Supply and demand

Supply and demand is an economic model based on price, utility and quantity in a market. It predicts that in a competitive market, price will function to equalize the quantity demanded by consumers, and the quantity supplied by producers, resulting in an economic equilibrium of price and quantity. Similarly, an increase in the number of workers tends to result in lower wages and vice-versa. The model incorporates other factors changing equilibrium as a shift of demand and/or supply.

Demand schedule

In microeconomic theory, demand is defined as the willingness and ability of a consumer to purchase a given product in a given frame of time.

The demand schedule, depicted graphically as the demand curve, represents the amount of goods that buyers are willing and able to purchase at various prices, assuming all other non-price factors remain the same. The demand curve is almost always represented as downwards-sloping, meaning that as price decreases, consumers will buy more of the good.[1]

Just as the supply curves reflect marginal cost curves, demand curves can be described as marginal utility curves.[2]

The main determinants of individual demand are: the price of the good, level of income, personal tastes, the population (number of people), the government policies, the price of substitute goods, and the price of complementary goods.

The shape of the aggregate demand curve can be convex or concave, possibly depending on income distribution. In fact, an aggregate demand function cannot be derived except under restrictive and unrealistic assumptions.[3]

As described above, the demand curve is generally downward sloping. There may be rare examples of goods that have upward sloping demand curves. Two different hypothetical types of goods with upward-sloping demand curves are a Giffen good (an inferior, but staple, good) and a Veblen good (a good made more fashionable by a higher price).

Similar to the supply curve, movements along it are also named expansions and contractions. A move downward on the demand curve is called an expansion of demand, since the willingness and ability of consumers to buy a given good has increased, in tandem with a fall in its price. Conversely, a move up the demand curve is called a contraction of demand, since consumers are less willing and able to purchase quantities of the product in question.

Changes in market equilibrium

Practical uses of supply and demand analysis often center on the different variables that change equilibrium price and quantity, represented as shifts in the respective curves. Comparative statics of such a shift traces the effects from the initial equilibrium to the new equilibrium.

Demand curve shifts

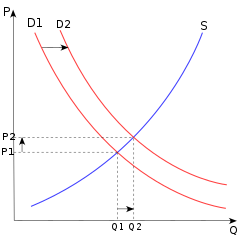

When consumers increase the quantity demanded at a given price, it is referred to as an increase in demand. Increased demand can be represented on the graph as the curve being shifted outward. At each price point, a greater quantity is demanded, as from the initial curve D1 to the new curve D2. More people wanting coffee is an example. In the diagram, this raises the equilibrium price from P1 to the higher P2. This raises the equilibrium quantity from Q1 to the higher Q2. A movement along the curve is described as a "change in the quantity demanded" to distinguish it from a "change in demand," that is, a shift of the curve. In the example above, there has been an increase in demand which has caused an increase in (equilibrium) quantity. The increase in demand could also come from changing tastes and fads, incomes, complementary and substitute price changes, market expectations, and number of buyers. This would cause the entire demand curve to shift changing the equilibrium price and quantity.

If the demand decreases, then the opposite happens: an inward shift of the curve. If the demand starts at D2, and decreases to D1, the price will decrease, and the quantity will decrease. This is an effect of demand changing. The quantity supplied at each price is the same as before the demand shift (at both Q1 and Q2). The equilibrium quantity, price and demand are different. At each point, a greater amount is demanded (when there is a shift from D1 to D2).

The demand curve "shifts" because a non-price determinant of demand has changed. Graphically the shift is due to a change in the x-intercept. A shift in the demand curve due to a change in a non-price determinant of demand will result in the market's being in a non-equilibrium state. If the demand curve shifts out the result will be a shortage - at the new market price quantity demanded will exceed quantity supplied. If the demand curve shifts in, there will be a surplus - at the new market price quantity supplied will exceed quantity demanded. The process by which a new equilibrium is established is not the province of comparative statics - the answers to issues concerning when, whether and how a new equilibrium will be established are issues that are addressed by stochastic models - economic dynamics.

Two assumptions are necessary for the validity of the standard model. First, that supply and demand are independent and second, that supply is "constrained by a fixed resource." [4]If either of these conditions does not hold, then the Marshallian model cannot be sustained.[5]

Supply curve shifts

When the suppliers' costs change for a given output, the supply curve shifts in the same direction. For example, assume that someone invents a better way of growing wheat so that the cost of growing a given quantity of wheat decreases. Otherwise stated, producers will be willing to supply more wheat at every price and this shifts the supply curve S1 outward, to S2—an increase in supply. This increase in supply causes the equilibrium price to decrease from P1 to P2. The equilibrium quantity increases from Q1 to Q2 as the quantity demanded extends at the new lower prices. In a supply curve shift, the price and the quantity move in opposite directions.

If the quantity supplied decreases at a given price, the opposite happens. If the supply curve starts at S2, and shifts inward to S1, demand contracts, the equilibrium price will increase, and the equilibrium quantity will decrease. This is an effect of supply changing. The quantity demanded at each price is the same as before the supply shift (at both Q1 and Q2). The equilibrium quantity, price and supply changed.

When there is a change in supply or demand, there are three possible movements. The demand curve can move inward or outward. The supply curve can also move inward or outward.

See also: Induced demand

Elasticity

Elasticity is a central concept in the theory of supply and demand. In this context, elasticity refers to how supply and demand respond to various factors, including price as well as other stochastic principles. One way to define elasticity is the percentage change in one variable divided by the percentage change in another variable (known as arc elasticity, which calculates the elasticity over a range of values, in contrast with point elasticity, which uses differential calculus to determine the elasticity at a specific point). It is a measure of relative changes.

Often, it is useful to know how the quantity demanded or supplied will change when the price changes. This is known as the price elasticity of demand and the price elasticity of supply. If a monopolist decides to increase the price of their product, how will this affect their sales revenue? Will the increased unit price offset the likely decrease in sales volume? If a government imposes a tax on a good, thereby increasing the effective price, how will this affect the quantity demanded?

Elasticity corresponds to the slope of the line and is often expressed as a percentage. In other words, the units of measure (such as gallons vs. quarts, say for the response of quantity demanded of milk to a change in price) do not matter, only the slope. Since supply and demand can be curves as well as simple lines the slope, and hence the elasticity, can be different at different points on the line.

Elasticity is calculated as the percentage change in quantity over the associated percentage change in price. For example, if the price moves from $1.00 to $1.05, and the quantity supplied goes from 100 pens to 102 pens, the slope is 2/0.05 or 40 pens per dollar. Since the elasticity depends on the percentages, the quantity of pens increased by 2%, and the price increased by 5%, so the price elasticity of supply is 2/5 or 0.4.

Since the changes are in percentages, changing the unit of measurement or the currency will not affect the elasticity. If the quantity demanded or supplied changes a lot when the price changes a little, it is said to be elastic. If the quantity changes little when the prices changes a lot, it is said to be inelastic. An example of perfectly inelastic supply, or zero elasticity, is represented as a vertical supply curve. (See that section below)

Elasticity in relation to variables other than price can also be considered. One of the most common to consider is income. How would the demand for a good change if income increased or decreased? This is known as the income elasticity of demand. For example, how much would the demand for a luxury car increase if average income increased by 10%? If it is positive, this increase in demand would be represented on a graph by a positive shift in the demand curve. At all price levels, more luxury cars would be demanded.

Another elasticity sometimes considered is the cross elasticity of demand, which measures the responsiveness of the quantity demanded of a good to a change in the price of another good. This is often considered when looking at the relative changes in demand when studying complement and substitute goods. Complement goods are goods that are typically utilized together, where if one is consumed, usually the other is also. Substitute goods are those where one can be substituted for the other, and if the price of one good rises, one may purchase less of it and instead purchase its substitute.

Cross elasticity of demand is measured as the percentage change in demand for the first good that occurs in response to a percentage change in price of the second good. For an example with a complement good, if, in response to a 10% increase in the price of fuel, the quantity of new cars demanded decreased by 20%, the cross elasticity of demand would be -2.0.

In a perfect economy, any market should be able to move to the equilibrium position instantly without travelling along the curve. Any change in market conditions would cause a jump from one equilibrium position to another at once. So the perfect economy is actually analogous to the quantum economy. Unfortunately in real economic systems, markets don't behave in this way, and both producers and consumers spend some time travelling along the curve before they reach equilibrium position. This is due to asymmetric, or at least imperfect, information, where no one economic agent could ever be expected to know every relevant condition in every market. Ultimately both producers and consumers must rely on trial and error as well as prediction and calculation to find an the true equilibrium of a market.

Vertical supply curve (Perfectly Inelastic Supply)

It is sometimes the case that a supply curve is vertical: that is the quantity supplied is fixed, no matter what the market price. For example, the surface area or land of the world is fixed. No matter how much someone would be willing to pay for an additional piece, the extra cannot be created. Also, even if no one wanted all the land, it still would exist. Land therefore has a vertical supply curve, giving it zero elasticity (i.e., no matter how large the change in price, the quantity supplied will not change).

Supply-side economics argues that the aggregate supply function – the total supply function of the entire economy of a country – is relatively vertical. Thus, supply-siders argue against government stimulation of demand, which would only lead to inflation with a vertical supply curve.[6]

Other markets

The model of supply and demand also applies to various specialty markets.

The model applies to wages, which are determined by the market for labor. The typical roles of supplier and consumer are reversed. The suppliers are individuals, who try to sell their labor for the highest price. The consumers of labors are businesses, which try to buy the type of labor they need at the lowest price. The equilibrium price for a certain type of labor is the wage.[7]

The model applies to interest rates, which are determined by the money market. In the short term, the money supply is a vertical supply curve, which the central bank of a country can influence through monetary policy. The demand for money intersects with the money supply to determine the interest rate.[8]

Other market forms

The supply and demand model is used to explain the behavior of perfectly competitive markets, but its usefulness as a standard of performance extends to other types of markets. In such markets, there may be no supply curve, such as above, except by analogy. Rather, the supplier or suppliers are modeled as interacting with demand to determine price and quantity. In particular, the decisions of the buyers and sellers are interdependent in a way different from a perfectly competitive market.

A monopoly is the case of a single supplier that can adjust the supply or price of a good at will. The profit-maximizing monopolist is modeled as adjusting the price so that its profit is maximized given the amount that is demanded at that price. This price will be higher than in a competitive market. A similar analysis can be applied when a good has a single buyer, a monopsony, but many sellers. Oligopoly is a market with so few suppliers that they must take account of their actions on the market price or each other. Game theory may be used to analyze such a market.

The supply curve does not have to be linear. However, if the supply is from a profit-maximizing firm, it can be proven that curves-downward sloping supply curves (i.e., a price decrease increasing the quantity supplied) are inconsistent with perfect competition in equilibrium. Then supply curves from profit-maximizing firms can be vertical, horizontal or upward sloping.

Positively sloped demand curves?

Standard microeconomic assumptions cannot be used to disprove the existence of upward-sloping demand curves. However, despite years of searching, no generally-agreed-upon example of a good that has an upward-sloping demand curve (also known as a Giffen good) has been found. Some suggest that luxury cosmetics can be classified as a Giffen good. As the price of a high end luxury cosmetic drops, consumers see it as a low quality good compared to its peers. The price drop may indicate lower quality ingredients, thus consumers would not want to apply such an inferior product to their face. Some example of a Giffen good could be potatoes during the Irish famine.

Lay economists sometimes believe that certain common goods have an upward-sloping curve. For example, people will sometimes buy a prestige good (eg. a luxury car) because it is expensive, a drop in price may actually reduce demand. However, in this case, the good purchased is actually prestige, and not the car itself. So, when the price of the luxury car decreases, it is actually decreasing the amount of prestige associated with the good (see also Veblen good). A similar example is the increased demand for assets in the growth phase of a speculative bubble (e.g., recent housing bubble), where higher prices drive up demand because of higher expected future prices. However, even with downward-sloping demand curves, it is possible that an increase in income may lead to a decrease in demand for a particular good, probably due to the existence of more attractive alternatives which become affordable: a good with this property is known as an inferior good.

Negatively sloped supply curve

There are cases where the price of goods gets cheaper, but more of those goods are produced. This is usually related to economies of scale and mass production. One example is computer software where creating the first instance of a given computer program has a high cost, but the marginal cost of copying this program and distributing it to many consumers is low (almost zero).

Empirical estimation

Demand and supply relations in a market can be statistically estimated from price, quantity, and other data with sufficient information in the model. This can be done with simultaneous-equation methods of estimation in econometrics. Such methods allow solving for the model-relevant "structural coefficients," the estimated algebraic counterparts of the theory. The Parameter identification problem is a common issue in "structural estimation." Typically, data on exogenous variables (that is, variables other than price and quantity, both of which are endogenous variables) are needed to perform such an estimation. An alternative to "structural estimation" is reduced-form estimation, which regresses each of the endogenous variables on the respective exogenous variables.

Macroeconomic uses of demand and supply

Demand and supply have also been generalized to explain macroeconomic variables in a market economy, including the quantity of total output and the general price level. The Aggregate Demand-Aggregate Supply model may be the most direct application of supply and demand to macroeconomics, but other macroeconomic models also use supply and demand. Compared to microeconomic uses of demand and supply, different (and more controversial) theoretical considerations apply to such macroeconomic counterparts as aggregate demand and aggregate supply. Demand and supply may also be used in macroeconomic theory to relate money supply to demand and interest rates.

Demand shortfalls

A demand shortfall results from the actual demand for a given product being lower than the projected, or estimated, demand for that product. Demand shortfalls are caused by demand overestimation in the planning of new products. Demand overestimation is caused by optimism bias and/or strategic misrepresentation.

History

The power of supply and demand was understood to some extent by several early Muslim economists, such as Ibn Taymiyyah who illustrates:

"If desire for goods increases while its availability decreases, its price rises. On the other hand, if availability of the good increases and the desire for it decreases, the price comes down."[9]

The phrase "supply and demand" was first used by James Denham-Steuart in his Inquiry into the Principles of Political Economy, published in 1767. Adam Smith used the phrase in his 1776 book The Wealth of Nations, and David Ricardo titled one chapter of his 1817 work Principles of Political Economy and Taxation "On the Influence of Demand and Supply on Price".[10]

In The Wealth of Nations, Smith generally assumed that the supply price was fixed but that its "merit" (value) would decrease as its "scarcity" increased, in effect what was later called the law of demand. Ricardo, in Principles of Political Economy and Taxation, more rigorously laid down the idea of the assumptions that were used to build his ideas of supply and demand. Antoine Augustin Cournot first developed a mathematical model of supply and demand in his 1838 Researches on the Mathematical Principles of the Theory of Wealth.

During the late 19th century the marginalist school of thought emerged. This field mainly was started by Stanley Jevons, Carl Menger, and Léon Walras. The key idea was that the price was set by the most expensive price, that is, the price at the margin. This was a substantial change from Adam Smith's thoughts on determining the supply price.

In his 1870 essay "On the Graphical Representation of Supply and Demand", Fleeming Jenkin drew for the first time the popular graphic of supply and demand which, through Marshall, eventually would turn into the most famous graphic in economics.

The model was further developed and popularized by Alfred Marshall in the 1890 textbook Principles of Economics.[10] Along with Léon Walras, Marshall looked at the equilibrium point where the two curves crossed. They also began looking at the effect of markets on each other.

See also

- Aggregate demand

- Aggregate supply

- Alpha consumer

- Artificial demand

- Barriers to entry

- Consumer theory

- Deadweight loss

- Demand Forecasting

- Demand shortfall

- Economic surplus

- Effect of taxes and subsidies on price

- Elasticity

- Externality

- Foundations of Economic Analysis by Paul A. Samuelson

- History of economic thought

- "invisible hand"

- Inverse demand function

- Labor shortage

- Microeconomics

- Producer's surplus

- Protectionism

- Profit

- Rationing

- Real prices and ideal prices

- Say's Law

- Supply shock

- An Inquiry into the Nature and Causes of the Wealth of Nations by Adam Smith

References

- ^ Note that unlike most graphs, supply & demand curves are plotted with the independent variable (price) on the vertical axis and the dependent variable (quantity supplied or demanded) on the horizontal axis.

- ^ "Marginal Utility and Demand". Retrieved 2007-02-09.

- ^ Keen, S. Debunking Economics (Zed 2004) citing Varian H., Microeconomic Analysis (Norton 1992).The assumptions are consumers have identical utility functions and consumers's buying habits do not change with time or circumstance. Keen. The problem for traditional economic analysis is that Marshall's scissors only "apply" to perfectly competitive markets and if the assumptions underlying the analysis are faulty then the primary pedagogical device is valuable, if at all, only as a first approximation of economic behavior.

- ^ Legge and Fishburn, A 75th Anniversary Present for Sraffa. www.debunking-economics.com/Maths/Present_for_Sraffa.ht. The article asserts that the assumptions are incompatible and backs it up with rather formidable mathematical proofs.

- ^ Id.

- ^ Understanding Supply-Side Economics

- ^ Kibbe, Matthew B. "The Minimum Wage: Washington's Perennial Myth". Cato Institute. Retrieved 2007-02-09.

- ^ Mead, Art. "Interest rates are prices". University of Rhode Island. Retrieved 2007-02-09.

- ^ Hosseini, Hamid S. (2003). "Contributions of Medieval Muslim Scholars to the History of Economics and their Impact: A Refutation of the Schumpeterian Great Gap". In Biddle, Jeff E.; Davis, Jon B.; Samuels, Warren J. (ed.). A Companion to the History of Economic Thought. Malden, MA: Blackwell. pp. 28–45 [28 & 38]. doi:10.1002/9780470999059.ch3. ISBN 0631225730.

{{cite book}}: CS1 maint: multiple names: editors list (link) - ^ a b Humphrey, Thomas M. (1992). "Marshallian Cross Diagrams and Their Uses before Alfred Marshall: The Origins of Supply and Demand Geometry" ([dead link] – Scholar search). Economic Review.

{{cite journal}}: External link in|format=|month=ignored (help) Federal Reserve Bank of Richmond.

External links

- Nobelpricewinner Prof. William Vickrey: 15 fatal fallacies of financial fundamentalism-A Disquisition on Demand Side Economics

- "Marshallian Cross Diagrams and Their Uses before Alfred Marshall: The Origins of Supply and Demand Geometry" by Thomas Humphrey (via the Richmond Fed)

- Supply and Demand book by Hubert D. Henderson at Project Gutenberg.

- Price Theory and Applications by Steven E. Landsburg ISBN 0-538-88206-9

- An Inquiry into the Nature and Causes of the Wealth of Nations, Adam Smith, 1776 [1]

- By what is the price of a commodity determined?, a brief statement of Karl Marx's rival account [2]

- The Economic Motivation of Open Source Software: Stakeholder Perspectives, Dirk Riehle, 2007 [3]

- Supply and Demand by Fiona Maclachlan and Basic Supply and Demand by Mark Gillis, Wolfram Demonstrations Project.