. The Energy Policy Act of 2005 mandates that billions of gallons of ethanol be blended into vehicle fuel each year, guaranteeing demand, but US corn ethanol subsidies are between $5.5 billion and $7.3 billion per year. Producers also benefitted from a federal subsidy of 51 cents per gallon, additional state subsidies, and federal crop subsidies that can bring the total to 85 cents per gallon or more. However, the federal ethanol subsidy expired December 31, 2011.[19] (US corn-ethanol producers were shielded from competition from cheaper Brazilian sugarcane-ethanol by a 54-cent-per-gallon tariff, however that tariff also expired December 31, 2011.[20][21])

| 2004 U.S. Crop Subsidies[22] | ||

|---|---|---|

| Commodity | Millions of US$ | Share |

| Feed grains, mostly corn | 2,841 | 35.4% |

| Upland cotton and ELS cotton | 1,420 | 17.7% |

| Wheat | 1,173 | 14.6% |

| Rice | 1,130 | 14.1% |

| Soybeans and products | 610 | 7.6% |

| Dairy | 295 | 3.7% |

| Peanuts | 259 | 3.2% |

| Sugar | 61 | 0.8% |

| Minor oilseeds | 29 | 0.4% |

| Tobacco | 18 | 0.2% |

| Wool and mohair | 12 | 0.1% |

| Vegetable oil products | 11 | 0.1% |

| Honey | 3 | 0.0% |

| Other crops | 160 | 2.0% |

| Total | 8,022 | 100% |

Asia

This section needs expansion. You can help by adding to it. (June 2012) |

Farm subsidies in Asia remain a point of contention in global trade talks.[23][24]

In 2009, Japan paid USD$46.5 billion in subsidies to its farmers,[25] and continued state support of farmers in Japan remains a controversial topic.[26]

South Korea has made attempts to reform its agricultural sector, despite resistance from vested interests.[27]

Impact of subsidies

Farm subsidies have the direct effect of transferring income from the general tax payers to farm owners. The justification for this transfer and its effects are complex and often controversial.

Global food prices and international trade

Although some critics and proponents of the World Trade Organization have noted that export subsidies, by driving down the price of commodities, can provide cheap food for consumers in developing countries,[28][29] low prices are harmful to farmers not receiving the subsidy. Because it is usually wealthy countries that can afford domestic subsidies, critics argue that they promote poverty in developing countries by artificially driving down world crop prices.[30] Generally, developing countries have a comparative advantage in producing agricultural goods,[citation needed] but low crop prices encourage developing countries to be dependent buyers of food from wealthy countries. So local farmers, instead of improving the agricultural and economic self-sufficiency of their home country, are forced out of the market and perhaps even off their land. This occurs as a result of a process known as "international dumping" in which subsidized farmers are able to "dump" low-cost agricultural goods on foreign markets at costs that un-subsidized farmers cannot compete with. Agricultural subsidies often are a common stumbling block in trade negotiations. In 2006, talks at the Doha round of WTO trade negotiations stalled because the US refused to cut subsidies to a level where other countries' non-subsidized exports would have been competitive.[31]

Others argue that a world market with farm subsidies and other market distortions (as happens today) results in higher food prices, rather than lower food prices, as compared to a free market.[citation needed]

Mark Malloch Brown, former head of the United Nations Development Program, estimated that farm subsidies cost poor countries about US$50 billion a year in lost agricultural exports:

"It is the extraordinary distortion of global trade, where the West spends $360 billion a year on protecting its agriculture with a network of subsidies and tariffs that costs developing countries about US$50 billion in potential lost agricultural exports. Fifty billion dollars is the equivalent of today's level of development assistance."[32][33]

Poverty in developing countries

The impact of agricultural subsidies in developed countries upon developing-country farmers and international development is well documented. Agricultural subsidies can help drive prices down to benefit consumers, but also mean that unsubsidised developing-country farmers have a more difficult time competing in the world market;[34] and the effects on poverty are particularly negative when subsidies are provided for crops that are also grown in developing countries since developing-country farmers must then compete directly with subsidised developed-country farmers, for example in cotton and sugar.[35][36] The IFPRI has estimated in 2003 that the impact of subsidies costs developing countries $24 billion in lost incomes going to agricultural and agro-industrial production; and more than $40Bn is displaced from net agricultural exports.[37] Moreover the same study found that the least developed countries have a higher proportion of GDP dependent upon agriculture, at around 36.7%, thus may be even more vulnerable to the effects of subsidies. It has been argued that subsidised agriculture in the developed world is one of the greatest obstacles to economic growth in the developing world; which has an indirect impact on reducing the income available to invest in rural infrastructure such as health, safe water supplies and electricity for the rural poor.[38] The total amount of subsidies that go towards agriculture in OECD countries far exceeds the amount that countries provide in development aid.

Haiti and US rice imports

Haiti is an excellent example of a developing country negatively affected by agricultural subsidies in the developed world. Haiti is a nation with the capacity to produce rice and was at one time self-sufficient in meeting its own needs.[39][40] At present, Haiti does not produce enough to feed its people; 60 percent of the food consumed in the country is imported.[41] Following advice to liberalize its economy by lowering tariffs, domestically produced rice was displaced by cheaper subsidised rice from the United States. The Food and Agriculture Organization describes this liberalization process as being the removal of barriers to trade and a simplification of tariffs, which lowers costs to consumers and promotes efficiency among producers.[42]

Opening up Haiti's economy granted consumers access to food at a lower cost; allowing foreign producers to compete for the Haitian market drove down the price of rice. However, for Haitian rice farmers without access to subsidies, the downward pressure on prices led to a decline in profits. Subsidies received by American rice farmers, plus increased efficiencies, made it impossible for their Haitian counterparts to compete.[43][44] According to Oxfam and the International Monetary Fund, tariffs on imports fell from 50 percent to three percent in 1995 and the nation is currently importing 80 percent of the rice it consumes.[45][46]

The United States Department of Agriculture notes that since 1980, rice production in Haiti has been largely unchanged, while consumption on the other hand, is roughly eight times what it was in that same year.[47] Haiti is among the top three consumers of long grain milled rice produced in the United States.[48]

As rice farmers struggled to compete, many migrated from rural to urban areas in search of alternative economic opportunities.[49]

Impact on nutrition

One peer-reviewed research suggests that any effects of U.S. farm policies on U.S. obesity patterns must have been negligible.[50] However, some critics argue that the artificially low prices resulting from subsidies create unhealthy incentives for consumers. For example, in the USA, cane sugar was replaced with cheap corn syrup, making high-sugar food cheaper;[51] beet and cane sugar are subject to subsidies, price controls, and import tariffs that distort the prices of these products as well.

The lower price of energy-dense foods such as grains and sugars could be one reason why low-income people and food insecure people in industrialized countries are more vulnerable to being overweight and obese.[52] According to the Physicians Committee for Responsible Medicine, meat and dairy production receive 63% of subsidies in the United States,[53] as well as sugar subsidies for unhealthy foods, which contribute to heart disease, obesity and diabetes, with enormous costs for the health sector.[53]

Market distortions due to subsidies have led to an increase in corn fed cattle rather than grass fed.[54] Corn fed cattle require more antibiotics and their beef has a higher fat content.[54]

Cross-border movement of businesses

Tariffs on sugar have also caused large candy makers in the USA to relocate to Canada and Mexico, where sugar is often half to a third the price.[55] The Dominican Republic Central America Free Trade Agreement (CAFTA), though, does not seen to be very impact in this area but known to not amounting to much. The sugar issue causing alarm had reasoning due to what plausible effects could come through the tariffs as well as the undetermined future of these types of negotiations considering sugar importation in the United States. Due to various continuing disputes in trade, Mexico began to have fewer exports of sugar into the United States, where the North American Free Trade Agreement (NAFTA) allowed. Those who left and sought out other companies for sugar have leaned marginally more towards Canada than Mexico. The tariffs are what keeps the large pressure from competition from south of the Rio Grande at bay.[55]

Non-farming companies

Subsidies are also given to companies and individuals with little connection to traditional farming. It has been reported that the largest part of the sum given to these companies flow to multinational companies like food conglomerates, sugar manufacturers and liquor distillers. For example in France, the single largest beneficiary was the chicken processor Groupe Doux, at €62.8m, and was followed by about a dozen sugar manufacturers which together reaped more than €103m.[citation needed]

Public economics implications

Government intervention, through agricultural subsidies, interferes with the price mechanism which would normally determine commodity prices, often creating crop overproduction and market discrimination. Subsidies are also an inefficient use of taxpayer’s money. For instance, in 2006, the Department of Agriculture estimated that the average farm household income was $77,654 or about 17% higher than the average U.S. household income.[56] From a public economics perspective, subsidies of any kind work to create a socially and politically acceptable equilibrium that is not necessarily Pareto efficient.[57]

Environmental implications

The monoculture system associated with subsidized large-scale production has been implicated as a contributory factor in Colony Collapse Disorder which has affected bee populations. Bee pollination is an essential ecosystem service essential for the production of many varieties of fruits and vegetables. Subsidies often go towards subsidising meat production which has other nutritional and environmental implications; and it has been found that out of the $200Bn subsidies to subsidise crops from 1995-2010 around two thirds of this went to animal feed, tobacco and cotton production.[58] On the other hand, farmers producing fruits and vegetables received no direct subsidies. The environmental impact of meat production is high due to the resource and energy requirements that go into production of feed for livestock throughout their lifespan, for example, a kilogram of beef uses about 60 times as much water as an equivalent amount of potato.[59] The subsidies contribute to meat consumption by allowing for an artificially low cost of meat products.[60]

Alternatives

Neoliberals argue that the current subsidies distort incentives for the global trade of agricultural commodities in which other countries may have a comparative advantage. Allowing countries to specialize in commodities in which they have a comparative advantage in and then freely trade across borders would therefore increase global welfare and reduce food prices.[61] Ending direct payments to farmers and deregulating the farm industry would eliminate inefficiencies and deadweight loss created by government intervention.

However, others disagree, arguing that a more radical transformation of agriculture is needed, one guided by the notion that ecological change in agriculture cannot be promoted without comparable changes in the social, political, cultural and economic arenas that conform and determine agriculture. The organized peasant and indigenous based agrarian movements, e.g. Via Campesina, consider that only by changing the export-led, free-trade based, industrial agriculture model of large farms can the downward spiral of poverty, low wages, rural-urban migration, hunger and environmental degradation be halted.[62]

See also

- Protectionism

- Free trade

- Agricultural policy

- Price support

- 2007–2008 world food price crisis

- Electrical energy efficiency on United States farms

References

- ^ Karnik, Ajit; Lalvani, Mala (1996). "Interest Groups, Subsidies and Public Goods: Farm Lobby in Indian Agriculture". Economic and Political Weekly. 31 (13): 818–820. JSTOR 4403965.

- ^ Meat Atlas 2014 – Facts and figures about the animals we eat , page 20, download Meat Atlas as pdf

- ^ OECD, Agricultural Policy Monitoring and Evaluation 2013, 2013, p. 317, table: "OECD: Producer Single Commodity Transfers (USD)"

- ^ "Title 05 – Agriculture and rural development". Retrieved 1 January 2011.

- ^ "Website redirection". Europa (web portal). Retrieved 12 April 2012.

- ^ a b "Towards 'smart' subsidies in agriculture? Lessons from recent experience in Malawi". Overseas Development Institute. September 2008.

- ^ "Save the Farms – End the Subsidies". Cato Institute. Archived from the original on 25 October 2008. Retrieved 22 October 2008.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Surviving with out subsidies", NYT

- ^ Pickford, John (16 October 2004). "New Zealand's hardy farm spirit". BBC News. Retrieved 12 April 2012.

- ^ "Return of US dairy subsidies sours Kiwis". Television New Zealand. 25 May 2009. Retrieved 15 September 2011.

- ^ "Why bother with a US FTA?". The New Zealand Herald. 23 March 2010. Retrieved 15 September 2011.

- ^ [1] Archived 2012-01-28 at the Wayback Machine

- ^ "Farm Subsidies Over Time". The Washington Post. 2 July 2006. Retrieved 12 April 2012.

- ^ Stephen Vogel. "Farm Income and Costs: Farms Receiving Government Payments". Ers.usda.gov. Retrieved 12 April 2012.

- ^ a b "EWG Farm Subsidy Database". Farm.ewg.org. 29 November 2004. Retrieved 12 April 2012.

- ^ "Texas Farm Subsidy Payments by Category || EWG Farm Subsidy Database". Farm.ewg.org. 29 November 2004. Retrieved 12 April 2012.

- ^ a b http://farm.ewg.org/farm/dp_text.php

- ^ "The 2002 Farm Bill: Title 1 Commodity Programs". USDA. 22 May 2002. Archived from the original (PDF) on 7 December 2006. Retrieved 6 December 2006.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Sweet, William. "Corn-o-Copia." IEEE Spectrum. January 2007

- ^ "Brazilian Sugarcane Industry Responds to Introduction of Pomeroy-Shimkus Legislation That Taxes Clean, Renewable Energy". District of Columbia: Prnewswire.com. Retrieved 12 April 2012.

- ^ "Brazil raises cane over U.S. ethanol tariff". Los Angeles Times. 4 November 2009. Retrieved 12 April 2012.

- ^ USDA 2006 Fiscal Year Budget. "USDA Budget Summary 2006. Farm and Foreign Agriculture Services".

- ^ "US, India, Japan Farm Subsidies Face WTO Ag Committee Scrutiny". ICTSD.

- ^ Ashok B Sharma (28 March 2012). "BRICS for end to rich nations' farm subsidies". The Indian Awaaz.

- ^ "EU farm subsidies fall, bucking global trend". Agrimoney.com. 1 July 2010.

- ^ Yutaka Harada (17 January 2012). "Can Japanese Farming Survive Liberalization?". The Tokyo Foundation.

- ^ "Coffee shop farmers". The Dong-A Ilbo. 17 March 2012.

- ^ Panagariya, Arvind (2005–12). "Liberalizing Agriculture". Foreign Affairs. Retrieved 26 December 2006.

{{cite web}}: Check date values in:|date=(help) - ^ "World Bank's Claims on WTO Doha Round Clarified" (Press release). Center for Economic and policy research. 22 November 2005.

- ^ Andrew Cassel (6 May 2002). "Why U.S. Farm Subsidies Are Bad for the World". Philadelphia Inquirer. Archived from the original on 9 June 2007. Retrieved 20 July 2007.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Alan Beattie; Frances Williams (24 July 2006). "US blamed as Trade Talks end in acrimony". Financial Times. Retrieved 18 May 2008.

- ^ [2] Address by Mark Malloch Brown, UNDP Administrator, Makerere University, Kampala, Uganda, 12 November 2002

- ^ [3] "Farm Subsidies That Kill", 5 July 2002, By NICHOLAS D. KRISTOF, New York Times

- ^ Patel, Raj (2007). Stuffed and Starved. UK: Portobello Books. p. 57.

- ^ Agricultural Subsidies in the WTO Green Box, ICTSD, September 2009.

- ^ "Agricultural Subsidies, Poverty and the Environment" (PDF). World Resources Institute. January 2007. Retrieved 25 February 2011.

- ^ "How much does it hurt? The Impact of Agricultural Trade Policies on Developing Countries" (PDF). IFPRI. 2010. Retrieved 25 February 2011.

- ^ "Farm subsidies: devastating the world's poor and the environment". Retrieved 25 February 2011.

- ^ "Trade and the Disappearance of Haitian Rice". .american.edu. Retrieved 12 April 2012.

- ^ http://dspace.mit.edu/bitstream/handle/1721.1/28350/56025477.pdf?sequence=1

- ^ http://www.ifad.org/operations/projects/regions/pl/factsheet/haiti_e.pdf

- ^ "Chapter 4. Trade liberalization and food security in developing countries[45]". Fao.org. 12 July 2002. Retrieved 12 April 2012.

- ^ http://search.proquest.com/docview/305170611/fulltextPDF?accountid=14656

- ^ http://www.unctad.org/en/docs/osgdp20053_en.pdf

- ^ "Haiti No Longer Grows Much of Its Own Rice and Families Now Go Hungry | Oxfam International". Oxfam.org. Retrieved 12 April 2012.

- ^ http://www.imf.org/external/pubs/ft/scr/2001/cr0104.pdf

- ^ http://gain.fas.usda.gov/Recent%20GAIN%20Publications/Rice%20Production%20and%20Trade%20Update_Santo%20Domingo_Haiti_11-9-2010.pdf

- ^ http://webarchives.cdlib.org/sw1wp9v27r/http://ers.usda.gov/Briefing/Rice/SpecialArticle/USricemarket.pdf

- ^ Doyle, Mark (4 October 2010). "BBC News – US urged to stop Haiti rice subsidies". BBC. Retrieved 12 April 2012.

- ^ "Farm subsidies and obesity in the United States: National evidence and international comparisons". Food Policy. 33: 470–479. doi:10.1016/j.foodpol.2008.05.008. Retrieved 12 April 2012.

- ^ Pollan, Michael (12 October 2003). "THE WAY WE LIVE NOW: 10-12-03; The (Agri)Cultural Contradictions Of Obesity". The New York Times. Archived from the original on 2 May 2008. Retrieved 29 April 2008.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ FRAC Food Research and Action Center

- ^ a b Physicians Committee for Responsible Medicine

- ^ a b Kummer, Corby. "Back To Grass". The Atlantic. Archived from the original on 16 May 2008. Retrieved 29 April 2008.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ a b "The Sugar Industry and Corporate Welfare".

- ^ Thompson, Wyatt; Mishra Ashok; Joe Dewbre (15 September 2009). "Farm Household Income and Transfer Efficiency: An Evaluation of United States Farm Program Payments". American Journal of Agricultural Economics. 91.5: 1926–1301.

- ^ Rosen, Harvey (2008). Public Finance. New York: McGraw-Hill Irwin. pp. 83–84.

- ^ Washington Post 11 October 2011

- ^ Hoesktra et al 2012

- ^ Yale Rudd Centre

- ^ Anderson, Kym; Will Martin (13 September 2005). "Agricultural Trade Reform and the Doha Development Agenda". The World Economy. 28 (9): 1301–1327. doi:10.1111/j.1467-9701.2005.00735.x.

- ^ Altieri, Miguel (July 2009). "Agroecology, small farms, and food sovereignty". Monthly Review. 61 (3): 102–113. doi:10.14452/mr-061-03-2009-07_8.

Further reading

- Sumner, Daniel A. (2008). "Agricultural Subsidy Programs". In David R. Henderson (ed.) (ed.). Concise Encyclopedia of Economics (2nd ed.). Indianapolis: Library of Economics and Liberty. ISBN 978-0865976658. OCLC 237794267.

{{cite encyclopedia}}:|editor=has generic name (help) - Farm Commodity Programs: A Short Primer, a Congressional Research Service Report for Congress, 20 June 2002.

External links

- Rethinking the Export-Import Bank by Aaron Lukas and Ian Vásquez

- Steel Trap: How Subsidies and Protectionism Weaken the U.S. Steel Industry

- Why Congress Should Repeal Sugar Subsidy

- Ten Reasons to Cut Farm Subsidies by Chris Edwards

- Should the United States Cut Its Farm Subsidies? – Daniel Griswold, director of the Cato Institute’s Center for Trade Policy Studies, and Bob Young, chief economist for the American Farm Bureau, debate whether the United States should be subsidizing its farmers

- Farm Security: The mohair of the dog that bites you – Comedy writer Dave Barry on farm subsidies

- You Are What You Grow – Article on farm subsidies from The New York Times.

- Kick All Agricultural Subsidies (kickAAS) – a campaign run by The Guardian newspaper in the UK

- Ripe for Reform: Six Good Reasons to Reduce U.S. Farm Subsidies and Trade Barriers by Daniel Griswold, Stephen Slivinski, and Christopher Preble (5 September 2005).

- Still at the Federal Trough: Farm Subsidies for the Rich and Famous Shattered Records in 2001– a paper presented by the Heritage Foundation arguing that farm subsidies are corporate welfare and do not benefit small family farms.

- Environmental Working Group's Farm Subsidy Database